Invest In Trinidad and Tobago Special Edition 2015

description

Transcript of Invest In Trinidad and Tobago Special Edition 2015

特立尼达和多巴哥:拉丁美洲和加勒比的投资门户为您敞开Trinidad and Tobago: Your Hub in Latin America and the Caribbean

特立尼达和多巴哥税收体系的效益及财政稳定性

Benefits of Trinidad and Tobago’s Tax System and Financial Stability

特立尼达和多巴哥的外资投资领域Sectors Targeted for Investment In Trinidad and Tobago

我们专注于能源开发行业

特立尼达和多巴哥国家能源公司(简称:国家能源公司)是特立尼达和多巴哥国家天然气有限公司(NGC)的全资子公司。过去的35年来,国家能源公司一直致力于通过天然气领域的能源业开发、基础设施建设和海事服务来对上述行业的发展提供支持。

公司的核心业务是“特立尼达和多巴哥新兴能源和下游行业的概念化、振兴、发展和实施。”国家能源公司也提供如下能源方面的服务:

我们是国家能源公司……我们是能源使用的未来

NGC集团公司成员

新工业园区的选择和开发,和深水港的协调工作海事和其它基础设施资产的所有权和经营,以促进国家所有的天然气和金属冶炼厂的发展拖船服务和港口运营La Brea和联合工业园区的开发和管理针对环境的可持续性管理

Cor. Rivulet and Factory RoadsBrechin Castle, CouvaTrnidad and TobagoP.O. Box 1127, Port of Spain

t: (868) 636-8471 f: (868) 679-8858

02 前言 PREFACE

封面故事 COVER STORY04 特立尼达和多巴哥:拉丁美洲和加勒比的投资门户为您敞开TRINIDAD AND TOBAGO:YOUR HUB IN LATIN AMERICA AND THE CARIBBEAN

专访 INTERVIEW10 专访:特立尼达和多巴哥能 源部CEO Thackwray “Dax” Driver博士

A TALK WITH DR. DRIVER, CEO OF THE ENERGY CHAMBER OF TRINIDAD AND TOBAGO

投资优势 INVESTMENT ADVANTAGES14 特立尼达和多巴哥税收体系 效益及财政稳定性 BENEFITS OF TRINIDAD AND TOBAGO’S TAX SYSTEM AND FINANCIAL STABILITY20 特立尼达和多巴哥的外资投资领域

SECTORS TARGETED FOR INVESTMENT IN TRINIDAD AND TOBAGO

Produced By: Sponsored By:

0410

14

2

前 言

INVEST IN SPECIAL EDITION

Welcome to Trinidad and

Tobago, your gateway to

the Americas. Backed

by over 100 years of success in the

energy sector and a proven track

record of foreign direct investment,

Trinidad and Tobago is the leading

Caribbean producer of oil and natural

gas. In addition, Trinidad and Tobago

is the largest exporter of ammonia and

methanol from a single site and also

is home to the sixth largest exporter of

liquefi ed natural gas (LNG) globally. As a

result, Trinidad and Tobago has earned

a reputation as an excellent investment

destination for international businesses

and has one of the highest growth rates

and per-capita incomes in the Caribbean

and Latin America.

The energy sector has encouraged

growth in downstream areas. At Point

Lisas, home to the island’s massive

industrial estate and port facilities, there

are investments in ammonia, methanol

and other petrochemicals manufacturing,

欢迎 您 来 到 特 立 尼 达 和 多 巴哥——您进军美洲的门户。追溯到一个世纪以前,这个

国家的能源行业就已经是外国直接投资所青睐的热门行业之一,特立尼达和多巴哥是加勒比地区领先的石油和天然气生产国。除此之外,特立尼达和多巴哥也是世界上 大的氨元素和甲醇单一矿址出口国和世界上第六大液化天然气(LNG)的出口国。正因如此,特立尼达和多巴哥得以以它一流的投资环境而闻名于世,也是加勒比和拉丁美洲地区经济增长速度快,人均收入增长 迅速的国家之一。

能源行业的增长让下游行业也因此受益。在利萨斯角(Point Lisas)以大量的工业设施和港口著称,在甲醇和石化产品的生产、制造业、食品和饮料、钢铁和电气产品项目上都有大量的投资。其它工业园区也在西半岛区域得到开发。所有石化和能源产业发展的龙头企业就是“特立尼达和多巴哥国家能源有限公司”(National Energy Corporation of Trinidad and Tobago Limited,简称“国家能源公司”)。

国家能源公司在特立尼达和多巴哥的多个能源相关项目上都扮演者

food and beverage, steel and electrical

goods. Other industrial estates are

also taking shape on the western

peninsula of the island. At the forefront

of all petrochemical and energy-based

industrial development is National Energy

Corporation of Trinidad and Tobago

Limited (National Energy).

National Energy has pioneered several

energy related developments in Trinidad

and Tobago and as a result of our

wealth of experience, we are poised

and ready to welcome the Chinese

business community to broaden its

participation in Trinidad and Tobago’s

world – renowned energy sector. We

are the State organisation responsible

for the conceptualization, development,

promotion and facilitation of new energy-

based and downstream industries in

Trinidad and Tobago.

Dr. Vernon Paltoo

总裁特立尼达和多巴哥国家能源公司President

National Energy Corporation of

Trinidad and Tobago

Photograph

Vessel loading at Pt.Lisas Industrial Estate, Trinidad.

3

INVEST IN SPECIAL EDITION

Preface

领头羊的角色,因此在这方面的丰富经验也让我们对欢迎中国的投资者入驻和深入探索特立尼达和多巴哥世界著名的能源行业方面胸有成竹。我们是国家官方的投资促进机构,负责特立尼达和多巴哥新能源方面和下游产业的概念化、开发和投资促进工作。

直到今日,国家能源公司着重关注的领域包括下游能源和天然气产业。我们希望能 大限度地利用这个国家的天然气资源,开发不同的投资项目组合,进一步向能源价值链的下游产业扩张。

由于在建立甲醇和氨元素产品制造业方面有丰富的成功经验,我们希望在特立尼达和多巴哥开发新的产业,我们不仅会在向价值链下方扩张的同时在利用天然气资源方面提供更大的价值,也会在就业和可持续性发展方面提供更多的投资机遇以创造工作机会,为我们国家的可持续性发展做贡献。我们一直以来都希望寻找那些渴望在整合和独立无机化工产品制造工厂方面投资的公司,来进一步发展特立尼达和多巴哥的无机化工产业。其它开发重点包括塑料、金属、可再生能源、生物化学和特殊化工产品行业。

为了配合本国的下游能源行业的继续发展,国家能源公司确保工业区的深水港口,并提供公司进驻的工业园区建设,确保能够赶上发展的脚步,提供及时的基础设施服务来支持上述行业。

目前,特立尼达和多巴哥是加勒比地区 大的向美国出口国,也是进入超过 9000 万人口国际市场的前哨站。特立尼达和多巴哥是进入现成市场桥梁,也能在签订多个贸易协议的前提下向中国公司提供便利到达美洲和即成市场的出口和业务增长机会。另外,这里有高技术和高能动性的劳动力队伍,稳定的金融环境和税务制度,这一切,都让特立尼达和多巴哥成为您理想的投资目的地之选。

Today, National Energy places particular

emphasis on the downstream energy

and gas-based industry. We seek to

maximize the benefi ts of the country’s

natural resources by developing a

diversifi ed portfolio of projects that go

further downstream the energy value

chain.

Building upon the successes in

establishing our methanol and ammonia

industries , we are now pursuing new

businesses that will not only provide

added value by going further down

the gas value chain but will also offer

new opportunities for investment,

employment creation and contribute

to the sustainable development of the

country. As such we are actively seeking

to develop an inorganic chemical

industry in Trinidad and Tobago via

companies desirous of establishing

both integrated and or stand-alone

inorganic chemical production facilities.

Other areas of focus for development

are Plastics, Metals, Renewables,

Biochemical and Specialty chemicals

industries.

In promoting the continued advancement

of the local downstream energy sector,

National Energy ensures the timely

establishment and availability of industrial

deep water ports and industrial estates

to support the industries.

Currently the largest Caribbean exporter

to the USA and with access to regional

and international markets of over 90

million people, Trinidad and Tobago is

the bridge to a ready market, which is

close proximity and with which there

are numerous trade agreements, for

Chinese companies wanting to grow

their businesses in the Americas. With

a skilled and highly motivated workforce

backed by a steady fi nancial climate

and tax regime, Trinidad and Tobago will

prove to be an ideal investment location

for you.

Photograph

National Energy Explorer at Port Galeota.

4

INVEST IN SPECIAL EDITION

封面故事

The fi rst group of Chinese

immigrants to ever set foot on the

island of Trinidad arrived on 12

October 1806 on a ship called Fortitude.

