Next wave of banking transformation strategy in china

-

Upload

kelvin-tai -

Category

Technology

-

view

1.717 -

download

8

description

Transcript of Next wave of banking transformation strategy in china

中国商业银行在数据大集中之后 下一轮的变革策略Next Stage of Banking Transformation Strategy

in China

Prepared by Kelvin Tai

Mobile +8613918235069 Email kelvinkftaigmailcom 第一

Research Study

2

目的 Objectives 回顾现在与预期未来中国银行业的发展趋势 Examine current amp future of

overall China Banking Market trend in China

探讨零售银行中的渠道整合在银行业务变革策略所带来的商业价值 Examine the strategy and business value of Retail Banking Distribution Channel Transformation

帮助银行打造核心能力于中间业务的创收能力 Build up the core competence on fee based revenue of the bank

渠道整合加上商业智能数据分析帮助银行打造核心能力开发以客户为中心的产品与服务 Build up the core competence on customer focus by business intelligence

帮助银行打造核心能力于下一代的电子渠道银行 ( 网上银行 手机银行 ) 以帮助提升与客户的亲密度与客户忠诚度 Build up the core competence on next wave of e-channel ie mobile banking to increase the customer intimacy and customer loyalty

以 HP 中国为例 分析外国的 IT 服务供应商如何以渠道整合为入点以扩大在中国银行业服务的市场占有率 HPExamine how and why HP choose this solution as major entry points for enlarging the market share in IT solution in China

3

主要的观点 Key Findings

好消息 The good news 在中国银行业利用 IT 进行业务改革 转型还是处于初

始阶段 IT 服务业市场在未来的 10 年预计会有很大的发展空间 Significant market potential for the growth of IT solution market in the next 10 years

渠道管理与整合 合规与管理类的系统应该是下一波中国银行业重点投资与增强的方向 Channel and Management amp compliance solution would be the next wave of investment for the bank

坏消息 The not so good news 监于欧洲的金融危机可能会影响中国银行业投资于 IT

服务改革的力度与时间表 The Euro economic turmoil would slow down the IT investment from Bank in 2011

4

关注 Issue 中国银行业市场的发展趋势 What are the trends of China Banking Market 我们分析了 5 个主要现行发展趋势的假设 We have identified five hypotheses about trends which shape the current financial market

Market Topography is Changing Rapidly and Competition is IntensifyingB 中国商业银行在收入 利润仍然

非常依赖存贷业务 Bankrsquos revenueprofit margin still heavily relied on loan offering 虽然在过去几年当中 商业银行的中间业务收入有长足的进步 但相对于国际领先的银行 中间业务收入占比还是偏低 这代表了中国商业银行的产品创新能力有待改进 Although the fee based revenue has significant growths but it still be lag behind compared to Foreign Bank revealing the needs of product innovation of the bank

A 激烈的市场竞争 - More intensive competition

Emergent and rapid growth of non-financial companies in traditional retail banking market

由于愈来愈多的非金融公司出现 如消费金融公司与第三方支付公司等加入传统金融市场 加深市场竞争 The emergent of consumer finance companies and 3rd party payment companies intensify the retail banking competition

E 农村合作社 信用社的合并 混合型银行的出现 Merger Among Rural credit union and FHCs growsContinuous reducing the no of Rural Credit Unions which are forming the city commercial banks Meanwhile the FHC starts to grow for example PingAn农村合作社 信用社的合并以增强实力市場中开始出现混合型的银行 例如平安銀行

C 愈来愈严峻的监管条例与政府提倡的扩大内需经济 More intensified regulatory requirements 中国银行零售业务的增长比对公业务快 成为中国银行业的增长亮点 Consumer banking segment has recorded a stronger growth rate than corporate banking

D 商业银行的 IPO 潮 Wave of IPO of Commercial Banks由于需要符合 IPO 的上市要求 银行需要对管理合规系统进行升级 特别是符合 BASELII 的系统 This triggers the demand of risk and audit compliance especially for meeting the standard of BASELII

5

根據國際著名的 IDC 研究報告中指出 中國銀行投資於 IT 的資金在 2010 年達到 500 億 並且預計在 2014 年會達到 800 的規模 With the research by IDC the banking investment in IT solution was 500 billion in 2010 and is expecting to grow to 800 billion in 2014

Insight 深度分析

在 2009 年银行 IT解决方案 (包括软件与服务 ) 约占中国银行业 IT总投资中的 30 并预计在2014 年达到 267 亿 这代表了在 IT解决放案的领域上在未来 5 年有超过 50 的增长 IT banking solution service including software would be about 30 among the total share and expects to have the market volume reached to 267 billion in 2014 it means that it has much room to grows in the next 5 years

另外 对比美国与欧洲的银行业 中国银行业的 IT 投资还是偏低而且在现有的硬件与网络投资占比过重 In addition compared to Foreign bank investment in IT the ratio of china bank investment is still far below from US and Euro bank

6

接下来 我们看一下零售银行渠道细分市场 在 2010 年市场规模达到 21 亿 当中渠道整合管理则为 8 亿 For the segmented market of retail distribution channel the market volume reached 21 billion in which channel integration and internet and mobile would shared about 8 billions in 2010

深度分析 Insight

最近几年 银行开始投资于渠道整合与网点改造 并且我相信这个市场愈来愈受重视与重点投资面In recent years more banks invests on channel integration and branch network reforms it has expected to grow more and more

自从 2009 有银行开始推行手机银行作为其中一个渠道 由于智能手机的渗透率会愈来愈高 预计手机银行的未来 5 年会作为银行重点发展的渠道 Since 2009 the mobile banking has been gaining more and more development in the market as the penetration of smart phone increased

7 |

内容零售银行中的渠道整合在银行业务变革策略所带来的商业价值Strategic and business value of Retail Banking Distribution Channel Transformation

8

中国的商业银行需要加快对渠道整知 网点布局与改造以幫助

ldquo虽然中国商业银行的中间业务收入有长足的增长 但是占比率 3 倍小于国际领先银行rdquo(The Banker)

优化银行的收入结构以减少未来利率自由化的冲击 同时 银行增加中间业务的收入可以减少因金融市场不稳定所带来的增加坏帐拨备而引起的利润下降 避免过份依赖传统的利差收入

更为高效的网点投资回报率 根据国外的研究 实体网点的成本是15倍高于电子 自动渠道 例如网上银行 手机银行 电话银行 渠道的布局与改造能帮助银行在实体网点的每平方的创收率与利用率以尽量的把网点改造为真正的销售 还有渠道的整合与智能分析能提高交叉销售的深度与广度

作为提高非金融公司的竞争准入手段 实体的网点是银行投资成本最高的一环 但是也是银行能够提高非金融公司加入市场的准入的最重要手段 所以如何把银行网点从交易中心转型到销售中心是银行未来几年需要重点改革的部份 其实 国外的领先银行已经从零售业中借监 为未来的网点格局作出多方面的测试 其中 APPLE 的网点定位为体验中心就值得中国的银行研究

在全球经济衰退的阴影之下 中国政府在 2008 年开始调整经济增长模式 强调要从过往的投资 出口驱动转型到内需驱动经济体系 所以在此背景之下 个人 零售财务的需求将会有很大的发展空间 但同时 中国政府可能会减缓对金融市场自由化的进度

ldquo收集并分析不同的客户在不同的渠道的信息能大大的帮助银行对客户的行为 财务需要进行有效的分析 从需推出有针对性的产品与服务rdquo(Deloitte)

9

Needs the China Bank to speed up the retail banking distribution network transformation to

ldquoAlthough the fee based revenue has significant increment for the past years it still 3 times less than International Best Practice bank (The Banker)

Improve the structural income component of the bank this need to increase the fee based income to counter part the impact of raise of provisional of bad debt during the economy unstable and reliance of interested based revenue

More viable ROI on channel investment As cost of physical branch network is about 15 times higher than other direct channel like internetMobileCall center the transformation can help to increase the revenue generation per sq foot of physical network by increasing the cross sales opportunities and to channelize the transaction based customer to use lower cost channel

Create higher entry barrier for competitive dynamics from non bank companies Physical sales outlets (branch network) would be the biggest entry barrier for e-commerce companies to erode the market share of bank Transform the transaction based physical outlet to sales oriented outlet should be put into Bank strategy agenda before those e-commerce companies grown up

Under the shadow of global economy turmoil the Chinese Government would be more emphasize on the ldquointernal consumer marketrdquo that will boost the retail banking needs and withhold the deregulation of financial market

ldquoRecognize different customer segments and capture information on them across channels to understand their needs and behaviour ndash develop product strategy accordinglyrdquo(Deloitte)

10

通过以下为提供客户增值服务

- ldquo渠道的整合加上商业智能分析为银行提供非常有价值的客户信息 帮助银行持续的创新的产品服务开发达到rdquo成为第一rdquo的地位rdquo

- ldquo智能手机能通过位置定位的功能 能为银行提供更为准确的客户信息rdquo 这对于银行与特约商店都创造双嬴的局面 对于客户而言 所提供的优惠信息更为准确与贴心

增加客户的忠诚 渠道整合能根据客户在不同的渠道使用银行服务 供更为有针对性的奖励回馈活动与价值 从而增加客户的忠诚度与银行的捆绑程度

提供针对性的推销活动 智能手机能通过位置定位的功能 能为银行提供更为准确的客户信息 以帮助银行即时的交叉销售的能力 为特约商店与银行形成一个良好的商业环境

客户更为便捷有效的从银行端接受咨询服务 通过渠道的整合能为银行网点的运营更为高效 帮助释放银行人力资源专注于提供财务咨询服务

渠道对于银行的作用就如人的眼睛与鼻子一样 是触摸感受客户的重要载体 所以渠道的转型改造能帮助银行通过提供针对性的服务产品来提升竞争力 增加客户的忠诚度与利润率

11

Create the ldquoUnique Customer Added Valuerdquo through

- ldquoChannel integration together with Business intelligence provide the valuable information for the bank to continuous product innovation and ldquoBe the Firstrdquo

- ldquoSmart phone App provide the location information which is not likely to gather in the past to provide more insightful information to the bankrdquo This is essential for creating Win Win situation for CustomerBankBank Partners ldquo

Enhance Customer loyalty Channel integration provide the ways for developing more customer oriented rewarding value for those who use the banking product in different channels

Tailored promotion and marketing Smart phone App provide the location information which is not likely to gather in the past to provide more insightful information to the bank to create a healthy ecosystem of customerbankbanking partners

Getting more tailored consulting service from bank With improved branch operational efficiency enabling the customer to receive consulting service without wasting time on waiting and waiting

As channel act like the eye and ears of bank the channel transformation would help the bank to provide more competitive differentiated value to the customer and in return increase the customer loyalty and profitability

12

保障了过往对数据大集中项目的投资回报 同时又能为打造以rdquo客户为中心rdquo的系统奠下坚固的基础 同时渠道的整合帮助银行的rdquo LEGACY 交易 财务核心系统rdquo有廷长寿命的作用 增加核心系统的投资回报率

