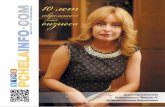

CER Aug. 2014

description

Transcript of CER Aug. 2014

Q&A: New BRICS bank will help Beijing’s geopolitical goals

China’s economy faces an uphill struggle despite recent pickup

Forming a clusterForming a clusterBuilding better integration between cities Building better integration between cities

is the way forward for urbanizationis the way forward for urbanization

中经评论:多屏互动时代中经评论:多屏互动时代

www.chinaeconomicreview.comAUGUST 2014 VOL. 25, NO. 8

AUGUST 2014VOL. 25, NO. 8FEATURED CONTENT

MONTH IN REVIEW08 NEWS BRIEF | Th e biggest China news stories in July

COVER STORY20 CLUSTER FORMATION | For a better future urban environment China needs to break up its megacities

ECONOMICS & POLICY31 NOT OVER THE HILL YET | China hit its 7.5% GDP target in the second quarter but the economy is still facing a downward path in the coming year33 A FAIR IP TRIAL? | Apple once again fi nds itself in a Chinese court over an intellectual property dispute but of all the challenges it faces in its biggest market, legal bias may not be one of them35 BLUEPRINT FOR TROUBLE | Th e problems at Xilin Steel underscore the risks in privatizing state assets

Q&A AND COLUMNS10 AUTOMATED LABOR | China has become the world’s largest market for industrial robotics12 WITHIN TOUCHING DISTANCE | JLL’s Jeremy Kelly discusses Shanghai’s rise as a “super city” 14 BITCOIN GOES PLASTIC | Th e digital currency may have fallen in value as Chinese speculators fl ed the market but one Hong Kong fi rm is betting that consumers will want to spend it in stores16 BUILDING THE BRICS BANK | How Beijing will use the New Development Bank to weave a web around Washington and further its economic diplomacy goals18 DRILLING WITH FRIENDS | Th e next wave of China’s overseas energy M&A is likely to involve strategic partnerships

AUGUST 2014 VOL. 25, NO. 8

HKABC membership approved and certifi ed

Published monthly since 1990

PublisherChina Economic Review Publishing

EditorOliver Pearce

Staff WriterHudson Lockett

Chinese EditorLiu Chen

Associate EditorSkye Sun

ContributorsTom Nunlist

InternsKangning Chen, Colleen Howe

Art DirectorJason Wong

Editor at LargeGraham Earnshaw

Associate PublisherGareth Powell

Director of Sales and MarketingRalph Wang

Account ManagerJerry Cheng

CHINA ECONOMIC REVIEW

(ISSN: 1350-6390) is published by

China Economic Review Publishing

Enquiries [email protected]

AddressesThe Plaza Building, 102 Lee High Road

London, SE13 5PT, England

Room 1801, 18F

Public Bank Centre

120 Des Voeux Road

Central, Hong Kong

Hong Kong printer01 Printing Limited

Suite M, 3/F, Tower 3,

Kwun Tong Industrial Centre,

448 Kwun Tong Road, Kowloon

CHINA ECONOMIC REVIEW welcomes

letters. Please write to the editor at:

HKABC membership approved and certifi ed

Advertising enquiries

Hong Kong: +852 3174 6136

Shanghai: +8621 5187 9633 ext 811

THE HOUSE VIEW06 COMFORTING CLUSTERS | Time to break up the megacity

BUSINESS26 FLYING PARCELS | Commercial drones are the latest hot product in the technology world and Chinese fi rms want in

China’s urbanization has long captured the imagination. Over the past two decades

the sight of millions of people mov-ing from farm to concrete residential compounds consisting of buildings that pierce the sky has been evocative and thought provoking.

By 2030, 70% of the population, or around one billion people, will live in cities, if a government blueprint re-leased earlier this year becomes reality. The story though is about more than just this movement of people – the trend is long established and virtually irreversible. The urban areas where they will live are now the focus.

Headlines talk about the urban ti-tans that are emerging in China, from Beijing to Chongqing. They are often dubbed “megacities,” vast sprawling areas that encompass every conceiv-able industry and social function. The idea behind this concept is to bring everything under one roof, to turn big cities into self-sustaining worlds of their own. Megacities carry negative connotations of density, overpopula-tion and pollution but they are not inherently bad. As urban conurbations grow public services and utilities scale up quickly, in effect reducing the neg-ative footprints of inhabitants. Wa-ter and heating are provided in tight networks over shorter distances while waste collection is more focused and therefore efficient. Even energy inten-sity can be stable.

However, they are clean and smart only up to a certain size, experts cau-tion. According a 2013 report by the Urban China Initiative, a think tank focusing on sustainable urbanization co-founded by the McKinsey Global Institute, Columbia University and Tsinghua University, megacities even-tually hit a turning point in sustain-ability. This comes when the popula-tion tops 4.5 million and density is higher than 8,000 people per square

kilometre. The likes of Shanghai and Guangzhou are already past that point.

In this frenetic era of planning and construction the time has come for the giant cluster city. Often used inter-changeably, the terms cluster city and megacity are not the same. The latter is a densely packed area, the former a collection of small cities around a cen-tral node that share strong transporta-tion and infrastructure links.

The cluster cities paradigm is, at its heart, a way of rethinking the eco-nomic model upon which giant cities are based. Many of the other factors under sustainability are more or less related to that central principle. Cities in a cluster can draw on the resources of central cities and begin to special-ize in certain economic fields instead of trying to do it all as megacities have done in the past. In our April issue, China Economic Review argued that Shanghai cannot hope to be both a service center rooted in finance while at the same time maintain its industri-al base if it ever wants to get rid of its pollution problem and become more sustainable.

At least at some regional levels, Chinese economic and urban planners are making plans for such groupings. In Beijing, the pressing need to curb pollution and general overcrowding – the capital city’s population has in-creased by two-thirds since the year 2000 – has created a desire to move not just industrial production to the surrounding regions of Tianjin and Hebei but also up to five million peo-ple. Similarly, the Pearl River Delta manufacturing hub is working at more closely integrating Guangzhou, Shenzhen and Dongguan plus six ad-ditional smaller cities. Leafy Suzhou that lies just past the distant outskirts of Shanghai is eyeing closer ties to the financial hub. Real estate agency JLL now even uses the term “Greater Shanghai” to describe the tie-up.

Comforting clusters

Theoretically speaking, a husband could commute to Dongguan, the wife to Guangzhou, and both return after work to their home in the middle. They would also be shopping mostly where they live, and consuming social services there as well – the burden on different systems, such as medical care and education, would be more thinly spread throughout the region. Indeed, part of the “turning point” problem lies in that the central megacities have been overwhelmed with increasing populations faster than public services such as hospitals and schools can keep up.

Cluster cities also create more space for experimenting with urban-ization and figuring out what works and doesn’t work. China cannot afford to build up thousands of cities that are flawed if its grand development ambi-tions are to be realized. If a sub-city in the cluster fails then it isn’t out there alone, as a megacity would be. There are resources to fall back on.

Despite the benefits of cluster-ing cities there is no simple roadmap for urbanizing millions more people. Clusters also face huge challenges. Economic growth is still an important evaluation metric for local government officials so there could be a reluctance to allow industry to leave or for a city to lump all its eggs in one basket. Not every big emerging city can work in a cluster, simply because some are too isolated to link up with other urban areas. This is the case with Urumqi in western Xinjiang province. A failing big city would eat up state funds and worsen an already bad government debt problem that could hurt China’s financial stability.

Yet amid all of the uncertainty sur-rounding mass urbanization, cluster cities clearly have an edge over the megacity. The future path for urban China should be to integrate, not sub-sume.