They came from Macao, Penang and

Canton, and the British colonials who

received them imagined that they would

establish themselves as farmers and

laborers. But these inaugural immigrants

displayed far more fortitude than their

host country had expected, and before

long, those who decided to remain on

the island had forged their legacy and

established themselves as butchers,

shopkeepers, carpenters and market

gardeners.

Ever ambitious and eager to succeed,

a second wave of Chinese immigrants

made their way to Trinidad from

Guangdong Province – an area

comprising Macao, Hong Kong and

Canton at the time – during the period

between 1853 and 1866, after the

abolition of slavery. This movement

1806 年,首批中国移民乘坐“坚毅号”船踏上特立尼达岛的中国移民,他们来自中国的澳门,

槟城和广东。这个英国殖民地国家认为他们会成为农民和工人,但这些首批移民却表现出了惊人的毅力,不久以后,决定留在当地的移民创造了传奇,通过自己的努力在各个行业,如屠夫、掌柜、木匠和种植园农场主。

基于对成功的渴望和野心,第二波来自广东澳门、香港和广州的移民来到这里——在 1853 和 1866 年之间奴隶制度废除之后。这是中国人向亚洲以外国家移民大潮中的一部分,这些国家包括澳大利亚、加拿大、美国和加勒比的许多其它国家。他们中一些人以契约工的方式来支付进入新世界的费用,另一些人则独自前来寻找梦想。

接着第三波中国移民要追溯到上世纪 20 年代和 40 年代之间,穿越

特立尼达和多巴哥:拉丁美洲和加勒比的投资门户为您敞开Trinidad and Tobago:Your Hub in Latin America and the Caribbean

By Frances Emery

was part of a larger, global migration

from China to countries beyond Asia’s

perimeters, including Australia, Canada,

the United States, and various nations

within the Caribbean. Some paid for their

passage to the New World by offering

their services as indentured laborers;

others came independently, to seek their

fortune.

And so it was for the third wave of

immigrants from China between the

1920s and 1940s, who made the

journey across the Pacifi c – often at the

encouragement of family and friends who

had already made a life for themselves

– to the recently unifi ed island nation,

Trinidad and Tobago. This group,

too, became successful merchants,

peddlers, traders and shopkeepers.

All this time, Chinese immigrants had

been bringing with them to the Caribbean

island their unique customs, traditions,

religion, games, and artifacts, but with

5

INVEST IN SPECIAL EDITION

Cover Story

Maria Lee, the founder of Trinidad and

Tobago’s Chinese Arts and Culture

Society and a respected businessperson

in her own right, was among those who

arrived in the fourth wave. Lee said that

when she fi rst arrived, her family set up

a shop in San Fernando and began

selling goods from China to the locals

with surprising ease. Lee’s passion

for the promotion of Chinese culture

eventually led her to open the Chinese

Arts and Culture Societyin 2011. “The

preservation of Chinese culture” was an

endeavor which the then-Ambassador

特立尼达和多巴哥:总体信息Tr inidad & Tobago: General info

• 国内生产总值(GDP)——246.4 亿美元(2013 年)• 人口数量——134.1 万人• 识字率——95.6%• 手机覆盖率——140%• 家庭互联网使用率——80.1%• 人均 GDP——18,123 USD• 发电——100% 天然气发电

• Gross domest ic product (GDP) – 24.64 b i l l ion USD (2013)

• Populat ion – 1.341 mi l l ion (2013)

• L i teracy – 95.6%

• Mobi le penet rat ion – 140%

• Household in ternet use – 80.1%

• GDP Per-capi ta – US$ 18,123

• E lect r ic i ty Generat ion – 100% Natura l Gas

太平洋来到这里——很多情况下是受已经在特立尼达和多巴哥生活亲友的怂恿——来到这个刚刚统一的岛国。这些移民也成功地在当地成为商贩和店主。

长久以来,中国移民也为加勒比群岛带来了他们的传统文化、宗教、风俗、游戏和手工艺品,但对第四波和第五波移民来说,这一现象已在一个不同的领域展现:商业。

1970 年代以后,中国施行改革开放政策,来到特立尼达和多巴哥的中国移民重新走上了轨道,中国 近在世界商贸舞台上的大展身手也让来到这里的工商业者和商人们,从某种程度上来说,成为十年后进出口业务激增的一个先驱力量。

特立尼达和多巴哥“中国艺术和文化协会”的创始人 Maria Lee 作为一个受人尊敬的商人,正是第四波进入这个国家的移民之一。Lee 表示当她刚到达这里时,她的家族在圣费尔迪南多开了一家商店,开始向当地人地销售来自中国的商品。Lee 对中国文化的激情 终让她在 2011 年创办了“中国艺术和文化协会”。“中国文化的保留”也是符合当时大使认为“中国和特立尼达和多巴哥之间和谐关系的继续发扬的重要努力”。

因此中国人在特立尼达和多巴哥的传奇源远流长,也让两国关系更为亲近。 近中国和特立尼达和多巴哥之间的关系更是进入了一个新时代,让两国不仅在外交关系上更为紧密,在经济利益上也更加互惠互利。

中国对这个地区的持续看好是这些紧密关系的重要因素之一。中国对拉丁美洲和加勒比地区的慷慨援助始于 2011 年,当时的副总理王岐山在访问加勒比地区时承诺向加勒比共同市场成员国发放 10 亿美元的贷款。这笔贷款在于对经济发展提供支持,后续又有一笔对加勒比共同市场基金进行的 100 万美元的捐赠款。

两年后的 2013 年,习近平主席宣布对加勒比国家提供 30 亿美元的

the fourth and fi fth “wave” of immigrants,

this phenomenon became evident in a

different arena: commerce.

By the 1970s, when China started

opening up to the outside world, Chinese

migration to Trinidad and Tobago picked

up pace once again, and with China’s

recent exposure to international trade and

commerce came the arrival of a class of

shopkeepers and businesspeople that, in

some ways, can be seen as a precursor to

the burgeoning growth in the import-export

sphere that began a few decades later.

Source: World Bank

来源:世界银行

Photograph

Power Plant at Union Industrial Estate.

6

INVEST IN SPECIAL EDITION

封面故事

援助计划,其中一半的款项被用于优惠买方信贷,其余款项被用于当地的基础设施建设。此外又有一笔 350亿美元的款项被承诺将用于“拉丁美洲和加勒比国家联盟”(CELAC)成员国的基础设施开发项目。

根据特立尼达和多巴哥驻华使馆官员的说法,这些注入拉丁美洲和加勒比国家的数以百亿计的金融资助款将“加强中国和 LAC 成员国之间的贸易、投资和旅游业的联系,其中包括特立尼达和多巴哥。”

中国和上述国家的合作在公众和私人领域里, 近几年里愈发紧密。中国私人投资者对上述地区的 大规模投资就是建设一个连接大西洋和太平洋的运河项目。总部位于香港的HKND 集团是一家私人控股的国际基础设施开发公司,该公司正着手该项目的准备工作,预计运河需要五年时间和 500 亿美元的资金。该公司首席执行官,中国富豪王晶在和 BBC进行的一场罕见专访中表示,“运河会是连接东西方的桥梁”。

上述项目是大型国家投资项目对私人投资者的引导作用的又一例证,如果该地区有一个领域是中国政府和多个国有企业都有极高的兴趣参与的,那就必定是基建。

但是中国对特立尼达和多巴哥 的投资还远不止于基建项目。特立

said was “important in the development of

continuing harmonious relations between

Trinidad and Tobago and China.”

And so the story of the Chinese in

Trinidad and Tobago began, and with it,

the start of a fruitful relationship. Though

it has long been considered a mutually

benefi cial one, in recent years, China’s

relations with Trinidad and Tobago have

entered a new era, unsurpassed in the

strength of the two nations’ diplomatic

ties and, indeed, in their mutual

economic interests too.

China’s optimism in the region as a

whole has been a major contributing

factor to the strengthening of these ties.

Its series of generous pledges of fi nancial

assistance to Latin American and

Caribbean countries began in earnest in

2011, when Vice Premier Wang Qishan

committed to a loan of US$ 1 billion

for countries with membership to the

Caribbean Community and Common

Market (CARICOM) during his visit to the

Caribbean. The loan was intended to

support local economic development,

and was supplemented by a US$ 1

million donation to the CARICOM Fund.

Two years later, in 2013, President

Xi Jinping announced a US$ 3 billion

scheme for concessional fi nancing for

Caribbean countries, half of which was

allocated to preferential buyers’ credit,

and the remainder to infrastructural

development. An additional US$ 35

billion was pledged for infrastructural

development projects for the Community

of Latin American and Caribbean States

(CELAC)’s member nations.

According to Trinidad and Tobago

embassy offi cials in China, the billions of

dollars pledged in fi nancial assistance

to Latin American and Caribbean

Countries will lead to “an intensifi cation in

trade, investment and tourism activities

between China and LAC Countries,

including Trinidad and Tobago.”

