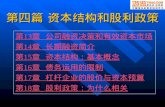

Part IV 資本結構與股利政策

description

Transcript of Part IV 資本結構與股利政策

-

Part IV 1314151617

13

-

1313.113.213.313.413.5 13.6EMH

13

-

13.1

13

How much debt and equity to sell

When (or if) to pay dividends

When to sell debt and equity

-

13

Fool Investors

Reduce Costs or Increase Subsidies

Create a New Security

-

13.2

13

efficient capital markets

-

13.3

13

Weak Form

Semi-Strong Form

Strong Form

-

13

-

13

EMH

Investors can throw darts to select stocks.

Prices are random or uncaused.

-

13.4

13

Rationality

Independent Deviations from Rationality

Arbitrage

-

13.5

13

Limits to Arbitrage

Earnings Surprises

Size

Value versus Growth

Crashes and Bubbles

-

13.6EMH

13

EMH

Investors should only expect to obtain a normal rate of return.

Firms should expect to receive the fair value for securities that they sell.

A firm can sell as many shares of stocks or bonds as it desires without depressing prices.

There is conflicting empirical evidence on all three points.

The price of a companys stock cannot be affected by a change in accounting.

Managers cannot time issues of stocks and bonds using publicly available information.

A firm can sell as many shares of stocks or bonds as it desires without depressing prices.

-

13

There are optical illusions, mirages, and apparent patterns in charts of stock market returns.

The truth is less interesting.

There is some evidence against market efficiency:

The tests of market efficiency are weak

2005 13-1

-

13

13

-

1414.114.2 14.3 14.4

13

-

14.1

13

par valuethe stated value on a stock certificate

dedicated capitalthe total par value

Authorized Common Stock Issued Common Stock

Capital Surplus

Retained Earnings

common equity

Market ValueBook Value

-

13

(1)(2)(3)

Cumulative VotingStraight Voting

Proxy Voting

Preferred Stocks

-

14.2

13

interestdividends

-

13

Amount of Issue, Date of Issue, Maturity

Denomination (Par value)

Annual Coupon, Dates of Coupon Payments

SecuritySinking Funds

Call ProvisionsCovenants

RatingYield-to-MaturityMarket price

-

14.3

13

(1)

(2)

(3)

(1)bad

(2)good

-

14.4

13

Patterns of Financing

Internal financing

debt financing

external equity financing

-

13

-

14

13

-

1515.1 15.2 15.3 15.4MM 15.5MM

13

-

15.1

13

VvalueBbondsSshares

(1)

(2)

_1172094257.unknown

-

15.2

13

As it turns out, changes in capital structure benefit the stockholders if and only if the value of the firm increases.

-

15.3

13

Shares outstanding

-

13

EPSEarn Per ShareROAReturn On AssetROEReturn On Equity

-

13

EBIT

B/S=1

-

Homemade Leverage

13

B/S=1

Homemade Leverage

10%

-

MM

13

M&MModigliani-Miller Model

Homogeneous Expectations

Homogeneous Business Risk Classes

Perpetual Cash Flows

Perfect Capital Markets:

Perfect competition

Firms and investors can borrow/lend at the same rate

Equal access to all relevant information

No transaction costs

No taxes

M&MMM Proposition I

-

15.4MM

13

M&MMM Proposition II

is the interest rate (cost of debt)

is the return on (levered) equity (cost of equity)

is the firms weighted average cost of capital

is the return on unlevered equity (cost of capital)

B is the value of the firms debt or bonds

S is the value of the firms stock or equity

-

13

_1311541042.unknown

-

13

-

15.5MM

13

MM Proposition I

MM Proposition II

-

13

-

13

-

13

2005 15-1

_1172250846.unknown

-

13

15-1(p427)AlphaBetaAlphaall-equity5,000$20Beta$25,00012%EBIT$350,00012%a. Alphab. Betac. Betad. 20%e. (d)f. 20%Alpha

Beta20%g.

2005 15-1

-

13

(a)

(b)

(c)

(d)

(e)

(f)A$15,00012%$5,000

$20,00020%Alpha

B$15,00020%Beta

$15,000$69,400

(g)BetaBeta

AlphaBeta

Beta

2005 15-1

_1209301685.unknown

_1209301716.unknown

_1209301741.unknown

_1209301846.unknown

_1209301703.unknown

_1209301598.unknown

_1209301611.unknown

_1209301413.unknown

-

13

15-6(p429)Rayburn$2,000,00018%Rayburn$400,00010%a. Rayburn

b.

c. (b)

(a)

2005 15-1

_1311572750.unknown

_1311572895.unknown

_1311572677.unknown

-

13

(a)

(b)

(c)