In planning how to move hundreds of millions of people into cities, China’s urban planners should consider an alternative to the suffocating megacity

THE HOUSE VIE W

China Economic Review | August 201406

NE WS ROUNDUP

MONTH IN REVIEWEconomyChina’s GDP rose 7.5% in the April-June period from a year earlier, the first acceleration in growth in three quarters, according to official data. That was higher than 7.4% in the previous quarter and came on the back of higher state spending and credit easing. Industrial production rose 9.2% in June from a year ear-lier, topping the 9% median estimate of analysts and 8.8% in May. Fixed-asset investment excluding rural households increased 17.3% in the first half from a year earlier. “The data are quite positive,” said Zhu Haibin, chief China economist at JPMorgan in Hong Kong.

China’s debt-to-GDP ratio reached 251% at the end of June, an increase from 147% at the end of 2008, Financial Times reported, citing esti-mates from Standard Chartered. Chi-nese policymakers have warned that the combination of slowing headline growth rates and ever-increasing debt dependency is unsustainable and has led to misallocation of capital, result-

ing in massive overcapacity. The growing dependency shows no sign of being reversed, with the debt-to-GDP ratio increasing by 17% in the last six months. Rather than reining in credit, the government has let it accelerate because of fears that slow-ing growth could trigger a hard land-ing. Estimates of China’s debt-to-GDP ratio vary depending on the type of credit included.

Twenty of 25 provinces and pro-vincial-level cities reporting eco-nomic data experienced growth in the first half of the year, Bloomberg reported, citing local-government data. The news signals an upturn after 30 of 31 provinces previous-ly reported first-quarter expansion below regional goals. “Both the national and provincial figures show a clear pickup, though the provin-cial ones more obviously so,” said economist Xu Gao, cautioning that provincial governments have incen-tives to inflate GDP figures. The regions are benefiting from central government investment as well as local government stimulus. Nation-wide, the first-half and first-quarter growth numbers were both 7.4%, while expansion increased 0.1% in the second quarter.

FinanceChinese banks have halted a trial pro-gram letting customers bypass cap-ital controls to transfer large sums of money overseas after an expose by state television, The Wall Street Journal reported, citing unnamed sources. The program was launched

by the People’s Bank of China two years ago and allowed approved banks including Bank of China to offer the service in Guangdong. The halt comes after criticism from China’s state broadcaster, underscoring the political sensitivity of wealthy Chi-nese moving money abroad. Officials close to PBOC believe the program will continue, as it is in keeping with Beijing’s efforts to promote the yuan’s use overseas.

Beijing agreed to stop interfering with the value of the yuan “as condi-tions permit,” representing a modi-cum of progress on an issue that has dogged US-China relations for years, Reuters reported. China’s Central Bank Governor Zhou Xiaochuan

WE ARE FAMILY: BRICS nations leaders celebrate their new

development bank, to be based in Shanghai

CHINA BY NUMBERS

Cre

dit

: F

rüh

tau

Cre

dit

: N

ath

an

Pa

cu

lba

30%

Percentage of new government vehicles that will be powered by alternative energy by 2016

Amount China will lend to Argentina for the construction of two hydroelectric dams

$7.5bn33%Increase in property sales in June

$14bnChina’s foreign aid to Africa from 2010 to 2012

China Economic Review | August 201408

said China would allow supply-and-demand to play a bigger role in deter-mining exchange rates. US officials say China deliberately holds down its currency to boost exports, an accusa-tion China denies. Instead, China says its currency policy is aimed at promoting economic stability. Poli-cymakers on both sides also agreed to avoid “competitive devaluation” of their currencies under a broader deal.

China stocks soared on grow-ing optimistic bets on the world’s second-largest economy, Reuters reported. The Hang Seng Index on July 28 closed up 0.9% at 24,428.63 points at its highest since November 2010. The CSI300 index of the lead-ing Shanghai and Shenzhen A-share listings jumped 2.8%, while the Shanghai Composite Index gained 2.4% to 2,177.95 points. The jump put the onshore share indices square-ly in the black for the first time this year after a disappointing recent performance. Bets are growing that China’s economy has turned a corner and investors expect more growth-friendly policies.

Politics and societyA Chinese oil rig has concluded exploration near the Paracel islands

in the South China Sea after discov-ering signs of oil and gas, Reuters reported, citing state media. Xinhua said the US$1 billion deepwater rig was scheduled to be relocated to what it called the Hainan Lingshui project operations. It had been operating for two months in waters also claimed by Vietnam. Chinese industry experts have said the rig had a good chance of finding enough gas to put the area into production. That would give China its first viable energy field in the disputed South China Sea.

Shanghai was appointed the head-quarters of a development bank being launched by BRICS emerging mar-kets nations, Reuters reported. Bra-zil, China, India, Russia and South Africa signed off on the new insti-tution, along with an emergency reserves fund, after two years of nego-tiations, a major step for the diverse group known more for its anti-Western rhetoric than coordinated action. New Development Bank, as it is officially called, will have starting capital of US$50 billion, with capital increased to US$100 billion.

BusinessKFC parent Yum! Brands and McDonald’s apologized to custom-ers after another food safety scan-dal broke in China, Reuters report-ed. Chinese regulators shut a local meat supplier after a TV report that showed workers picking up meat from a factory floor, as well as mix-ing meat beyond its expiration date with fresh meat. The companies said they immediately stopped using the supplier, Shanghai Husi Food, a unit of Aurora, Illinois-based OSI Group, and had switched to alternatives. They added that the factory served restaurants in the Shanghai area.China’s big three state-owned wire-

less carriers have agreed to jointly form a telecommunications tower company with a registered capital RMB10 billion (US$1.6 billion), Reuters reported. China Mobile, China Unicom and China Tel-ecom will have respective stakes of 40%, 30.1% and 29.9% in the tower company. China Communications Facilities Services Corp. will primarily engage in the construction, mainte-nance and operation of telecoms tow-ers. The joint tower firm could reduce individual spending by the firms and allow them to share the infrastruc-ture, as well as increasing each car-rier’s network coverage and quality.Microsoft said it was under an anti-

trust investigation in China, as offi-cials from the State Administration for Industry and Commerce visited some of its local offices in late July, Financial Times reported. Micro-soft’s offices in Beijing, Shanghai, Guangzhou and Chengdu were all the subject of unannounced visits from the SAIC, one of three Chi-nese antitrust bodies, Chinese media reported. The investigation is the lat-est setback for Microsoft in China, following a ban on central govern-ment purchases of its Windows 8 PC software, which was imposed in May over alleged concerns about security.

NE WS ROUNDUP

Cre

dit

: B

oa

z G

utt

ma

n

Cre

dit

: M

arg

na

c

200

Number of top officials ordered to quit corporate posts70%

Percentage of Chinese coal fi rms that are loss-making

Percentage of Japanese surveyed who had confi dence in Chinese President Xi Jinping

6%

$317bn

China’s aggregate fi nancing in June

China Economic Review | August 2014 09

Q&A: ROBOTICS IN CHINA

Automated labor

China overtook Japan last year to become the

world’s largest market for industrial robots, accounting for 37,000 of 180,000 units sold worldwide, according to a new report from the International Fed-eration of Robotics. IFR president Arturo Baroncelli tells China

Economic Review why this is hap-pening, where he thinks the industry is headed and argues that automa-tion doesn’t necessarily lead to high-er unemployment.

Where do you see the future direc-tion of the robotics industry in terms of sectors and applications?Historically there is one sector which is most important for robotics: Au-tomotive. Many of these robots have been sold in the booming automotive market of China. But not only. Robots start to be used in another sector, one that we call general industry. Indus-try divides automotives and general industry, because automotives more or less is part of the market, and the rest is all the other sectors. Last year worldwide out of nearly 180,000 units sold, 70,000 were in automotives. The rest were electronics, rubber, plastics and so forth. China is today now the biggest robot consumer in the world and will also be tomorrow.