渠道整合是连贯前后台的枢纽 在过去的渠道建设当中 每一个的渠道或多或少形为了信息孤岛的情况 渠道整合把各处分散的系统信息转化为有用的信息

通过整合减少接口开发量 银行的 IT部门最头痛的地方就是在某一渠道的接口改变引起其他相关连的接口也要跟着改动 根据过去的经验 接口的改动占了 IT 预算的 40 到 60

从 IT 的角度而言 大部份的中国商业银行在 2000 年初已经实施了数据大集中的项目 银行很难在短期之内为核心系统进行再次升级计划 所以渠道的整合与改造在中长期 IT 规划中就成为银行最优的业务改革的利器

13

Protect the past IT investment on core banking replacement while offering the customer centric channel Channel integration can help to extend life cycle of legacy transactionalfinancial based core banking system to maximize the ROI

Logical second milestone of integration Every channel would like a isolated information repository channel integration would be the next core platform to create value for end bank users

Reduce the interface cost by integration The most headache of IT department is that whenever the change made in one channel the interface with other channel needs to be changed accordingly Around 40 to 60 of IT budget would be expensed to interface change

From IT perspective as most of the China Bank have done a core banking replacement for data centralization in the past decade it is hard for the bank to invest such a big investment to replace the core banking again As such the channel integration would be the best option for the bank to plan for their short term IT planning roadmap

14 |

内容

以 HP 中国为例 分析外国的 IT 服务供应商如何以渠道整合为入点以扩大在中国银行业服务的市场占有率 Strategic suggestion for HP for enlarging the IT banking solution market in China

15

-- 以下的图表示的是解决方案服务供应商在不同的商业银行层次和解决方案类型的覆盖范围 HP 中国在市场上主要专注于提供管理合规类产品与渠道类的解决方案予所有不同层次的银行

细分市场 客户

Product (產品重心 )

管理合规类1048713 企业资源管理1048713 商业智能 决策支持1048713 风险管理1048713 金融审计和稽核1048713 客户关系管理

渠道类1048713 渠道管理1048713 银行卡系统1048713 电话银行 呼叫中心1048713 网络银行1048713 其他渠道

核心业务系统类 核心业务bull 支付与清算bull 中间业务bull 信贷操作

国有商业银行 State

股份制商业银行

城市商业银行

农村商业银行 信用合作社

外资商业银行

IBM

HPLocalVendor

LocalVendor

16

-- 以下的圖表示的是解決方案服務供應商在不同的商業銀行層次和解決方案類型的覆蓋範圍 HP 中國在市場上主要專注於管理合規類產品與渠道類的解決方案 Below charts shows the solution vendor coverage for different type of commercial bank HP is focusing providing the management amp compliance and channel solution to all type of banks except stated owned commercial banks

Segmented Market customer

Product (產品重心 )

Management amp Compliance1048713 企业资源管理1048713 商业智能 决策支持1048713 风险管理1048713 金融审计和稽核1048713 客户关系管理

Channel Category1048713 渠道管理1048713 银行卡系统1048713 电话银行 呼叫中心1048713 网络银行1048713 其他渠道

Core Business Categorybull 核心业务bull 支付与清算bull 中间业务bull 信贷操作

State Owned Commercial Bank

Shared Owned Commercial Bank

City Commercial Bank

Rural Commercial Bank

Foreign Commercial Bank

IBM

HPLocalVendor

LocalVendor

17

Channel Integration

混业性银行 全方位银行 ndash 区域性商业银行

全方位银行 ndash 全国性商业银行 专业银行

Channel Integration

among different

legal entity

Enterprise ndashwide

Business Intelligence

BASELII Compliance

Enterprise ndashwide CRM

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

BASELII Complian

ce

Channel Integration

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

Channel Integration

Data Mining

BPOITO

New Distributi

on Channel

Specialized Solution

根据国外的经验 将来中国的商业银行有可能会发展为以下 4 种的银行定位 下图表示的是不同的银行定位有可能需要的业务改革需要

HP China competitive advantage and entry points

18

Channel Integration

Financial Holding Bank Full Service ndash Regional Bank

Full Service - Nationwide Bank Specalized Bank

Channel Integration

among different

legal entity

Enterprise ndashwide

Business Intelligence

BASELII Compliance

Enterprise ndashwide CRM

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

BASELII Complian

ce

Channel Integration

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

Channel Integration

Data Mining

BPOITO

New Distributi

on Channel

Specialized Solution

There are 4 types of banking position which might be evolved in China below chart shows what are the transformation initiatives would be needed for each type of position

HP China competitive advantage and entry points

19

Banking Position Transformation Initiatives Major IT Implication

bull Specialized Bank

bull 4家消費金融公司

bull Non-Financial

Companies

bull Focus on Product innovationdifferentiation and

segmented groupmarket with flexible pricing

bull Well relationship with the customer by enriching

customer experience and keeping customer intimacy

A Highly Flexible specialized software with parameter

driven especially for workflow authorization control

product setup pricing and fee configuration

B Flexible external interface socket

C Multiple direct delivery channels eg Mobileinternet

with integrated channel management

D Data Mining for supporting product innovation and

customer preference and behavior

E Outsourcing the non competence operation eg

collectioncall centerdata center ops and

management

bull Full Service ndash Regional

Bank

bull City Commercial

Bank

bull Would have full scope of retail service but would focus

on Product innovationdifferentiation and segmented

groupmarket

bull Use the scientific method to analyse the customer

preference and behaviour and launch customized

product to target segment

bull Effective channel management to lower the operation

cost and simplified business process to raise the

customer experience

bull Risk and Audit compliance

A Integrated channel management to gather the data

from different channel and use the business

intelligence solution to turn them into value

information for continuous product and service

innovation

B Innovated product delivery channel mobile

banking to cater for 8090 GEN

C CRM and Decision support system can provide the

bank of proactive marketing and competitive

pricing

D Different kind of outsourcing should be considered

to have flexible costing to cater for the economic up

and down

Below table show the how are the IT implications for each type of banking position and the needed transformation initiatives in which details the Specialized bank and Regional bank

20

银行定位 业务改革策略需要 主要的银行系统含义

bull专业银行

bull 4 家消费金融公司

bull 非金融公司 例如第三方支付公司

bull 专注于产品的创新 细分产品与市场 配以灵活的定价以形成竞争力

bull 通过增强的客户使用经验与迎亲和力 拥有与客户的良好的关系

A 拥有以参数驱动的灵活专业系统 特别是在流程定义 授权控制 产品刮定 费用设定等

B 雳活定制的接口

C 多样性的销售渠道 例如网上 手机银行配以渠道整合数据挖掘以支持产品创新与客户偏好与行为分析

D 利用外包服务供应商以把非核心的业务进行外包以减少运营成本 例如催收 Call Center 数据中心管理等等

bull 全方位银行 ndash 区域性商业银行

bull 城市商业银行

bull 提供全方位的零售业务但会有偏重的产品的创新 细分产品与市场

bull 使用科学的方法分析客户的偏好与行为以推出针对性的细分产品与市场

bull 高效的渠道管理与简化的业务流程以降低运营成本与增加客户的满意程度

bull 风险与合规

A 整合的渠道管理系统统一各渠道的接口 形成数据治理 配合商业智能分析系统把各渠道的信息转化成有内容 有价值的信息以及促进产品 服务创新

B 产品 服务创新于特定渠道与人群 例如以手机银行针对 8090 后的青年

C 客户关系管理系统和决策支持系统提供银行主动式营销与有竞争力的定价

D 应考虑采用不同类型的外包以应对经济的起落 实现运营成本最少化

下面的表格中显示是不同的银行定位与业务改革需要对银行系统的含义 ndash 详细描述了专业银行与全方位银行 ndash 区域性商业银行

21

Position of Bank Transformation Initiatives IT Implication

bull Full Service ndash Nationwide

Bank

bull Share Owned

Bank

bull Similar to Regional bank but would have more capability to

develop a new target segment eg 8090 GENElder group

a new channel eg mobile banking to provide full banking

service

bull Branch Network Transformation including physical network

and virtual network to transform to customer and selling

centric

A Similar to Regional Bank but the solution needs to

have high availability and high processing capability

with high resilience

B Leverage the specialized solution to provide the

better support for specialized function

C Transform the transactional based physical branch

network to sales based network with by simplifying

the business process and channeling the

transaction from teller to Kiosk as well as setting up

the customer experience center like Apple Store

D Channel Integration and to upgrade the internet

banking to use Web20 to provide the realtime

online assistance as well as enhancing the mobile

banking with LBS function to provide better

merchant selling and promotion to enhance the

customer loyalty for GEN 8090

E Customer Centric core banking system

bull Financial Holding

Companies

bull PingAn Bank is

targeting for this

model

bull Establish the Risk compliance to BASELII to cover credit

riskoperational riskmarket riskEvent Risk

bull Run different type of business under one financial group to

include insurance retail banking wholesale banking

investment banking to maximize the cross selling by using

the Bank Reputation

bull One stop banking product store to provide the financial

product to satisfy the enterprise vertical value chain

A Fully integration of CIF and channel with Business

Intelligence to create the chance for cross sale

B BaseI lI compliance is a must that needs the

specialized solution to support

Below table show the how are the IT implications for each type of banking position and the needed transformation initiatives in which details the Nationwide Bank and Financial Holding Company

