GREATER METRO DENVER REAL ESTATE MARKET STATISTICS

-

Upload

lora-stephens -

Category

Documents

-

view

217 -

download

3

description

Transcript of GREATER METRO DENVER REAL ESTATE MARKET STATISTICS

Denver Trends

2010 Year-End Analysis

GREATER METROPOLITAN DENVER REAL ESTATE MARKET STATISTICS

DECEMBER, 2010 YEAR END

TRANSACTIONS

SINGLE FAMILY

49,313 Single Family properties were placed under contract in ’10 versus 56,174 properties in ’09 ‐ ↓ 12%

38,818 Single Family properties closed in ’10 versus 42,070 properties in ’09 ‐ ↓ 8%

YTD closed dollar volume was $9.9 Billion in ’10, ↔ even versus year to date ‘09

RESIDENTIAL

39,200 Residential properties were placed under contract in ’10 versus 44,546 properties in ’09 ‐ ↓ 12%

30,777 Residential properties closed in ’10 versus 33,114 properties in ’09 ‐ ↓ 7%

YTD closed dollar volume was $8.6 Billion in ’10, ↔ even versus year to date ‘09

CONDO

10,113 Condo properties were placed under contract in ’10 versus 11,628 properties in ’09 ‐ ↓ 13%

8,041 Condo properties closed in ’10 versus 8,956 properties in ’09 ‐ ↓ 10%

YTD closed dollar volume was $1.3 Billion in ’10, ↓ $ 0.1 Billion versus year to date ‘09

INVENTORY

Single Family unsold homes on the market at 12/10 of 18,867 units ‐ ↑ 15% from 12/09

Residential unsold homes on the market at 12/10 of 14,450 units ‐ ↑ 18% from 12/09

Condo unsold homes on the market at 12/10 of 4,417 units ‐ ↑ 5% from 12/09

Denver Trends11

,839

,147

31

54

11,000

11,093

0,35

2

0

16,482

20,676

21,623

20,891

23,572

24,534

24,603

19,600

16,456

18,867

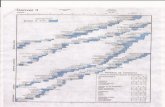

Greater Metropolitan Denver Real Estate StatisticsMonth End Inventory ‐ December

11,839

10,147

9,63

1

7,71

1

8,56

9

9,85

4

11,000

11,093

10,352

8,09

7

8,82

0

16,482

20,676

21,623

20,891

23,572

24,534

24,603

19,600

16,456

18,867

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10

Greater Metropolitan Denver Real Estate StatisticsMonth End Inventory ‐ December

© 2011 Garold D Bauer, All Rights Reserved, Information Deemed Reliable But Not Guaranteed

7 27,215

30,763

29,703

27,810

29,522

30,981

35,159

35,480

37,012

35,888

36,272

36,677

41,682

41,365

39,208

38,845

37,988

33,114

30,777

25,619

26,410

33,477

38,598

38,072

36,038

38,101

40,185

45,951

46,742

48,611

47,832

47,919

47,966

53,482

53,106

50,244

49,789

47,837

42,070

38,818

20,000

30,000

40,000

50,000

60,000

Greater Metropolitan Denver December Year To Date Closed Transactions

20,464

21,547

27,215

30,763

29,703

27,810

29,522

30,981

35,159

35,480

37,012

35,888

36,272

36,677

41,682

41,365

39,208

38,845

37,988

33,114

30,777

5,15

5

4,86

3

6,26

2

7,83

5

8,36

9

8,22

8

8,57

9

9,20

4

10,792

11,262

11,599

11,944

11,647

11,289

11,800

11,741

11,036

10,944

9,84

9

8,95

6

8,04

1

25,619

26,410

33,477

38,598

38,072

36,038

38,101

40,185

45,951

46,742

48,611

47,832

47,919

47,966

53,482

53,106

50,244

49,789

47,837

42,070

38,818

0

10,000

20,000

30,000

40,000

50,000

60,000

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Greater Metropolitan Denver December Year To Date Closed Transactions

Res Cond Single Family

© 2011 Garold D Bauer, All Rights Reserved, Information Deemed Reliable But Not Guaranteed

AVERAGE PRICING

Single Family ↑ 6%, $257,000 versus $242,413

Residential ↑ 7%, $282,080 versus $264,803

Condo ↑1%, $161,005 versus $159,628

MEDIAN PRICING

Residential ↑7%, $235,000 versus $219,000

Condo ↑1%, $136,000 versus $135,000

GENERAL

A review of 2010 versus 2009 provides the following observations:

The inventory of unsold Single Family homes started the year at 16,456 units, peaked at 23,933 units in July, and ended the year at 18,867 units.

Under Contract and Sold units were down 12% and 8% respectively when compared to 2009.

Largest number of Residential and Condo properties sold in price range of $100,000 to $199,999 for 2010.

Million dollar plus homes accounted for 494 Residential closings in ’10 versus 439 in ’09.

Million dollar plus homes accounted for 30 Condo closings in ’10 versus 32 in ’09.

2010 saw several extensions of the First Time Home Buyer Tax Credit which caused a flurry of Under Contract activity in the first four months of the year followed by closings through September, 2010.

2010 saw mortgage interest rates fall to levels never seen for many years.