Do you see the biggest applications of industrial robots in China con-tinuing to be in the automotive sec-tor, or will new sectors and appli-cations be more prominent in the future?Both. Both will continue because as far as I know we have to consider the investment in new automotives plants. And they are continuing. But

at the same time the application in all other segments, well, China has a huge internal market that will contin-ue to grow. There is also another im-portant sector considering the devel-opment of robotics in China. In the world we have a very important figure which is robot density. What is the robot density? It is the number of ro-bots per 10,000 employees. This aver-age worldwide is 58, in countries like Korea, Japan, Sweden, Italy, Denmark where robotics started many, many years ago. So if we consider the value of China, its value today is around 20. What does it mean? It means there is a big room for improvement.

So do you think the robot density will increase to match that of Japan and western countries in the future?I think the industrial robots will continue all over the world besides China, and I tell you why. Because robotics has a natural tendency to

diffuse into more segments. So seg-ments which were not populated by robots yesterday, today can be populated by robots. Why? Because people, specialists, engineers, entre-preneurs, they understand that using robots in a specific new field will have better products and higher efficiency. So this special tendency of industrial robots to be applied in new applica-tion fields will constitute a boost for the forthcoming years.

How do you think automation will affect China’s manufacturing industry?My opinion is that in many fields is there is no choice. No choice to go for automation because using robots is not an advantage but it’s your only choice. Let’s consider for example the automotive industry. In automo-tives the tool, not a tool, the tool for making cars is the robot. There is no alternative. So it’s not even a question of choice. It would be like printing your magazine by hand instead of us-ing other modern devices. So I think that automation will be the necessary choice. My professional experience, I’m in the business since 1995, is that when you introduce automation in robotics, it commands, it requires, it will dictate a sort of improvement of the whole process. So automation is synonymous of higher quality and ef-ficiency.

Do you think that more reshoring will occur or do you think Chi-na’s manufacturing industry will become stronger with the use of robots?Robots can be used both in China and other countries. So in many cases, it depends, case by case. Where some companies have come to China or other countries only considering the labor costs, okay that was a choice. But other countries have decided to

As the factory of the world becomes its biggest consumer of goods, domestic and foreign fi rms are installing more robots to address China’s ongoing economic shift

“It’s not a question of choice. It would be like printing your magazine by hand instead of using other modern devices. So I think that automation will be the necessary choice ... when you introduce automation in robotics, it commands, it requires, it will dictate a sort of improvement of the whole process”

China Economic Review | August 201410

wfaowtteIB

Arturo Baroncelli

automate, using robots in their own countries. In this case, since labor cost is not the basic reason to go east, they’ve been able to keep the produc-tion at home in their own countries. But there is also another fact. Many other countries using robots are using robots both in their own countries and also in China. Why? Because producing with robots in China is an advantage: Internal efficiency and cost and overall quality so I can think that many solutions can be considered, and in many cases, many international companies have both – robots in their home countries, Italy, Germany, United States, and in Chi-na because of the high demand of the Chinese nation.

Foreign providers currently con-trol 90% of the Chinese market and two-thirds of global robotics supply is dominated by four firms. What is holding Chinese robotics compa-nies back and how can they break into this market? We have to see. The robotics market is like every other market, there are many players. I have seen both foreign companies and the Chinese suppli-ers, many, so it will be a question of

competitiveness, a question of quality of products. Just like every other field, like cars, ice cream, telephones. If the Chinese suppliers will be able to have competitive and good products, this will be okay for them. For the Chinese suppliers it’s a relatively new market so they will have to do better than the foreign companies. On the other hand I see that China has very good universities, very good engineers and managers, so it will be like every other market, a question of competitiveness.

What will be the effect of increas-ing automation in the Chinese job market? With automation it means that first of all you have higher production, standardization of the production process, and this is very important because this is the basis of improv-ing the quality, so you have these two things: Higher productivity and a better complete process. Because automation works very well where all the components that must be han-dled, assembled, welded, produced by the automative line are of good qual-ity. If they are not of good quality, the automation has some troubles. So if you use automation you are forced to

improve the quality of your company. And I think that in every other part of the world, and in China it is the same story, if you are forced to auto-mate you will have higher productiv-ity and higher quality.

But do you think it will affect the job market at all?If you look at the figures showing who are the biggest robot users of the world, it is China. The second is United States. In the last four years, we have seen a continuous increase in the use of robots in the United States. But what’s happened to employment in the United States? It increased as well. So we had an increase of robots and better employment rate. This was United States. Then, who is one of the biggest robot users of the world? Germany. Germany has a very good economy, unemployment rate very low, because they use a lot of robots. Japan as well. Republic of Korea as well. These five countries—China, Japan, Republic of Korea, United States and Germany—are the biggest robot users of the world. And they have in absolute terms, employment rate in check, very good, or they have decreased unemployment.

Q&A: ROBOTICS IN CHINA

Cre

dit

: A

BB

Me

dia

Re

lati

on

s

China Economic Review | August 2014 11

ROBOTS MAKE WORK: Baroncelli says that counttries with high numbers of robots are creating more jobs, not losing them

China Economic Review | August 201412

Q&A: SUPER CIT IES

Within touching distance

You talk about the changing hierarchy of cities. Could you elab-orate a bit about what that entails?Basically we’ve identi-fied three themes that are driving that chang-ing hierarchy: Global-ization, urbanization and digitization. Those are the three things that are turning the economic

geography of the world on its head. Urbanization is really about cities

in the emerging markets that are ex-panding through “flash urbanization,” as you sometimes call it. And so just by pure power of influence and size and dynamic, they are asserting themselves more on the world stage. You’re get-ting cities like Wuhan and Chengdu that only ten years ago were just not on the radar, but now are certainly mov-ing into the top 100 cities.

The second is globalization, and by that, what we’re finding is that there are certain cities that are benefitting from the increasing interconnectivity between cities both in terms of trans-port, but also in terms of the virtual connections between sets of people, such as London and Dubai.

The third theme is what we call digitization, and that’s just a phrase that we use about how technology is making the world smaller.

Are there any examples in China of this development?Well, I think it needs a density, it needs culture, and so I think Shang-hai is probably the only example of a city that has the ingredients to start to build that culture, I would argue, at this stage. Because technology has of-ten been about business parks, as you know - London’s Western Corridor and Silicon Valley, but now some of

Jeremy Kelly, Director, Global Research programs at real estate services fi rm JLL, discusses Shanghai’s rise as a “super city” and why he thinks Hong Kong isn’t going to make the cut

the real innovations are in downtown San Francisco, or downtown London, or Berlin, or Amsterdam, so it needs that cultural burst, which at the mo-ment I only really see that in Shanghai.

You were talking about the global city, and how you see that Shanghai has some of the things in place that can move towards that, so can you talk more about how Shanghai com-pares to its global peers?What we’ve observed, certainly from a real estate perspective, is the emer-gence of what we’re calling the super cities. And at the moment we can see four cities that are sticking their head above the parapet: London, Paris, New York and Tokyo. And they have largely four key ingredients. One is pure eco-nomic size and economic influence as financial trading hubs. They have very deep corporate bases and many headquarter locations. They have deep liquidity in terms of huge turnover of real estate, in terms of investment. All four of them are head and shoulders above the rest in terms of investment. And they account for about 20% of global commercial real estate invest-ment, so huge concentration in these four cities. And then the final compo-nent of that is a large and diverse real estate stock.

Our thesis is that Shanghai has the ingredients to move to super city status, we’re saying by 2025. The real-ity is in the positions of these cities, is that it’s a steady progression, and therefore you’re not overnight going to see Shanghai being catapulted to super city status. Even in a place like China, it does take time to put in those ingredients. What we’re saying is there is real commitment by the central government to establish Shanghai as a truly global, international financial and trading hub.

How about the development of the commercial real estate stock in Shanghai?It’s been interesting to listen to the debate recently about concerns about oversupply in Shanghai. But I think if you look at it over a longer-term hori-zon, essentially what Shanghai is doing is building the real estate infrastruc-tures to move into its new skin as a super city. Thirteen million square me-ters by 2020 is what we’re saying here, of grade-A office stock. Compared to London and Paris and New York and Tokyo it’s not huge, and therefore cit-ies like Shanghai will go through those cycles of supply-demand disequilib-rium, but there is a long-term demand base that one can see that would allow that space to be occupied.