22

银行定位 业务改革策略需要 主要的银行系统含义

bull 全方位银行 ndash 全国性商业银行

bull 国有商业银行

bull跟全方位的区域性跟行非常类似 但会更有实力在开拓新市场例如 8090 后与老人群众与新渠道例如开发手机银行提供全方位的银行服务

bull 银行网点的改造包括实体网点以及电子渠道网点以达到以客户为中心 以销售为核心的渠道布局

A 跟全方位的区域性跟行非常类似 但是解决方案系统必需具备高可用性 高处理量 双系统的能力

B 利用专家的解决方案提供更好的专业系统支持 例如使用专业的信用卡管理系统

C 为银行网点转型 从过往的交易处理中心转型为以销售为中心的渠道 通过业务流程简化 网点改造使用来增强客户使用体验

D 渠道整合加上网上银行升级 行用 Web20 的技术来提供实时的网上人工帮助 在手机银行中行用 LBS

的功能为商店的促销提供针对性的客户 这些可以增加 8090 后的使用经验和忠诚度

E 实施以客户为中心的核心系统

bull 混业性银行

bull 平安银行正在朝往该业务模式进发

bull 建立完整的风险与合规以符合 BASEL II 的要求 覆盖信用风险 操作风险 市场风险以及系统性风险

bull 在同一个金融集团中包括有对公 零售 投资 保险于一身

以达到金融产品超级市场一站式的服务 以达到交叉销售的最大化

bull 一站式的金融服务提供在企业价值鐽中的不同金融产品

A 完全整合全金融集团的客户信息加上全行的商业智能方案以达到交叉销售的最大化

B 需要以专业的风险合规系统以符合 BASEL II 的要求

下面的表格中显示是不同的银行定位与业务改革需要对银行系统的含义 ndash 详细描述了全方位银行 ndash 全国性商业银行与混业性银行

23

机会 Opportunity 危机 Threat

1 对比于外国的商业银行 中国商业银行在业务改革中还是属于初始阶段

2 中国商业银行对 IT 投入有很大的增长空间 IT 3 中国的 GDP 增长仍然预计在未来的十年属

于上升阶段4 在中国商业银行在 IPO潮后 需要加大力度

与速度于业务改革以增加竞争力于本土以及海外扩张

1 需要加大對高端的 IT 业务咨询人才的投入加上銷售時期比較長對公司的 EBITA 在短時間內造成壓力

2 2 金融衰退對銀行的中短期的 IT 投資策略有所影響

3 需要時間 ( 以年算 ) 建立核心的競爭力於軟件服務上 加上中國的金融自由化與服務外包的成熟度都約制了短期的利潤

强项 Strength

1 全球第二位的 Mid range 服务器供应商

2 全球第一位的 PC 供应商 3 在 2008 年收购了全球知名

的外包服务公司 并且成为全美第二位的外包服务供应商

4 全球首屈一指的数据中心建造与云计算方案的供应商

SO ST

1 定位于领先的服务供应商 为中国的银行业引进国外的专业领先产品 配合本土化的交付能力为客户进行最佳实践的交付

2 与国外的专业产品供应商和本土的集成商建立策略性伙伴关系

3 监视非金融公司在中国的发展 并提供整体方案予该等机构

1 避免与 IBM面对面的直接竞争于核心系统建置直至本土化的咨询与与交付能力的提升

2 建立核心竞争力于 IT 与业务咨询上以提供优于本土服务供应商 集成商竞争力的高端资源上

弱項 Weakness

1 硬件供应商的观念在短时间很难改变

2 缺乏独特性的银行解决方案3 在中国缺乏高端的 IT 业务咨询人才

WO WT

1 定期发布市场 产品趋势 策略性研究报告以倡导式教育客户

2 定期发布大陆与国外的成功案例分析予客户

1 利用 HP 台湾的核心竞争力于信用卡解决方案

2 专注于 HP 的独特能力于应用系统从主机迁移至MID RANGE 服务器 (case study from Common Wealth Bank in AUS by EDS)

结论 Conclusion1利用商业智能分析软件与渠道的整合作为优势竞争力于细分市场上2利用云计算以扩大服务外包市场 3行用使用 HP 服务器的客户进行交叉销售

以 SWOT 分析工具来分析 HP 中国应该以提供渠道整体解决方案包装渠道整合 网上银行 手机银行再加上商业智能分析系统为契机 针对性对城市商业银行和农村商业银行提供服务 以争取扩大 IT 服务市场的占用率

24

Opportunity Threat

1 Transformation of China Bank still in infant stage compared to Foreign bank

2 IT investment of China Bank would have much room to grow

3 GDP growth in China still in up rising trend in the next decade

4 The needs and urgency of bank transformation would be increased over the time after the IPO wave

1 High Investment on high end resource team and long selling cycle would impact the EBITA in a certain period of times 2 Economic turmoil would impact the short and long term strategy3 Take times (years) to build up the core competence in service market due to regulation restriction and maturity of outsourcing in financial market

Strength 1 No 2 Mid range server Vendor in the world 2 No 1 PC vendor in the world3 Acquired EDS in 2008 and becoming the 2nd largest outsourcing companies in US4 World Class Data Center with cloud computing solution

SO ST

1 Position as Foreign Service company with introducing the International Best Practice software and service with strong local delivery capabilities

2 Strategic Alliance with foreign specialized solution vendor and with local SI vendor

3 Closely monitor the non-bank companies development and their needs

1 Avoid the face to face competition with IBM for the playfield of core banking until core competence built upon

2 Build up the core teams with both IT and business consulting experience to provide the competitive advantage over the local vendor

Weakness 1 Hardware Vendor Preconception 2 Lack of Proprietary Banking Solution 3 Lack of High End consulting expertise in China

WO WT

1 Regular publication on MarketProduct trendStrategic Roadmap to educate the customer

2 Regular publication of Successful Case Study from both Mainland and International clients

1 Leverage the HP Taiwan core competence on Unix Platform Credit Card solution

2 Focus on HP capability to application migration from Mainframe to Unix Platform (case study from Common Wealth Bank in AUS by EDS)

Conclusion1Leverage the BI software and Channel Integration as competitive edge in niche market2Leverage the cloud computing to enlarge the outsourcing market3Customer base of HP Unix server as the assets for cross selling

With the SWOT analysis HP China should focus on the Channel solution including the channel integration internet banking and mobile banking bundling with Business Intelligence solution to cater for City commercial bank and share owned commercial bank

25

-- 下面提出的策略建议是建立于 HP 中国在达到扩大市场占有率 建立核心竞争力于细分市场上 所应该考虑的几个方案

ldquo可能被执行的策略rdquo ldquo所需执行的行动rdquo

1) 渠道整合 网点改造 网上银行 信用卡系统都是 HP 中国的长项2) 利用 HP 中国现有的 ITO 服务器客户进行交叉销售3) 建立核心能力于渠道解决方案 提升本地化的高端人才与交付能

力

A ldquo專注於渠道 rdquo 并且提供一站式服务

1) 定位于领先的服务供应商 为中国的银行业引进国外的专业领先产品 配合本土化的交付能力为客户进行最佳实践的交付

2) 与本地集成商建立策略性伙伴关系以加强国外产品本地化开发与集成

3) 短期内以项目的主承包商与项目管理辨公司以监控项目的交付

B ldquo专注于城市商业银行与股份制商业银行rdquo

C 与国外的专业产品供应商和本土的集成商建立策略性伙伴关系以提供渠道类的一站式解决方案

1) 在資源有限的情況下 專注於幫助中小型銀行在渠道上的核心能力因為大部份的國有銀行 例如 ICBC都偏向於自主開發

26

-- Below are the suggested strategy for HP China for achieving enlarging the market share and building up the core competence and center of excellence in niche market with niche target bank

ldquo Possible Strategyrdquo Strategy for the ldquoPossible Moverdquo

1) Channel IntegrationBranch network transformationInternet bankingCredit Card are those HP China can leverage

2) Leverage the existing HP ITOServer client base to cross selling the channel solution

3) Build up the Channel One Stop solution competence by hiring high end business consultant and delivery team

A ldquoFocus on Channel rdquo with One Stop solution store

1) HP Position should position to be brought the Foreign Solution and Expertise to China as Best Practice

2) Align with local vendor is to provide the solution which HP lack of and SI capability for localization development and system integration

3) Position as main Contractor and PMO for the project implementation

B ldquoFocus on City Commercial Banks and Share Owned Commercial Bank

C Alliance with local SI vendor and the solution provider to provide one stop solution store

1) Resource is always limited focus on those SampM bank to help the bank to develop their core competence on Channel

2) State owned bank would prefer to build up their own IT solution and capability eg ICBC

- Slide 1

-

2

目的 Objectives 回顾现在与预期未来中国银行业的发展趋势 Examine current amp future of

overall China Banking Market trend in China

探讨零售银行中的渠道整合在银行业务变革策略所带来的商业价值 Examine the strategy and business value of Retail Banking Distribution Channel Transformation

帮助银行打造核心能力于中间业务的创收能力 Build up the core competence on fee based revenue of the bank

渠道整合加上商业智能数据分析帮助银行打造核心能力开发以客户为中心的产品与服务 Build up the core competence on customer focus by business intelligence

帮助银行打造核心能力于下一代的电子渠道银行 ( 网上银行 手机银行 ) 以帮助提升与客户的亲密度与客户忠诚度 Build up the core competence on next wave of e-channel ie mobile banking to increase the customer intimacy and customer loyalty

以 HP 中国为例 分析外国的 IT 服务供应商如何以渠道整合为入点以扩大在中国银行业服务的市场占有率 HPExamine how and why HP choose this solution as major entry points for enlarging the market share in IT solution in China

3

主要的观点 Key Findings

好消息 The good news 在中国银行业利用 IT 进行业务改革 转型还是处于初

始阶段 IT 服务业市场在未来的 10 年预计会有很大的发展空间 Significant market potential for the growth of IT solution market in the next 10 years

渠道管理与整合 合规与管理类的系统应该是下一波中国银行业重点投资与增强的方向 Channel and Management amp compliance solution would be the next wave of investment for the bank

坏消息 The not so good news 监于欧洲的金融危机可能会影响中国银行业投资于 IT

服务改革的力度与时间表 The Euro economic turmoil would slow down the IT investment from Bank in 2011

4

关注 Issue 中国银行业市场的发展趋势 What are the trends of China Banking Market 我们分析了 5 个主要现行发展趋势的假设 We have identified five hypotheses about trends which shape the current financial market

Market Topography is Changing Rapidly and Competition is IntensifyingB 中国商业银行在收入 利润仍然

非常依赖存贷业务 Bankrsquos revenueprofit margin still heavily relied on loan offering 虽然在过去几年当中 商业银行的中间业务收入有长足的进步 但相对于国际领先的银行 中间业务收入占比还是偏低 这代表了中国商业银行的产品创新能力有待改进 Although the fee based revenue has significant growths but it still be lag behind compared to Foreign Bank revealing the needs of product innovation of the bank

A 激烈的市场竞争 - More intensive competition

Emergent and rapid growth of non-financial companies in traditional retail banking market

由于愈来愈多的非金融公司出现 如消费金融公司与第三方支付公司等加入传统金融市场 加深市场竞争 The emergent of consumer finance companies and 3rd party payment companies intensify the retail banking competition

E 农村合作社 信用社的合并 混合型银行的出现 Merger Among Rural credit union and FHCs growsContinuous reducing the no of Rural Credit Unions which are forming the city commercial banks Meanwhile the FHC starts to grow for example PingAn农村合作社 信用社的合并以增强实力市場中开始出现混合型的银行 例如平安銀行

C 愈来愈严峻的监管条例与政府提倡的扩大内需经济 More intensified regulatory requirements 中国银行零售业务的增长比对公业务快 成为中国银行业的增长亮点 Consumer banking segment has recorded a stronger growth rate than corporate banking

D 商业银行的 IPO 潮 Wave of IPO of Commercial Banks由于需要符合 IPO 的上市要求 银行需要对管理合规系统进行升级 特别是符合 BASELII 的系统 This triggers the demand of risk and audit compliance especially for meeting the standard of BASELII

5

根據國際著名的 IDC 研究報告中指出 中國銀行投資於 IT 的資金在 2010 年達到 500 億 並且預計在 2014 年會達到 800 的規模 With the research by IDC the banking investment in IT solution was 500 billion in 2010 and is expecting to grow to 800 billion in 2014

Insight 深度分析

在 2009 年银行 IT解决方案 (包括软件与服务 ) 约占中国银行业 IT总投资中的 30 并预计在2014 年达到 267 亿 这代表了在 IT解决放案的领域上在未来 5 年有超过 50 的增长 IT banking solution service including software would be about 30 among the total share and expects to have the market volume reached to 267 billion in 2014 it means that it has much room to grows in the next 5 years

另外 对比美国与欧洲的银行业 中国银行业的 IT 投资还是偏低而且在现有的硬件与网络投资占比过重 In addition compared to Foreign bank investment in IT the ratio of china bank investment is still far below from US and Euro bank

6

接下来 我们看一下零售银行渠道细分市场 在 2010 年市场规模达到 21 亿 当中渠道整合管理则为 8 亿 For the segmented market of retail distribution channel the market volume reached 21 billion in which channel integration and internet and mobile would shared about 8 billions in 2010