2005 15-1

_1209294994.unknown

_1209301107.unknown

_1209301180.unknown

_1209301215.unknown

_1209301138.unknown

_1209295081.unknown

_1209294855.unknown

_1209294871.unknown

_1209294814.unknown

-

13

15-11(p430) Digital1,000,000$10Digital$1,500,000Michael Lefton1%10%20%40%60%a. Michael Leftonb. Michael Lefton

2005 15-1

-

13

(a)

1%

20%

40%

60%

(b)

20%

40%

60%

2005 15-1

_1209295920.unknown

_1209302164.unknown

_1209302433.unknown

_1209302566.unknown

_1209302578.unknown

_1209302553.unknown

_1209302352.unknown

_1209302030.unknown

_1209302057.unknown

_1209295921.unknown

_1209295767.unknown

_1209295919.unknown

_1209295694.unknown

-

13

15-13(p431) $500,000$1,700,00010%34%$306,000a. b.

2005 15-1

-

13

(a)

(b)

2005 15-1

_1209296710.unknown

_1209296755.unknown

_1209296790.unknown

_1209296735.unknown

_1209296642.unknown

-

13

15-16(p431) Gibson$1,200,0008%$200,00012%Gibson35%a. b. c. (b)

2005 15-1

-

13

(a)

(b)

2005 15-1

_1209302754.unknown

_1209302799.unknown

_1209302821.unknown

_1209302877.unknown

_1209302766.unknown

_1209302732.unknown

-

13

15-19(p431) Williamson2.5

15%10%35%a. Williamson

b. Williamson

c. Williamson0.75

1.5

2005 15-1

_1219326783.unknown

_1219326795.unknown

_1219326766.unknown

-

13

(a)

2005 15-1

_1209303657.unknown

_1209305433.unknown

_1209306309.unknown

_1209306402.unknown

_1209306533.unknown

_1209306368.unknown

_1209306253.unknown

_1209305194.unknown

_1209305418.unknown

_1209305170.unknown

_1209303269.unknown

_1209303309.unknown

_1209302821.unknown

-

13

(b)

(c)

2005 15-1

_1209884386.unknown

_1209884690.unknown

_1209884726.unknown

_1209884807.unknown

_1209884397.unknown

_1209306652.unknown

_1209306794.unknown

_1209306575.unknown

-

15

13

-

1616.116.2 16.3 16.4 16.5 16.6 16.7 16.8 16.9

13

-

16.1

13

-

13

1

KnightDay(1)$10050%(2)$5050%Knight$49Day$6010%

_1172775184.unknown

_1172775741.unknown

_1172775766.unknown

_1172775786.unknown

_1172775200.unknown

_1172775160.unknown

-

13

Day

_1172776051.unknown

_1172776242.unknown

-

13

Day$15

Day

Day$5020%$43.1839%$68.18$61.36

_1172776566.unknown

_1172776801.unknown

-

13

Direct Costs

Legal and administrative costs (tend to be a small percentage of firm value).

Indirect Costs

Impaired ability to conduct business (e.g., lost sales)

Agency Costs

Selfish strategy 1: Incentive to take large risks

Selfish strategy 2: Incentive toward underinvestment

Selfish Strategy 3: Milking the property

-

13

2

$100

$150$145$50$70

-

13

3

$1,000$1,700

$900$1,000$800

_1172789004.unknown

_1172789134.unknown

-

16.2

13

(1) Protective Covenants

(2) Debt Consolidation

Negative covenant:

Pay dividends beyond specified amount.

Sell more senior debt & amount of new debt is limited.

Refund existing bond issue with new bonds paying lower interest rate.

Buy another companys bonds.

Positive covenant:

Use proceeds from sale of assets for other assets.

Allow redemption in event of merger or spin off.

Maintain good condition of assets.

Provide audited financial information.

-

16.3

13

The Trade-off Theory

There is a trade-off between the tax advantage of debt and the costs of financial distress. It is difficult to express this with a precise and rigorous formula.

-

13

MMThe essence of the M&M intuition is that

depends on the cash flow of the firm; capital structure just slices the pie.

-

16.4

13

The Signaling Theory

The firms capital structure is optimized where the marginal subsidy to debt equals the marginal cost.

Investors view debt as a signal of firm value

Firms with low anticipated profits will take on a low level of debt.

Firms with high anticipated profits will take on high levels of debt.

A manager that takes on more debt than is optimal in order to fool investors will pay the cost in the long run.

-

16.5

13

An individual will work harder for a firm if he is one of the owners than if he is just a hired hand.

-

13

4

Ms. Pagell $1,000,000$2,000,000(1)12%$2,000,000(2)$200,000Ms. Pagell 6$300,00010$400,000

Ms. Pagell $100,000$100,000

6

_1172825117.unknown

-

13

Who bears the burden of these agency costs?