It’s not like Dubai where you can see all these buildings with 40% va-cancy rates, and although it’s a very dynamic city – I know I may be proved wrong – but you just really can’t see where the demand base is going to come from. Whereas in a place like Shanghai, it has the economic power and strength, and corporate dynamics to enable the space to be absorbed over a relatively short period of time. I’ve seen it elsewhere, and I think Shanghai has been through several cycles where its supply has looked uncomfortably

YccotBfaiiaa

Jeremy Kelly

“We’re not predicting the decline of Hong Kong by any means, but we just think that Shanghai has got that real momentum ... it is developing as the main financial hub of China”

China Economic Review | August 2014 13

Q&A: SUPER CIT IES

high, but in many transitional markets we often get vacancy rates of 20-30%. It’s a part of that evolutionary process.

What are the implications of Shang-hai becoming a super city?I think success breeds success. What we’re finding is that as a super city there is huge gravitational pull of peo-ple, capital and companies. So that will encourage economic growth. But I think, just to be a bit more provocative, there are downsides to that. As we’re seeing in London, there are inevitably issues of affordability, there are issues relating to social cohesion, congestion and diseconomies of scale. So I know I can speak for London about its con-tributing to economic success, and these cities are succeeding as a result of being truly open, but there are issues.

Obviously Shanghai is the stand-out candidate from China, but given your China 50 report, what emerg-ing cities do you see?

The two that I would highlight, and perhaps neither of them would be a huge surprise, would be Chengdu – which has certainly emerged from our China 50 work as the premier city outside of the top tier of Shanghai, Beijing, Guangzhou and Shenzhen. I think that’s very much driven by the openness and the deliberate policy of Chengdu to attract multinational cor-porations. And so it’s a much more international city than others. It also has that livability component to it. The other one is now Wuhan. And so from our City Momentum Index [published in January], Wuhan was fifth globally in terms of momentum, and what’s driving that one is the of-ficial recognition about central China. It’s already happened on the coast, it’s already happened in western China as a result of the Go West policy.

Of the four big global cities you mentioned earlier, Hong Kong wasn’t in there?

Hong Kong is not in those five cities, and that is contentious. We’ve actually created a simple model which looks at economic power, corporate base, real estate stock and investment vol-umes. That’s where the four cities have come from, and Shanghai is moving up there. Hong Kong falls just outside of that. I think that we’re not assert-ing that it will become a super city. It certainly has many of the ingredients – it’s an international trade hub – and we’re not predicting the decline of Hong Kong by any means, but we just think that Shanghai has got that real momentum. So I would say if you look at comparisons Hong Kong does have many similarities as an international trading hub with the Singapores, New Yorks and Londons. But what Shang-hai has is I think it will be developing as the main financial and trading hub of mainland China, and therefore has got that extra boost. But I certainly don’t think Hong Kong is going to suffer.

Q&A: B ITCOIN DEBIT CARD

Bitcoin goes plastic

Asia, in particu-lar Hong Kong and mainland

China, has been a quick adopter of the bitcoin digital currency. Early headlines focused on the speculative buying of Chinese investors that drove bitcoin prices up to record levels late last year. Prices have since

eased off by about 40% as the initial surge of speculative buying dried up, but acceptance of the currency among consumers, if not necessarily cen-tral banks, is steadily rising. Bitcoin ATMs have popped up in Shanghai and Hong Kong and more and more retailers are accepting them.

In mid-June Hong Kong-based ANX, one of the world’s largest bit-coin exchanges, launched the world’s first reloadable prepaid bitcoin debit card, which could potentially spark the next wave of consumer activity with the crypto currency. In an inter-

view with China Economic Review, ANX CEO Ken Lo explains how the debit card works and how it removes a substantial barrier for bitcoin users by allowing them to use bitcoins in tra-ditional credit card payment systems.

Why did you launch a bitcoin debit card?We believe prepaid cards will play an integral role in a bitcoin consumer’s day-to-day financial life. As a market leader we felt it was important to go beyond current offerings in the mar-ketplace and bring something new and innovative to our customers. Although the merchant adoption is increas-ing daily, there are still a lot of places where bitcoins are not accepted. We wanted to allow our bitcoin users to be able to use their bitcoins on a tra-ditional payment network that has 30 million merchants worldwide.

Can you explain how the process, from applying for the card to loading and paying, works?

The ANX Bitcoin Debit cards are only offered to our customers. Us-ers must first register and verify their account on ANX before applying for the debit card … Once they receive their card, they send a request to the ANX support team to load funds from their ANX account to the debit card. We will be releasing a fully automated solution in our following release. The card is then useable in over 30 million merchants worldwide through a tradi-tional payment network.

How are a card holder’s bitcoins exchanged into useable currency? Funds can be loaded onto the ANX debit card via bitcoin or in any of the 10 major currencies that ANX sup-ports. The stored currency on the ANX debit card is in US dollars. This card is then useable at merchants and ATMs worldwide that don’t support bitcoins because the card will be deb-ited in US dollars.

Can card holders convert the bal-ance on their cards back into bit-coins?No.

Which card payment processing providers are you working with?Although it is public knowledge we are not allowed to market publicly the payment provider.

Where do you expect your biggest user base to be in the short-to-medi-um term?People who need to travel a lot, and students who study abroad. This card can use bitcoins to purchase items through conventional payment sys-tems such as online retailers or physi-cal retail stores. Cash withdrawals can be performed via an extensive ATM network spanning over 200 countries. The debit cards are linked to our ANX bitcoin exchange account and

The digital currency may have fallen in value as Chinese speculators fl ed the market but one Hong Kong exchange is betting that consumers will want to spend it in stores

WELCOME TO THE CLUB: Despite reservations among central bankers, a growing number of retailers

both online and offl ine are accepting bitcoin

Cre

dit

: N

iall

Ke

nn

ed

y

China Economic Review | August 201414

CadhtCdty

Ken Lo

bitcoin wallet. This integration does not exist today.

The debit card currently supports the US dollar. Are there plans to add the yuan?The debit card currently supports the US dollar only as the base currency. However, we are working on adding more currencies later.

Can the card be used to make pay-ments in mainland China?Yes.

Can people in mainland China apply for your card?No.

China is one of the world’s biggest bitcoin markets. If the debit card takes off there, what could that mean for global acceptance?A debit card would definitely be a plus for global acceptance. However, we have no plans for that region right now.

How closely is this system able to follow bitcoin’s constantly changing exchange rate?The cards will be loaded at the market rate and thus will not be fluctuating.

How does this debit card promote the acceptance of bitcoin among retailers if the onus for conversion is placed on a service provider like ANX?By having an ANX bitcoin debit card, bitcoin users now have another way for spending their bitcoins at a retailer that doesn’t accept bitcoins because the card is debited in US dollar.

ANX is not a traditional financial services company. How are you able to operate a debit card and how can users be sure that it will be accepted by retailers?This is because our payment provider is one of the largest payment proces-sors in the world.

Part of the appeal for bitcoin users is anonymity. Surely that ends with a physical debit card as transactions can be much more easily traced?We have no anonymous users on our

system. All of our users are verified. The one advantage to our ANX bit-coin debit card is now you are able to buy that surprise gift from Amazon to your significant other using bitcoins, whereas previously you had no alter-native because Amazon does not ac-cept bitcoins.

What interest are you getting from retailers in Hong Kong?Hong Kong being a world financial capital has all the right ingredients for driving and leading innovation in the bitcoin industry. More and more merchants and people are accepting bitcoin as a payment method. We are glad that we are a part of it.

How is the card integrated into existing payment networks?Our payment processor is global and can process in 30 million merchants worldwide and can access an extensive ATM network in 200 countries.