Such intensifi cation has become

increasingly evident in recent years, both

in the public and private sectors. The

largest scale example of private Chinese

investment in the region is easily the

construction of a shipping canal through

Nicaragua, connecting the Atlantic

and the Pacifi c. The HKND Group, the

privately-held international infrastructure

development fi rm headquartered in Hong

Kongwhich is getting ready to implement

the gargantuan project, estimates that the

canal will cost US$ 50 billion and take fi ve

years to build. The fi rm’s Chairman and

CEO, Chinese billionaire Wang Jing, told

the BBC in a rare interview, “This canal is

connecting East and West.”

This project is one example of how

bullish state investment often causes

private investors to follow suit, and if

there’s one sector where investment from

both China’s government and several

state-owned enterprises has shown

immense enthusiasm in the region, it is

infrastructure.

But Chinese investment in Trinidad and

Tobago goes far beyond infrastructure,

too. “China has been deeply involved

in development activities through trade,

investment and other fi nancial programs

as well as technical cooperation in health

care, sport, education, agriculture,

science and technology and national

security,” so said embassy offi cials at an

Investment Trade Fair in Lanzhou, Gansu

Province in July 2015.

“To help in making all of this happen,

the following are some of the Chinese

companies who have been operating

in Trinidad and Tobago or are seriously

thinking of going there to invest:

Photograph

Port of Galeota

7

INVEST IN SPECIAL EDITION

Cover Story

Shanghai Construction, China Harbor,

China Railway, Sinohydro, , TBEA,

Shandong Weimer [and] Beijing

Construction.”

The Caribbean nation, which is among

the few countries in the region to have

a primarily industrial economy, attributes

its wealth to its large reserves and

exploration of oil and natural gas. The

country’s experience in the energy

sector makes it an ideal location from

which to harness the vast potential

of the renewable energy market, too.

With Chinese fi rms leading several

innovations in this fi eld, we can expect

to see increased investment in this

particular sector of Trinidad and Tobago’s

economy. Indeed, Trinidad and Tobago

is already leading the trend to reduce

greenhouse gases in this part of the

world.

As far as energy is concerned an

audience of would-be investors earlier

this year in Lanzhou were informed that,

“Trinidad and Tobago has been in this

business for over one hundred years and

our economy is still heavily dependent

on this sector. We have played our part

in contributing a healthier environment

by producing large quantities of clean

fuels by being second largest exporter

of Methanol and a signifi cant exporter of

[Liquefi ed Natural Gas] LNG.”

According to the Oxford Business

Group, which publishes investment

and economic reports on over 30

countries, “The energy sector remains

the backbone of T&T’s economy…

accounting for 42% of GDP in 2014,

80% of exports from April 2013 to May

2014, and 34.8% of fi scal revenues

for the period from October 2013 to

September 2014.”

Trinidad and Tobago is intent on

reducing its (negligible) carbon footprint.

“even though it accounts for less than

1% of global greenhouse gas emission,

the government remains committed

to playing its part in achieving the

stabilization of Carbon Dioxide levels

consistent with the U.N. framework

convention on climate change (UNFCO).”

The country was, in fact, referred to

by the U.N. Secretary General as the

“regional leader” in implementing the U.N.

Post 2015 Development Agenda, and

was congratulated for having surpassed

several Millennium Development Goals

after a recent CARICOM meeting in

Barbados.

In addition to being an appealing

choice of location for investment in

the production of alternative energy

sources, including wind and solar power,

Trinidad and Tobago offers alluring

尼达和多巴哥驻华使馆官员在今年2015 年 7 月在中国甘肃省兰州举行的一个贸易投资展会上表示:“中国通过贸易、投资和其它金融项目,以及在医疗健康、体育、教育、农业、科技和国家安全方面的投入深入了特立尼达和多巴哥的各个领域。”

“为了让这一切都实现,以下是一些已经在特立尼达和多巴哥经营的或正认真考虑在这里投资的部分公司:上海建设集团、中国港口集团、中国铁路集团、中国水电、重庆博赛、特变电工、山东威玛(和)北京建设集团。”

特立尼达和多巴哥是加勒比国家

中的工业国之一,这也要归功于该国丰富的石油和天然气矿藏。该国在能源行业的丰富经验让它成为一个掌控能源市场的理想之地。中国公司在这一领域的投资已经拔得头筹而且会继续深入。特立尼达和多巴哥已经成为该地区降低温室气体排放的领先国家。

一名潜在的投资者在今年早些时候在兰州举办的会议中得知:“对于能源业来说,特立尼达和多巴哥已有超过 100 年的经验,我们国家的经济仍然在很大程度上依赖这个行业。我们作为世界上氨气的 大出口国,生产大量的清洁汽油,我们也是世界第二大甲醇出口国和液化天然气出口国,对全球环境的保护功不可没。”

在 30 多个国家出版经济报道的“牛津商业集团”称:“特立尼达和多巴哥的能源产业仍然是这个国家的支柱产业……占该国 2014 年 GDP的 42%,2013 年 4 月 到 2014 年 5月间出口的 80%,和 2013 年 10 月到 2014 年 9 月 间 国 家 财 政 收 入 的34.8%。”

特立尼达和多巴哥正致力于减少(已经可以忽略不计的)碳排放量。 “虽然我们只有全球温室气体排放量的 1%,政府仍承诺对降低全球二氧化碳排放水平的联合国标准框架(UNFCO)做出贡献。” Photograph

Atlantic LNG facility at Pt. Fortin.

8

INVEST IN SPECIAL EDITION

封面故事

incentives for investing in downstream

energy-based industries, information

and communications technology (ICT)

services, agriculture, tourism (including

health and eco-tourism), entertainment

(including sports, leisure, entertainment

and the fi lm industry), fi nancial services,

manufacturing, and the creative

industries.

With such commitment on Trinidad and

Tobago's part to attracting Chinese

investment. it is little wonder that the

two countries celebrated 40 years of

Diplomatic Relations. The countries

enjoy excellent relations, have celebrated

deep historical and cultural ties and

have entered a new era of trade,

investment and tourism promotion as

well as technical cooperation. It is clear

that Trinidad and Tobago has become a

pivotal partner for China in the Caribbean

and, despite being a physically small

island nation; it is run on very sturdy

ground.

Trinidad and Tobago is the third richest

country by GDP (Purchasing Power

Parity) per capita in the Americas after the

United States and Canada. In addition,

the country’s GDP per capita has grown

continuously since 1990. It is recognized

as a high income economy by the World

Bank, and was ranked 37 out of 148

countries for the soundness of its banks

in the Global Competitiveness Index (GCI)

of 2013. It boasts a 95.6% literacy rate,

and the country’s availability of scientists

and engineers puts it at 48th in the world

as measured by the GCI. It is a stable

democracy populated by talented people

联合国秘书长把这个国家称作联合国后 2015 年发展时间表的“领导者”,也在 近巴巴多斯举行的CARICOM 会议上以达到数个千禧年发展目标而受到称赞。

除了作为可替代能源,包括风能和太阳能产地的投资国之外,特立尼达和多巴哥还提供在下游能源行业和通讯技术服务、农业、旅游业(包括医疗和生态旅游)、娱乐业(包括体育、休闲、电影娱乐业)、金融服务、制造业和创新产业方面极具吸引力的刺激政策。

特立尼达和多巴哥做出了吸引中国投资的承诺,两国间 40 年友好外交关系的保持也可以说是一个小小的奇迹,两国之间的关系也正在不断加强。特立尼达和多巴哥业已成为中国在加勒比投资的中流砥柱,这一事实已经毋庸置疑,虽然我们是一个面积相对狭小的岛国,但这一趋势不会改变。

从 1990 年知道现在,特立尼达和多巴哥一直是美洲大陆上,继美国和加拿大之后人均 GDP 产值第三富有的国家。它被世界银行列为高收入国家,且在 2013 年的全球竞争力 指 数(GCI) 排 名 上 位 列 148 个国家中的第 37 位。它的识字率高达95.6%。且在科学家和工程师拥有率方面被 GCI 列为世界排名第 48 位的国家。特立尼达和多巴哥是一个科技知识普及率异常高的民主国家。也因此,这个国家被世界银行列为营商便

who continuously strive to improve.

Indeed, the country places 61st in the

World Bank ranking of all countries for

the ease of doing business, which –

when it comes down to it – is what

investors are usually most interested in.

Foreign investors in Trinidad and Tobago

can open a business in just three days

with the assistance of the government’s

investment arms, National Energy and

InvesTT, which endeavors to “ensure that

you possess all the knowledge, tools,

linkages and facilitation your organization

needs to effi ciently navigate the way to

new business opportunities in our nation.