深度分析 Insight

最近几年 银行开始投资于渠道整合与网点改造 并且我相信这个市场愈来愈受重视与重点投资面In recent years more banks invests on channel integration and branch network reforms it has expected to grow more and more

自从 2009 有银行开始推行手机银行作为其中一个渠道 由于智能手机的渗透率会愈来愈高 预计手机银行的未来 5 年会作为银行重点发展的渠道 Since 2009 the mobile banking has been gaining more and more development in the market as the penetration of smart phone increased

7 |

内容零售银行中的渠道整合在银行业务变革策略所带来的商业价值Strategic and business value of Retail Banking Distribution Channel Transformation

8

中国的商业银行需要加快对渠道整知 网点布局与改造以幫助

ldquo虽然中国商业银行的中间业务收入有长足的增长 但是占比率 3 倍小于国际领先银行rdquo(The Banker)

优化银行的收入结构以减少未来利率自由化的冲击 同时 银行增加中间业务的收入可以减少因金融市场不稳定所带来的增加坏帐拨备而引起的利润下降 避免过份依赖传统的利差收入

更为高效的网点投资回报率 根据国外的研究 实体网点的成本是15倍高于电子 自动渠道 例如网上银行 手机银行 电话银行 渠道的布局与改造能帮助银行在实体网点的每平方的创收率与利用率以尽量的把网点改造为真正的销售 还有渠道的整合与智能分析能提高交叉销售的深度与广度

作为提高非金融公司的竞争准入手段 实体的网点是银行投资成本最高的一环 但是也是银行能够提高非金融公司加入市场的准入的最重要手段 所以如何把银行网点从交易中心转型到销售中心是银行未来几年需要重点改革的部份 其实 国外的领先银行已经从零售业中借监 为未来的网点格局作出多方面的测试 其中 APPLE 的网点定位为体验中心就值得中国的银行研究

在全球经济衰退的阴影之下 中国政府在 2008 年开始调整经济增长模式 强调要从过往的投资 出口驱动转型到内需驱动经济体系 所以在此背景之下 个人 零售财务的需求将会有很大的发展空间 但同时 中国政府可能会减缓对金融市场自由化的进度

ldquo收集并分析不同的客户在不同的渠道的信息能大大的帮助银行对客户的行为 财务需要进行有效的分析 从需推出有针对性的产品与服务rdquo(Deloitte)

9

Needs the China Bank to speed up the retail banking distribution network transformation to

ldquoAlthough the fee based revenue has significant increment for the past years it still 3 times less than International Best Practice bank (The Banker)

Improve the structural income component of the bank this need to increase the fee based income to counter part the impact of raise of provisional of bad debt during the economy unstable and reliance of interested based revenue

More viable ROI on channel investment As cost of physical branch network is about 15 times higher than other direct channel like internetMobileCall center the transformation can help to increase the revenue generation per sq foot of physical network by increasing the cross sales opportunities and to channelize the transaction based customer to use lower cost channel

Create higher entry barrier for competitive dynamics from non bank companies Physical sales outlets (branch network) would be the biggest entry barrier for e-commerce companies to erode the market share of bank Transform the transaction based physical outlet to sales oriented outlet should be put into Bank strategy agenda before those e-commerce companies grown up

Under the shadow of global economy turmoil the Chinese Government would be more emphasize on the ldquointernal consumer marketrdquo that will boost the retail banking needs and withhold the deregulation of financial market

ldquoRecognize different customer segments and capture information on them across channels to understand their needs and behaviour ndash develop product strategy accordinglyrdquo(Deloitte)

10

通过以下为提供客户增值服务

- ldquo渠道的整合加上商业智能分析为银行提供非常有价值的客户信息 帮助银行持续的创新的产品服务开发达到rdquo成为第一rdquo的地位rdquo

- ldquo智能手机能通过位置定位的功能 能为银行提供更为准确的客户信息rdquo 这对于银行与特约商店都创造双嬴的局面 对于客户而言 所提供的优惠信息更为准确与贴心

增加客户的忠诚 渠道整合能根据客户在不同的渠道使用银行服务 供更为有针对性的奖励回馈活动与价值 从而增加客户的忠诚度与银行的捆绑程度

提供针对性的推销活动 智能手机能通过位置定位的功能 能为银行提供更为准确的客户信息 以帮助银行即时的交叉销售的能力 为特约商店与银行形成一个良好的商业环境

客户更为便捷有效的从银行端接受咨询服务 通过渠道的整合能为银行网点的运营更为高效 帮助释放银行人力资源专注于提供财务咨询服务

渠道对于银行的作用就如人的眼睛与鼻子一样 是触摸感受客户的重要载体 所以渠道的转型改造能帮助银行通过提供针对性的服务产品来提升竞争力 增加客户的忠诚度与利润率

11

Create the ldquoUnique Customer Added Valuerdquo through

- ldquoChannel integration together with Business intelligence provide the valuable information for the bank to continuous product innovation and ldquoBe the Firstrdquo

- ldquoSmart phone App provide the location information which is not likely to gather in the past to provide more insightful information to the bankrdquo This is essential for creating Win Win situation for CustomerBankBank Partners ldquo

Enhance Customer loyalty Channel integration provide the ways for developing more customer oriented rewarding value for those who use the banking product in different channels

Tailored promotion and marketing Smart phone App provide the location information which is not likely to gather in the past to provide more insightful information to the bank to create a healthy ecosystem of customerbankbanking partners

Getting more tailored consulting service from bank With improved branch operational efficiency enabling the customer to receive consulting service without wasting time on waiting and waiting

As channel act like the eye and ears of bank the channel transformation would help the bank to provide more competitive differentiated value to the customer and in return increase the customer loyalty and profitability

12

保障了过往对数据大集中项目的投资回报 同时又能为打造以rdquo客户为中心rdquo的系统奠下坚固的基础 同时渠道的整合帮助银行的rdquo LEGACY 交易 财务核心系统rdquo有廷长寿命的作用 增加核心系统的投资回报率

渠道整合是连贯前后台的枢纽 在过去的渠道建设当中 每一个的渠道或多或少形为了信息孤岛的情况 渠道整合把各处分散的系统信息转化为有用的信息

通过整合减少接口开发量 银行的 IT部门最头痛的地方就是在某一渠道的接口改变引起其他相关连的接口也要跟着改动 根据过去的经验 接口的改动占了 IT 预算的 40 到 60

从 IT 的角度而言 大部份的中国商业银行在 2000 年初已经实施了数据大集中的项目 银行很难在短期之内为核心系统进行再次升级计划 所以渠道的整合与改造在中长期 IT 规划中就成为银行最优的业务改革的利器

13

Protect the past IT investment on core banking replacement while offering the customer centric channel Channel integration can help to extend life cycle of legacy transactionalfinancial based core banking system to maximize the ROI

Logical second milestone of integration Every channel would like a isolated information repository channel integration would be the next core platform to create value for end bank users

Reduce the interface cost by integration The most headache of IT department is that whenever the change made in one channel the interface with other channel needs to be changed accordingly Around 40 to 60 of IT budget would be expensed to interface change

From IT perspective as most of the China Bank have done a core banking replacement for data centralization in the past decade it is hard for the bank to invest such a big investment to replace the core banking again As such the channel integration would be the best option for the bank to plan for their short term IT planning roadmap

14 |

内容

以 HP 中国为例 分析外国的 IT 服务供应商如何以渠道整合为入点以扩大在中国银行业服务的市场占有率 Strategic suggestion for HP for enlarging the IT banking solution market in China

15

-- 以下的图表示的是解决方案服务供应商在不同的商业银行层次和解决方案类型的覆盖范围 HP 中国在市场上主要专注于提供管理合规类产品与渠道类的解决方案予所有不同层次的银行

细分市场 客户

Product (產品重心 )

管理合规类1048713 企业资源管理1048713 商业智能 决策支持1048713 风险管理1048713 金融审计和稽核1048713 客户关系管理

渠道类1048713 渠道管理1048713 银行卡系统1048713 电话银行 呼叫中心1048713 网络银行1048713 其他渠道

核心业务系统类 核心业务bull 支付与清算bull 中间业务bull 信贷操作

国有商业银行 State

股份制商业银行

城市商业银行

农村商业银行 信用合作社

外资商业银行

IBM

HPLocalVendor

LocalVendor

16

-- 以下的圖表示的是解決方案服務供應商在不同的商業銀行層次和解決方案類型的覆蓋範圍 HP 中國在市場上主要專注於管理合規類產品與渠道類的解決方案 Below charts shows the solution vendor coverage for different type of commercial bank HP is focusing providing the management amp compliance and channel solution to all type of banks except stated owned commercial banks

Segmented Market customer

Product (產品重心 )

Management amp Compliance1048713 企业资源管理1048713 商业智能 决策支持1048713 风险管理1048713 金融审计和稽核1048713 客户关系管理

Channel Category1048713 渠道管理1048713 银行卡系统1048713 电话银行 呼叫中心1048713 网络银行1048713 其他渠道

Core Business Categorybull 核心业务bull 支付与清算bull 中间业务bull 信贷操作

State Owned Commercial Bank

Shared Owned Commercial Bank

City Commercial Bank

Rural Commercial Bank

Foreign Commercial Bank

IBM

HPLocalVendor

LocalVendor

17

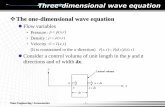

Channel Integration

混业性银行 全方位银行 ndash 区域性商业银行

全方位银行 ndash 全国性商业银行 专业银行

Channel Integration

among different

legal entity

Enterprise ndashwide

Business Intelligence

BASELII Compliance

Enterprise ndashwide CRM

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

BASELII Complian

ce

Channel Integration

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

Channel Integration

Data Mining

BPOITO

New Distributi

on Channel

Specialized Solution

根据国外的经验 将来中国的商业银行有可能会发展为以下 4 种的银行定位 下图表示的是不同的银行定位有可能需要的业务改革需要

HP China competitive advantage and entry points

18

Channel Integration

Financial Holding Bank Full Service ndash Regional Bank

Full Service - Nationwide Bank Specalized Bank

Channel Integration

among different

legal entity

Enterprise ndashwide

Business Intelligence

BASELII Compliance

Enterprise ndashwide CRM

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

BASELII Complian

ce

Channel Integration

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

Channel Integration

Data Mining

BPOITO

New Distributi

on Channel

Specialized Solution

There are 4 types of banking position which might be evolved in China below chart shows what are the transformation initiatives would be needed for each type of position