If holders can use the card at a regu-lar point of sale, is there some kind of integration that needs to happen at the merchant?Nope, the whole benefit to the ANX bitcoin debit card is that it is debited through traditional POS systems and there’s no change that has to happen on the merchant side. ANX provides all the integration to get the card to be accepted globally.

Q&A: B ITCOIN DEBIT CARD

HOW TO SPEND IT: Lo says ANX wants to improve acceptance of bitcoins among consumers

Cre

dit

: Im

ag

ine

ch

ina

China Economic Review | August 2014 15

OP-ED: CHINA AND THE WORLD

Building the BRICS Bank

The leaders of the BRICS coun-tries – Brazil,

Russia, India, China and South Africa – on 15 July signed the ‘Fortaleza Declaration’ creating a new inter-national development bank. Initial capital of US$50 billion, eventu-ally rising to US$100

billion, will make the New Develop-ment Bank (NDB) a player on the scale of the US$223 billion World Bank.

Unlike the World Bank – with 188 participants but dominated by the US, Europe and Japan – the terms of membership are pointedly egali-tarian: Equal capital contributions and a portioning out of key posts– a Brazilian chairing the board of direc-tors, a Russian chairing the board of governors, a head office in China and a “regional centre” in South Africa.

China could easily fund an insti-tution the size of the NDB single-handed. The China Development Bank, a key policy lender, alone has foreign currency loans of more than US$200 billion. So why would Bei-jing commit to a scheme that gives it less control over how its capital is used and ties it down by the need to reach consensus with some of the most fiercely independent (and in Russia’s case openly truculent) of the world’s economic powers? And why should it stake resources on what is ostensibly a redundant and unprom-ising initiative based on the flimsiest of collective identities? One possibil-ity is that Beijing’s participation is part of a broader strategy.

It is a widespread and safe as-sumption that the ultimate motive behind Chinese foreign policy is the need to defend and bolster the Com-munist Party’s grip on power at home.

That means ensuring access to mar-kets and resources necessary for the economic growth that raises living standards and legitimises its rule. But it also means“making the world safe for authoritarianism,” in the words of Aaron Friedberg, former deputy assistant for national security affairs and director of policy planning for Vice President Dick Cheney.

The Party’s principle threat in this respect is the international prepon-derance of the US. The world’s most powerful country has a deep-rooted hostility to one-party rule and makes no secret of its wish to undermine the Party’s monopoly, so neutralising the threat posed by US dominance of international institutions– and the liberal democratic norms this under-pins – is imperative as a matter of self-defence. Beijing articulates this as ‘opposing hegemony’ – pragmatism dressed up as principle.

Another explicit tenet of Chinese foreign policy, however, is “never to

claim leadership.” Beijing recognises the risks it would run in directly chal-lenging the US and the established world order. The fate of past ris-ing powers – particularly the Soviet Union and Germany (twice) – is un-likely to be far from the Politburo’s collective mind. Much as it fears the potential for Western ideological in-fluence to undermine its regime from within, it also recognises the potential for destructive international rivalry to become so costly that it fatally weak-ens the Party’s position at home.

Instead of confronting the estab-lished US-led global order directly, Beijing may hope to work around it, in effect “surrounding the cities from the countryside” as Mao Zedong’s guerrillas did during their revolution-ary wars.

China’s post-Mao economic de-velopment path offers another analo-gy: Reformist leaders did not begin by trying to break up the powerful state industrial sector, but rather encour-

A look at how Beijing will use the New Development Bank to weave a web around Washington and further its economic diplomacy goals

SOMETHING TO BE PROUD OF?: BRICS nations seemingly only share frustration towards the West’s

control of global institutions, but perhaps thier new development bank will bring them closer together

China Economic Review | August 201416

Rao‘cnbUa

Benjamin Charlton

Cre

dit

: M

ich

el

Te

me

r

OP-ED: CHINA AND THE WORLD

aged new, entrepreneurial businesses to “grow outside the plan.” Only once these had become the mainstay of the economy did the leadership gradually begin to dismantle the apparatus of the planned economy.

Much commentary has described the NBD as a rival to the World Bank, but Beijing is unlikely to frame it this way. The impression that Chi-na is mobilising a rival camp under its own leadership is precisely what Bei-jing wants to avoid, because it would fuel the sort of “Cold War thinking” of which Beijing so frequently ac-cuses Washington.

This may also explain why Bei-jing, despite being economically in a league of its own among the BRICS, accepts the constraints of a structure in which all members have an equal say. An ostensibly egalitarian initia-tive appears less threatening and more legitimate than a unilateral or clearly China-led one, presenting Beijing’s agenda as part of a greater cause and parrying criticism that its international initiatives are self-inter-ested bids to enhance its own power.

The initiatives China promotes – such as the Shanghai Cooperation Organisation (SCO) and more re-cently the Conference on Interaction and Confidence Building Measures in Asia (CICA) – do not demand exclusive allegiance, and it presents them as supplements to existing in-ternational institutions rather than alternatives.This moves in line with what Beijing calls the “historical trend” of global integration–but to-wards a world order of more diverse and decentralised international gov-ernance structures that does not have the West at its core.

The strategy of diluting rather than confronting US influence on global governance would leave ample scope for different groupings to focus on different issues. In this context, the truism that the BRICS have little in common in terms of culture, de-mography, history, political systems or wealth is beside the point: They share a need for development fund-ing. Other matters fall outside the NDB’s remit, and can be dealt with by other institutions that may or may

not involve the BRICS as a group.Championing a number of dif-

ferent groups with different mem-berships might even help Beijing cultivate the impression that it does not seek to create a rival camp. Insti-tutions such as the BRICS, the SCO or the CICA allow cooperation on issues where members’ interests con-verge and need not signify broader affiliation.

In development funding, China’s needs sometimes converge with the BRICS’s; on counter-terrorism, they converge with the SCO’s; on piracy, they converge with those of most maritime trading powers. There is no reason why membership of these dif-ferent issue-specific groupings, each with a narrow focus of activity, should coincide.

In the multi-layered world order Beijing may be envisioning, potential for spill-over from one narrow sphere of activity to another would be lim-ited. There is therefore little prom-ise that cooperation on, for example, the NDB will ease tensions in other spheres, such as the border dispute between China and India or New Delhi’s fears vis-a-vis China’s grow-ing maritime power.

Conversely, the limited focus of each of Beijing’s plurilateral initia-tives bodes well for its commitment to making them successful on their own narrow terms, despite a lack of deep affinity between their partici-pants.

Beijing’s plurilateral initiatives are tentative and fragile, and do not sit easily with China’s increasingly high-handed behaviour towards its near neighbours. But if enough new links are fastened, the result would be far from the ‘walled world’ that Mark Leonard envisaged as China’s global goal. Rather, it would be a ‘worldwide web’ of slender threads thickly woven – without the US spider pulling the strings from the centre.

China Economic Review | August 2014 17

Benjamin Charlton is the Senior Analyst for East Asia at the global analysis and advisory firm Oxford Analytica

OP-ED: CHINA’S ENERGY HUNT

Drilling with friends

Outbound for-e i g n d i r e c t investment by

Chinese energy com-panies began to gain momentum in the early 2000s when large Chinese state-owned enterprises, or SOEs, stepped up their search for natural resources overseas. As China’s continued economic growth drove increased domestic demand for energy,Chinese ener-gy companies began to look overseas to securenew reserves and long-term energy sup-plies.This international pursuit was led pre-dominantly by China’s largest energy compa-nies: China National

Petroleum Corporation (CNPC), China National Offshore Oil Cor-poration (CNOOC) and China Petroleum & Chemical Corporation, more commonly known as Sinopec.

While China’s SOEs operate as commercial enterprises similar to their counterparts among international oil companies, their overseas acquisitions do contribute to China’s energy se-curity and the SOEs have benefited from Chinese government policies promoting outbound investment in energy and natural resources as well as from export credit and similar finan-cial support – again not unlike their counterparts among US and other international oil companies. Chinese government leaders have also given support to overseas energy and natural resources investments during visits to energy-producing countries in Africa, South America and elsewhere.