Foreign investors are allowed to own

100% of their business, and to purchase

up to one acre of land for residential

purposes, and up to 5 acres for trade or

business purposes, without requiring a

license to do so. 100% of business profi ts

can be repatriated, and up to 30% of the

share capital of a local public company

owned, without a license.

As far as the country’s currency is

concerned, the last 20 years have seen

the Trinidad and Tobago dollar remain

very stable as a free fl oating currency.

The fact that it is based on a fl oating

peg system to the US dollar means that

foreign exchange risks are signifi cantly

reduced. The Oxford Business Group

stated in their extensive publication,

The Report: Trinidad and Tobago 2015,

“The country’s low debt ratio, substantial

foreign reserves and the momentum

provided by major infrastructure projects

should ensure stability in 2015 and

beyond.”

9

INVEST IN SPECIAL EDITION

Cover Story

捷度世界排名 61 位,而这也是投资者 终看中的优点之一。

特立尼达和多巴哥的外国投资者能在政府部门 InvesTT 的支持下在三天之内开设公司,该机构的使命是致力于“确保您获得所有希望在我们国家高效率地经营生意方面所需要的所有知识、工具、人脉和设施。”外国投资者能被允许对其产业的 100%所有权,能购买 大面积为 1 英亩的住宅用地和 大面积为 5 英亩的贸易和商务用地而不必申请执照。营商利润能得到 100% 的回汇,且能在不必申请执照的情况下拥有当地公众公司 30% 的股权资本。

货币方面,过去的 20 年里,“特立尼达和多巴哥元”作为一个自由浮动的货币来说相当稳定。《牛津商务集团》在一份详细的出版物中说明,事实上这个基于美元的自由浮动货币系统意味着外汇交易的风险得到显著降低。这个名为《特立尼达和多巴哥2015 年报告》的报道宣称:“这个国家的低负债率,大量的外汇储备和大型基建项目所提供的经济动力应该确保它在 2015 年和之后的经济稳定性。”

拉丁美洲、加勒比地区,特别是特立尼达和多巴哥,和其它很多国家一样,对中国的“一带一路”政策而言充满了机遇。曾几何时,作为一个中国移民背井离乡追寻梦想的前哨站,特立尼达和多巴哥已把自己建成一个四通八达和世界经济的完整一份子。而使馆官员们也对此间的巨大价值深表认同:“在这个真正全球化的世界,一带一路周围发生的任何事情都会对其它地方产生深远影响,不管我们身处何处,有多遥远,都不应等闲视之。”

在演讲结尾处,使馆官员还着重宣布:“特立尼达和多巴哥张开双臂迎接中国商务人士的到来,我们将给您红地毯的 优待遇。”而不管是红地毯还是一带一路的政策,特立尼达和多巴哥将会竭尽全力地将它延伸到中国。

Latin America, the Caribbean, and

Trinidad and Tobago in particular, have

a lot to offer both China and the various

other countries in the swathe of land that

currently comprises the Belt and Road’s

expanse. Trinidad and Tobago, once a

small but promising outpost to which

Chinese immigrants travelled to improve

their fortunes has established itself as

a well-connected and integral player

in the global economy, and embassy

offi cials are well aware of the value –

and the effects – of global connectivity.

Offi cials are quoted as saying “In this

truly globalized world, everything that

takes place along the One Belt and

One Road…will impact the rest of us

regardless how far removed we are,

physically, from this region.”

The embassy has further stated

that “Trinidad and Tobago is open for

business and is ready to welcome

Chinese business people with the

red carpet treatment.” And, whether

or not there is a single Belt and Road

along which to spread the proverbial

red carpet, Trinidad and Tobago will

do whatever it takes to make sure it is

extended to China.

特立尼达和多巴哥:税率Tr inidad & Tobago: Tax Rates

增值税(VAT)——12.5%

公司税——25%

预提税——红利:5/10%,利息:15%,版税:15%

雇主所支付的社会安全金额——不一;雇主支付的金额两倍于雇员

Value Added Tax (VAT) – 12.5%

Company Tax – 25%

Withhold ing Taxes – Div idends: 5/10%, In terests: 15%, Roya l t ies: 15%

Socia l Secur i ty Contr ibut ions Pa id By Employers – Var ies; employers

cont r ibute twice the employee’s cont r ibut ion

Source: Santander�Trade来源:Santander�Trade

10

INVEST IN SPECIAL EDITION

专 访

专访:特立尼达和多巴哥能源部 CEO Thackwray “Dax” Driver博士A Talk with Dr. Driver, CEO of the Energy

Chamber of Trinidad & Tobago

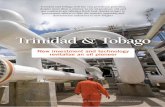

在中国能源业的公司不断在海外寻求新机遇的时候,特立尼达和多巴哥已成为他们加勒比地区的首选国家。这个岛国是加勒比地区 大的石油和

天然气生产国,能源业占整个国家 GDP 的 40% 和出口的 80%。

特立尼达和多巴哥的第一口油井 1857 年在特立尼达和多巴哥南部的沥青湖(The Pitch Lake)钻探成功,在过去100 多年的时间里,特立尼达已生产了超过 30 亿桶石油。预计 2013 年的原油储量将达到 7.28 亿桶,根据 EIA 的数据,这个国家的石油产量并没有放缓的迹象。

By Jonathan DeHart

As Chinese energy companies seek to expand their

business overseas, Trinidad and Tobago is the fi rst port

of call in the Caribbean. The island nation is the region’s

largest producer of oil and gas, which account for a whopping

40% of its GDP and 80% of exports.

Starting with the drilling of the fi rst oil well near the Pitch Lake

in South Trinidad in1857, over more than the past 100 years

Trinidad has produced more than three billion barrels of oil.

Estimated crude oil reserves in 2013 reached about 728 million

barrels, according to the EIA, and the nation shows no signs of

slowing down.

In addition to oil, Trinidad also has a booming natural gas sector,

with its Phoenix Park Gas Processors Limited among the largest

natural gas processing plants in the Western Hemisphere. The

facility is based in the Port of Savonetta and boasts processing

capacity of nearly two billion cubic feet daily, or a daily output

capacity of 70,000 barrels.

It is no surprise that the roster of oil and gas companies

operating in Trinidad includes the world’s largest players, with

major Chinese oil players such as LandOcean entering the

market. Given that Trinidad’s oil and gas sub-sectors are seeing

a surge in the realm of deep water exploration, and have

received a recent nod of acknowledgement for their adherence

to international laws and transparency, there is no better time

than now for Chinese fi rms to consider establishing operations

in the country.

We spoke with Dr. Thackwray“Dax” Driver, Chief Executive

Offi cer of Trinidad’s Energy Chamber, about what these exciting

developments mean for Chinese investors eager to engage the

country’s energy sector.

1. Relative to other countries, can you briefl y describe

the current state of development of Trinidad and

Dr. Driver, CEO of the Energy Chamber of Trinidad & Tobago

特立尼达和多巴哥能源部 CEO Thackwray “Dax” Driver博士

11

Interview

INVEST IN SPECIAL EDITION

除了石油之外,特立尼达还有相当可观的天然气行业,它的 Phoenix Park 天然气加工有限公司是西半球 大的天然气加工工厂。该工厂位于萨沃尼塔港(Port of Savonetta),每天的天然气加工能力高达 20 亿立方英尺,或者日产量 70000 桶。

因此,世界上 大的石油和天然气公司都有在特立尼达设立工厂也不足为奇了,中国的石油企业 LandOcean 也在其中。在特立尼达的石油和天然气子行业进入深海勘探时代之时,全球性的法律和税务信息透明度也在这里得到承认,对中国企业来说,现在正是考虑进入这个国家能源行业的 佳时期。

我 们 有 幸 对 特 立 尼 达 和 多 巴 哥 能 源 部 首 席 执 行 官Thackwray“Dax” Driver 进行了独家专访,让他对中国投资者进入这个国家的能源行业做了详细说明。

1. 和其它国家相比,您能否简单介绍一下特立尼达和多巴哥目前的发展状况(以下简称为特立尼达),它和中国特别在能源行业的贸易和经济关系?

特立尼达和多巴哥在石油和天然气行业的历史悠久,可上溯到一百年以前。特立尼达和中国之间在能源行业的贸易和经济关系有限,但 近这一状况有所改观,中国公司正积极进入我们的能源行业进行投资。在上游行业,朝阳石油(BVI)有限公司,一家中海油和中石化成立的联合财团,持有 BHP Billiton 运作的离岸安格斯图拉石油和天然气开发的 25% 的非经营者股权。

另一家中国公司 LandOcean 是伦敦证交所上市的 Range Resources 公司的主要投资者和战略合作伙伴,在特立尼达的在岸持有多个勘探和生产基地。特立尼达的能源行业还有许多家活跃的中国公司,比如对石油行业,特别是钻井行业供应设备和服务的科瑞集团。中国国有企业也在特立尼达的“大西洋液化天然气工厂”进行了投资。贸易方面,特立尼达对中国的产品出口非常有限。偶尔有运往中国的液化天然气集装箱,我们也向中国出口世界著名的产于我国的沥青湖(Pitch Lake)的沥青。

2. 我知道有一个在最近对特立尼达投资的中国大型企业叫做 LandOcean。LandOcean 是不是第一批中国公司对特立尼达石油行业投资的企业,或者说这个行业已经有很多其它企业了?您是否认为这家公司会刺激更多的中国公司进入特立尼达?