HP China competitive advantage and entry points

19

Banking Position Transformation Initiatives Major IT Implication

bull Specialized Bank

bull 4家消費金融公司

bull Non-Financial

Companies

bull Focus on Product innovationdifferentiation and

segmented groupmarket with flexible pricing

bull Well relationship with the customer by enriching

customer experience and keeping customer intimacy

A Highly Flexible specialized software with parameter

driven especially for workflow authorization control

product setup pricing and fee configuration

B Flexible external interface socket

C Multiple direct delivery channels eg Mobileinternet

with integrated channel management

D Data Mining for supporting product innovation and

customer preference and behavior

E Outsourcing the non competence operation eg

collectioncall centerdata center ops and

management

bull Full Service ndash Regional

Bank

bull City Commercial

Bank

bull Would have full scope of retail service but would focus

on Product innovationdifferentiation and segmented

groupmarket

bull Use the scientific method to analyse the customer

preference and behaviour and launch customized

product to target segment

bull Effective channel management to lower the operation

cost and simplified business process to raise the

customer experience

bull Risk and Audit compliance

A Integrated channel management to gather the data

from different channel and use the business

intelligence solution to turn them into value

information for continuous product and service

innovation

B Innovated product delivery channel mobile

banking to cater for 8090 GEN

C CRM and Decision support system can provide the

bank of proactive marketing and competitive

pricing

D Different kind of outsourcing should be considered

to have flexible costing to cater for the economic up

and down

Below table show the how are the IT implications for each type of banking position and the needed transformation initiatives in which details the Specialized bank and Regional bank

20

银行定位 业务改革策略需要 主要的银行系统含义

bull专业银行

bull 4 家消费金融公司

bull 非金融公司 例如第三方支付公司

bull 专注于产品的创新 细分产品与市场 配以灵活的定价以形成竞争力

bull 通过增强的客户使用经验与迎亲和力 拥有与客户的良好的关系

A 拥有以参数驱动的灵活专业系统 特别是在流程定义 授权控制 产品刮定 费用设定等

B 雳活定制的接口

C 多样性的销售渠道 例如网上 手机银行配以渠道整合数据挖掘以支持产品创新与客户偏好与行为分析

D 利用外包服务供应商以把非核心的业务进行外包以减少运营成本 例如催收 Call Center 数据中心管理等等

bull 全方位银行 ndash 区域性商业银行

bull 城市商业银行

bull 提供全方位的零售业务但会有偏重的产品的创新 细分产品与市场

bull 使用科学的方法分析客户的偏好与行为以推出针对性的细分产品与市场

bull 高效的渠道管理与简化的业务流程以降低运营成本与增加客户的满意程度

bull 风险与合规

A 整合的渠道管理系统统一各渠道的接口 形成数据治理 配合商业智能分析系统把各渠道的信息转化成有内容 有价值的信息以及促进产品 服务创新

B 产品 服务创新于特定渠道与人群 例如以手机银行针对 8090 后的青年

C 客户关系管理系统和决策支持系统提供银行主动式营销与有竞争力的定价

D 应考虑采用不同类型的外包以应对经济的起落 实现运营成本最少化

下面的表格中显示是不同的银行定位与业务改革需要对银行系统的含义 ndash 详细描述了专业银行与全方位银行 ndash 区域性商业银行

21

Position of Bank Transformation Initiatives IT Implication

bull Full Service ndash Nationwide

Bank

bull Share Owned

Bank

bull Similar to Regional bank but would have more capability to

develop a new target segment eg 8090 GENElder group

a new channel eg mobile banking to provide full banking

service

bull Branch Network Transformation including physical network

and virtual network to transform to customer and selling

centric

A Similar to Regional Bank but the solution needs to

have high availability and high processing capability

with high resilience

B Leverage the specialized solution to provide the

better support for specialized function

C Transform the transactional based physical branch

network to sales based network with by simplifying

the business process and channeling the

transaction from teller to Kiosk as well as setting up

the customer experience center like Apple Store

D Channel Integration and to upgrade the internet

banking to use Web20 to provide the realtime

online assistance as well as enhancing the mobile

banking with LBS function to provide better

merchant selling and promotion to enhance the

customer loyalty for GEN 8090

E Customer Centric core banking system

bull Financial Holding

Companies

bull PingAn Bank is

targeting for this

model

bull Establish the Risk compliance to BASELII to cover credit

riskoperational riskmarket riskEvent Risk

bull Run different type of business under one financial group to

include insurance retail banking wholesale banking

investment banking to maximize the cross selling by using

the Bank Reputation

bull One stop banking product store to provide the financial

product to satisfy the enterprise vertical value chain

A Fully integration of CIF and channel with Business

Intelligence to create the chance for cross sale

B BaseI lI compliance is a must that needs the

specialized solution to support

Below table show the how are the IT implications for each type of banking position and the needed transformation initiatives in which details the Nationwide Bank and Financial Holding Company

22

银行定位 业务改革策略需要 主要的银行系统含义

bull 全方位银行 ndash 全国性商业银行

bull 国有商业银行

bull跟全方位的区域性跟行非常类似 但会更有实力在开拓新市场例如 8090 后与老人群众与新渠道例如开发手机银行提供全方位的银行服务

bull 银行网点的改造包括实体网点以及电子渠道网点以达到以客户为中心 以销售为核心的渠道布局

A 跟全方位的区域性跟行非常类似 但是解决方案系统必需具备高可用性 高处理量 双系统的能力

B 利用专家的解决方案提供更好的专业系统支持 例如使用专业的信用卡管理系统

C 为银行网点转型 从过往的交易处理中心转型为以销售为中心的渠道 通过业务流程简化 网点改造使用来增强客户使用体验

D 渠道整合加上网上银行升级 行用 Web20 的技术来提供实时的网上人工帮助 在手机银行中行用 LBS

的功能为商店的促销提供针对性的客户 这些可以增加 8090 后的使用经验和忠诚度

E 实施以客户为中心的核心系统

bull 混业性银行

bull 平安银行正在朝往该业务模式进发

bull 建立完整的风险与合规以符合 BASEL II 的要求 覆盖信用风险 操作风险 市场风险以及系统性风险

bull 在同一个金融集团中包括有对公 零售 投资 保险于一身

以达到金融产品超级市场一站式的服务 以达到交叉销售的最大化

bull 一站式的金融服务提供在企业价值鐽中的不同金融产品

A 完全整合全金融集团的客户信息加上全行的商业智能方案以达到交叉销售的最大化

B 需要以专业的风险合规系统以符合 BASEL II 的要求

下面的表格中显示是不同的银行定位与业务改革需要对银行系统的含义 ndash 详细描述了全方位银行 ndash 全国性商业银行与混业性银行

23

机会 Opportunity 危机 Threat

1 对比于外国的商业银行 中国商业银行在业务改革中还是属于初始阶段

2 中国商业银行对 IT 投入有很大的增长空间 IT 3 中国的 GDP 增长仍然预计在未来的十年属

于上升阶段4 在中国商业银行在 IPO潮后 需要加大力度

与速度于业务改革以增加竞争力于本土以及海外扩张

1 需要加大對高端的 IT 业务咨询人才的投入加上銷售時期比較長對公司的 EBITA 在短時間內造成壓力

2 2 金融衰退對銀行的中短期的 IT 投資策略有所影響

3 需要時間 ( 以年算 ) 建立核心的競爭力於軟件服務上 加上中國的金融自由化與服務外包的成熟度都約制了短期的利潤

强项 Strength

1 全球第二位的 Mid range 服务器供应商

2 全球第一位的 PC 供应商 3 在 2008 年收购了全球知名

的外包服务公司 并且成为全美第二位的外包服务供应商

4 全球首屈一指的数据中心建造与云计算方案的供应商

SO ST

1 定位于领先的服务供应商 为中国的银行业引进国外的专业领先产品 配合本土化的交付能力为客户进行最佳实践的交付

2 与国外的专业产品供应商和本土的集成商建立策略性伙伴关系

3 监视非金融公司在中国的发展 并提供整体方案予该等机构

1 避免与 IBM面对面的直接竞争于核心系统建置直至本土化的咨询与与交付能力的提升

2 建立核心竞争力于 IT 与业务咨询上以提供优于本土服务供应商 集成商竞争力的高端资源上

弱項 Weakness

1 硬件供应商的观念在短时间很难改变

2 缺乏独特性的银行解决方案3 在中国缺乏高端的 IT 业务咨询人才

WO WT

1 定期发布市场 产品趋势 策略性研究报告以倡导式教育客户

2 定期发布大陆与国外的成功案例分析予客户

1 利用 HP 台湾的核心竞争力于信用卡解决方案

2 专注于 HP 的独特能力于应用系统从主机迁移至MID RANGE 服务器 (case study from Common Wealth Bank in AUS by EDS)

结论 Conclusion1利用商业智能分析软件与渠道的整合作为优势竞争力于细分市场上2利用云计算以扩大服务外包市场 3行用使用 HP 服务器的客户进行交叉销售

以 SWOT 分析工具来分析 HP 中国应该以提供渠道整体解决方案包装渠道整合 网上银行 手机银行再加上商业智能分析系统为契机 针对性对城市商业银行和农村商业银行提供服务 以争取扩大 IT 服务市场的占用率

24

Opportunity Threat

1 Transformation of China Bank still in infant stage compared to Foreign bank

2 IT investment of China Bank would have much room to grow

3 GDP growth in China still in up rising trend in the next decade

4 The needs and urgency of bank transformation would be increased over the time after the IPO wave

1 High Investment on high end resource team and long selling cycle would impact the EBITA in a certain period of times 2 Economic turmoil would impact the short and long term strategy3 Take times (years) to build up the core competence in service market due to regulation restriction and maturity of outsourcing in financial market

Strength 1 No 2 Mid range server Vendor in the world 2 No 1 PC vendor in the world3 Acquired EDS in 2008 and becoming the 2nd largest outsourcing companies in US4 World Class Data Center with cloud computing solution

SO ST

1 Position as Foreign Service company with introducing the International Best Practice software and service with strong local delivery capabilities

2 Strategic Alliance with foreign specialized solution vendor and with local SI vendor

3 Closely monitor the non-bank companies development and their needs

1 Avoid the face to face competition with IBM for the playfield of core banking until core competence built upon

2 Build up the core teams with both IT and business consulting experience to provide the competitive advantage over the local vendor

Weakness 1 Hardware Vendor Preconception 2 Lack of Proprietary Banking Solution 3 Lack of High End consulting expertise in China

WO WT

1 Regular publication on MarketProduct trendStrategic Roadmap to educate the customer

2 Regular publication of Successful Case Study from both Mainland and International clients

1 Leverage the HP Taiwan core competence on Unix Platform Credit Card solution

2 Focus on HP capability to application migration from Mainframe to Unix Platform (case study from Common Wealth Bank in AUS by EDS)

Conclusion1Leverage the BI software and Channel Integration as competitive edge in niche market2Leverage the cloud computing to enlarge the outsourcing market3Customer base of HP Unix server as the assets for cross selling

With the SWOT analysis HP China should focus on the Channel solution including the channel integration internet banking and mobile banking bundling with Business Intelligence solution to cater for City commercial bank and share owned commercial bank

25

-- 下面提出的策略建议是建立于 HP 中国在达到扩大市场占有率 建立核心竞争力于细分市场上 所应该考虑的几个方案

ldquo可能被执行的策略rdquo ldquo所需执行的行动rdquo

1) 渠道整合 网点改造 网上银行 信用卡系统都是 HP 中国的长项2) 利用 HP 中国现有的 ITO 服务器客户进行交叉销售3) 建立核心能力于渠道解决方案 提升本地化的高端人才与交付能