According to data published by the Chinese government, by end of

2012 China’s oil imports reached 57% of its demand. Both Chinese energy demand as well as imports as a proportion of overall supply have-continued to increase since that time. Meanwhile imports of natural gas by pipeline and in the form of lique-fied natural gas (LNG) have likewise continued to increase. To meet this growing demand, it is expected that Chinese energy companies will con-tinue to seek opportunities to acquire and develop overseas oil and gas as-sets. Yet the manner in which they go about selecting and acquiring new as-sets is evolving.

Chinese energy companies now place greater emphasis on efficiency and return on investment whereas in the past they had focused on acquir-ing overseas reserves and production barrels. There is also a greater focus on improving integration of assets as well as portfolio management. As Chinese energy companies look at new opportunities they are likely to become more selective and strategic in the deals they choose to pursue.

Going out into the worldChina’s accession to the World Trade Organization in 2001 spurred the country’s continued economic growth, and with it increased demand for en-ergy and natural resources both as an input for export-oriented, often ener-gy-intensive manufacturing as well as to fuel the new cars and other products for the rising urban middle class.

Early transactions tended to be acquisitions of oil and gas assets from smaller companies, often one-off transactions and relative to the com-plex transactions of recent years quite small. The sellers and deal counter-parties were often smaller, privately-held upstream companies rather than publicly-listed global players of simi-lar size to the Chinese SOEs. In a few instances where SOEs attempted to pursue higher-value M&A activ-ity they were pre-empted by interna-tional oil companies exercising rights of first refusal.

The global economic slowdown that ensued in late 2008 created op-portunities for Chinese energy com-

The next wave of China’s overseas energy M&A is likely to involve strategic partnerships with majors and independent international oil companies

NEW HORIZONS: China’s hunt for energy will take it to new places it can't explore alone

China Economic Review | August 201418

CpmeCesfo

David M. Blumental

cgdegtslppdln

Hon C. Ng

OP-ED: CHINA’S ENERGY HUNT

panies with their ready access to cash to pursue larger, more complex deals.With a smaller universe of poten-tial buyers and often under pressure to monetize assets, international oil companies now viewed Chinese en-ergy companies as attractive potential buyers for negotiated deals and as strategic joint venture partners.

In the past six years,Chinese ener-gy companies have completed a series of multibillion dollar, sophisticated transactions with and opposite large independent oil and gas companies and integrated oil majors, including takeovers of publicly-listed companies, large asset acquisitions and complex joint ventures for the development of deep water blocks offshore Brazil, of unconventional shale plays in North America,and of LNG liquefaction and export projects in Australia, Canada and Mozambique.CNOOC’s success-ful acquisition of Nexen, a publicly-listed Canadian oil and gas company, for US$15.1 billion represents the largest Chinese outbound M&A deal to date in any sector, following Sino-pec’s successful acquisition of Addax Petroleum in 2009.

Having completed this series of large acquisitions and joint ventures, the focus has now shifted to inte-gration and operation of acquired assets as well as to the development of experienced management and

technical personnel and improving efficiency and return on investment. At the same time, there has been a corresponding slowdown in new ac-quisition activity. This slowdown is likely to be only a short hiatus, how-ever, and Chinese energy companies are likely to resume new acquisition activity in due course, but now with a view to being more selective and

more strategic in the opportunities they elect to pursue.

What happens next?We expect to see large Chinese en-ergy companies continuing to pursue complex acquisitions, strategic part-nerships with majors and indepen-dent international oil companies and other transactions potentially includ-ing partial selldowns and divestitures as they rationalize their portfolios. At the same time, we expect to see more private (non-SOE) companies and private equity funds backed by both private and SOE limited part-ners becoming active in cross-border energy transactions. Successful in-tegration of assets and operations around the globe and the develop-ment of experienced management and technical teams that can bridge cultural and language gaps will be an ongoing task for Chinese energy companies.

TEAMWORK: Where once Chinese oil majors bought production rights to drill alone, deals will increasingly be about equity stakes and working with partners

Cre

dit

: Im

ag

ine

ch

ina

China Economic Review | August 2014 19

“We expect to see large Chinese energy companies continuing to pursue complex acquisitions, strategic partnerships with majors and independent international oil companies and other transactions potentially including partial selldowns and divestitures as they rationalize portfolios"

David M. Blumental is a partner in Latham & Watkins Hong Kong office. He serves as Global Co-chair of the firm’s Oil & Gas Industry Group. Hon C. Ng is an associ-ate in the firm’s Hong Kong office focusing on cross-border M&A and finance transactions.

FOR A BETTER FUTURE URBAN ENVIRONMENT CHINA NEEDS TO BREAK UP FOR A BETTER FUTURE URBAN ENVIRONMENT CHINA NEEDS TO BREAK UP

ITS MEGACITIESITS MEGACITIES

Cluster formationCluster formation

FIT IT ALL IN: Packing cities with people, factories and jobs isn’t a smart way to grow. An alternative known as city clusters could be the answer for China

Barely two decades ago China was known as the “Kingdom of Bicycles” and cars were a rare sight on the streets. Now there is hardly any

room to park. The likes of Shanghai and Guangzhou have morphed into giant urban centers as millions of new arrivals flooded in to pursue economic opportu-nities. They are widely touted as examples of the new Asian megacity.

As China reaches the limits of its current export and investment-based growth model, its biggest cit-ies have also begun to reach a developmental limit. The megacity no longer appears to be a sustainable path forward. Changing track will not be easy, but plans are already underfoot to break existing megaci-ties up into clusters with a central hub surrounded by smaller cities.

Across the country, in Shanghai and Suzhou, in Beijing and Tianjin, and in the Pearl River Delta around Guangdong and Shenzhen, cities are link-ing up, clustering together into urban units of a truly grand scale – approaching and potentially exceeding 100 million people. By building stronger physical and economic links with their surrounding areas big cities can relocate industry, jobs and people, making them less dense and more efficient. The formation of these clusters is not simply the future of the urban land-scape, but the future of China’s development.

Megacity vs. clusterThe sheer scale of this phenomenon is dizzying, to be sure, and not a little bit confusing. The terms megacity and cluster cities are often used inter-changeably to describe what is going on, but in fact each has a distinctive meaning. Those differences are crucial to China’s development.

“Megacity” is a hefty term. Written in proper, that big capital “M” imparts a swagger commen-

COVER STORY: MEGA CITIES

Cre

dit

: Im

ag

ine

ch

ina

China Economic Review | August 2014 21

surate with the cities themselves. It conjures up an image of towering skyscrapers by the dozens, hundreds of kilometers of subway track, peo-ple and cars filling the streets. Big money, big opportunity… big smog, too. But like most buzzwords, it’s a bit more fanciful than descriptive.

The United Nations officially defines a megacity as any municipal-ity with over 10 million residents – an arbitrary but convenient benchmark. However, even this doesn’t account for how municipal boundaries are drawn. For example, it’s easy to be wowed by Shanghai’s 24 million peo-ple versus the eight million in New York City. But it is often omitted that Shanghai covers an area five times that of the Big Apple that includes large swathes of farmland. The broad-er New York Metropolitan Statistical Area, essentially greater New York, has a population of 19.9 million. Yet nobody considers New York as fitting into the megacity category.

COVER STORY: MEGA CITIES

“Everybody has a different defi-nition” of a megacity, says Jonath-an Woetzel, co-chair of the Urban China Initiative and director at con-sultancy McKinsey. “I think 10 mil-lion on up is reasonably accepted as a megacity, but we may end up chang-ing that definition over time.” Par-ticularly, he added, if the population of cities in the average continues to push higher.

According to the China Urban Sustainability Index, an annual research project carried out by UCI and the McKinsey Global Institute, known as cluster cities might be more appropriate for China. “In the first report, we contrasted two versions of urbanization: Concentrated megaci-ties and clusters,” said Woetzel. “We concluded that the cluster form made a bit more sense … and that has been borne out [by the data].”