LandOcean 通过与 Range Resources 的战略合作和投资而进入特立尼达。他们在钻探和石油生产行业都有涉足。该公司也对其它行业,包括地质数据储存等方面表现出了

Tobago’s (Trinidad for short, going forward) trade and

economic relationship with China in the energy sector

— in particular?

Trinidad & Tobago has a very long history in the oil and gas

industry, going back well over a century. There has traditionally

been limited trade and economic relationships between Trinidad

&Tobago and China in the energy sector, but this has been

changing in the recent past mainly through Chinese companies

investing in our energy sector. In the upstream sector, Chaoyang

Petroleum (BVI) Limited, a consortium between CNOOC and

Sinopec, hold a 25% non-operator interest in the offshore

Angostura oil and gas development operated by BHP Billiton.

Another Chinese company, LandOcean, is a major investor

and strategic partner in the London-listed Range Resources,

who hold various exploration and production blocks onshore

Trinidad. There are also a number of Chinese companies active

in the energy services sector, such as Kerui Group who have

been supplying equipment and services to the oil industry,

in particular in the drilling sub-sector. There is also Chinese

state investment in the Atlantic Liquefi ed Natural Gas facility. In

terms of trade, there are very limited volumes of products from

Trinidad to China. There are occasional LNG cargoes that do

make it to China and we also supply asphalt to China from the

world famous La Brea pitch lake.

2. I’ve read that one of the major new investors in

Trinidad is the Chinese advanced oil recovery company

LandOcean. Is LandOcean a trailblazer among Chinese

oil fi rms in Trinidad’s oil sector, or one of many already

involved? Do you expect the company’s presence

to trigger a wave of Chinese investment in the oil

industry?

LandOcean has entered the Trinidad market through their

strategic alliance and investment in Range Resources. They

are active in both the drilling sector and, through Range, in oil

production. They have also stated their intention to become

involved in other sectors including seismic data storage. They

are not the fi rst Chinese company to invest in our oil sector, but

they have been very active in the recent past and are playing an

important role at the moment.

Through their involvement in the drilling sector, they are

interacting with a wider number of established companies in

Trinidad. Given our very long history in the industry, Trinidad &

Tobago has many skilled professionals in the energy industry

12

INVEST IN SPECIAL EDITION

专 访

兴趣。他们并不是第一家进入特立尼达石油行业的中国公司,但 近他们表现得异常活跃,成为一个重要的行业角色。

LandOcean 通过钻探行业和特立尼达的其它公司建立联系。我们在行业里有着悠久的历史,特立尼达和多巴哥在能源行业也有数量众多的技术专家,经验非常丰富。这些都让特立尼达和中国之间能够更好地分享经验、知识和技术。

3. 特立尼达的下游能源行业是否会有,或者已有外国投资项目?哪些对中国投资者来说具有吸引力?

特立尼达的下游石化和天然气加工产业在上世纪 90 年代中期到 2000 年以后,有一个加速发展的过程。过去的七年里,我国在石化和天然气加工行业里的发展有限,过去几年里的投资侧重点在于上游产业,以确保我们能找到新的天然气储备来维持现有的产出水平。出于对未来特立尼达和多巴哥的油矿发现和不断增加的石油产量,国家能源公司——负责开发能源洗项目的国营促进机构——正在开发一系列的下游能源项目,让我们向能源价值链的下游进一步扩张,更接近可在加勒比共同市场上销售的 终成品,以我们位于美洲大陆上的战略性地理位置来供应不断扩张的拉丁美洲市场。我们 新获批的下游项目是二甲醚工厂,由三菱公司、特立尼达和多巴哥国家天然气公司和一家当地的财团 Massy 投资兴建。由国家能源公司开发的,同

and companies with long histories of involvement in the sector.

This creates the opportunity for sharing of knowledge and

technology between Trinidad and China.

3. What are some of the specifi c projects that are or

will be open for investment in Trinidad’s downstream

energy sector, which could potentially be of strong

interest to Chinese investors?

Trinidad’s downstream petrochemical and gas processing

sector underwent a period of rapid growth between the mid-

1990s and the late 2000s. For the past seven years there

has been limited new growth in the petrochemical or gas

processing sectors. The focus of investment over the past few

years has been in the upstream, to ensure that we are able

to fi nd new gas reserves and maintain production at current

levels. Given the expectation for future gas fi nds and increased

gas production going forward, National Energy – our state

agency responsible for developing energy projects – is currently

developing a suite of downstream energy projects that will allow

us to further expand down the energy value chain closer to fi nal

products for markets in CARICOM and to supply the expanding

Latin American market from our strategic location in the

Americas. Our latest downstream project to receive approval

is a methanol and DME plant, with investment from Mitsubishi

Corporation, the Trinidad & Tobago National Gas Company and

Photograph

Port of Brighton, La Brea

13

Interview

INVEST IN SPECIAL EDITION

a local conglomerate, Massy. Other projects being developed

by National Energy and which they are seeking to attract

investment include plastics, inorganic chemicals and renewable

technology manufacturing.

4. What does EITI compliance mean for Trinidad

and China in terms of potential collaboration and

investment?

Trinidad & Tobago achieved EITI compliance in February 2016.

This means that the global EITI movement recognized our efforts

to provide comprehensive information, verifi ed by an independent

third-party, on the revenue received from the upstream oil and gas

industry by the Government of Trinidad & Tobago. Compliance

with EITI gives international investors increased assurance about

Trinidad & Tobago’s adherence to international standards of

governance and a commitment to transparency. The EITI reports,

available online, are also an excellent source of information about

the upstream energy sector.

5. What specifi c benefi ts — legal, taxes, etc. — does

Trinidad offer to potential Chinese investors?

Trinidad & Tobago has introduced a number of reforms to

encourage investment over the past few years, including tax

incentives to encourage new exploration and development in

the upstream energy sector. Trinidad & Tobago offers a level

playing fi elds for investors from all countries and we welcome

direct foreign investment from any part of the globe.

6. How signifi cant do you envision Chinese investment

to be in Trinidad’s energy sector a decade or two down

the line, compared with that of other nations?

Traditionally our major investors in the energy sector have been

from the United Kingdom, the United States, Canada and

Germany. As a country we are open to investment from all

sources, including from China. The opening of the new Trinidad

and Tobago Embassy in China should help to foster deeper

economic and social ties between the two countries and we look

forward to welcoming new investors from China in the future.

The Energy Chamber of Trinidad & Tobago organizes the major

energy sector conference in Trinidad & Tobago each year (it will

be on the 18th January 2016) and we welcome delegations

from around the world to the event. This is an ideal time for

Chinese investors and business people seeking new markets to

visit Trinidad & Tobago and to learn more about our sector.

时也希望吸引投资的其它项目包括塑料、无机和化学品和可再生科技产品的制造。 4. 对 EITI(采掘业透明度行动计划)来说,特立尼达和中国有哪些潜在的合作和投资机会?

特立尼达和多巴哥在 2015 年 2 月达成了 EITI。这意味着全球 EITI 行动对我们提供的,由第三方对我们政府的上游石油和天然气收到的税收信息表示认可。符合 EITI 的标准,能让国际投资者对我们政府在国际透明度合规的方面增加信心。EITI 报告可在线阅读,它也是一个上游石油产业方面的极佳信息来源之一。

5. 有什么特定的优势——如法律、税务等——特里尼达可以向中国投资者提供?

特立尼达和多巴哥在过去几年内出台了一系列的改革措施来鼓励投资,其中包括鼓励上游能源行业的新勘探和开发项目的税收措施,特立尼达和多巴哥为所有国家的投资者提供一个公平竞争的环境,并热忱欢迎来自世界各个国家的投资者。

6. 您认为来自中国的投资和其它国家相比,在未来的一二十年内会有怎样的趋势?

