PWM 6-11 rev 6-14c

-

Upload

amit-arora -

Category

Documents

-

view

228 -

download

0

Transcript of PWM 6-11 rev 6-14c

-

8/3/2019 PWM 6-11 rev 6-14c

1/12

Private Wealth ManagementExclusively for High Net Worth Individuals and Families

October 1114, 2011Optional Half-Day Session: Investment Fundamentals October 10, 2011

-

8/3/2019 PWM 6-11 rev 6-14c

2/12

-

8/3/2019 PWM 6-11 rev 6-14c

3/12

1

An integrated and strategicapproach to wealth management

specically or wealth owners.

Chicago, Illinois

October 1114, 2011Optional Hal-Day Session: Investment Fundamentals October 10, 2011

Private Wealth ManagementExclusively for High Net Worth Individuals and Families

-

8/3/2019 PWM 6-11 rev 6-14c

4/12

Private Wealth ManagementExclusively or High Net Worth Individuals and Families

As a wealthy individual, you are working to protect and grow your wealth, enjoy nancial security, and build a lastinglegacy. Eective investment management is critical, o course, but successul wealth management is an integrated andstrategic discipline which also includes tax, estate planning, philanthropy, governance, and amily culture. Each amilys

situation is unique, and no one solution will suce or all. In this program, you will gain rameworks, tools, and skills sothat you can clariy your amily and nancial goals, design a strategy to preserve and manage your wealth, and overseenancial advisors with greater condence, accountability, and results.

This rigorous program incorporates case studies, lectures, and small and large group discussions. Some o the mostvaluable learning in the course takes place in the shared experiences among classmates and peers, so we create acondential and solicitation-ree environment.

Private Wealth Management is designed or U.S. and international individuals and amilies who have built wealthin this generation, have inherited amily wealth, or are contemplating or have recently experienced a liquidity event.Family oce executives may attend with principal amily members, but the course is closed to all other nancialservices proessionals.

Program Outline

You will learn practical, tested, and actionable rameworks. Deneyournancialandfamilyobjectives,andusethemtodesignawealthmanagementstrategy

that is consistent with your values and personal circumstances, and delivers on your priorities.

Selectaninvestmentstrategythatisrealistic,prudent,taxefcient,andactionablegiventhetimeand resources you have to commit.

Learnthedifferencesamongtheinvestment,brokerage,andwealthmanagementindustries,andtheir complex relationships and incentive systems. How can you align their interests with yours?

Decidehowtoevaluate,select,andoverseethermsandindividualadvisorswhoarerightforyouand your amily. Do you make decisions based on trust, service, or perormance?

Buildperformanceevaluation,goodreporting,andaccountabilityintoyourrelationshipswithyour advisors.

Identifyissuesandoptionsinmultigenerationalestateplanning.Howcanlegalstructuresandtax management save you millions, protect your privacy, and serve current and uture generations?

Developandcommunicateagovernancesystemthathelpsyourfamilytostewardassetswiselyand that encourages its members to fourish. Ater all, human capital is your amilys mostimportant asset.

Integratephilanthropyandpublicserviceintoyourwealthmanagementstrategy.

Optional Hal-Day Session:Investment Fundamentals Monday, October 10 (1:30 5 p.m.)

This session covers investment basics or those with limited investment experience or or those who would like aconcentrated reresher. Day 2 o the program will build upon this oundation by examining investment theory andstrategies in greater detail. Participants with limited exposure to investing concepts are strongly encouraged to attend

this optional session. This session will ocus on the basics o investments such as stocks, bonds, mutual unds, ETFs,and hedge unds; access to investments through advisors, brokers, and direct investments; understanding perormancereports; ees and other costs; and measures o risk and return.

Program Dates and Fees#11C23002 October 1114, 2011 ($8,950)

Optional Hal-Day Session: October 10, 2011 Investment Fundamentals

The program ee includes tuition, lunches, two class dinners, and all educational materials. The ee is subject to changeand payable in advance upon conrmation o registration. This course begins at 8 a.m. on October 11 and ends at 5p.m. on October 14.

