Slide 14-1Copyright © 2003 Pearson Education, Inc. Money, Interest, and the Exchange Rate MONEY...

-

date post

22-Dec-2015 -

Category

Documents

-

view

215 -

download

1

Transcript of Slide 14-1Copyright © 2003 Pearson Education, Inc. Money, Interest, and the Exchange Rate MONEY...

Slide 14-1

Copyright © 2003 Pearson Education, Inc.

Money, Interest, and the Exchange Rate

MONEYMedium of Exchange

• A generally accepted means of payment

Unit of Account• A widely recognized measure of value

• Express prices, keep records,…write contracts!

Store of Value• Transfer purchasing power from the present to the

future

Slide 14-2

Copyright © 2003 Pearson Education, Inc.

What Is Money?• Asset used and accepted as means of payment.

• A liquid asset with little or no return.– All other assets are less liquid but pay higher return.

• Money Supply (Ms)

Ms = Currency + Checkable Deposits

How Is Economy’s Money Supply Determined?• Controlled by central bank that

– Directly regulates the amount of currency in existence

– Indirectly controls the amount of checking deposits issued by private banks

Money Defined: A Brief Review

Slide 14-3

Copyright © 2003 Pearson Education, Inc.

Demand for money: a function of …• Expected return – interest earnings forgone

• Risk – money loses value if prices increase unexpectedly– A change in the inflation risk of holding money causes

an equal change in the riskiness of holding bonds that are denominated in money.

• Liquidity– Money is the easiest way to pay for everyday

purchases– More transactions increased demand for money

The Demand for Money by Individuals

Slide 14-4

Copyright © 2003 Pearson Education, Inc.

The aggregate demand for money:

Md = P x L(R,Y)where:

P = price level

Y = real national income

R = interest rate

L(R,Y) is the aggregate real money demand

The demand for money can also be expressed as the demand for real balances:

Md/P = L(R,Y)

Aggregate Money Demand

Slide 14-5

Copyright © 2003 Pearson Education, Inc.

Aggregate Real Money Demand and the Interest Rate

L(R,Y)

Interest rate, R

Aggregate realmoney demand

Aggregate Money Demand

Slide 14-6

Copyright © 2003 Pearson Education, Inc.

Effect on the Aggregate Real Money Demand of a Rise in Real Income

L(R,Y2)

Increase inreal income

L(R,Y1)

Interest rate, R

Aggregate realmoney demand

Aggregate Money Demand

Slide 14-7

Copyright © 2003 Pearson Education, Inc.

Equilibrium in the Money Market: Md = Ms or Ms/P = L(R,Y)

Determination of the Equilibrium Interest Rate: Equate Md to Ms

Aggregate realmoney demand,L(R,Y)

Interest rate, R

Real moneyholdings

Real money supply

MS

P( = Q1)

R2

Q2

2

R1 1

R3

Q3

3

Slide 14-8

Copyright © 2003 Pearson Education, Inc.

M2

P

R2 2

M1

P

Real money supply Real money

supply increase

The Equilibrium Interest Rate: The Interaction of Money Supply and Demand

Effect of an Increase in the Money Supply on the Interest Rate

L(R,Y1)

R11

Interest rate, R

Real moneyholdings

Slide 14-9

Copyright © 2003 Pearson Education, Inc.

Q2

1'

The Equilibrium Interest Rate: The Interaction of Money Supply and Demand

Effect on the Interest Rate of a Rise in Real Income

L(R,Y1)

L(R,Y2)

Increase inreal income

Real money supply

MS

P( = Q1)

R22

R11

Interest rate, R

Real moneyholdings

Slide 14-10

Copyright © 2003 Pearson Education, Inc.

The Money Supply and the Exchange Rate in the Short Run

Short run analysis: The price level and real output are given.

Long run analysis: The price level is perfectly flexible and adjusts to preserve full employment.

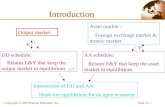

Linking Money, the Interest Rate, and the Exchange Rate

• The US money market determines the dollar interest rate which, together with the foreign interest rate, determines the exchange rate that maintains the interest rate parity.

Slide 14-11

Copyright © 2003 Pearson Education, Inc.

Money Market and Exchange Market Interaction

Simultaneous Equilibrium in the U.S. Money Market and the Foreign-Exchange Market

Return on dollar deposits

Expectedreturn oneuro deposits

L(R$, YUS)

U.S. real money holdings

Rates of return(in dollar terms)

Dollar/euro exchange Rate, E$/€

0

(increasing)

Foreignexchangemarket

Moneymarket

E1$/€

1'

R1$

1

U.S. realmoneysupply

MSUS

PUS

Slide 14-12

Copyright © 2003 Pearson Education, Inc.

Equilibrium Interest Rates and Exchange Rates

Money-Market/Exchange Rate Linkages

European money market

United Statesmoney market

EuropeEuropean System

of Central Banks

United StatesFederal Reserve System

(United Statesmoney supply)

MSUS MS

E(European money supply)

R$

(Dollar interest rate)

R€

(Euro interest rate)

Foreignexchange

market

E$/€

(Dollar/Euro exchange rate)

Slide 14-13

Copyright © 2003 Pearson Education, Inc.

