N A S A Clear Lake Office Market Presentation Jan 2010

-

Upload

coy-davidson -

Category

Documents

-

view

701 -

download

0

Transcript of N A S A Clear Lake Office Market Presentation Jan 2010

NASA / Clear Lake Office Market Overview

January 2010January 2010

Prepared by:

Coy DavidsonSenior Vice President

Our Knowledge is your Property

COLLIERS INTERNATIONAL

NASA / Clear Lake Office Market Overview

2009 Hi hli ht

Market withstood recessionary period without decline. Leasing activity was flat

2009 Highlights

but positive net absorption of 79,248 square feet year in 2009.

Stable overall occupancy rate of 88.7%.

Minimal sublease space on the market.

No significant movement in rental rates in 2009.

Minimal large blocks of contiguous space particularly in Class A & B buildings.

Minimal sales activity due to economy and debt market conditions (5 sales in )2009).

Proposed office developments failed to get out of the ground.

Our Knowledge is your Property

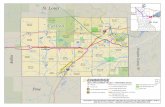

NASA / Clear Lake Office Market

Market Area MapMarket Area Map

Our Knowledge is your Property

Summary Statisticsy

Summary Overview

Class TotalInventorySq Feet

DirectVacantSq Feet

PercentLeased

SubleaseAvailableSq Feet

TotalVacantSq Feet

TotalVacancyRate

2009Net Absorption

Weighted Avg.QuotedRental Rate

Summary Overview

Sq. Feet Sq. Feet Sq. Feet Sq. Feet Rate Absorption Rental Rate

A 1,500,938 127,134 91.53% 40,257 167,391 11.15% 19,880 $22.88

B 3,042,181 229,175 92.47% 26,309 255,484 8.40% 57,762 $18.09

C 911,728 127,134 80.65% 13,047 189,843 20.78% 1,606 $14.98

Total 5,454,847 532,745 90.23% 79,613 612,358 11.23% 79,248 $18.49

• Excludes Medical Office Buildings• Excludes buildings less than 10,000 square feet

Our Knowledge is your Property

g , q f

Average Rental Ratesg

$22.88

$18 09 $18.49$20 00

$25.00

Weighted Average Quoted Rent

$18.09 $14.98

$18.49

$10 00

$15.00

$20.00

Class A

Class B

$‐

$5.00

$10.00 Class C

Total

$

Class A Class B Class C Total

• Gross full service rental rate

Our Knowledge is your Property

Gross full service rental rate

Vacancy Ratesy

Vacancy Rate by Class

20.78%20.00%

25.00%

Vacancy Rate by Class

11.15%8 40%

11.23%10 00%

15.00% Class A

Class B8.40%

0 00%

5.00%

10.00%Class C

Total

0.00%

Class A Class B Class C Total

• Vacancy rates for direct space and sublease space

Our Knowledge is your Property

• Vacancy rates for direct space and sublease space

Net Absorptionp

79 24890,000

Net Absorption 2009 (Square Feet)

57,762

79,248

60,000 70,000 80,000

Class A

19,880 20 00030,000 40,000 50,000

Class B

Class C

Total

1,606 ‐

10,000 20,000

Class A Class B Class C Total

Total

Our Knowledge is your Property

Class A Class B Class C Total

Vacant Square Feet by Classq y

612,358 6,000,000 Vacant Square Feet by Class

255,484 3 000 000

4,000,000

5,000,000

Vacant

167,391 189,843

1 000 000

2,000,000

3,000,000 Occupied

‐

1,000,000

Class A Class B Class C Total

Our Knowledge is your Property

2009 Office Building Salesg

Building Address Class Size Price Price / SF Sale DateBuilding Address Class Size Price Price / SF Sale Date

One Harbour Square 3027 Marina Bay Drive B 58,204 Not Disclosed N/A 10/15/09

University Park Business Center 15200 Middlebrook Dr. B 14,320 Not Disclosed N/A 7/31/09

700 Gemini 700 Gemini B 18,500 $1,800,000 $97.30 5/29/09

Atrium @ Nassau Bay 2100 Space Park Drive B 115,878 $8,000,000 $69.04 4/30/09

Saturn Executive Office Park 17300 Saturn Lane C 24 330 $1 200 000 $49 32 3/31/09Saturn Executive Office Park 17300 Saturn Lane C 24,330 $1,200,000 $49.32 3/31/09