2

-

8/3/2019 PWM 6-11 rev 6-14c

5/12

Who Should AttendThis course is or wealth owners only. Family oce executives may attend with principal amily members butno other nancial services proessionals may attend.

The course will be o greatest interest to those:

strivingtomaintainprosperityandaourishingfamilythroughretirementand,or many, across generations.

contemplatingorrecentlyexperiencingasignicantliquidityevent,whether

through the sale o a company, inheritance, or other major wealth transition.

committedtoengagingtheirfamiliesinmoreproductivedialogueaboutthechallengesand opportunities o wealth.

seekingaddedcondencetoevaluateandselectnancialadvisorsand/ortosetstrategic direction or a amily oce.

Wehavefoundthatmultiplemembersofthesamefamilyhusbandandwife,parentandoffspring,cousinandcousinderiveconsiderablebenetfromtakingthecoursetogether.Theprogramgivesthemafoundationor continued productive dialogue well into the uture.

To acilitate the interactive nature o the course experience, the program is capped at 50 participants.We recommend submitting your application beore September 2 to assure your place.

Praise From Participants The course provided the perect launch platorm or setting my nancial objectives and beginning the exerciseo deciding on investment strategies and conronting the overall wealth management challenge.

Guillaume Cuvelier, Founder and former CEO, SVEDKA Vodka

Rare to have access to this quality o participants, academics, and proessionals.Great experience not solely based on program content, but total class.

William Brewer, CEO, Cornell Forge

A+bestwealthmanagementseminarIhaveeverattended. David W. Burleigh, Partner, Buechner Haffer Meyers & Koenig

The course was incredibly interesting and thought-provoking.The true transparency o shared inormation by aculty andparticipants was especially rereshing.

Kathy Leventhal

My amily learned a great deal rom the knowledgeable aculty

and interaction with other participants. Attending with my amily

was enormously valuable and I would highly recommend it --

we could discuss the sessions and how they related to our situation,

urther cementing what we learned.

Esther Brabec, 2010 Participant

Excellent program and I would say better than others that I have attended. I ound it

extremely benefcial to attend with my amily, and we liked that the programs structure

allowed time to share knowledge and learning with each other and ellow classmates.

Kristen, 2010 Participant

Your program covered a great deal o complex material and made it come to lie! As a result o what my wie andIlearned,wearegoingtomakeBIGchangesinourportfolio.ItisalongtripfromShanghai,butIcanhonestly say it was one o the most valuable weeks in my lie.

Patrick Hopkins, 2011 Participant

For More Inormation Contact:EXECUTIVE EDUCATION Mark LewisThe University o Chicago Associate Director o Executive Education

BoothSchoolofBusiness Telephone:312.464.8732

450N.CityfrontPlazaDrive,Suite514 Fax:312.464.8731

Chicago,IL60611-4316 E-Mail:[email protected]

www.chicagoexec.net3

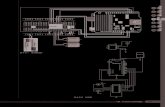

4.64.6 4.6 4.7

High Participant SatisactionAverage Course Evaluation Score is 4.64

4.65

4

3

2

1

0 Dec.07 June08 Sept.08 March09 Nov.09 May 10 Nov. 10 May 11(Spain) (Spain)

Course Dates

OverallCourse

Valu

e

(outof5) 4.6 4.6

4.85

-

8/3/2019 PWM 6-11 rev 6-14c

6/12

OutstandingChicagoBoothFacultyTheUniversityofChicagoBoothSchoolofBusiness,withthemosthighlyregardednancefacultyofanybusinessschool in the world, ranked rst in a recent Journal of Financereport or the impact o its acultys research. Theprograms aculty members are not only world-class researchers, but also singled out by BusinessWeekmagazineas being among the nations best teachers in the world o business. Complementing our aculty are wealthmanagement experts who have practical experience in the complex nancial and amily issues o wealth. Together,they oer academic excellence, rigorous scholarship, real-world experience, and practical application that provideparticipants with unparalleled opportunities to expand their horizons.