力

A ldquo專注於渠道 rdquo 并且提供一站式服务

1) 定位于领先的服务供应商 为中国的银行业引进国外的专业领先产品 配合本土化的交付能力为客户进行最佳实践的交付

2) 与本地集成商建立策略性伙伴关系以加强国外产品本地化开发与集成

3) 短期内以项目的主承包商与项目管理辨公司以监控项目的交付

B ldquo专注于城市商业银行与股份制商业银行rdquo

C 与国外的专业产品供应商和本土的集成商建立策略性伙伴关系以提供渠道类的一站式解决方案

1) 在資源有限的情況下 專注於幫助中小型銀行在渠道上的核心能力因為大部份的國有銀行 例如 ICBC都偏向於自主開發

26

-- Below are the suggested strategy for HP China for achieving enlarging the market share and building up the core competence and center of excellence in niche market with niche target bank

ldquo Possible Strategyrdquo Strategy for the ldquoPossible Moverdquo

1) Channel IntegrationBranch network transformationInternet bankingCredit Card are those HP China can leverage

2) Leverage the existing HP ITOServer client base to cross selling the channel solution

3) Build up the Channel One Stop solution competence by hiring high end business consultant and delivery team

A ldquoFocus on Channel rdquo with One Stop solution store

1) HP Position should position to be brought the Foreign Solution and Expertise to China as Best Practice

2) Align with local vendor is to provide the solution which HP lack of and SI capability for localization development and system integration

3) Position as main Contractor and PMO for the project implementation

B ldquoFocus on City Commercial Banks and Share Owned Commercial Bank

C Alliance with local SI vendor and the solution provider to provide one stop solution store

1) Resource is always limited focus on those SampM bank to help the bank to develop their core competence on Channel

2) State owned bank would prefer to build up their own IT solution and capability eg ICBC

- Slide 1

-

3

主要的观点 Key Findings

好消息 The good news 在中国银行业利用 IT 进行业务改革 转型还是处于初

始阶段 IT 服务业市场在未来的 10 年预计会有很大的发展空间 Significant market potential for the growth of IT solution market in the next 10 years

渠道管理与整合 合规与管理类的系统应该是下一波中国银行业重点投资与增强的方向 Channel and Management amp compliance solution would be the next wave of investment for the bank

坏消息 The not so good news 监于欧洲的金融危机可能会影响中国银行业投资于 IT

服务改革的力度与时间表 The Euro economic turmoil would slow down the IT investment from Bank in 2011

4

关注 Issue 中国银行业市场的发展趋势 What are the trends of China Banking Market 我们分析了 5 个主要现行发展趋势的假设 We have identified five hypotheses about trends which shape the current financial market

Market Topography is Changing Rapidly and Competition is IntensifyingB 中国商业银行在收入 利润仍然

非常依赖存贷业务 Bankrsquos revenueprofit margin still heavily relied on loan offering 虽然在过去几年当中 商业银行的中间业务收入有长足的进步 但相对于国际领先的银行 中间业务收入占比还是偏低 这代表了中国商业银行的产品创新能力有待改进 Although the fee based revenue has significant growths but it still be lag behind compared to Foreign Bank revealing the needs of product innovation of the bank

A 激烈的市场竞争 - More intensive competition

Emergent and rapid growth of non-financial companies in traditional retail banking market

由于愈来愈多的非金融公司出现 如消费金融公司与第三方支付公司等加入传统金融市场 加深市场竞争 The emergent of consumer finance companies and 3rd party payment companies intensify the retail banking competition

E 农村合作社 信用社的合并 混合型银行的出现 Merger Among Rural credit union and FHCs growsContinuous reducing the no of Rural Credit Unions which are forming the city commercial banks Meanwhile the FHC starts to grow for example PingAn农村合作社 信用社的合并以增强实力市場中开始出现混合型的银行 例如平安銀行

C 愈来愈严峻的监管条例与政府提倡的扩大内需经济 More intensified regulatory requirements 中国银行零售业务的增长比对公业务快 成为中国银行业的增长亮点 Consumer banking segment has recorded a stronger growth rate than corporate banking

D 商业银行的 IPO 潮 Wave of IPO of Commercial Banks由于需要符合 IPO 的上市要求 银行需要对管理合规系统进行升级 特别是符合 BASELII 的系统 This triggers the demand of risk and audit compliance especially for meeting the standard of BASELII

5

根據國際著名的 IDC 研究報告中指出 中國銀行投資於 IT 的資金在 2010 年達到 500 億 並且預計在 2014 年會達到 800 的規模 With the research by IDC the banking investment in IT solution was 500 billion in 2010 and is expecting to grow to 800 billion in 2014

Insight 深度分析

在 2009 年银行 IT解决方案 (包括软件与服务 ) 约占中国银行业 IT总投资中的 30 并预计在2014 年达到 267 亿 这代表了在 IT解决放案的领域上在未来 5 年有超过 50 的增长 IT banking solution service including software would be about 30 among the total share and expects to have the market volume reached to 267 billion in 2014 it means that it has much room to grows in the next 5 years

另外 对比美国与欧洲的银行业 中国银行业的 IT 投资还是偏低而且在现有的硬件与网络投资占比过重 In addition compared to Foreign bank investment in IT the ratio of china bank investment is still far below from US and Euro bank

6

接下来 我们看一下零售银行渠道细分市场 在 2010 年市场规模达到 21 亿 当中渠道整合管理则为 8 亿 For the segmented market of retail distribution channel the market volume reached 21 billion in which channel integration and internet and mobile would shared about 8 billions in 2010

深度分析 Insight

最近几年 银行开始投资于渠道整合与网点改造 并且我相信这个市场愈来愈受重视与重点投资面In recent years more banks invests on channel integration and branch network reforms it has expected to grow more and more

自从 2009 有银行开始推行手机银行作为其中一个渠道 由于智能手机的渗透率会愈来愈高 预计手机银行的未来 5 年会作为银行重点发展的渠道 Since 2009 the mobile banking has been gaining more and more development in the market as the penetration of smart phone increased

7 |

内容零售银行中的渠道整合在银行业务变革策略所带来的商业价值Strategic and business value of Retail Banking Distribution Channel Transformation

8

中国的商业银行需要加快对渠道整知 网点布局与改造以幫助

ldquo虽然中国商业银行的中间业务收入有长足的增长 但是占比率 3 倍小于国际领先银行rdquo(The Banker)

优化银行的收入结构以减少未来利率自由化的冲击 同时 银行增加中间业务的收入可以减少因金融市场不稳定所带来的增加坏帐拨备而引起的利润下降 避免过份依赖传统的利差收入

更为高效的网点投资回报率 根据国外的研究 实体网点的成本是15倍高于电子 自动渠道 例如网上银行 手机银行 电话银行 渠道的布局与改造能帮助银行在实体网点的每平方的创收率与利用率以尽量的把网点改造为真正的销售 还有渠道的整合与智能分析能提高交叉销售的深度与广度

作为提高非金融公司的竞争准入手段 实体的网点是银行投资成本最高的一环 但是也是银行能够提高非金融公司加入市场的准入的最重要手段 所以如何把银行网点从交易中心转型到销售中心是银行未来几年需要重点改革的部份 其实 国外的领先银行已经从零售业中借监 为未来的网点格局作出多方面的测试 其中 APPLE 的网点定位为体验中心就值得中国的银行研究

在全球经济衰退的阴影之下 中国政府在 2008 年开始调整经济增长模式 强调要从过往的投资 出口驱动转型到内需驱动经济体系 所以在此背景之下 个人 零售财务的需求将会有很大的发展空间 但同时 中国政府可能会减缓对金融市场自由化的进度

ldquo收集并分析不同的客户在不同的渠道的信息能大大的帮助银行对客户的行为 财务需要进行有效的分析 从需推出有针对性的产品与服务rdquo(Deloitte)

9

Needs the China Bank to speed up the retail banking distribution network transformation to

ldquoAlthough the fee based revenue has significant increment for the past years it still 3 times less than International Best Practice bank (The Banker)

Improve the structural income component of the bank this need to increase the fee based income to counter part the impact of raise of provisional of bad debt during the economy unstable and reliance of interested based revenue

More viable ROI on channel investment As cost of physical branch network is about 15 times higher than other direct channel like internetMobileCall center the transformation can help to increase the revenue generation per sq foot of physical network by increasing the cross sales opportunities and to channelize the transaction based customer to use lower cost channel

Create higher entry barrier for competitive dynamics from non bank companies Physical sales outlets (branch network) would be the biggest entry barrier for e-commerce companies to erode the market share of bank Transform the transaction based physical outlet to sales oriented outlet should be put into Bank strategy agenda before those e-commerce companies grown up

Under the shadow of global economy turmoil the Chinese Government would be more emphasize on the ldquointernal consumer marketrdquo that will boost the retail banking needs and withhold the deregulation of financial market

ldquoRecognize different customer segments and capture information on them across channels to understand their needs and behaviour ndash develop product strategy accordinglyrdquo(Deloitte)

10

通过以下为提供客户增值服务

- ldquo渠道的整合加上商业智能分析为银行提供非常有价值的客户信息 帮助银行持续的创新的产品服务开发达到rdquo成为第一rdquo的地位rdquo

- ldquo智能手机能通过位置定位的功能 能为银行提供更为准确的客户信息rdquo 这对于银行与特约商店都创造双嬴的局面 对于客户而言 所提供的优惠信息更为准确与贴心

增加客户的忠诚 渠道整合能根据客户在不同的渠道使用银行服务 供更为有针对性的奖励回馈活动与价值 从而增加客户的忠诚度与银行的捆绑程度

提供针对性的推销活动 智能手机能通过位置定位的功能 能为银行提供更为准确的客户信息 以帮助银行即时的交叉销售的能力 为特约商店与银行形成一个良好的商业环境

客户更为便捷有效的从银行端接受咨询服务 通过渠道的整合能为银行网点的运营更为高效 帮助释放银行人力资源专注于提供财务咨询服务

渠道对于银行的作用就如人的眼睛与鼻子一样 是触摸感受客户的重要载体 所以渠道的转型改造能帮助银行通过提供针对性的服务产品来提升竞争力 增加客户的忠诚度与利润率

11

Create the ldquoUnique Customer Added Valuerdquo through

- ldquoChannel integration together with Business intelligence provide the valuable information for the bank to continuous product innovation and ldquoBe the Firstrdquo

- ldquoSmart phone App provide the location information which is not likely to gather in the past to provide more insightful information to the bankrdquo This is essential for creating Win Win situation for CustomerBankBank Partners ldquo

Enhance Customer loyalty Channel integration provide the ways for developing more customer oriented rewarding value for those who use the banking product in different channels

Tailored promotion and marketing Smart phone App provide the location information which is not likely to gather in the past to provide more insightful information to the bank to create a healthy ecosystem of customerbankbanking partners

Getting more tailored consulting service from bank With improved branch operational efficiency enabling the customer to receive consulting service without wasting time on waiting and waiting

As channel act like the eye and ears of bank the channel transformation would help the bank to provide more competitive differentiated value to the customer and in return increase the customer loyalty and profitability

12

保障了过往对数据大集中项目的投资回报 同时又能为打造以rdquo客户为中心rdquo的系统奠下坚固的基础 同时渠道的整合帮助银行的rdquo LEGACY 交易 财务核心系统rdquo有廷长寿命的作用 增加核心系统的投资回报率