Our Knowledge is your Property

Largest Available Contiguous Spaceg g p

B ildi N Add Cl R t bl ATotal

A il blContiguous A il blBuilding Name Address Class Rentable Area Available Available

Galaxy II 455 E. Medical Center Blvd. A 110,000 60,000 60,000

1275 Space Park Drive 1275 Space Park Drive C 43,222 43,222 43,222

555 Gemini 555 Gemini Street B 124 908 40 000 40 000555 Gemini 555 Gemini Street B 124,908 40,000 40,000

1300 Bay Area Boulevard 1300 Bay Area Blvd. C 35,690 35,690 35,690

16055 Space Center Blvd. 16055 Space Center Blvd. A 147,000 32,841 22,400

Atrium@ Nassau Bay 2100 Space Park Drive B 115 878 24 436 17 953Atrium @ Nassau Bay 2100 Space Park Drive B 115,878 24,436 17,953

Corporate Center Texas 16969 Texas Avenue B 50,100 17,906 17,906

Webster Professional Building I 500 N. Kobayashi B 15,545 15,545 15,545

1322 Space Park Drive 1322 Space Park Drive C 102,715 11,933 13,407p p , , ,

16441 Space Center Blvd. 16441 Space Center Blvd. C 64,000 12,400 12,400

Space Park Office Building 2200 Space Park Drive B 76,282 11,933 11,933

Our Knowledge is your Property

Market Outlook

Tremendous uncertainty regarding NASA, job losses and what a new direction for the space program will have on jobs with NASA and related contractors.

Effects of projected layoffs at USA Space Alliance as Space Shuttle program isEffects of projected layoffs at USA Space Alliance as Space Shuttle program is schedule to end after last flight in 2011. What NASA contractors / tenants, if any might absorb the 800,000 plus square feet of USA Space Alliance leases that roll in 2010 and 2011.

Leasing activity and rental rates to remain flat for 2010 as economy emerges from recession.

Minimal sales activity if any due to uncertainty in marketplace regarding NASA, k l b l f b fperceived risk and availability of debt for acquisitions.

Our Knowledge is your Property

The NASA Factor

45% of the currently occupied space and 41% of the total market is made of NASA related companies

Over 2 million square feet of buildings with 100% or single tenant occupancy by NASA related tenants. This excludes NASA related

Our Knowledge is your Property

tenants in multi-tenant buildings.

The NASA Factor

U it d S Alli i t t f th S Sh ttlUnited Space Alliance prime contractor for the Space Shuttle contract which ends in 2011 has 800,000 square feet of office leases scheduled for expiration in 2010 and 2011

Our Knowledge is your Property

The NASA Factor

Boeing and Lockheed Martin cumulatively own or lease overBoeing and Lockheed Martin cumulatively own or lease over 800,000 Square Feet in the Clear Lake Office Market

Our Knowledge is your Property

The NASA Factor

There are several other significant office projects with 100%There are several other significant office projects with 100% occupancy from NASA related tenants

Our Knowledge is your Property

Coy Davidsony

Coy DavidsonCoy DavidsonSenior Vice PresidentOffice Services GroupCoy Davidson has over twenty years experience in commercial real estate specializing in corporate real y y y p p g pestate services, tenant representation, office leasing and investment sales. Mr. Davidson joined Colliers International in June 2000 as Vice President in the Office Services Group. Prior to joining Colliers, Mr. Davidson served eleven years with two local commercial real estate brokerage firms.

Mr. Davidson has completed over three (3) million square feet of lease and sales transactions and the brokerage of over 700 acres of land development sites throughout the Greater Houston area. Mr.brokerage of over 700 acres of land development sites throughout the Greater Houston area. Mr. Davidson is widely recognized as an authority on the NASA/Clear Lake Market area of Houston where he has completed over one (1.5) million square feet of office lease and sales transactions, and is an active member in the Bay Area Houston Economic Partnership. Mr. Davidson has vast experience assisting corporate, medical and institutional office space users with their facilities requirements throughout the Greater Houston area. Mr. Davidson is an active member of the Houston Office Leasing Broker’s Association (HOLBA) and Colliers International’s National Healthcare Practice GroupBroker s Association (HOLBA) and Colliers International s National Healthcare Practice Group.

Direct: 713.830.2128Email: [email protected]

Our Knowledge is your Property

www.collierstexas.comwww.coydavidson.com

COLLIERS INTERNATIONALCommercial Real Estate Services

1300 Post Oak Boulevard, Suite 200Houston, Texas 77056www.collierstexas.com

Our Knowledge is your Property