Steven N. KaplanCo-Faculty Director and Neubauer Family Distinguished Service Proessor o Entrepreneurship and FinanceThe University o Chicago Booth School o Business

Steven N. Kaplan is the Neubauer Family Distinguished Service Proessor o Entrepreneurship and Finance at theUniversityofChicagoBoothSchoolofBusiness,wherehehasbeenamemberofthefacultysince1988.HeisalsothefacultydirectorofChicagoBoothsPolskyEntrepreneurshipCenter.ProfessorKaplanteachesadvancedMBAand executive courses in entrepreneurial nance and private equity, corporate nancial management, corporategovernance,andwealthmanagement.Hehasbeenoneofthetop-ratedteachersatChicagoBoothinBusiness-Weeksbi-annualsurveyssince1992.BusinessWeeknamed Proessor Kaplan one o the top 12 business schoolteachers in the country.

ProfessorKaplanisaresearchassociateattheNationalBureauofEconomicResearchandisanassociateeditor

o the Journal of Finance, the Journal of Financial Economics, and several other journals. He serves on the board odirectors o Accretive Health, Columbia Acorn Funds, and Morningstar (MORN). He also serves as a director o theIllinoisVentureCapitalAssociationandtheUniversityofChicagoLaboratorySchools,andastheacademicdeanofthe Kauman Fellows Program, an educational and mentoring program or new venture capitalists.

Proessor Kaplan earned his PhD in business economics rom Harvard University and received his bachelors degreeinappliedmathematicsandeconomicsfromHarvardCollege.AtChicagoBoothExecutiveEducation,ProfessorKaplan teaches in the Finance or Executives and Private Wealth Management programs.

John C. HeatonCo-Faculty Director and Joseph L. Gidwitz Proessor o FinanceThe University o Chicago Booth School o Business

JohnC.HeatonistheJosephL.GidwitzProfessorofFinanceattheUniversityofChicagoBoothSchoolofBusiness.

His research has ocused on asset pricing, portolio allocation, and time series econometrics. His work has beenpublished in Econometrica, the Journal of Finance, the Journal of Political Economy, and the Journal of Businessand Economic Statistics.ProfessorHeatoncurrentlyisaresearchassociatewiththeNationalBureauofEconomicResearch.

Proessor Heaton has published papers and articles in numerous business and academic journals. He is anassociate editor o the American Economic Review. He currently serves on the board o directors o the Center orResearch in Security Prices (CRSP).

StuartE.LucasChairman, Wealth Strategist Partners LLCAuthor o Wealth: Grow It, Protect It, Spend It, and Share It

StuartLucasisthechairmanofWealthStrategistPartnersLLC,aproviderofwealthmanagementeducationandconsulting services to individuals and amilies. Along with Steve Kaplan and John Heaton, he is one o the principal

designers o the Private Wealth Management program. The program expands and operationalizes the approachdescribed in his book, Wealth: Grow It, Protect It, Spend It, and Share It. He is a eatured speaker around theworld and the author o numerous articles on wealth management.

As a ourth-generation descendent o E. A. Stuart, ounder o the Carnation Company, he also co-manages hisamilys investment oce. Previously, he was the senior managing director o the Ultra-High Net Worth Group withinPrivateClientServicesatBankOne(nowJPMorganChase).Earlierinhiscareer,heservedasgeneralmanagerofWellington Management Companys European operations and as the assistant portolio manager o a Forbes HonorRoll mutual und.

Mr.LucasservesontheinvestmentcommitteesofNPR,Inc.andtheStuartFoundation.

HehasabachelorsdegreefromDartmouthCollege,anMBAfromHarvardBusinessSchool,andisaCharteredFinancial Analyst.

4

-

8/3/2019 PWM 6-11 rev 6-14c

7/12

Howard M. HelsingerLecturer in Law

The University o Chicago Law SchoolHoward M. Helsinger is a partner in the Chicago law rm o Sugar & Felsenthal, and a lecturer at the University oChicagoLawSchool,wherehehastaughttrustsandestatesforthepast10years.HeisamemberoftheAmericanCollegeofTrustandEstateCounsel,apastchairoftheChicagoBarAssociationProbatePracticeCommittee,andafrequentlecturerfortheIllinoisInstituteofContinuingLegalEducationandotherstateandnationalbarassociations.He concentrates his practice in estate planning, estate administration, probate, charitable planning, and trust andestate related litigation.