Increase in U.S.real money supply

Expectedreturn oneuro deposits

Equilibrium Interest Rates and Exchange RatesEffect on the Dollar/Euro Exchange Rate and Dollar Interest Rate of an Increase in the U.S. Money Supply

E2$/€ 2'

U.S. real money holdings

Rates of return(in dollar terms)

Dollar/euro exchange Rate, E$/€

0

Return on dollar deposits

L(R$, YUS)

E1$/€

1'

R1$

1

M1US

PUS

R2$

2M2

US

PUS

Slide 14-14

Copyright © 2003 Pearson Education, Inc.

Effect of an Increase in the European Money Supply on the Dollar/Euro Exchange Rate

Increase in Europeanmoney supply

U.S. real money holdings

Rates of return(in dollar terms)

Dollar/euro exchange Rate, E$/€

0

Expectedeuro return

L(R$, YUS)

U.S. realmoneysupply

MSUS

PUS

R1$

1

E1$/€

1'Dollar return

Equilibrium Interest Rates and Exchange Rates

E2$/€

2'

Slide 14-15

Copyright © 2003 Pearson Education, Inc.

Money, the Price Level, and the Exchange Rate in the Long Run

Long-run equilibrium: Prices are perfectly flexible and adjust to preserve full employment.

Money and Money PricesFrom the money market equilibrium condition, Ms/P = L(R,Y)

P = Ms/L(R,Y)• An increase in a country’s money supply causes a proportional

increase in its price level.• A change in the supply of money has no effect on the long-run

values of the interest rate or real output.• This long-run equilibrium condition implies that

P/P = Ms/Ms - L/L.The inflation rate equals the monetary growth rate less the

growth rate of the demand for money (real balances).

Slide 14-16

Copyright © 2003 Pearson Education, Inc.

Monetary Growth and Price-Level Change in the Seven Main Industrial Countries, 1973-1997

Money, the Price Level, and the Exchange Rate in the Long Run

Slide 14-17

Copyright © 2003 Pearson Education, Inc.

Month-to-Month Variability of the Dollar/DM Exchange Rate and of the U.S./German Price-Level Ratio, 1974-2001

Inflation and Exchange Rate Dynamics:The short-run “stickiness” of price levels

Slide 14-18

Copyright © 2003 Pearson Education, Inc.

• A change in the money supply creates demand and cost pressures that lead to future increases in the price level from three main sources:

– Excess demand for output and labor

– Inflationary expectations

– Raw materials prices

Inflation and Exchange Rate Dynamics

Slide 14-19

Copyright © 2003 Pearson Education, Inc.

Permanent Money Supply Changes and the Exchange Rate• How does the dollar/euro exchange rate adjust to a

permanent increase in the U.S. money supply?– Figure 14-12 shows both the short-run and long-run

effects of the increase in the U.S. money supply.

nflation and Exchange Rate Dynamics

Slide 14-20

Copyright © 2003 Pearson Education, Inc.

Short-run and Long-run Effects of an Increase in the U.S.Money Supply

Dollar return Dollar return

M1US

P1US

M2US

P1US

U.S. real money supply

M2US

P2US

M2US

P1US

Dollar/euro exchangeRate, E$/€

Rates of return(in dollar terms)

U.S. real money holdings

0

(a) Short-run effects

0

(b) Adjustment to long- run equilibrium

Dollar/euro exchangeRate, E$/€

U.S. real money holdings

E2$/€

2'

E3$/€

4'

R1$

4

R2$

2

R1$

1

Permanent Money Supply Changes and the Exchange Rate

3'

2'E2$/€

Expectedeuro return Expected

euro return

L(R$, YUS)R2

$

2

L(R$, YUS)

E1$/€

1'

Slide 14-21

Copyright © 2003 Pearson Education, Inc.

Time Paths of U.S. Economic Variables After a Permanent Increase in the U.S. Money Supply

Permanent Money Supply Changes and the Exchange Rate

P2US E3

$/€

E1$/€

t0

(a) U.S. money supply, MUS

Time

(c) U.S. price level, PUS

Time

(b) Dollar interest rate, R$

Time

M1US

t0t0

R1$

M2US

P1US

t0

R2$

E2$/€

(d) Dollar/euro exchange rate, E$/€

Time

Slide 14-22

Copyright © 2003 Pearson Education, Inc.

Exchange Rate Overshooting• The exchange rate is said to overshoot when its

immediate response to a disturbance is greater than its long-run response.

• “Overshooting” helps explain why exchange rates move so sharply form day to day.

• “Overshooting” is a direct result of sluggish short-run price level adjustment and the interest parity condition.

Inflation and Exchange Rate Dynamics

Slide 14-23

Copyright © 2003 Pearson Education, Inc.

Summary

Money is held because of its liquidity. Aggregate real money demand depends negatively on

the opportunity cost of holding money and positively on the volume of transactions in the economy.

The money market is in equilibrium when the real money supply equals aggregate real money demand.

By lowering the domestic interest rate, an increase in the money supply causes the domestic currency to depreciate in the foreign exchange market.

Slide 14-24

Copyright © 2003 Pearson Education, Inc.

Permanent changes in the money supply push the long-run equilibrium price level proportionally in the same direction.• These changes do not influence the long-run values of

output, the interest rate, or any relative prices.

An increase in the money supply can cause the exchange rate to overshoot its long-run level in the short run.

Summary