© 2011 Garold D Bauer, All Rights Reserved, Information Deemed Reliable But Not Guaranteed

Denver Trends

8 53

72,215

4,46

0,31

0

$4,779

,902

$4,910

,865

$5,515

,801

$6,180

,791

$7,775

,673

$8,769

,865

$10,55

8,87

7

$11,15

2,51

7

$11,71

3,82

4

$12,16

8,92

9

$14,22

3,03

1

$14,94

0,42

2

$14,51

6,32

1

$14,03

1,63

4

$11,95

4,29

0

$10,19

8,33

3

$9,976

,222

$6,000,000

$8,000,000

$10,000,000

$12,000,000

$14,000,000

$16,000,000

Greater Metropolitan Denver December Year To Date Closed Dollar Volume($000's)

Res

Cond

Single Family

$2,411

,638

$2,669

,553

$3,572

,215

$4,460

,310

$4,779

,902

$4,910

,865

$5,515

,801

$6,180

,791

$7,775

,673

$8,769

,865

$10,55

8,87

7

$11,15

2,51

7

$11,71

3,82

4

$12,16

8,92

9

$14,22

3,03

1

$14,94

0,42

2

$14,51

6,32

1

$14,03

1,63

4

$11,95

4,29

0

$10,19

8,33

3

$9,976

,222

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

$14,000,000

$16,000,000

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Greater Metropolitan Denver December Year To Date Closed Dollar Volume($000's)

Res

Cond

Single Family

© 2011 Garold D Bauer, All Rights Reserved, Information Deemed Reliable But Not Guaranteed

$150,000

$200,000

$250,000

$300,000

$350,000

Greater Metropolitan Denver December Year To Date Average PriceClosed Properties ‐ 1990 to 2010

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10

Greater Metropolitan Denver December Year To Date Average PriceClosed Properties ‐ 1990 to 2010

Res Cond Single Family

© 2011 Garold D Bauer, All Rights Reserved, Information Deemed Reliable But Not Guaranteed

Denver Trends

$170

,000

$195

,000

$213

,950

$221

,000

$230

,000

$237

,000

$247

,000

$249

,900

$245

,000

$219

,900

$219

,000

$235

,000

0 00

500

4,00

0

7,00

0

0,00

0

7,00

0

,000

00

00

00

$150,000

$200,000

$250,000

$300,000

Greater Metropolitan Denver DecemberYear To Date Median Price ‐ Closed

$170

,000

$195

,000

$213

,950

$221

,000

$230

,000

$237

,000

$247

,000

$249

,900

$245

,000

$219

,900

$219

,000

$235

,000

$107

,500

$126

,500

$141

,000

$149

,500

$154

,000

$157

,000

$160

,000

$157

,000

$150

,000

$138

,000

$135

,000

$136

,000

$‐

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

99 00 01 02 03 04 05 06 07 08 09 10

Greater Metropolitan Denver DecemberYear To Date Median Price ‐ Closed

Res Condo

© 2011 Garold D Bauer, All Rights Reserved, Information Deemed Reliable But Not Guaranteed METROPOLITAN DENVER REAL ESTATE STATISTICS

AS OF DECEMBER 31, 2010

% % % % %Snapshot - YTD Change Change Change Change Change

YTD 2010 YTD 2009 YTD 2008 YTD 2007 YTD 2006 YTD 2005 10 vs '09 10 vs '08 10 vs '07 10 vs '06 10 vs '05

Single Family (Residential + Condo)

Active 18,867 16,456 19,600 24,603 24,534 23,092 14.65% -3.74% -23.31% -23.10% -18.30%Under Contract 49,313 56,174 62,647 61,663 61,736 65,256 -12.21% -21.28% -20.03% -20.12% -24.43%Sold 38,818 42,070 47,837 49,789 50,244 53,106 -7.73% -18.85% -22.03% -22.74% -26.90%

Avg DOM 92 98 102 105 102 90 -6.12% -9.80% -12.38% -9.80% 2.22%Avg Sold Price $257,000 $242,413 $249,897 $281,822 $288,916 $281,332 6.02% 2.84% -8.81% -11.05% -8.65%

Residential

Active 14,450 12,263 14,995 18,709 18,109 16,428 17.83% -3.63% -22.76% -20.21% -12.04%Under Contract 39,200 44,546 50,517 48,794 48,628 51,464 -12.00% -22.40% -19.66% -19.39% -23.83%Sold 30,777 33,114 37,988 38,845 39,208 41,365 -7.06% -18.98% -20.77% -21.50% -25.60%

Avg DOM 90 97 100 102 97 84 -7.22% -10.00% -11.76% -7.22% 7.14%Median Sold Price $235,000 $219,000 $219,900 $245,000 $249,900 $247,000 7.31% 6.87% -4.08% -5.96% -4.86%Avg Sold Price $282,080 $264,803 $270,261 $310,418 $317,112 $307,529 6.52% 4.37% -9.13% -11.05% -8.28%

Condo

Active 4,417 4,193 4,605 5,894 6,425 6,664 5.34% -4.08% -25.06% -31.25% -33.72%Under Contract 10,113 11,628 12,130 12,869 13,108 13,792 -13.03% -16.63% -21.42% -22.85% -26.67%Sold 8,041 8,956 9,849 10,944 11,036 11,741 -10.22% -18.36% -26.53% -27.14% -31.51%

Avg DOM 98 101 108 114 122 111 -2.97% -9.26% -14.04% -19.67% -11.71%Median Sold Price $136,000 $135,000 $138,000 $150,000 $157,000 $160,000 0.74% -1.45% -9.33% -13.38% -15.00%Avg Sold Price $161,005 $159,628 $171,350 $180,321 $188,745 $189,035 0.86% -6.04% -10.71% -14.70% -14.83%

Footnotes: Active, Under Contract, and Sold presented as # of units. Avg DOM = Average Days on MarketThis representation may or may not reflect all real estate activity in the market.Source: Metrolist, Inc.© 2011 Garold D Bauer, All Rights Reserved, Information Deemed Reliable But Not Guaranteed