From Investment to Exit - afema.se · You can easily get The Pictures as well as The E-book at . 3 ...

Transcript of From Investment to Exit - afema.se · You can easily get The Pictures as well as The E-book at . 3 ...

Afema

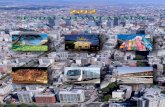

From Investment to Exit- elements to strengthen the value of VC investments

Jönköping International Business School7th of May 2014Eric Martin

Get the pictures at www.afema.se

3

www.afema.se

Eric Martin• In the business of VC and

entrepreneurs since 1982 Svetab Företagskapital TUAB Aldano

• Own consultancyorganization since 1984 Afema AB

entrepreneurial coaching

• Among present assignments Mentor

Communication Group chairman

Axolot Games chairman

• Among past assignments Swedish Venture

Capital Association chaiman

Connect Eastern Swedenchaiman

Board member and consultant in some100+ entrepreneurialcompanies

• BSc in Business Administration with a technical background

• Secret talent: Former water ski coach

for Swedish national team

4

www.afema.se

The lecture in short

Part 1 In theory• Definitions• Typical VC• The American

model

Part 2In practice• The meeting• The curve of

Akbar• The journey• How to choose

your VC

5

www.afema.se

Venture Capital (Minority) Investments in non-public companies

with an active and timelimited ownership

Equity

Public Equity

OMX Other stockexchanges Private Equity

InvestmentcompaniesLongterm

majority owners

Buy out compTimelimited

majority owners

VC companiesTimelimited

minority owners

Business angelsTimelimited

minority owners

Crowd financingSeveral small

private investors

OthersMezzanine

Private owners Etc

6

www.afema.se

When to go for VC

You desire to grow fast

You accept outside influences on running your business

You are willing to make EXIT in 2-7 years

7

www.afema.se

How do VCs act

Minority share holder (mostly)

Active owner

Always a board position

59% have at least one contact a week

Basically no fees

Active strategy towards exit

8

www.afema.se

VCs bring in 3C

Capital• Equity

Contacts• Mostly in finance and law

Competence• Specialists on rapid growth and exits

10

www.afema.se

Development phases and company strategies

Time

Com

pany

dev

elop

men

t

IPO phase

Focusing

Innovation phase

Customer designed products for limited

number of customers

Growth phase

Standardized products for large number of

customers

Administrative phase

IPO

11

www.afema.se

The American management model

Time

Com

pany

dev

elop

men

t

Innovation phase Growrh phase IPO phase Administration phase

IPO

12

www.afema.se

Characteristics for Sweden

Salesmanship does not come natural Small home market Few business angels and early phase VCs –

limited financing in early phases Only a few companies reach IPO characteristics

13

www.afema.se

Adaptation to SwedenC

ompa

ny d

evel

opm

ent

Time

Innovation phase Growth phase IPO phase Administration phase

Tradesale

14

www.afema.se

The equity possibilities

Time

Com

pany

dev

elop

men

t

Innovation phase Growrh phase IPO phase Administration phase

IPO

Pre-seed

Seed capital

Mezzanine

MBO/LBO funds

Stock exchangecapital

Traditional VC

16

www.afema.se

First meeting Making a presentation

• The pitch (6 seconds)• The short version

The business plan• Excellent executive

summary• Customer benefits• Sales process• Team presentation• SWOT analysis• Owners´ goals and

strategies Exit possibilities

The funnel

Red Flags• Out of scoop• The entrepreneur• Lack of sales• Lack of customer

benefits• Limited growth

possibilities• Weak exit possibilities• Multiple risks• Different goals of

owners

17

www.afema.se

The curve of AkbarCompany value

Time

Distressinvestments

Original idea1st investment

The critical2nd investment

Bankruptcy

Swedish tradition

18

www.afema.se

Required yield 10 investments >>

• 3 bankruptcies• 3 +/- zero• 3 fair• 1 excellent

Desired average yield 18-28% p.a.

A priori expectation mimimum 50% p.a.

Normal duration of investment 2-10 years

19

www.afema.se

Shareholders´ agreement

The Investment• How much money – How large piece of the cake• Guarantees

Business development• Board of directors• Veto

Exit• Owners goals• Time frame

Quibblings• Disputes

20

www.afema.se

Ownership strategies – two tracks

Day-to-day operations

Turn over and profit Outside relations

• Customers• Colleagues – competitors• Enviroment issues

Organization

Ownership issues

Number of partners• Single• Equal partners• Institutional partner• Large number of partners• Listed company

Financing• Equity• Customers• Bank loans• Loans from owners

Ownership goals• Bread-and-butter company• Trade sale• IPO

21

www.afema.se

Growth business development

Management style• The goals sets the direction, not the cross bar• Sales is the engine of growth

Invests in sales Everyone is a sales man

• Organization Task force, put out fires, monday meetings

• Prepare for working capital• Give priority to time tables before cost savings

Focus• Outsource• Growth through buying functions• Prevent narrow sectors

22

www.afema.se

How do you choose your VC

Motives Muscles Personal chemistry Track record - references Network Competence

Afema

Afema ABwww.afema.se

Segelbåtsvägen 12SE-112 64 STOCKHOLM, Sweden

[email protected]+46-705-922 899

![568; TUAB 0gs.sxu.edu.cn/docs/20140703105753994053.pdf568; TUAB 0 568 TUAB 0 568 VW>?. % 0 568 TUXY>?.ZI[-\]^; % 0 568>?. _`abLMABcdPQe 568>?. fgMh 568. i jCDE4k 1l 568.](https://static.fdocument.pub/doc/165x107/60bdaae5163d00118933a9ac/568-tuab-0gssxueducndocs-568-tuab-0-568-tuab-0-568-vw-0-568-tuxyzi-.jpg)