Financial Ratios Handout

-

Upload

ellena98 -

Category

Economy & Finance

-

view

1.618 -

download

0

Transcript of Financial Ratios Handout

FinancialRatios

MEASURES OF FINANCIAL PERFORMANCE

What is being measured?Two Things

Condition – The financial condition of a firmPerformance – The financial performance of a firm

Types of “Measures”Condition

LiquiditySolvency

PerformanceProfitabilityRepayment CapacityFinancial Efficiency

Why use “Measures” or “Ratios?”They enable us to –

Quickly assess the financial condition and performance of a business Track a business over a period of years with few numbers Compare a business to industry averages easily Monitor many businesses with a minimum of time

Lenders use them – As one factor in making credit decisions To monitor businesses in their loan portfolio

Financial regulators use them – To monitor loan portfolios of banks and other lenders

Producers use them – To evaluate the condition and performance of their business To track the performance of their business over a period of time

Precautions in Using “Measures” The help in asking the right questions, but do not provide answers A benchmark is needed to assess a firm’s performance

- Compare with several previous years’ performance- Compare with averages of similar firms

When comparing measures between firms or with previous years, make sure that they are calculated using the same formulas, and with comparable data

The Farm Financial Standards Task Force A national group to further the use of uniform terminology, formats, and procedures in

farm financial reporting and analysis They recommended –

- A set of universal financial reports- A set of universal “measures”

Measures Recommended by the Task Force

Liquidity Measures1. Current ratio2. Working capital

Solvency Measures3. Debt/Asset ratio4. Equity/Asset ratio5. Debt/Equity ratio

Profitability Measures6. Rate of return on farm assets7. Rate of return on farm equity8. Operating profit margin ratio9. Net farm income

Repayment Capacity Measures10. Term debt and capital lease coverage ratio11. Capital replacement and term debt repayment margin

Financial Efficiency Measures12. Asset turnover ratio13. Operating expense ratio14. Depreciation expense ratio15. Interest expense ratio16. Net farm income from operations ratio

EXPLANATIONS OF FINANCIAL MEASURES

1. Current Ratio – the ratio of current assets to current liabilities. It measures liquidity, or the ability to meet short-term debt obligations, production expenses, and unexpected cash expenses without severe interruption of the daily farm operation. The higher the ratio, the greater the liquidity.

Historically, lenders have preferred a current ration of at least 2:1. Some financial analysts now feel that a ratio of 1.5:1 is adequate. A ratio below 1:1 indicates financial problems.

The calculated value of the current ratio is affected by the classification of assets and liabilities. For example, if breeding livestock are classified as a current asset by one farmer, and the “benchmark” value is based on a non-current classification, it would be dangerous to draw any conclusions from a comparison. The current ratio is also affected by the manner in which items are entered on the balance sheet. For example, often the value of sealed grain is shown only as a current asset, using the difference between its market value and the amount of the loan against it as its value. The current ratio resulting from that method will not be comparable to one which is calculated when the value of the grain is shown as a current asset, and the loan against it as a current liability.

2. Working Capital – current assets minus current liabilities. This is another measure of liquidity. It is a theoretical measure of the amount of funds available to purchase inputs and inventory items after the sale of current farm assets and payment of all current farm liabilities. The amount of working capital considered adequate must related to the size and type of the farm business. Thus, there is no “benchmark” value for this measure.

This measure is subject to the same conditions and limitations as stated above for the current ratio.

3. Debt/Asset Ratio – total farm liabilities divided by total farm assets. This ratio measures the percentage of total assets that are funded by borrowed money. It is an important measure of solvency, or the ability to repay all liabilities by selling all assets.

Some financial analysts feel that a ratio of over 40% is an indicator of problems, and a ratio of over 70% indicates an irreversible condition. While this may be true in general, the critical factor is the rate of return on total assets versus the cost of borrowed capital. If a business is earning 15% on assets, and is borrowing money at 10% interest, a debt/asset ratio above 70% may not necessarily be bad. In contrast, if a business is earning 4% on total assets, and paying 10% interest on borrowed money, a debt/asset ratio of anything above zero is undesirable.

4. Equity/Asset Ratio – total farm equity divided by total farm assets. This ratio measures the proportion of total farm assets that are funded by the owner’s equity capital. It is 100% minus the Debt/Asset Ratio. That is, if the Debt/Asset Ratio is 40%, the Equity/Asset Ratio is 60%.

5. Debt/Equity Ratio – total farm liabilities divided by total farm equity. This is commonly called the “leverage ratio.” It measures how many dollars of borrowed capital are “leveraged” with each dollar of equity capital.

In the 1970’s, the young tigers often had leverage ratios of two, three, and above. Since the farm financial crises of the 1980’s, ratios of less than one are considered more desirable.