一般来说,我国能源行业的主要投资者大部分来自英国、美国、加拿大和德国等发达国家。我国对来自所有国家的投资都持开放态度,其中也包括中国。特立尼达和多巴哥驻中国大使馆的成立,应该能加强两国间更深入的经济和社会文化合作,我们热忱欢迎有更多的中国投资者到来。

特立尼达和多巴哥的能源部每年都在本国举行一次能源行业的会议( 近的会议定在 2016 年 1 月 18 日),我们热情邀请全球各地的代表参加。这是中国投资者和商务人士访问特立尼达和多巴哥,寻求市场新机遇和了解本国投资行业的绝佳机会。

14

INVEST IN SPECIAL EDITION

投资优势

• 特立尼达和多巴哥的财政稳定性

特立尼达和多巴哥的官方语言是

英语,它是一个资源丰富、政治稳定

的岛国,并且是公认的金融服务之都。

它是南北美之间的重要商业通道。特

立尼达和多巴哥利于营商,并且欢迎

外来投资。

不仅如此,特立尼达和多巴哥还

拥有有利于中国投资者的税收体系和

健全的监管体制。而且,一旦满足条

件,投资者可以获得一定的财政鼓励,

享受较低的物价消费,并且可以进入

美洲市场。

就整个区域而言,这里还有强大

的信用评级。2015 年 4 月,穆迪给

予特立尼达和多巴哥 Baa2 投资评级,

这是 好的信用等级,它是基于一个

强有力的政府资产负债表,具有能负

担的债务和牢固的外部地位。2014

年 12 月,标准普尔评级机构(S&P)

将该国的投资等级确定为长期和短期

的‘A/A-1’主权信用评级。提及理由,

标普表示:“特立尼达和多巴哥的外

部净资产的地位,外部稳固性以及稳

定的政治系统支持该评级。”

我们的财政体系占国内生产总值

的 12%,组织严密,管理良好并且

极大地促进了经济的发展。特立尼达

和多巴哥的中央银行独立于政府的运

作,可以自行决定货币政策,设立折

扣利率和法定存款准备金率。该体系

规范商业银行和其他金融机构的操作

系统。

• 特立尼达和多巴哥的税收体系

特立尼达和多巴哥的税收主要包

括所得税、企业所得税、商业税、各

种石油税、增值税(VAT)、预提税、

关税以及消费税。对于资本汇回、利

特立尼达和多巴哥税收体系的效益及财政稳定性特立尼达和多巴哥税收体系的效益及财政稳定性Benefits of Trinidad and Tobago’s Tax System and Financial Stability

Benefits of Trinidad and Tobago’s Tax System and Financial Stability

By National Energy of Trinidad and TobagoBy National Energy of Trinidad and Tobago

15

INVEST IN SPECIAL EDITION

Investment Advantages

• Financial Stability in Trinidad

and Tobago

Trinidad & Tobago is a stable English-

speaking democracy with a strong

Energy sector, and is recognised as the

region’s capital for Financial Services.

It is strategically located as a prime

commercial gateway between North and

South America. Trinidad and Tobago is

business friendly, agile and welcomes

foreign investment.

As such, Trinidad and Tobago

possesses a favourable tax system and

a robust regulatory framework that can

be benefi cial to Chinese investors. Also,

investors will be able to access fi scal

incentives once all requirements are met,

benefi t from low utility costs and gain

entrance to the Americas marketplace.

Enablers include strong credit ratings

that compare favourably across the

region. In April 2015, Moody’s bestowed

upon Trinidad and Tobago an investment

grade of Baa2 based on a strong

government balance sheet, moderate

and affordable debt burden and strong

external position. In December 2014,

Standard & Poor’s Ratings Services (S&P)

affi rmed its ‘A/A-1’ long- and short-

term (investment grade) sovereign credit

ratings given to the country. Giving its

rationale, S&P said: “T&T’s net external

asset position, low external vulnerability

and stable political system support the

ratings.

Our fi nancial system which accounts for

12 per cent of GDP, is well-organised,

soundly-regulated and plays a pivotal

role in the economy. The Central

Bank of Trinidad & Tobago operates

independently of Government in

determining monetary policy and setting

discount rates and reserve requirements.

It regulates operations of the commercial

banks and other fi nancial institutions.

• Trinidad and Tobago Tax

System

The principal taxes in Trinidad and

Tobago are income tax, corporation

tax, business levy, various petroleum

taxes, value added tax (VAT), withholding

tax and customs and excise duties.

There are no restrictions on repatriation

of capital, profi ts, dividends, interest,

distributions or gains on Investment.

Corporate Tax Rates

Chinese companies stand to benefi t

from a stable tax rate. Corporation tax is

charged at a rate of 25% on chargeable

profi ts and short term capital gains for

companies in the downstream energy-

based manufacturing sub-sector and

other types manufacturing concerns.

A rate of 35% is applied for companies

engaged in liquefaction of natural

gas, manufacture of petrochemicals,

润、股息、利息、分销或投资收益,

没有任何限制。

企业税率

中国企业将受益于稳定的税率。企业

税率占应缴税利润以及下游能源制造

业和其它产业企业短期资金收益的

25%。

35%的税率适用于从事天然气液化、

石油化工产品生产、天然气输送和分

配以及石油产品营销和批发分销的公

司。还需重点指出的是,在特立尼达

和多巴哥生产和炼油的石油公司拥有

一个独立的税收制度。

商业税

公司每年的商业税占公司总收入的

0.6%,公司有权运用其一年收入抵

免其任何一年的 高商业税。

绿色基金税

绿色基金税占公司总收入的 0.3%,

即在正常运营中允许业务开支减税之

前的所有收入。

亏损的税收处理方法

对于公司所得税,一个公司的普通交

易亏损可能结转,并且抵消未来第一

笔可用的利润(不包括短期资本收

益),没有时间限制。损失可能无法

弥补。

对中国投资者的财政激励

政府的经济政策是针对强健的、开放

的、以市场为导向的经济发展。政府

承诺积极鼓励在特立尼达和多巴哥的

外商投资。已经采取措施立法消除对

外商投资的限制,并且为投资者提供

各种激励措施。

Mr. Carlton Thomas

Business Analyst

National Energy Corporation of

Trinidad and Tobago

16

INVEST IN SPECIAL EDITION

投资优势

各种税收减免和其他激励措施会在

特立尼达和多巴哥的免税区法案第

81:07 章和财政激励法第 85:01 章的

保护下实施。这两部法规都要求公司

满足一定的条件才能获得税收减免的

资格。

激励机制由以下几个方面组成:

• 财政豁免

• 进口关税减免

• 研发设施

• 免税区

成本效益和激励措施

自由贸易区

该国提供与其他国家具有可比性的激

励措施。中国投资者可以从免税区获

益,无期限地免除关税、增值税以及

股息所得税。在当地注册的公司有百

分之百的所有权;没有外汇管制,企

业可以完全享受资金外汇。员工培训

的激励措施也被视为运营商的具体需

求。

市场准入

特立尼达和多巴哥通过与委内瑞拉、

哥伦比亚、多米尼加共和国、哥斯达

黎加、法国、美国、加拿大、古巴以

及欧洲等的双边贸易协定,提供一个

超过 7 亿人的拓展市场。

该国还参与被称为“加勒比海盆地计

划(CBI)”的贸易项目,它是美国

transmission and distribution of natural

gas and wholesale marketing and

distribution of petroleum products. It is

important to also note that petroleum

companies involved in production

and refi ning operations in Trinidad and

Tobago operate under a separate tax

regime.

Business Levy

Business levy at the rate of 0.6% is

charged yearly on the gross income of

a company The company is entitled to a

tax credit against its business levy liability

for a year of income of any payment

made in respect of its corporation tax

liability for that year up to a maximum of

its business levy liability.

Green Fund Levy

Green Fund Levy is charged at the rate

of 0.3% of the company’s gross income,

that is, all income received in the ordinary

course of business before allowing any

deductions for business expenses.

Tax Treatment of Losses

For corporation tax purposes, a

company's ordinary trading losses

may be carried forward and set off

against the fi rst available future profi ts

(excluding short-term capital gains),

without time limit. Losses may not be

carried back.

• Fiscal Incentives Available to

Chinese Investors

The government’s economic policy

is geared towards the development

of a robust and open market-driven

economy. The Government has made

a commitment to actively encourage

foreign investment in Trinidad & Tobago.

As such legislation removing restrictions

on foreign investment and providing

various incentives to investors has been

enacted.

Various forms of tax relief and other

incentives may be applied for and

obtained under the Trinidad and Tobago

Free Zones Act, Chap. 81:07 and under

the Fiscal Incentives Act, Chap. 85:01.

Both statutes require that certain pre-

requisites be satisfi ed before a company

can become eligible for the tax relief

benefi ts being offered.