He has a bachelors degree in English rom Haverord College, a PhD in English literature rom Princeton University,andaJDfromtheUniversityofChicagoLawSchool(1978).Beforelawschool,hetaughtEnglishLiteratureatBostonUniversity,andafterlawschoolheclerkedfortwoyearsintheU.S.CourtofAppealsfortheSeventhCircuit.

Sara Hamilton

Founder and CEOFamily Ofce Exchange (FOX)

Sara Hamilton is the ounder and CEO o Family Oce Exchange (FOX). Recognized or her expertise on wealthowners and their amily oces, Ms. Hamilton and FOX serve as strategic advisors to sophisticated investors withassets lasting beyond one generation.

As an innovator in the wealth management industry, she developed a number o unique resources designedspecically to increase knowledge and control or nancial amilies and their advisors. At FOX, she spearheadedthe rst global online community or nancial amilies, called FOX Exchange, accessible to members throughwww.familyofce.com.In1991,FOXconductedtherststate-of-the-industrystudywhichproledthebuyingbehaviorof100familieswithaverageassetsover$300million.In1994,FOXhelpedlaunchtherstventurecapitalfund-of-fundsdesignedtoaccesstop-tierventurefunds,nowcalledFLAGVenturePartners.In1999,Ms.Hamiltonwas a ounding member o the Family Oce Exchange Foundation, which designed and housed curriculum toeducate owners about the stewardship o wealth.

As one o the countrys leading spokespersons about private wealth management and the amily oce concept,Ms.Hamiltonistheco-authorofanewbookcalledFamilyLegacyandLeadership:PreservingTrueFamilyWealthin Challenging Times. She serves on the editorial boards o the Journal of Wealth Managementand TrustsandEstates,aswellasontheFoundingBoardoftheChicagoGlobalDonorsNetwork.SheholdsanMBAfromtheUniversityofNorthFloridaandaBAfromVanderbiltUniversity.

BetsyBrillFounder and PresidentStrategic Philanthropy, Ltd.

BetsyBrillisthefounderandpresidentofStrategicPhilanthropy,Ltd.,aChicago-basedrmworkingworldwidewith individuals and their advisors, amilies, corporations, and established oundations to help design, manage,and support giving strategies that relate to social and economic change and build responsive, meaningul, andsustainable philanthropic strategies.

WithanMBAininternationalmanagementfromtheAmericanGraduateSchoolofInternationalManagement(Thunderbird),andacerticateinnonprotmanagementfromRooseveltUniversity,Ms.Brillhasintegratedor-prot and nonprot perspectives into her business ocus. She is a requent speaker, a regular contributor toThe Journal of Practical Estate Planning, and initiated and co-authored, Mapping a Path or Evaluation, A PlanningGuide, which has become a critical resource or numerous oundations and nonprots to evaluate the impact otheir eorts.

Ms.BrillisoneofthefoundingsteeringcommitteemembersoftheChicagoGlobalDonorsNetworkandamemberoftheNationalNetworkofGrantmakers,GrantmakersWithoutBorders,CouncilonFoundations,PhilanthropicAdvisors Network, Women & Philanthropy, the Chicago Foundation or Women Alumni Council, and the DonorsForum o Chicago.

5

-

8/3/2019 PWM 6-11 rev 6-14c

8/12

TheUniversityofChicagoBoothSchoolofBusinessThe University o Chicago has a long history steeped in a tradition o academic excellence and innovation. Chicagois about deep thinking and big ideas. That commitment to discovery has translated into enduring contributions to theworld. Its aculty, researchers, students, and graduates boast 85 Nobel laureates.

TheideasandstrategiesthatwillshapethebusinessenvironmenttomorrowarebeingformulatedandtaughtatTheUniversityofChicagoBoothSchoolofBusinesstoday.Formorethan100years,Chicagohasbeenaleaderandinnovator in the eld o business research and education.

Many o Chicagos current innovations are directly related to its close ties with the leaders o some o the worlds

mostrespectedcorporations.ThisgroundingintherealworldhashelpedChicagoBoothmaintainitsreputationasone o the worlds leading centers o business education and research.