Clusters, as he refers to them, form with at least one very large city as a central hub, surrounded by many

other smaller cities as its spokes. The model allows for more diversity as each city remains an individual play-er, and can bring its complementary strengths to bear regionally through smart integration. This geographi-cal huddling has major implications. “We think of clusters as the most sus-tainable form of urbanization,” said Woetzel. “In all ways.”

Best laid plansCities across China are a curious mix of careful planning, thoughtful con-sideration and a whole lot of hap-penstance in between. The vast urban regions of today are the result of plan-ners forging ahead with their ideas and then reacting to change.

Most of the big urban centers we see in China now are the direct result of the opening up of the country in the 1970s and the productive tumult that followed. The Pearl River Delta manufacturing hub is a prime exam-ple. Before 1949, a huge portion of Chinese goods were sent through Guangzhou and on to Hong Kong for export. Once that route closed the need for a new one became apparent, setting in motion the birth of the port city and factory hub of Shenzhen.

“15 years ago, there was no Shen-zhen,” said Ma Xiangming, chief planner at the Urban and Rural Plan-ning and Design Institute. “When Deng Xiaoping opened up policy in Shenzhen… it meant that things could only be sent to Shenzhen. For ten years things concentrated in Shenzhen.”

Money flowed, factories were built, more people followed. Soon enough the city was expanding. In 1990, the highway system in the region was very underdeveloped, so Shenzhen took it upon itself to begin correcting that. “The city itself planned its own road system, and then the central government con-nected it and formed the regional highway system,” Ma said. “So it comes two ways: Bottom-up, and top-down.”

Shenzhen is not something that occurred naturally. It was created, and then it grew. The newly built highways encouraged it further and

DROP THE EGO: Cities should be built for the people who live in them and not subjected to the some-

times irrational whims of plannins offi cials and overzealous developers and their showy projects

Cre

dit

: Im

ag

ine

ch

ina

China Economic Review | August 201422

the population exploded. Guangdong grew. Dongguan, the third big city, become the place to go as a young migrant worker fresh from the coun-tryside. The region became what we know it as: China’s engine, the world’s factory. “If there is no new China, there is no Shenzhen,” Ma said. It would seem the same is true vice versa.

The current planning situation is both proactive and reactive – bot-tom-up and top-down. China’s urban population surpassed 50% a few years ago and now it is the explicit goal of the central government to keep the trend going. By 2020, 60% of the population will be in urban areas, ris-ing to 70% by 2030, according to a new urbanization blueprint released by Beijing in May. As Ma conceded, there is no way to block the fire hose of migration, whether you plan for it or not. The question now is figuring out the best way to turn villagers into urbanites.

Rethinking the economic modelHuge cities tend to conjure mostly negative images of sprawl, density, overpopulation, crime, social inequal-ity and all the other downsides of modern urban living. These cities might be economic centers, but they are tough and rank poorly in terms of sustainable living.

That doesn’t always have to be the case. The China Urban Stability Index 2013 shows that most Chinese cities have in fact improved their level of sustainability in recent years, and that the top 10 best performing are located mostly in the coastal or east-ern regions. Sustainability is positively correlated with increased population size, density, migration and foreign investment.

As urban conurbations grow public services and utilities scale up quickly, in effect reducing the nega-tive footprints of inhabitants. Water and heating are provided in tight net-works over shorter distances while waste collection is more focused and therefore efficient. While some Chi-nese urban dwellers continue to dis-pose of their rubbish in public streets, armies of cleaners are there to remove

COVER STORY: MEGA CITIES

it quickly; nobody burns refuse in open pits or lights crop fires that pol-lute the skies.

Still, cities can only be green and clean up to a certain point. “There is a limit to how far one can go with-out rethinking the economic model,” said Woetzel. According to the CUSI report, the “turning point” where big cities outgrow their efficiency comes when the population tops 4.5 million, density reaches over 8,000 people per square kilometer and migrants make up over 30% of residents. Places like Shanghai and Tianjin went past that point long ago.

Over the next 15 years or so more cities will join the ranks of giant urban areas. In order for them to be workable and successful, planners will need to improve how they are put together.

The cluster cities paradigm is, at its heart, a way of rethinking the economic model. Many of the other factors generally considered neces-sary for sustainability are more or less related to that central princi-ple. In this model a big city acts as the main hub for administrative functions, capital and talent with a few core industries such as servic-es. Meanwhile smaller outer-lying cities develop their own economic fields such as high-tech or industrial production. This allows for indus-try, services, jobs and people to be spread out but still easily connected. A traditional megacity, by contrast, typically encompasses all functions within itself.

In our April issue, China Eco-nomic Review argued that Shang-hai cannot hope to be both a service center rooted in finance while at the same time maintain its industrial base if it ever wants to get rid of its pol-lution problem and enjoy a healthier growth.

Suzhou, a small city to the west of Shanghai that has for all intents and purposes become a distant suburb, is attempting to create its own special-ism while also drawing on its prox-imity to China’s economic hub.“You have to leverage the resources in this region. I wouldn’t say [Suzhou is] trying to be different, but trying to be

different in very specific segments,” said Joe Zhou, head of research for East China at real estate services firm JLL.

Suzhou is still carving out its eco-nomic identity, but Zhou says it’s already good at semiconductors and pharmaceuticals. The aim is to keep on attracting high-tech industry as low value-added industries such as textiles move away.

The planned direct linkage of Shanghai and Suzhou’s municipal subway systems will help to do the actual leveraging by making travel between the two even more con-venient. The goal, Zhou says, is to use Suzhou’s cheaper land and rent prices along with the more livable environment to lure businesses and residents away from Shanghai. As part of a bid to create that more liv-able environment, Suzhou created the Suzhou Industrial Park, which helped it claim the Lee Kuan Yew World City Prize, an award that recognizes leadership in sustain-able development. Because of the pending connection, the move is all that more attractive for people and businesses. Zhou notes that several financial services firms have opened offices in the SIP in the past year.

“We use the words ‘Greater Shanghai’ like ‘Greater London’ to describe this coming together of the two cities, said Zhou.

The Pearl River Delta Into One project, which is integrating Guangzhou, Shenzhen, Dongguan and six other satellite cities, essentially has the same aim. As Ma explained, a family could live in one of smaller cities and work where they can find the best jobs. Theoretically speak-ing, a husband could commute to Dongguan, the wife to Guangzhou, and both return at night back to their home in the middle. They would also be shopping mostly where they live, and consuming social services there as well – the burden on differ-ent systems, such as medical care and education, will be more thinly spread throughout the region. Indeed, part of the “turning point” problem lies in that the central megacities have been overwhelmed with increasing

China Economic Review | August 2014 23

COVER STORY: MEGA CITIES

populations faster than public such as hospitals and schools can keep up.

In the north of China, the Bohai Economic Rim Project is integrating Beijing, Tianjin, several surrounding cities and Hebei province – well over 100 million people. Beijing is tak-ing an aggressive stance when comes to tackling the “turning points” and endemic pollution. Not only are the authorities looking to push out indus-trial production from the nation’s capital but also to send up to five million residents into nearby areas to de-clutter a congested city. For a city that’s seen its population grow by two-thirds since the turn of the mil-lennium, that would be a huge trend reversal.

Clusters drive innovationBringing lesser-tier cities into the game has some unique advantages. Not least among them is the time and space for more sensible urban planning, and even a little experimen-tation – they are often where the big-gest improvements can be made.

One such example is Urumqi, the capital of Xinjiang and the largest city in western China. The region has been earmarked for major invest-ment by Beijing to exploit is abun-dant natural resources and strategic location on the old Silk Road. The authorities in that region have been working with the “Future Megacities” scheme established by the German government in 2004 to fund research in emerging giant cities around the globe in the hope they might influ-ence sustainable urban design.