The Incentive Regime is comprised of:

• Fiscal Exemptions

• Import Duty Concessions

• Research and Development Facility

• Free Zones

Cost Benefi ts and Incentives

Free Trade Zone

The country has comparable incentives

to other regional locations. Chinese

investors can benefi t from being

17

INVEST IN SPECIAL EDITION

Investment Advantages

及其在中美洲和加勒比地区邻国的经

济关系的重要元素。

成本效益

特立尼达和多巴哥的成本效益在中美

洲和加勒比地区一直首屈一指。特立

尼达和多巴哥向中国投资者提供的电

力价格低至 0.03 美元 / 千瓦小时,

这是西半球 低的电价,远低于中国

的平均价格。

低廉的运营成本

根据 2015 年《金融时报》提供的外

商直接投资成本比较基准,特立尼达

和多巴哥是在加勒比和拉丁美洲地

区,提供电、水、通讯以及天然气的

价格第二便宜的国家。

财政鼓励

根据财政鼓励法第 85:01 章,在特立

尼达和多巴哥成立的大规模生产企

业,包括石油化工产品和无机化学产

品制造或加工的企业可以获得关税、

相关产品或服务的增值税豁免。

进口关税减免

根据该国的海关条文规定,生产企业

可以获得原材料、机器设备以及特殊

情况下的包装材料等的免税。

利润汇款和资金汇回

对资本、利润、股息、利息、分销或

投资收益的汇回没有任何限制,可在

商业银行实现汇回。适用时,仍需支

付预扣税。

资本成本津贴

所有进行贸易、商业或行业的公司有

权获得每年的机械设备磨损津贴,根

located in a free zone where they

are exempted from customs duties,

value added tax and income tax on

dividends for an indefi nite period. There

is 100% ownership of locally registered

companies; there are no foreign

exchange controls, and companies can

enjoy full repatriation of funds. Incentives

for staff training will also be considered

based on the specifi c needs of the

operator.

Market Access

Trinidad and Tobago provides access

to an extended market of over 700

million people through bilateral trade

agreements with Venezuela, Colombia,

the Dominican Republic, Costa Rica,

France, USA, Canada, and Cuba,

Europe.

The country also participates in a trade

programme known collectively as the

Caribbean Basin Initiative (CBI), which

is a vital element of the United States

economic relations with its neighbours in

Central America and the Caribbean.

Cost Effectiveness

Trinidad and Tobago has been ranked

1st for cost effectiveness in Central

America and the Caribbean. Electricity

rates within Trinidad & Tobago start as

low as US$0.03/KWh offering Chinese

investors access to some of the

lowest electricity tariffs in the Western

Hemisphere, and signifi cantly lower than

average rates in China.

Low Operational Costs

Based on a cost comparison by FDI

Benchmarks (A service of Financial

Times Limited 2015) Trinidad and

Tobago is the second cheapest location

within the Caribbean and Latin American

regions when the costs of electricity,

water, telecoms and natural gas are

compared.

Fiscal Incentives

Under the Fiscal Incentives Act Chapter

85:01 large scale manufacturing

including petrochemicals and inorganic

chemicals or processing companies

established in Trinidad and Tobago

can receive an exemption from paying

customs duties, Value Added Tax on

the costs related to the production of

approved products and or services.

Import Duty Concessions

Manufacturing enterprises are allowed

duty free treatment on their raw materials,

machinery and equipment and in some

cases packaging material based upon

the provisions of the country’s Customs

Act.

18

INVEST IN SPECIAL EDITION

投资优势

据余额递减法计算。第一年, 初和

年度津贴是以成本计算的。此后,年

度津贴先要扣除之前获得的津贴,然

后平衡成本计算。

税赋的加速降低会以向在工厂和

机械上投入的资金消耗能方面初步折

扣的形式向制造商提供。对那些涉足

石化产品制造或通过“财政激励法案”

而享受税收优惠的公司来说,税率为

20%。

A - 建筑和改造

B - 工厂和机械,汽车、家具

Profi t Remittance and Capital

Repatriation

There are no restrictions on repatriation

of capital, profi ts, dividends, interest,

distributions or gains on investment.

Repatriation may be effected through

the commercial banking sector. There

remains the liability to pay withholding

tax, where applicable.

Allowances for Capital Costs

All companies carrying on a trade,

business, or profession are entitled to

annual wear and tear allowances on their

machinery and equipment, calculated

according to the declining-balance

method. In the fi rst year, the initial and

annual allowances are calculated on

cost. Thereafter, annual allowances are

calculated on the balance of cost after

deducting the allowances previously

granted.

Accelerated tax depreciation is allowed

to manufacturers in the form of an initial

allowance at the rate of 90% on capital

expenditure on plant and machinery.

For those companies engaged in

the production of petrochemicals, or

enjoying concessions under the Fiscal

Incentives Act, the rate is 20%.

A - Buildings and Improvements

B - Plant and machinery, motor vehicles,

furniture

C - Heavy equipment, trucks, computer

equipment

D - Aircraft and Extra Heavy Equipment

Foreign Ownership

The Foreign Investment Act provides

for the acquisition by foreign investors

of an interest in land or shares in local

private or public companies and for

the formation of companies by foreign

investors. In summary, the Foreign

Investment Act, 1990 makes the

following provisions:

现在的汇率New Rate

A 级

Class A10%

B 级

Class B25%

C级

Class C33%

D级

Class D40%

19

INVEST IN SPECIAL EDITION

Investment Advantages

C - 重型机械、卡车、电脑设备

D - 飞机和超重型设备

外资所有权

《外商投资法》规定外商可以获

得当地私营企业或上市公司的地产或

股票及外商成立公司。总之,1990

年的《外商投资法》有以下规定:

• 允许外国投资者在私营企业持有

100% 的股份,但投资前必须事先告

知财政部长。

• 允许外国投资者拥有当地上市公司

(可以无许可证)总股本 30% 的股份。

• 如果有许可证,外国投资者可以拥

有当地上市公司总股本 30% 以上的

股份。

• 如果没有许可证,外国投资者可以

获得五英亩土地用于商业目的;如果

超过五英亩的面积,必须提前告知财

政部长,并获得许可证。

通过在特立尼达和多巴哥开展业

务,中国投资者将可以获得适宜的财

政鼓励。此外,他们可以信赖特立尼

达和多巴哥拥有一个强大的财政体

系、较低的运营成本以及在北美和南

美地区 7 亿多人的市场拓展,而且该

国欢迎并尊重他们的投资。

Photograph

Aerial view of the Pt. Lisas Industrial Estate.

• A foreign investor is permitted to own

100% of the share capital in a private

company, but prior to the investment the

Minister of Finance must be notifi ed.

• Foreign investors are permitted to own

up to 30% in total of the share capital of

a local public company without a licence.

Photograph

Shiploading at National Energy's Savonetta Piers, Pt.Lisas

• A licence is required to permit foreign

investors to own more than 30% in total

of the share capital of a public company.

• A foreign investor may acquire interest

in land for business purposes up to

fi ve acres without having to acquire

a licence. For any further acreage in

excess of the fi ve acre limit, a license

must be acquired from the Minister of

Finance prior to acquiring such acreage.

By locating operations in Trinidad and

Tobago, Chinese investors will be able

to access a suite of fi scal incentives.

Additionally, you can have confi dence

in knowing that Trinidad and Tobago

possesses a strong fi nancial system,

comparatively low operating costs,

market access to the 700 million plus

people that make up North and South

America region and that your investments

are welcomed and respected.

20

INVEST IN SPECIAL EDITION

投资优势

特立尼达和多巴哥的外资投资领域Sectors Targeted for Investment In Trinidad and Tobago

特立尼达和多巴哥能源行业一览

特立尼达和多巴哥能源行业的主要分析数据如下显示:

投资特立尼达和多巴哥的优势

• 高度发达的石油、石化和钢铁工业• 以贸易协定进入发达和新兴市场的通路• 高素质和经验丰富的劳动力队伍• 竞争力强的能源开采成本• 竞争力强的原材料出产和开采成本• 竞争力强的财政激励政策• 极佳的重工业基础设施和服务支持行业• 发达的支持和次级产业• 先进的教育和培训设施• 极佳的生活水平和为外国人和其家属预备的住宅社区• 可便捷使用高度发达的通讯基础设施

投资目的行业

无机化工

特立尼达和多巴哥现有的天然气使用和发展成为一个更为多元化和可持续性的化工行业。

目前,特立尼达和多巴哥希望吸引有兴趣开发综合氢氧化钠无机化工工厂的投资。

无机化工产品是特立尼达和多巴哥固有的优势:

渴望开发无机化工产业,希望籍此将下游能源行进行多元化的发展。因此国家能源公司作为政府负责下游能源行业的臂膀,正在寻找感兴趣的,希望在岛上建设开发一家无机化工制造工厂的中国企业。国家能源公司已探索整合了一家生产苛性钠工厂,更希望希望吸引那些能够在这个

Overview of the Energy Industry

Key statistics from Trinidad and

Tobago’s energy sector are shown

below:

表 1——2014 年的能源出口Table 1 - Energy Sector Exports in 2014

产品Product

2014 年(出口)2014 (Exports)

甲醇Methanol

560 万公吨5.6 million tonnes

氨Ammonia

470 万公吨4.7million tonnes

尿素Urea

44.1 万公吨441,000 tonnes

硝酸Nitric Acid

49.5 万公吨495,000 tonnes

硝酸铵Ammonium Nitrate

13 万公吨130,000 tonnes

尿素硝酸铵UAN

130 万公吨1.3 million tonnes

三聚氰胺Melamine

2.5 万公吨25,000 tonnes

尿素甲醛Urea Formaldehyde

1.2 万公吨12,000 tonnes

钢铁Iron and Steel

170 万公吨1.7 million tonnes

Source: Ministry of Energy and

Energy Industries- Trinidad and Tobago

来源:能源和能源工业部——特立尼达和多巴哥

• Excellent living standards and

communities for foreign nationals and

their families

• Access to a highly developed

communications infrastructure

Target Sectors for Investment

Inorganic Chemicals

The expansion in the utilization of

our natural gas led to the creation

of a diversifi ed and sustainable

petrochemical industry.

