AUSTRALIAN AGRICULTURAL COMPANY … While every care has been taken in the preparation of this...

Transcript of AUSTRALIAN AGRICULTURAL COMPANY … While every care has been taken in the preparation of this...

AUSTRALIAN AGRICULTURAL COMPANY LIMITED

Results Presentation1st Half Year 30 June 2011

1

For

per

sona

l use

onl

y

DISCLAIMER

While every care has been taken in the preparation of this presentation, Australian Agricultural Company Limited (“AAco”) and each of their respective related bodies corporate and associated entities and each of their respective officers, employees, associates, agents, independent contractors and advisers, do not make any representation, guarantee or warranty, express or implied, as to the accuracy, completeness, currency or reliability (including as to auditing or independent verification) of any information contained in this presentation and do not accept, to the maximum extent permitted by law:

(a) any responsibility arising in any way for any errors in or omissions from any information or for any lack of accuracy, completeness, currency or reliability of any such information made available;

(b) any responsibility to provide any other information or notification of matters arising or coming to their notice which may affect any information provided;

(c) any liability for any loss or damage (whether under statute, in contract or tort for negligence or otherwise) suffered or incurred by any person as a result of or in connection with a person or persons using, disclosing, acting on or placing reliance on any information contained in this presentation, whether the loss or damage arises in connection with any negligence, default or lack of care or from any misrepresentation or any other cause.

No representation, guarantee or warranty is given as to the accuracy, completeness, likelihood of achievement or reasonableness of p , g y g y, p ,any forecasts, projections or forward‐looking statements contained in this presentation.

You acknowledge and agree that you will rely only on your own independent assessment of any information, statements or representations contained in this presentation and such reliance will be entirely at your own risk.

2

For

per

sona

l use

onl

y

FIRST HALF FY11 RESULTS SUMMARY

Sales $ 58.2m ↑ 53% previous corresponding period

EBITDA $ 4.2m ↑ 7% previous corresponding period

PBT $(18.5m) ↓ $2.3m previous corresponding period

NPAT $(12 6m) ↓ $0 4mNPAT $(12.6m) ↓ $0.4m previous corresponding period

Herd Size 641,306 head ↑ 10%previous corresponding period

Major impacts on the result at the Profit Before Tax level were:

• Live Cattle Ban – VRG herd write down of $8 2 million• Live Cattle Ban – VRG herd write down of $8.2 million

• Closure of Chefs Partner – $3.2 million in impairment losses, operating losses of $2.8 million and direct closure costs of $0.8 million

3

• Total non‐recurring impact of $15.0 million to Profit Before Tax

For

per

sona

l use

onl

y

OPERATIONAL DRIVERS OF RESULT

The underlying result was driven by:The underlying result was driven by:

• 92,600 cattle sold @ average price of $987 per head

• 37 800 000 kg’s of weight gain into trading herd• 37,800,000 kg s of weight gain into trading herd

• 8,100,000 kg’s of Branded Beef sales

• 96 700 calves branded to 30 June 2011• 96,700 calves branded to 30 June 2011

• 11,500 bales of cotton harvested

• Excellent seasonal conditions• Excellent seasonal conditions

• Motivated, disciplined management

4

For

per

sona

l use

onl

y

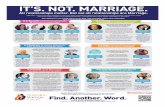

CATTLE TRADINGC ttl S l 1HFY11C ttl S l 1HFY10

16%

Cattle Sales 1HFY11

8%

19%

Cattle Sales 1HFY10

20%

31%

41%

7%

13%20%

41%

25%

Grass Short fed G i W

Breeder and Li E t T t l S l

Average P i

Total Average P i

Grass Finished Short fed Grain Finished Wagyu Breeder and Feeder Live ExportGrass Finished Short fed Grain Finished Wagyu Breeder and Feeder Live Export

FinishedGrain

FinishedWagyu

FeederLive Export Total Sales Price

($/head)Purchases

Price ($/head)