Knownforenduringcontributionstotheeldofbusinessasresearchersandconsultants,ChicagoBoothsfacultyisalso noted as some o the worlds best business teachers.

ChicagoBoothofferssevenfullandparttimeprogramsleadingtotheMBAdegree.Inaddition,ChicagooffersaPhDprogram, open enrollment executive education seminars, and custom programs tailored to the needs o individualcompanies.ChicagoBoothoperatestwocampusesinChicago,oneinLondon,andoneinSingapore.

Chicagos reputation, commitment to academic research, and high quality aculty oer a prestige that ew can match.

Recent Rankings Recent surveys conrm our commitment to excellence and innovation.

BusinessWeekrankedChicagosFull-TimeMBAProgramfrst in its biennialrankings(2010),whiletheExecutiveMBAwasrankedsecond(2009).

The EconomistrankedChicagosFull-TimeMBAProgramfrst globally (2010).

U.S. News & World Report(2011)ratedChicagoBoothsecond in nance,third in accounting, and fth overall o ull-time programs, frst (tie) amongpart-timeMBAprograms,andsecondamongexecutiveMBAprograms.

Financial TimesrankedChicagosExecutiveMBAProgramfth (2010).

CustomLearningSolutionsChicagoBoothhasdevelopededucationalprogramsthatcreatelastingvaluefororganizationsaroundtheworld.Whatever the reason or seeking our expertise, one outcome is certain: participants emerge as better thinkers,

able not just to apply tested concepts to the issues at hand, but also to approach and think through the unknownchallenges ahead.

Case Study: Ater attending the Private Wealth Management (PWM) program in Chicago, a Spanish amilyencouragedthecreationofasimilarprogramforfamiliesinSpain.InSpring2009,ChicagoBoothandtheNUMAFoundation launched PWM Spain which continues to be oered each year in Madrid. Approximately 25 percento the participants in each course are riends or amily o previous course participants.

The SettingClassesareheldattheGleacherCenteroftheUniversityofChicagoBoothSchoolofBusiness,450NorthCityfrontPlaza Drive, situated along the Chicago River (one block east o Michigan Avenue), in the heart o the downtownarea known as The Magnicent Mile. The Center is within walking distance o some o Chicagos most excitingretail and entertainment areas.

TheGleacherCenter,whichalsohousesChicagoBoothstop-rankedexecutiveMBAandeveningMBAprograms,provides state-o-the-art classrooms that complement the exceptional quality o the programs content and aculty.

AccommodationsTheGleacherCenterisconvenientlylocatednearmanydowntownhotels.TheUniversityofChicagoBoothSchoolofBusinessworksspecicallywiththeInterContinentaltoprovidealimitedblockofroomsatadiscountedrate. To make a reservation at the InterContinental, please contact the Reservations Department by telephone at312.944.4100orbyfaxat312.321.8725.ParticipantsshouldidentifythemselvesasregistrantsintheUniversity oChicago Private Wealth Management program. Four weeks prior to the programs start date, or once the block isflled, the hotel cannot guarantee accommodations.

Forotherhoteloptionsinthearea,pleasecontactRebeccaMeyerat312.423.8037.

6

-

8/3/2019 PWM 6-11 rev 6-14c

9/12

APPLICATION FOR ADMISSION

Private Wealth ManagementExclusively or High Net Worth Individuals and Families

Code: 11C23002 A Date: October 1114, 2011 I will attend the optional Investment Fundamentals session

Fee: $8,950 (Theprogramfeeincludestuition,lunches,twoclassdinners,and all educational materials. Fee is subject to change and payable in advance.)

I am unable to attend. Please provide inormation regarding uture sessions o this program.

Personal Inormation

NameMr. Ms. Dr._________________________________________________________ FIRSTMIDDLELAST

Preerred name or name tag _________________________________________________________

Businessphone(_________)________________Businessfax(_________) _________________

Preerred e-mail ___________________________________________________________________

Home phone (_________) __________________ Mobile phone (_________) _________________

Most recent degree? High School BSBA MS MA MBA PhD JD LLD MD Year Earned _____________________

School/University __________________________________________________________________

Please provide a brie biographical sketch. Please include inormation about your amily and the

source o your wealth. You may attach a separate sheet.