渠道整合是连贯前后台的枢纽 在过去的渠道建设当中 每一个的渠道或多或少形为了信息孤岛的情况 渠道整合把各处分散的系统信息转化为有用的信息

通过整合减少接口开发量 银行的 IT部门最头痛的地方就是在某一渠道的接口改变引起其他相关连的接口也要跟着改动 根据过去的经验 接口的改动占了 IT 预算的 40 到 60

从 IT 的角度而言 大部份的中国商业银行在 2000 年初已经实施了数据大集中的项目 银行很难在短期之内为核心系统进行再次升级计划 所以渠道的整合与改造在中长期 IT 规划中就成为银行最优的业务改革的利器

13

Protect the past IT investment on core banking replacement while offering the customer centric channel Channel integration can help to extend life cycle of legacy transactionalfinancial based core banking system to maximize the ROI

Logical second milestone of integration Every channel would like a isolated information repository channel integration would be the next core platform to create value for end bank users

Reduce the interface cost by integration The most headache of IT department is that whenever the change made in one channel the interface with other channel needs to be changed accordingly Around 40 to 60 of IT budget would be expensed to interface change

From IT perspective as most of the China Bank have done a core banking replacement for data centralization in the past decade it is hard for the bank to invest such a big investment to replace the core banking again As such the channel integration would be the best option for the bank to plan for their short term IT planning roadmap

14 |

内容

以 HP 中国为例 分析外国的 IT 服务供应商如何以渠道整合为入点以扩大在中国银行业服务的市场占有率 Strategic suggestion for HP for enlarging the IT banking solution market in China

15

-- 以下的图表示的是解决方案服务供应商在不同的商业银行层次和解决方案类型的覆盖范围 HP 中国在市场上主要专注于提供管理合规类产品与渠道类的解决方案予所有不同层次的银行

细分市场 客户

Product (產品重心 )

管理合规类1048713 企业资源管理1048713 商业智能 决策支持1048713 风险管理1048713 金融审计和稽核1048713 客户关系管理

渠道类1048713 渠道管理1048713 银行卡系统1048713 电话银行 呼叫中心1048713 网络银行1048713 其他渠道

核心业务系统类 核心业务bull 支付与清算bull 中间业务bull 信贷操作

国有商业银行 State

股份制商业银行

城市商业银行

农村商业银行 信用合作社

外资商业银行

IBM

HPLocalVendor

LocalVendor

16

-- 以下的圖表示的是解決方案服務供應商在不同的商業銀行層次和解決方案類型的覆蓋範圍 HP 中國在市場上主要專注於管理合規類產品與渠道類的解決方案 Below charts shows the solution vendor coverage for different type of commercial bank HP is focusing providing the management amp compliance and channel solution to all type of banks except stated owned commercial banks

Segmented Market customer

Product (產品重心 )

Management amp Compliance1048713 企业资源管理1048713 商业智能 决策支持1048713 风险管理1048713 金融审计和稽核1048713 客户关系管理

Channel Category1048713 渠道管理1048713 银行卡系统1048713 电话银行 呼叫中心1048713 网络银行1048713 其他渠道

Core Business Categorybull 核心业务bull 支付与清算bull 中间业务bull 信贷操作

State Owned Commercial Bank

Shared Owned Commercial Bank

City Commercial Bank

Rural Commercial Bank

Foreign Commercial Bank

IBM

HPLocalVendor

LocalVendor

17

Channel Integration

混业性银行 全方位银行 ndash 区域性商业银行

全方位银行 ndash 全国性商业银行 专业银行

Channel Integration

among different

legal entity

Enterprise ndashwide

Business Intelligence

BASELII Compliance

Enterprise ndashwide CRM

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

BASELII Complian

ce

Channel Integration

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

Channel Integration

Data Mining

BPOITO

New Distributi

on Channel

Specialized Solution

根据国外的经验 将来中国的商业银行有可能会发展为以下 4 种的银行定位 下图表示的是不同的银行定位有可能需要的业务改革需要

HP China competitive advantage and entry points

18

Channel Integration

Financial Holding Bank Full Service ndash Regional Bank

Full Service - Nationwide Bank Specalized Bank

Channel Integration

among different

legal entity

Enterprise ndashwide

Business Intelligence

BASELII Compliance

Enterprise ndashwide CRM

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

BASELII Complian

ce

Channel Integration

Business Intelligenc

e amp Decision Support

BPOITO

Customer Centric Core

banking System

New Distributi

on Channel

Channel Integration

Data Mining

BPOITO

New Distributi

on Channel

Specialized Solution

There are 4 types of banking position which might be evolved in China below chart shows what are the transformation initiatives would be needed for each type of position

HP China competitive advantage and entry points

19

Banking Position Transformation Initiatives Major IT Implication

bull Specialized Bank

bull 4家消費金融公司

bull Non-Financial

Companies

bull Focus on Product innovationdifferentiation and

segmented groupmarket with flexible pricing

bull Well relationship with the customer by enriching

customer experience and keeping customer intimacy

A Highly Flexible specialized software with parameter

driven especially for workflow authorization control

product setup pricing and fee configuration

B Flexible external interface socket

C Multiple direct delivery channels eg Mobileinternet

with integrated channel management

D Data Mining for supporting product innovation and

customer preference and behavior

E Outsourcing the non competence operation eg

collectioncall centerdata center ops and

management

bull Full Service ndash Regional

Bank

bull City Commercial

Bank

bull Would have full scope of retail service but would focus

on Product innovationdifferentiation and segmented

groupmarket

bull Use the scientific method to analyse the customer

preference and behaviour and launch customized

product to target segment

bull Effective channel management to lower the operation

cost and simplified business process to raise the

customer experience

bull Risk and Audit compliance

A Integrated channel management to gather the data

from different channel and use the business

intelligence solution to turn them into value

information for continuous product and service

innovation

B Innovated product delivery channel mobile

banking to cater for 8090 GEN

C CRM and Decision support system can provide the

bank of proactive marketing and competitive

pricing

D Different kind of outsourcing should be considered

to have flexible costing to cater for the economic up

and down

Below table show the how are the IT implications for each type of banking position and the needed transformation initiatives in which details the Specialized bank and Regional bank

20

银行定位 业务改革策略需要 主要的银行系统含义

bull专业银行

bull 4 家消费金融公司

bull 非金融公司 例如第三方支付公司

bull 专注于产品的创新 细分产品与市场 配以灵活的定价以形成竞争力

bull 通过增强的客户使用经验与迎亲和力 拥有与客户的良好的关系

A 拥有以参数驱动的灵活专业系统 特别是在流程定义 授权控制 产品刮定 费用设定等

B 雳活定制的接口

C 多样性的销售渠道 例如网上 手机银行配以渠道整合数据挖掘以支持产品创新与客户偏好与行为分析

D 利用外包服务供应商以把非核心的业务进行外包以减少运营成本 例如催收 Call Center 数据中心管理等等

bull 全方位银行 ndash 区域性商业银行

bull 城市商业银行

bull 提供全方位的零售业务但会有偏重的产品的创新 细分产品与市场

bull 使用科学的方法分析客户的偏好与行为以推出针对性的细分产品与市场

bull 高效的渠道管理与简化的业务流程以降低运营成本与增加客户的满意程度

bull 风险与合规

A 整合的渠道管理系统统一各渠道的接口 形成数据治理 配合商业智能分析系统把各渠道的信息转化成有内容 有价值的信息以及促进产品 服务创新

B 产品 服务创新于特定渠道与人群 例如以手机银行针对 8090 后的青年

C 客户关系管理系统和决策支持系统提供银行主动式营销与有竞争力的定价

D 应考虑采用不同类型的外包以应对经济的起落 实现运营成本最少化

下面的表格中显示是不同的银行定位与业务改革需要对银行系统的含义 ndash 详细描述了专业银行与全方位银行 ndash 区域性商业银行

21

Position of Bank Transformation Initiatives IT Implication

bull Full Service ndash Nationwide

Bank

bull Share Owned

Bank

bull Similar to Regional bank but would have more capability to

develop a new target segment eg 8090 GENElder group

a new channel eg mobile banking to provide full banking

service

bull Branch Network Transformation including physical network

and virtual network to transform to customer and selling

centric

A Similar to Regional Bank but the solution needs to

have high availability and high processing capability

with high resilience

B Leverage the specialized solution to provide the

better support for specialized function

C Transform the transactional based physical branch

network to sales based network with by simplifying

the business process and channeling the

transaction from teller to Kiosk as well as setting up

the customer experience center like Apple Store

D Channel Integration and to upgrade the internet

banking to use Web20 to provide the realtime

online assistance as well as enhancing the mobile

banking with LBS function to provide better

merchant selling and promotion to enhance the

customer loyalty for GEN 8090

E Customer Centric core banking system

bull Financial Holding

Companies

bull PingAn Bank is

targeting for this

model

bull Establish the Risk compliance to BASELII to cover credit

riskoperational riskmarket riskEvent Risk

bull Run different type of business under one financial group to

include insurance retail banking wholesale banking

investment banking to maximize the cross selling by using

the Bank Reputation

bull One stop banking product store to provide the financial

product to satisfy the enterprise vertical value chain

A Fully integration of CIF and channel with Business

Intelligence to create the chance for cross sale

B BaseI lI compliance is a must that needs the

specialized solution to support

Below table show the how are the IT implications for each type of banking position and the needed transformation initiatives in which details the Nationwide Bank and Financial Holding Company