1H FY11 14,789 18,070 12,407 18,503 28,792 92,561 987 117,905 612

1H FY10 3 704 17 758 10 747 3 148 8 395 43 752 1 177 74 270 562

5

1H FY10 3,704 17,758 10,747 3,148 8,395 43,752 1,177 74,270 562

For

per

sona

l use

onl

y

FINANCIAL PERFORMANCE

Summary – Profit & Loss1HFY11$m

1HFY10$m

Movement$m

Gross Revenue 122 8 97 1 ↑ 25 8Gross Revenue 122.8 97.1 ↑ 25.8

Pastoral Group Gross Margin 27.3 25.6 ↑ 1.7p g

Branded Beef Group Trading Gross Margin 5.6 8.2 ↓ 2.6

Crops Gross Margin 4.5 (0.9) ↑ 5.4

Total Gross Margin 37.8 33.5 ↑ 4.3

EBITDA 4 2 3 9 ↑ 0 3EBITDA 4.2 3.9 ↑ 0.3

EBIT (3.1) (2.0) ↓ 1.1

NPAT (12.6) (12.2) ↓ 0.4

6 6

For

per

sona

l use

onl

y

EASTERN YOUNG CATTLE INDEX &EASTERN YOUNG CATTLE INDEX & ROMA PRICES

7

For

per

sona

l use

onl

y

AUD:USD1 10

1.05

1.10

1.00

ange Rate

0.90

0.95

UD:USD

Excha

0.85

0.90

AU

0.80

8

For

per

sona

l use

onl

y

2ND HALF 2011 OUTLOOKDirectors reconfirm the EBITDA forecast range of $50‐$60 million for Dec 2011Directors reconfirm the EBITDA forecast range of $50 $60 million for Dec 2011

Post 30 June 2011:

• Australian Government Live Cattle Ban repealed• Australian Government Live Cattle Ban repealed

– Indonesia opens permits for 180,000 head for 3rd quarter 2011

– No exporters granted qualification to date of new Australian Government export protocols

– AACo has a pre ban forward sales position of 11,000 head at pre ban prices awaiting shipment

– New exporting protocols to limit trade ability to meet Indonesian demand for 2nd half

• Meteor Downs station sold

– Price $21.6 million

– Premium to book valuation of $5.8 million

– Sale and profit to emerge in 2nd half

• Seasonal and Market Conditions

– Grass and pasture conditions remain favorable

Cattle market prices remain stable

9

– Cattle market prices remain stable

– AUD/USD exchange rate continue at current price

For

per

sona

l use

onl

y

BALANCE SHEET1H FY11 1H FY10

Summary – Balance Sheet1H FY11

$m1H FY10

$m

Cash and cash equivalents 20.1 17.0

Li k 453 7 413 6Livestock 453.7 413.6

Property, Plant & Equip 601.8 598.9

Other assets 53.6 43.2

Total Assets 1,129.1 1,072.7

Interest bearing liabilities 362.0 357.3

Other liabilities 122.4 122.8Other liabilities 122.4 122.8

Total Liabilities 484.4 480.1

Net Assets 644.7 592.6

Shares on Issue (‘000) 311,969 264,264

Gearing (Net Debt/(Net Debt + Equity)) 35% 37%

Net Tangible Assets/Share 2.07 2.40

10

For

per

sona

l use

onl

y

CASH FLOW

Summary – Cash Flow Statement1H FY11

$1H FY10

$y

$m $m

Net Operating Cash Flows (56.9) (43.6)

Net Payments for Property, Plant & Equip. (5.6) (2.8)

Payment for Tipperary assets (5.0)

N t I ti C h Fl (10 6) (2 8)Net Investing Cash Flows (10.6) (2.8)

Proceeds from share issues * 65.5 ‐

Net cash inflow / (outflow) before debt drawn 3.1 (2.1)