(1)(2)LBO

Leverage Buyouts, LBO

Free Cash Flow Hypothesis

While managers may have motive to partake in perquisites, they also need opportunity. Free cash flow provides this opportunity.

The free cash flow hypothesis says that an increase in dividends should benefit the stockholders by reducing the ability of managers to pursue wasteful activities.

The free cash flow hypothesis also argues that an increase in debt will reduce the ability of managers to pursue wasteful activities more effectively than dividend increases.

-

16.6

13

The Pecking-Order Theory

The pecking-order theory is at odds with the trade-off theory:

(1) There is no target D/E ratio.

(2) Profitable firms use less debt.

(3) Companies like financial slack

-

16.7

13

Growth implies significant equity financing, even in a world with low bankruptcy costs.

Thus, high-growth firms will have lower debt ratios than low-growth firms.

Growth is an essential feature of the real world; as a result, 100% debt financing is sub-optimal. 100%

-

13

5

$1,00010%10%EBIT$100

_1172865345.unknown

-

13

EBIT5%5%5%5%

_1172865904.unknown

-

16.8

13

The Miller Model

-

13

-

13

-

16.9

13

(1)Most Corporations Have Low Debt-Asset Ratios.

(2)Changes in Financial Leverage Affect Firm Value.

Stock price increases with increases in leverage and vice-versa; this is consistent with M&M with taxes.

Another interpretation is that firms signal good news when they lever up.

(3)There are Differences in Capital Structure Across Industries.

(4)There is evidence that firms behave as if they had a target Debt to Equity ratio.

-

13

(1)Taxes

If corporate tax rates are higher than bondholder tax rates, there is an advantage to debt.

(2)Types of Assets

The costs of financial distress depend on the types of assets the firm has.

(3)Uncertainty of Operating Income

Even without debt, firms with uncertain operating income have high probability of experiencing financial distress.

(4)Pecking Order and Financial Slack

Theory stating that firms prefer to issue debt rather than equity if internal finance is insufficient

2005 16-1

-

16

13

-

1717.1 17.2 17.3 17.4 17.517.6

13

-

17.1

13

APV

NPV

NPVF

There are four side effects of financing:

(1)The Tax Subsidy to Debt

(2)The Costs of Issuing New Securities

(3)The Costs of Financial Distress

(4)Subsidies to Debt Financing

_1173421556.unknown

-

13

1

$475,000$500,00072%

$126,229.50

_1173422779.unknown

_1173423066.unknown

_1173423344.unknown

_1173422932.unknown

_1173422721.unknown

-

17.2

13

There are three steps in the FTE Approach:

(1)Calculate the levered cash flows, LCF

(2)Calculate

(3)Valuation of the levered cash flows at .

_1173423841.unknown

_1173426822.unknown

_1173423825.unknown

-

13

2

$475,000$500,00072%

$126,229.5010%

_1173422779.unknown

_1173424200.unknown

_1173424468.unknown

_1173422721.unknown

-

13

LCF

-

17.3

13

_1173426650.unknown

_1173426754.unknown

-

13

3

$475,000$500,00072%

$126,229.50

_1173422779.unknown

_1173426428.unknown

_1173426463.unknown

_1173422932.unknown

_1173422721.unknown

-

13

-

17.4

13

Guidelines:

(1)WACCFTE

(2)APV

WACC

-

17.5

13

4

WWE25%widget10%AWAW40%12%1.540%8.5%8%WWE

WWEAW

AW

AW

security market lineSML

_1173436775.unknown

_1173436899.unknown

_1173437040.unknown

_1173437303.unknown

_1173437316.unknown

_1173437662.unknown

_1173437192.unknown

_1173436988.unknown

_1173436865.unknown

_1173436881.unknown

_1173436806.unknown

_1173428908.unknown

_1173428919.unknown

_1173428896.unknown

-

13

AW

AW

WWE

_1173438022.unknown

_1173438159.unknown

_1173438428.unknown

_1173438557.unknown

_1173438567.unknown

_1173438473.unknown

_1173438220.unknown

_1173438045.unknown

_1173438057.unknown

_1173438034.unknown

_1173437593.unknown

_1173437763.unknown

_1173437811.unknown

_1173437624.unknown

_1173437460.unknown

_1173437571.unknown

_1173437420.unknown

-

17.6

13

-

13

5

C.F.Lee scale-enhancing project$100$20034%210%8.5%

SML

_1173445091.unknown

_1173445361.unknown

_1173445606.unknown

_1173445615.unknown

_1173445480.unknown

_1173445238.unknown

_1173437192.unknown

-

13

_1173445717.unknown

_1173445744.unknown

_1173445833.unknown

_1173446161.unknown

_1173446191.unknown

_1173445761.unknown

_1173445733.unknown

_1173445480.unknown

_1173445671.unknown

_1173437624.unknown

-

17

13