Urumqi has a population of around 3.2 million and 10 million square meters of construction is cur-rently taking place, equal to half of the new construction in Germany at this time, according to Bernd Franke, an environmental planning and assessment expert, who worked on the Urumqi project for the German government. Franke says the project had several successes.

He his team found a willing ear and collaborator in the local gov-ernment, and a city of the right size to affect change. They contributed to the local government’s decision

to recently convert the entire city’s heating system from coal to natural gas – a feat accomplished in just nine months – and the decision earlier this year to increase new housing efficien-cy standards by 25%.

In term of new ideas, Franke says that sustainable housing has been the most promising. With extreme winters as cold as minus 30 degrees centigrade a huge amount of energy is required for heating. The construc-tion boom created the opportunity for the “Passive House,” which Franke says utilizes modern design and mate-rials to achieve better insulation.

“Passive housing can be done in a very demanding climate, in a very poor area and be done quickly,” Franke said, crediting that proof-of-concept with the landing of their next passive house project in Tianjin. That spreading of innovation is crucial.

Urumqi is on track to become another major city in China. The fact that it is implementing policies

focused on sustainability early on in its development could set it on a good path for the future. Nevertheless its rise also points to the problems other emerging centers will face.

Competing ambitionsPlanning and building China’s future urban environment is no easy task. Regardless of the research into and awareness of urbanization, sustain-ability and other related issues, there is a lack of a unified national vision for how to move forward and many competing priorities.

Back in Xinjiang, Franke and his team came across a PVC plant that used coal as feedstock. Franke says that switching to petroleum-based fuels would cost a bit more but curb carbon emissions significantly. “I said [to the CEO], what if the govern-ment banned PVC production from coal?” recalls Franke. “He said, ‘Then I would have to find something else to do with my coal.’” Many industries

OVERCROWDED: China’s urban areas may well need to be dense to pack in the millions of people who

live within them but they can be built in clusters instead of on top of one another

China Economic Review | August 201424

COVER STORY: MEGA CITIES

are vertically integrated in this way and not easily changed.

Perhaps more important is the issue of communication and coordi-nated planning between the central government and the many local gov-ernments. Right now, Urumqi is the proposed location of a new coal gasi-fication plant that will generate clean-er natural gas to be piped to Beijing. Coal gasification is enormously dirty, so much so that its central location in Urumqi would effectively cancel out the gains brought by more efficient housing standards and the conver-sion of city heating to natural gas. In this sense, the project seems to make little sense. Nevertheless, the powers that be are pushing for it very hard to boost the economy.

Communication and disputes are also a problem at lower levels. In the Pearl River Delta, all the constituent cities and the provincial government recognize that integrated rail con-nections are the future of the region.

What they cannot agree on is who exactly will build what. According to Ma, every city wants its own subway system while the provincial govern-ment prefers a broader, integrated network. Space is already extremely constricted so there’s simply no room to build both, and even if there was doubling-over construction would be a waste of resources. The Pearl River Delta already has four international airports all within 50 kilometers of each other.

Beijing’s more radical plan has an entirely different set of problems. The first is challenging nearby local governments to fall in line with its plan for fairer regional tax systems and social infrastructure. The second is moving all those factories and their migrant workers away, which is a bit more intractable. In the short term, it would lessen pressure on Beijing’s infrastructure and alleviate some of the nasty pollution for which it has become infamous. In the longer term, that’s less of a solution to pollution than simply moving the problem else-where.

Crucially, not every city is a growing metropolis or located close enough to other emerging cities to form the big clusters that would give the best returns on integration. Despite its strategic location, Urumqi sits many kilometers from any other big urban area – one of the reasons planners in Beijing are content to send coal gasification and other dirty industry its way.

These cities could very well turn out to be the big losers in the game. “The reality is that we will have a portfolio of outcomes,” said Woetzel. “If you have an isolated city, you have a failure. The risk is blowing a hole in the balance sheet of cities.” With the mounting indebtedness of local governments a major risk for China’s financial stability, that could spell dis-aster.

A blueprint based on clustersChallenges notwithstanding, the integration of cities into clusters is clearly the way forward. The future of China as a dynamic country now hinges on moving to higher value-

added industries, solving pollution problems and creating space for the comfortable and growing middle classes to build a consumption-based economy. Bunching cities together is integral to this process.

“Clusters work because they cap-ture economies of scale,” Woetzel said, adding that, “a cluster city is very specific. It goes to one specific product and dominates.” In other words: Specialize, divide and conquer. That’s what Suzhou is trying to do by leaning on the resources and global connectedness of nearby Shanghai. That’s what the cities in the Pearl River Delta can all do, while sharing skilled workers in a big, connected regional pool.

Another aspect is the ease of experimenting at reduced risk, and then sharing what works. “Regardless of where it is derived, what matters is dissemination… and that starts with the cluster,” said Woetzel. “If Xin-tiandi [an upscale shopping district] works in Shanghai, then we see it in other cities. It goes to other cities in the cluster and then beyond.”

Similarly, if a city tries something and falls flat on its face, it isn’t out there all alone. Part of the point of linking up with the big city is that the big city can step in if there is a problem. There are resources to fall back on.

All of the above are more than what would traditionally be consid-ered a megacity can handle as a single entity. There is no space left, local resources and infrastructure are over-whelmed, and living standards are sacrificed. The cluster lets the largest city act as a center of gravity for a diverse system of satellite areas that divide urban tasks. To make a rough analogy: Ten families in ten differ-ent houses is resource inefficient; ten families in one giant room is chaos; ten families living in an apartment complex pools group needs and pre-serves individuality – that’s what the cluster does on a grand scale.

Ultimately, the cluster enables people to keep doing what they’ve been doing for the past 30 years: Envisioning a richer future. China should embrace this model.

China Economic Review | August 2014 25

Cre

dit

: Im

ag

ine

ch

ina

BUSINESS: COMMERCIAL DRONES

Commercial drones are the latest hot product in the technology world and China is emerging as a leading developer and user of unmanned aerial devices

Drones have flown into pub-lic view in China in the past fortnight as weapons in the

war on pollution. The environment ministry recently employed drone-mounted infrared cameras to moni-tor and collect data on industrial pol-luters in the north of the country.

This is just one example of the growing number of non-military applications for drones domestically. Increasingly, these unmanned aeri-al vehicles are being used for com-mercial purposes in fields including aerial photography, video and even logistics. According to some esti-mates, the market for commercial drones is now worth a few hundred

million renminbi annually and grow-ing fast.

But Chinese companies are not only buying drones: They are designing and producing commercial units for sale at home and abroad. Yet despite entrepreneurs showing a knack for drone production, design and commercial application, govern-ment regulations and market forces may forestall a quick takeoff for an industry that is rapidly capturing the attention of the business world.

In June spying drones swept through the airspace of three prov-inces home to major steel and coal-mining industries on patrol for pol-luters. Roughly a quarter of the firms

had exceeded air pollution limits according to an announcement from the Ministry of Environmental Pro-tection. Hebei Iron & Steel Group, the country’s top steel producer, was named and shamed for egregious emissions.

Government ministries aren’t the only ones with eyes in the skies. Drones, many of them designed by Chinese entrepreneurs, have begun to dot the airspace above China’s cities and countryside to capture airborne vistas on film where only heavily regulated helicopters once hovered. MF Vision, a Shanghai-based company specializing in remote-control aerial photogra-

Flying parcelsAERIAL DELIVERY: Commercial drones that can deliver pacels are still waiting for permission to fl y in China

China Economic Review | August 201426

Cre

dit

: B

ud

i N

usyi

rwa

n

phy and videography, boasts clients including the BBC, Fuji TV and a number of Chinese provincial and municipal television stations.

Many drone fleets increasing-ly include craft designed and pro-duced by two companies from South China, XAircraft and DJI Innova-tions. Their growing successes at home and abroad are signs that local firms have the chops to thrive in this booming field within the commercial drone sector.