6. Rate of Return on Farm Assets – the return to farm assets expressed as a percent of total assets. It is an overall index of profitability. When used for comparisons between farms, this measure should be calculated using market value of farm assets. However, when used for comparisons between accounting periods for an individual farm, it is most meaningful when the cost approach is used. The higher the Rate of Return on Farm Assets, the more profitable the farming operation.

7. Rate of Return on Farm Equity – the return to farm equity expressed as a percent of farm equity. It measures the productivity of the owner’s equity capital. In addition to comparing with other farms and previous years on the same farm, it can be compared with yields from non-farm investments with comparable risks.

8. Operating Profit Margin Ratio – the operating margin as a percent of gross revenue. It measures the financial efficiency of the farm in terms of return per dollar of gross revenue. A farm business has two ways to increase profits – either by increasing the profit per unit produced or by increasing the volume of production (if the business is profitable). The Operating Profit Margin Ratio, multiplied by the Asset Turnover Ratio (Measure No. 12) equals the Rate of Return on Farm Assets (Measure No. 6).

“Desirable” values for this measure vary by type of farm, and are not generally available.

9. Net Farm Income – the return to the farm operator of unpaid labor, management, and owner’s equity. It is “Net Farm Income from Operations,” adjusted for gains or losses on the sale of farm capital assets. The measure is an absolute amount, so it is difficult to compare between farm businesses, or to establish a standard for all farms.

Net farm income, plus income from non-farm sources, is used to pay family living expenses, income and social security taxes, loan principal payments, capital purchases, and to accumulate cash reserves.

10. Term Debt & Capital Lease Coverage Ratio – provides a measure of the ability of the farm business to cover all term debt and capital lease payments. The greater the ratio over 1:1, the greater the margin to cover the payments.

The appropriate value for this measure will vary depending on the production and price variability associated with farm enterprise(s), the degree of diversification of farm and non-farm enterprises, and the financial and risk management abilities of the operator.

11. Capital Replacement & Term Debt Repayment Margin – enables the farmer and his/her lender to evaluate the ability of the business to generate funds necessary to repay debts with maturity dates longer than one year and to replace capital assets. It also enables them to evaluate the ability to acquire capital or service additional debt and to evaluate the risk margin for capital replacement and debt service.

This measure is an absolute amount, so it is difficult to compare between farm businesses. It is impossible to establish one standard for all farm businesses.

12. Asset Turnover Ratio – gross revenues divided by average total farm assets. It measures how efficiently farm assets are being used to generate revenue. The higher the ratio, the more efficiently assets are being used to generate revenue. Refer to the discussion of measure No. 8 for the relationship of this measure with measures No. 6 and No. 8.

Desirable values of this measure will vary with type of farm. Cattle ranches typically have a low Asset Turnover Ratio, often less than 20%. In contrast, swine enterprises may achieve over 100%.

13. Operating Expense Ratio – operating expenses (not including depreciation or interest) as a percent of gross revenue. Measures 13, 14, 15 and 16 will add to 100%. They as a group show how gross revenues are utilized. Values of this measure will vary by type of farm, but generally should not exceed 65%.

14. Depreciation Expense Ratio – depreciation expense as a percent of gross revenue. This measure will also vary by type of farm, depending on the capital intensity of the enterprises.

15. Interest Expense Ratio – interest expense as a percent of gross revenue. Some financial analysts feel that this measure should not be over 20%.

16. Net Farm Income from Operations Ratio – net farm income from operations as a percent of gross revenue. This is the residual, after expenses. At present, there is not a good indicator of a desirable value for this measure. Possibly a minimum of 15% should be considered.

FINANCIAL MEASURES WORKSHEET FOR SAMPLE FARM

Liquidity Measures1. Current Ratio

Total current farm assets / Total current farm liabilities$__________ / $__________ = _______:1

2. Working CapitalTotal current farm assets – Total current farm liabilities$__________ - $__________ = $_______

Solvency Measures3. Debt to Asset Ratio

Total farm liabilities / Total farm assets$__________ / $__________ x 100 = _______ %

4. Equity to Asset RatioTotal farm equity / Total farm assets$__________ / $__________ x 100 = _______ %

5. Debt to Equity Ratio (Leverage Ratio)Total farm liabilities / Total farm equity$__________ / $__________ = _______:1

Profitability Measures6. Rate of Return on Farm Assets

Net farm income from operations __________+ Farm interest expense + __________- Value of oper & unpaid fam. labor & management - __________

= __________

Divided by Average Total Farm Assets / __________Multiplied by 100 x _____100__

EQUALS = __________ %

7. Rate of Return on Farm EquityNet farm income from operations __________- Value of oper. & unpaid fam. labor & management - __________