At present, Trinidad and Tobago is

desirous of developing an inorganic

chemical industry in an effort to further

diversify the downstream energy sector.

As such National Energy the arm of

the Government responsible for the

expanding the downstream energy

sector is seeking to attract and work

with interested Chinese companies

wanting to develop an inorganic

chemical producing facility in the island.

National Energy has explored an

integrated caustic soda complex but is

not limited to caustic soda production

and is open to investors who may

be willing to establish other types of

inorganic facilities in the country.

Raw materials from Trinidad and Tobago

or the CARICOM region can be sourced

for proposed projects.

For example, ammonia, methanol,

limestone and natural gas are available

in the country and region and can be

source of raw material for an integrated

complex.

Benefi ts of investing in the Energy

Industry of Trinidad and Tobago

• Highly developed oil, petrochemical

and steel industries

• Access to developed and emerging

markets through trade agreements

• Highly skilled and trained labor force

• Competitive energy costs

• Competitive raw material cost and

availability

• Competitive fi scal incentives

• Excellent infrastructure and support

services for heavy industries

• Developed support and secondary

industries

• Advanced education and training

facilities

21

INVEST IN SPECIAL EDITION

Investment Advantages

Additionally, inorganic chemical projects

would be afforded incentives as

highlighted in the above “Trinidad and

Tobago Taxation System and Financial

Stability” section and benefi t from the

several advantages of locating facilities

in Trinidad and Tobago.

For example, the economics of an

integrated or standalone inorganic

chemical plant would be enhanced

by the low electricity costs in the

island as electricity is one of the major

cost elements in operating such a

facility. Electricity in the country is both

competitive and highly reliable and as

such production costs in Trinidad should

be lower than in both the United States

and European countries. Trinidad and

Tobago’s electricity cost at US$0.03/

kWh is approximately half the average

charge to industrial customers in the U.S

for 2014 at US$0.73/kWh. (U.S Energy

Information Administration 2014)

Ms. Merlyn Rennie-Browne

Vice-President, Energy Industry

Development (Ag.)

国家设立其它类型的无机化工企业的投资者。

来自特立尼达和多巴哥或加勒比共同市场地区的原材料能被用作上述项目之用。

举例说明,氨、甲醇、石灰和天然气在本地都有开采,能被用于在整个综合设施中建设整合工厂。

此外,无机化工产品项目也是上述“特立尼达和多巴哥税务系统和金融稳定性”一文中介绍的政策激励行业,能从特立尼达和多巴哥的当地企业所能获得的众多优势中获益。

举例说明,一家整合的或独立的无机化工厂能由当地岛上低廉的电费中获益,因为电费是上述工厂的主要成本之一。这个国家的电费十分具有竞争力也很可靠,因此特立尼达和多巴哥的制造成本应该比美国和欧洲国家更为低廉。特立尼达和多巴哥的电费是 0.03 美元 / 千瓦时,是美国工业用电在 2014 年的 0.73 美元 /千瓦时的一半左右(美国能源信息管理局 2014 年数据)。

在推荐进行二次开发之前,由感兴趣方提交的项目提案将会根据设定的标准,包括科技评估、市场分析、对环境造成的影响和经济活力等方面得到审核。

不仅仅在无机化工产品行业方面的努力,国家能源公司也正致力于发展石油化工行业和建立可再生能源科技和能源制造行业。

石化产品

氨和下游产品

特立尼达在 2014 年的氨出口量为 450 万立方公吨。国家能源公司希望吸引氨和下游产品工厂的投资,当地的天然气可用来制造氨,其衍生产品为尿素、尿素硝酸铵(UAN)、三聚氰胺和磷酸氢二铵(DAP)。

甲醇和下游产品甲醇和烯烃

特立尼达在 2014 年出口了大约560 万立方公吨的甲醇。国家能源公司很希望甲醇的下游产品得到开发机会,它们是:

22

INVEST IN SPECIAL EDITION

投资优势

Proposed projects from interested

parties are assessed, prior to being

recommended for further development,

according to set criteria that include a

technology evaluation, market analyses,

impact on the environment and

economic viability.

Not with standing the thrust towards

the inorganic chemical sub-sector,

National Energy is pursuing the

expansion of the Petrochemical Industry

and the establishment of Renewable

Energy Technology and Energy-Based

Manufacturing industries.

Petrochemicals

Ammonia and Downstream

In 2014, Trinidad exported approximately

4.5 million metric tonnes of ammonia.

National Energy is seeking investment for

an ammonia and downstream complex

utilizing natural gas to produce ammonia

and derivatives such as urea, urea

ammonium nitrate (UAN), Melamine and

Diammonium Phosphate (DAP).

Methanol and Downstream

In 2014, Trinidad exported

approximately 5.6 million metric

tonnes of methanol. National Energy is

desirous of developing the downstream

opportunities from methanol such as:

• Acetic Acid

• Formaldehyde

• Polyethylene

• Polypropylene

• Propylene Oxide

Other potential areas for investment

include acrylates, acrylic acid and

oxoalcohols.

National Energy is not limited to

receiving proposals for projects only

from the areas previously listed, but also

welcomes investors to propose projects

that can be of mutual benefi t.

Renewable Energy Technology

Manufacturing

Solar Module Manufacturing

We are also currently exploring the

potential for photovoltaic (PV) module

manufacturing in the country. We have

already identifi ed sites with ready access

to ports for locating such projects and

welcome investment in this new and

sustainable industry to our shores.

Energy Based Manufacturing

National Energy has been focusing on

developing linkages between the energy

and manufacturing sectors in order

to maximize on the full value of our

resources. Currently, the downstream

chemicals produced in Trinidad and

Tobago from ammonia and methanol

are urea ammonia nitrate (UAN) and

melamine.

National Energy is pursuing the

advancement of energy-based

manufacturing industries from

methanol and ammonia and for their

derivatives to produce consumables

such as but not limited to plasticizers,

coatings, adhesives, laminates for

pharmaceuticals.

For further information, please

contact:

Ms. Merlyn Rennie-Browne

Vice-President, Energy Industry

Development (Ag.)

National Energy Corporation of Trinidad

and Tobago

Corner Rivulet and Factory Roads

Brechin Castle Pt. Lisas, Couva

The Republic of Trinidad and Tobago. W.I

Tel: 868-636-8471

Fax: 868-636-2905

Email:

Website: www.nationalenergy.tt

Other websites of interest:

www.investt.co.tt

• 醋酸• 甲醛• 聚乙烯• 聚丙烯• 氧化丙烯

其它潜在的投资领域包括丙烯酸酯、丙烯酸和羰基醇。

我们乐于接受上述行业之外的投资项目提案,欢迎投资者提交让双方互惠的投资建议。

可再生能源科技制造

太阳能电池模组制造

国家能源公司目前正研究在特立尼达和多巴哥建立一个独立的太阳能光伏模组制造工厂的可能性。我们已经为可再生能源科技产品的制造工厂选定了能够方便我往返于港口的用地。

基于能源的制造业

国家能源公司一直关注能源和制造业之间的联系,以求 大程度地利用我们国家的自然资源。目前,特立尼达和多巴哥的下游化工产品是氨和甲醇的衍生品尿素硝酸铵(UAN)和三聚氰胺。

国家能源公司有兴趣吸引基于能源的制造业升级开发项目,比如说,首先是基于甲醇和氨及其衍生产品制造的消耗品,包括但不限于塑化剂、涂料、粘合剂、层板和药物。

欲知详情,请联系:

Merlyn Rennie-Browne 女士特立尼达和多巴哥国家能源公司能源业开发部,副总裁Corner Rivulet and Factory RoadsBrechin Castle Pt. Lisas, CouvaThe Republic of Trinidad and Tobago. W.ITel: 868-636-8471Fax: 868-636-2905Email:[email protected]: www.nationalenergy.tt其它建议浏览的网站:www.investt.co.tt