22

银行定位 业务改革策略需要 主要的银行系统含义

bull 全方位银行 ndash 全国性商业银行

bull 国有商业银行

bull跟全方位的区域性跟行非常类似 但会更有实力在开拓新市场例如 8090 后与老人群众与新渠道例如开发手机银行提供全方位的银行服务

bull 银行网点的改造包括实体网点以及电子渠道网点以达到以客户为中心 以销售为核心的渠道布局

A 跟全方位的区域性跟行非常类似 但是解决方案系统必需具备高可用性 高处理量 双系统的能力

B 利用专家的解决方案提供更好的专业系统支持 例如使用专业的信用卡管理系统

C 为银行网点转型 从过往的交易处理中心转型为以销售为中心的渠道 通过业务流程简化 网点改造使用来增强客户使用体验

D 渠道整合加上网上银行升级 行用 Web20 的技术来提供实时的网上人工帮助 在手机银行中行用 LBS

的功能为商店的促销提供针对性的客户 这些可以增加 8090 后的使用经验和忠诚度

E 实施以客户为中心的核心系统

bull 混业性银行

bull 平安银行正在朝往该业务模式进发

bull 建立完整的风险与合规以符合 BASEL II 的要求 覆盖信用风险 操作风险 市场风险以及系统性风险

bull 在同一个金融集团中包括有对公 零售 投资 保险于一身

以达到金融产品超级市场一站式的服务 以达到交叉销售的最大化

bull 一站式的金融服务提供在企业价值鐽中的不同金融产品

A 完全整合全金融集团的客户信息加上全行的商业智能方案以达到交叉销售的最大化

B 需要以专业的风险合规系统以符合 BASEL II 的要求

下面的表格中显示是不同的银行定位与业务改革需要对银行系统的含义 ndash 详细描述了全方位银行 ndash 全国性商业银行与混业性银行

23

机会 Opportunity 危机 Threat

1 对比于外国的商业银行 中国商业银行在业务改革中还是属于初始阶段

2 中国商业银行对 IT 投入有很大的增长空间 IT 3 中国的 GDP 增长仍然预计在未来的十年属

于上升阶段4 在中国商业银行在 IPO潮后 需要加大力度

与速度于业务改革以增加竞争力于本土以及海外扩张

1 需要加大對高端的 IT 业务咨询人才的投入加上銷售時期比較長對公司的 EBITA 在短時間內造成壓力

2 2 金融衰退對銀行的中短期的 IT 投資策略有所影響

3 需要時間 ( 以年算 ) 建立核心的競爭力於軟件服務上 加上中國的金融自由化與服務外包的成熟度都約制了短期的利潤

强项 Strength

1 全球第二位的 Mid range 服务器供应商

2 全球第一位的 PC 供应商 3 在 2008 年收购了全球知名

的外包服务公司 并且成为全美第二位的外包服务供应商

4 全球首屈一指的数据中心建造与云计算方案的供应商

SO ST

1 定位于领先的服务供应商 为中国的银行业引进国外的专业领先产品 配合本土化的交付能力为客户进行最佳实践的交付

2 与国外的专业产品供应商和本土的集成商建立策略性伙伴关系

3 监视非金融公司在中国的发展 并提供整体方案予该等机构

1 避免与 IBM面对面的直接竞争于核心系统建置直至本土化的咨询与与交付能力的提升

2 建立核心竞争力于 IT 与业务咨询上以提供优于本土服务供应商 集成商竞争力的高端资源上

弱項 Weakness

1 硬件供应商的观念在短时间很难改变

2 缺乏独特性的银行解决方案3 在中国缺乏高端的 IT 业务咨询人才

WO WT

1 定期发布市场 产品趋势 策略性研究报告以倡导式教育客户

2 定期发布大陆与国外的成功案例分析予客户

1 利用 HP 台湾的核心竞争力于信用卡解决方案

2 专注于 HP 的独特能力于应用系统从主机迁移至MID RANGE 服务器 (case study from Common Wealth Bank in AUS by EDS)

结论 Conclusion1利用商业智能分析软件与渠道的整合作为优势竞争力于细分市场上2利用云计算以扩大服务外包市场 3行用使用 HP 服务器的客户进行交叉销售

以 SWOT 分析工具来分析 HP 中国应该以提供渠道整体解决方案包装渠道整合 网上银行 手机银行再加上商业智能分析系统为契机 针对性对城市商业银行和农村商业银行提供服务 以争取扩大 IT 服务市场的占用率

24

Opportunity Threat

1 Transformation of China Bank still in infant stage compared to Foreign bank

2 IT investment of China Bank would have much room to grow

3 GDP growth in China still in up rising trend in the next decade

4 The needs and urgency of bank transformation would be increased over the time after the IPO wave

1 High Investment on high end resource team and long selling cycle would impact the EBITA in a certain period of times 2 Economic turmoil would impact the short and long term strategy3 Take times (years) to build up the core competence in service market due to regulation restriction and maturity of outsourcing in financial market

Strength 1 No 2 Mid range server Vendor in the world 2 No 1 PC vendor in the world3 Acquired EDS in 2008 and becoming the 2nd largest outsourcing companies in US4 World Class Data Center with cloud computing solution

SO ST

1 Position as Foreign Service company with introducing the International Best Practice software and service with strong local delivery capabilities

2 Strategic Alliance with foreign specialized solution vendor and with local SI vendor

3 Closely monitor the non-bank companies development and their needs

1 Avoid the face to face competition with IBM for the playfield of core banking until core competence built upon

2 Build up the core teams with both IT and business consulting experience to provide the competitive advantage over the local vendor

Weakness 1 Hardware Vendor Preconception 2 Lack of Proprietary Banking Solution 3 Lack of High End consulting expertise in China

WO WT

1 Regular publication on MarketProduct trendStrategic Roadmap to educate the customer

2 Regular publication of Successful Case Study from both Mainland and International clients

1 Leverage the HP Taiwan core competence on Unix Platform Credit Card solution

2 Focus on HP capability to application migration from Mainframe to Unix Platform (case study from Common Wealth Bank in AUS by EDS)

Conclusion1Leverage the BI software and Channel Integration as competitive edge in niche market2Leverage the cloud computing to enlarge the outsourcing market3Customer base of HP Unix server as the assets for cross selling

With the SWOT analysis HP China should focus on the Channel solution including the channel integration internet banking and mobile banking bundling with Business Intelligence solution to cater for City commercial bank and share owned commercial bank

25

-- 下面提出的策略建议是建立于 HP 中国在达到扩大市场占有率 建立核心竞争力于细分市场上 所应该考虑的几个方案

ldquo可能被执行的策略rdquo ldquo所需执行的行动rdquo

1) 渠道整合 网点改造 网上银行 信用卡系统都是 HP 中国的长项2) 利用 HP 中国现有的 ITO 服务器客户进行交叉销售3) 建立核心能力于渠道解决方案 提升本地化的高端人才与交付能

力

A ldquo專注於渠道 rdquo 并且提供一站式服务

1) 定位于领先的服务供应商 为中国的银行业引进国外的专业领先产品 配合本土化的交付能力为客户进行最佳实践的交付

2) 与本地集成商建立策略性伙伴关系以加强国外产品本地化开发与集成

3) 短期内以项目的主承包商与项目管理辨公司以监控项目的交付

B ldquo专注于城市商业银行与股份制商业银行rdquo

C 与国外的专业产品供应商和本土的集成商建立策略性伙伴关系以提供渠道类的一站式解决方案

1) 在資源有限的情況下 專注於幫助中小型銀行在渠道上的核心能力因為大部份的國有銀行 例如 ICBC都偏向於自主開發

26

-- Below are the suggested strategy for HP China for achieving enlarging the market share and building up the core competence and center of excellence in niche market with niche target bank

ldquo Possible Strategyrdquo Strategy for the ldquoPossible Moverdquo

1) Channel IntegrationBranch network transformationInternet bankingCredit Card are those HP China can leverage

2) Leverage the existing HP ITOServer client base to cross selling the channel solution

3) Build up the Channel One Stop solution competence by hiring high end business consultant and delivery team

A ldquoFocus on Channel rdquo with One Stop solution store

1) HP Position should position to be brought the Foreign Solution and Expertise to China as Best Practice

2) Align with local vendor is to provide the solution which HP lack of and SI capability for localization development and system integration

3) Position as main Contractor and PMO for the project implementation

B ldquoFocus on City Commercial Banks and Share Owned Commercial Bank

C Alliance with local SI vendor and the solution provider to provide one stop solution store

1) Resource is always limited focus on those SampM bank to help the bank to develop their core competence on Channel

2) State owned bank would prefer to build up their own IT solution and capability eg ICBC

- Slide 1

-

4

关注 Issue 中国银行业市场的发展趋势 What are the trends of China Banking Market 我们分析了 5 个主要现行发展趋势的假设 We have identified five hypotheses about trends which shape the current financial market

Market Topography is Changing Rapidly and Competition is IntensifyingB 中国商业银行在收入 利润仍然

非常依赖存贷业务 Bankrsquos revenueprofit margin still heavily relied on loan offering 虽然在过去几年当中 商业银行的中间业务收入有长足的进步 但相对于国际领先的银行 中间业务收入占比还是偏低 这代表了中国商业银行的产品创新能力有待改进 Although the fee based revenue has significant growths but it still be lag behind compared to Foreign Bank revealing the needs of product innovation of the bank

A 激烈的市场竞争 - More intensive competition

Emergent and rapid growth of non-financial companies in traditional retail banking market

由于愈来愈多的非金融公司出现 如消费金融公司与第三方支付公司等加入传统金融市场 加深市场竞争 The emergent of consumer finance companies and 3rd party payment companies intensify the retail banking competition

E 农村合作社 信用社的合并 混合型银行的出现 Merger Among Rural credit union and FHCs growsContinuous reducing the no of Rural Credit Unions which are forming the city commercial banks Meanwhile the FHC starts to grow for example PingAn农村合作社 信用社的合并以增强实力市場中开始出现混合型的银行 例如平安銀行

C 愈来愈严峻的监管条例与政府提倡的扩大内需经济 More intensified regulatory requirements 中国银行零售业务的增长比对公业务快 成为中国银行业的增长亮点 Consumer banking segment has recorded a stronger growth rate than corporate banking

D 商业银行的 IPO 潮 Wave of IPO of Commercial Banks由于需要符合 IPO 的上市要求 银行需要对管理合规系统进行升级 特别是符合 BASELII 的系统 This triggers the demand of risk and audit compliance especially for meeting the standard of BASELII

5

根據國際著名的 IDC 研究報告中指出 中國銀行投資於 IT 的資金在 2010 年達到 500 億 並且預計在 2014 年會達到 800 的規模 With the research by IDC the banking investment in IT solution was 500 billion in 2010 and is expecting to grow to 800 billion in 2014

Insight 深度分析

在 2009 年银行 IT解决方案 (包括软件与服务 ) 约占中国银行业 IT总投资中的 30 并预计在2014 年达到 267 亿 这代表了在 IT解决放案的领域上在未来 5 年有超过 50 的增长 IT banking solution service including software would be about 30 among the total share and expects to have the market volume reached to 267 billion in 2014 it means that it has much room to grows in the next 5 years

另外 对比美国与欧洲的银行业 中国银行业的 IT 投资还是偏低而且在现有的硬件与网络投资占比过重 In addition compared to Foreign bank investment in IT the ratio of china bank investment is still far below from US and Euro bank

6

接下来 我们看一下零售银行渠道细分市场 在 2010 年市场规模达到 21 亿 当中渠道整合管理则为 8 亿 For the segmented market of retail distribution channel the market volume reached 21 billion in which channel integration and internet and mobile would shared about 8 billions in 2010

深度分析 Insight

最近几年 银行开始投资于渠道整合与网点改造 并且我相信这个市场愈来愈受重视与重点投资面In recent years more banks invests on channel integration and branch network reforms it has expected to grow more and more

自从 2009 有银行开始推行手机银行作为其中一个渠道 由于智能手机的渗透率会愈来愈高 预计手机银行的未来 5 年会作为银行重点发展的渠道 Since 2009 the mobile banking has been gaining more and more development in the market as the penetration of smart phone increased

7 |

内容零售银行中的渠道整合在银行业务变革策略所带来的商业价值Strategic and business value of Retail Banking Distribution Channel Transformation

8

中国的商业银行需要加快对渠道整知 网点布局与改造以幫助

ldquo虽然中国商业银行的中间业务收入有长足的增长 但是占比率 3 倍小于国际领先银行rdquo(The Banker)

优化银行的收入结构以减少未来利率自由化的冲击 同时 银行增加中间业务的收入可以减少因金融市场不稳定所带来的增加坏帐拨备而引起的利润下降 避免过份依赖传统的利差收入

更为高效的网点投资回报率 根据国外的研究 实体网点的成本是15倍高于电子 自动渠道 例如网上银行 手机银行 电话银行 渠道的布局与改造能帮助银行在实体网点的每平方的创收率与利用率以尽量的把网点改造为真正的销售 还有渠道的整合与智能分析能提高交叉销售的深度与广度