= __________

Divided by Average Total Farm Equity / __________Multiplied by 100 x _____100__

EQUALS = __________ %

8. Operating Profit Margin RatioNet farm income from operations __________+ Farm interest expense + __________- Value of oper. & unpaid fam. labor & management - __________

= __________

Divided by Gross Revenues / __________Multiplied by 100 x _____100__

EQUALS = __________ %

9. Net Farm IncomeFrom Income State$ _____________

Repayment Capacity Measures10. Term Debt and Capital Lease Coverage Ratio

Net farm income from operations __________+ Total non-farm income + __________+ Depreciation expense + __________+ Interest on term debt + __________+ Interest on capital leases + __________- Income tax expense - __________- Withdrawals for family living - __________

= __________

Divided byPrincipal and interest payments on term debt __________+ Principal & interest payments on capital leases + __________

= __________EQUALS = _____ times

11. Capital Replacement and Term Debt Repayment MarginNet farm income from operations __________+ Total non-farm income + __________+ Depreciation expense + __________- Income tax expense - __________- Withdrawals for family living - __________- Payment on unpaid operating debt from previous year - __________- Principal payment on current part of term debt - __________- Principal payment on current part of cap leases - __________

EQUALS = $ _____________

12. Asset Turnover RatioGross revenues / Total farm assets$__________ / $__________ = _______ Times

Operational Ratios13. Operating Expense Ratio

Operating expenses (except depr. & interest) / Gross revenues__________ / __________ x 100 = _______ %

14. Depreciation Expense RatioDepreciation expense / Gross revenues__________ / __________ x 100 = _______ %

15. Interest Expense RatioTotal farm interest expense / Gross revenues__________ / __________ x 100 = _______ %

16. Net Farm Income from Operations RatioNet farm income from operations / Gross revenues__________ / __________ x 100 = _______ %

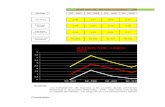

Financial Measurements

FINANCIAL CATEGORIESA. Liquidity GREEN YELLOW RED1. Current Ratio

Total Current Farm Assets / Total Current Farm Liabilities . . . . . . 1.50 1.25 1.002. Working Capital

Total Current Farm Assets – Total Current Farm Liabilities . . . . . . Varies with Size/Type Bus.

B. Solvency GREEN YELLOW RED3. Debt/Asset Ratio

Total Farm Liabilities / Total Farm Assets . . . . . . . . . . . . . . . . . . . . 30% 45% 60%4. Equity to Asset Ratio

Total Farm Equity / Total Farm Assets . . . . . . . . . . . . . . . . . . . . . . . 70% 55% 40%5. Debt to Equity Ratio

Total Farm Liabilities / Total Farm Equity . . . . . . . . . . . . . . . . . . . . 0.70 0.90 1.20

C. Profitability GREEN YELLOW RED6. Rate of Return on Farm Assets

(Net Farm Income + Int. Exp. – Value Labor & Mgt) / Avg: Total Farm Assets. . . . 6% 4.5% 3%7. Rate of Return on Farm Equity

(Net Farm Income – Value of Labor & Mgt) / Average Total Farm Equity. . . . . . . 15% 10% 5%8. Operating Profit Margin Ratio Compare to Other Investments

(Net Farm Income + Interest Exp. – Value of Labor & Mgt) / Gross Revenues . . . . 15% 10% 5%9. Net Farm Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Compare Year to Year

D. Repayment Capacity GREEN YELLOW RED10. Term Debt and Capital Lease Coverage Ratio

(Net Farm + Non-Farm Income + Deprec. + Interest – Income Tax – Family Living)/ (Scheduled Principal &Interest Payments on Term Debt & Capital Leases) . . . . . . 1.50 1.27 1.10

11. Capital Replacement and Term Debt Repayment . . . . . . . . . . . . . . . Compare Year to Year

E. Financial Efficiency GREEN YELLOW RED12. Asset Turnover Ratio

Gross Revenue / Average Total Farm Assets . . . . . . . . . . . . . . . . . . Varies by Type of Farm

F. Operating Ratios GREEN YELLOW RED13. Operating Expense Ratio

(Cash Operating Expense – Interest – Depreciation) / Gross Revenue . . . . . . . . . . 55% 62% 70%14. Depreciation Expense Ratio

Depreciation Expense / Gross Revenue . . . . . . . . . . . . . . . . . . . . . . . Varies by Type of Farm15. Interest Expense Ratio

Total Farm Interest / Gross Revenue . . . . . . . . . . . . . . . . . . . . . . . . . 10% 15% 20%16. Net Farm Income From Operations Ratio

Net Farm Income From Operations / Gross Revenues . . . . . . . . . . . . 15% 10% 5%

TOTAL OF MEASURES 13 + 15 + 15 + 16 = 100%