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

How would you describe your current nancial and amily objectives? ________________________

__________________________________________________________________________________

Would you be interested in sharing your biographical sketch and nancial objectives with your

classmates? And reading theirs? Yes No

Payment Inormation

Checkenclosed,payabletoChicagoBoothExecutiveEducation.

Check to ollow. Please invoice.

Charge to my:

Card No. __________________________________________ Exp. Date ______________________

INSTRUCTIONSPlease ax, e-mail or mail this orm to:

The University o ChicagoBooth School o Business

450 N. Cityront Plaza Dr., Suite 514Chicago,IL60611-4316

Telephone:312.464.8732Fax: 312.464.8731E-mail: [email protected]

www.chicagoexec.net

Cancellations and transersareaccepted without charge i written

notication is received at least 30 daysprior to the programs starting date.Cancellations received ater that timewill be charged 25 percent o the totalprogram ee. No-shows are liable orull tuition.

Chicago Booth reserves the right tocancel any program.

Transer requestsreceived within30 days o the program start will besubject to a $200 transer ee to coveradministrative costs. Any late transersollowed by a cancellation will becharged 25 percent o the programee. Transerees will have a period oone year rom the date o their transerrequest to attend a subsequent programoering. Ater a one-year period, tuitionees will be oreited. Transerees will berequired to pay ee increases, shouldany take place.

Substitutions o registrants in asession may be made, without penalty,any time prior to the programscommencement.

Photo rightsThe University o Chicago reservesthe right to use photos taken duringseminar activities or promotionalpurposes.

Confdentiality and Non-SolicitationAll participants must agree to and signa condentiality and non-solicitationagreement to protect the privacy o theparticipants.

PLEASE DUPLICATE THIS FORM FOR ADDITIONAL REGISTRANTS. 7

-

8/3/2019 PWM 6-11 rev 6-14c

10/12

Business Inormation (i applicable)

Position/Title ______________________________________________________________________________________________________

Employing company ________________________________________________________________________________________________

Mailing address ____________________________________________________________________________________________________

City ________________________________________________________ State ______________ Zip _______________________________

Type o rm (manuacturing, service, retail, etc.) ________________________________________________________________________

Course Objectives

Describe your goals in attending the PWM program. What are your highest priority wealth management issues, concerns, or objectives?

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

Profle

Are you the benecial owner o nancial assets over $10 million? (stocks, bonds, private equity, hedge unds, investments, real estate, etc.)

Yes No

Please indicate your amilys approximate net worth. $10m$50m $50m$250m $250m$1b >$1b

Is your primary interest in wealth management during your lietime? with a multigenerational timerame?

What generation are you relative to the original wealth creator? 1st 2nd 3rd 4th more

How many amily members are involved with, or beneciaries o, your wealth management activities?

Involved:___________Beneciaries:___________

What type o company or enterprise created the amilys wealth? __________________________________________________________

_________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________

How did you hear about this program?

I received a brochure in the mail Wealth Strategist Partners A past participant recommended this course

Family Oce Exchange (FOX) Online search A Chicago alum recommended this course

Membership organization: ____________________________________ Other: _________________________________________

8

-

8/3/2019 PWM 6-11 rev 6-14c

11/12

-

8/3/2019 PWM 6-11 rev 6-14c

12/12

For more inormation concerning Chicago Booths Executive Education courses:

Phone: 312.464.8732 | Fax: 312.464.8731 | E-mail: [email protected] | Web: www.chicagoexec.netWrite: 450 North Cityront Plaza Drive, Suite 514 | Chicago, Illinois 60611-4316

![シクロプロトリン...10 2011 2 3 5 3 14C [cyc-14C] 3-14C [phe-14C] mg/kg g/g 1 2 Fischer 3 [cyc-14C] 50 mg/kg 5,000 mg/kg Fischer 3 7 2 1 50 mg/kg 5,000 mg/kg 50 mg/kg / Tmax](https://static.fdocument.pub/doc/165x107/60ef4da753c03d22e86933e7/ffffff-10-2011-2-3-5-3-14c-cyc-14c-3-14c-phe-14c-mgkg.jpg)