* Proceeds from Placement & Share Purchase Plan

11

For

per

sona

l use

onl

y

CATTLE OPERATIONS UPDATE• 2011 excellent and extended wet season

– Complimentary nutrient supplementation produced optimum cattle body and fertility conditions

– Improved pregnancy confirmations

– Calf branding one month behind schedules

– Grass and pasture conditions holding

• Breeder Herd Composition– Older non performing bulls retired from herd and sold

Older aged empty (non pregnant) cows retired from herds and sold– Older aged empty (non pregnant) cows retired from herds and sold

– Segregation management of age and pregnancy status improving overall herd performance

– Optimal breeder aging being achieved

• Herd Genetics– New generation (2011 ‐2016) heteosis traits selected

– Finalised the older breeder cooperation supply contracts

– Relocated elite stud herds to CQ

– Re‐established the herd genetics advisory committee

• Trading Herd – Positioned well for weight gain and 2nd half sales

– Restocking of Indo feeders on hold

Good restocker demand from southern states– Good restocker demand from southern states

– Grass feed cattle price holding firm

12

For

per

sona

l use

onl

y

INDONESIAN LIVE CATTLE TRADE UPDATE

• Australian Government live cattle export ban has been repealed– New Australian live cattle export protocols (farm, ship , feedlot , abattoir , OIE standards) implemented

– No exporters government approved to date

– Logistics' supply chain (trucks, yards, ships) will require rebuilding

– No exports effected during July

• Indonesia Government will issue permits for import 180 000 head for 3rd quarter of 2011Indonesia Government will issue permits for import 180,000 head for 3 quarter of 2011– Australia supplies 28% of Indo live cattle requirements

– Australian cattle feed ~48,000,000 Indonesians per year or ~150,000 Indonesian daily

– Indonesian cattle Feedlotting , compliments Australia northern herd breeding Bos Indus genetics‘

Australia is a important contributor to the Indonesian protein and food security supplies– Australia is a important contributor to the Indonesian protein and food security supplies

• The Indonesian challenge to secure sustainable trade– ~600 small remote under resourced (little electrical and water supply) abattoirs

– Aus‐Aid engagement

– Acceptance and installation of Australian “knocking boxes” and OIE slaughter techniques

– Acceptance of Australian audit standards within Indonesian owned abattoirs

– Collaborative successful working relationship between Australian industry representative bodies and governments

– Resolve of the Australian Government to support Live Exporting of Australian livestock industries

13

For

per

sona

l use

onl

y

AAco Directors have resolved to build a profitable processing abattoir in the Northern Territory

OPERATIONAL UPDATE ‐ NT ABATTOIRAAco Directors have resolved to build a profitable processing abattoir in the Northern Territory, conditional upon:

• Northern Territory S46 site development approval• 5 to 6 month process

• Cost $500,000

• Maintaining a capital development project returning 16% EBITDA IRR• Processing capacity ~200,000 head

• Operating Shift Structure• 7 months double shift

• 4 months single shift

• 1 month maintenance

• Federal and NT government support on:l i l d l• Electrical, gas and water supply

• Road rail and port access and facilities development

• Development of Common and Community use assets

• Education and skilling assistance

• Approved 457 working visa conditions• Approved 457 working visa conditions

• Efficient and responsive development and approval process

• Access to housing developments for employees

• Community engagement and support for the project

• Workable and equitable industrial relations platformWorkable and equitable industrial relations platform

• Continued pastoralist support for the project

• Northern Australian pastoral industry remaining financially viable 14

For

per

sona

l use

onl

y

AACO STATIONS PROFILE

15

For

per

sona

l use

onl

y

CATTLE ANALYSISFirst half

2011First half

2010Full year

2010

Opening balance (head) 577,144 507,676 507,676Opening balance (head) 577,144 507,676 507,676Natural increase (including calf accrual) 50,267 50,756 134,236Purchases 117,905 74,270 121,267Cattle write offs (11,433) (6,710) (20,100)Cattle sales (92,577) (43,772) (165,935)( , ) ( , ) ( , )

Closing balance (head) 641,306 582,220 577,144Closing balance consists of:

Breeding (head) 267,425 224,095 295,856Non breeding (head) 373 881 358 125 281 288Non breeding (head) 373,881 358,125 281,288

Cattle valuation ($’000) 451,526 391,594 411,592

Average price of cattle sold ($ per head) 987 1,177 946

Average price of cattle purchased ($ per head) 612 562 607

Average cattle inventory value ($ per head) 704 673 713Average cattle inventory value ($ per head) 704 673 713

16

For

per

sona

l use

onl

y

CATTLE BY BREED

Cattle by Breed Cattle by Location

VRG25%

Barkly42%

25%

Gulf14%

Central Qld8%

Channel Country5%

Darling Downs6%

17

For

per

sona

l use

onl

y

BREEDING HERD AGE PROFILEOptimising the herd’s breeding potential by ensuring correct age profile is maintainedOptimising the herd’s breeding potential by ensuring correct age profile is maintained

and non performance culling

18

For

per

sona

l use

onl

y

STRATEGY

Strategic initiatives Strategy

Delivering on the three year strategic plan

Evolution from pastoral company to integrated beef producer and processor

Progress so farStrategic initiatives Strategy Progress so far

Improved land utilisation

Improved land utilisation

• Tipperary agistment agreement

• Agistment agreements in Northern Territory and areas near to South Galway station in Queensland

S l f M D

• Focus on higher returning land

• Rebalance land portfolio

Value added processingValue added processing

• Expanded beef processing from one to three processing platforms in South East Queensland

• Continue to assess meat processing facility in Northern

• Sale of Meteor Downs

• Improves EBITDA through value retention —

− access to additional profits made by the abattoirs

Improved herd mix Improved herd mix

Continue to assess meat processing facility in Northern Territory

• Expanded Wagyu Production• Strengthen and improve efficiency and t th k t d d

the abattoirs

− save freight and animal losses shipping to East Coast

and qualityand quality

Cattle TradingCattle Trading • Increased cattle trading volumes• Reduce volatility in cash flows and earnings

• Expanded fertility programs

• Early weaning strategy

meet the market demand

19

For

per

sona

l use

onl

y

3 YEAR PLAN UPDATE

2013h l d l

2011 ‐ 2012•Further adjustment of land holdings

•Achieve scale and relevance

•Reward Shareholders

•Dividends

In Progress•Vertical integration (build NT abattoir)

•Ongoing divestment of underperforming/sub scale properties

•Expansion of vertical

2010 – Complete•Rebuild herd

•Achieve positive fi l

•Adjust land holdings (Tipperary)

•Increase Feedlotting

•Capital Raised to fund

Expansion of vertical integration plans

profit result •Capital Raised to fund enlarged asset base/growth

Work in Progress

20

Work in Progress

For

per

sona

l use

onl

y

APPENDICES

21

For

per

sona

l use

onl

y

AACO BUSINESS MODEL

Live cattle division Wholesale boxed beef division

Breeding Herd

Breeding Herd

Trading Herd(Grass feeding / feedlotting)

Trading Herd(Grass feeding / feedlotting)

Branded salesBranded salesMeat processing

(currently outsourced to facilities in South East Qld)

• Fertility and re‐breeding rates

• Age profile of breeding herd

• Kilograms of beef produced

− size of trading herd

• Volume of production

• Processing costs (outsourced)

− weight gain

• Weight gain driven by rainfall / cost of grain

• Market cattle prices

• International prices

• Strength of brands

• Customer preferences

• Energy and logistics costs

• FX

Value chain

22

For

per

sona

l use

onl

y

![Australian Birdstm[1].](https://static.fdocument.pub/doc/165x107/554f6ea6b4c9058a148b5125/australian-birdstm1.jpg)