Business confidence survey 2014 by the European Chamber - European Business in China

-

Upload

roland-weber -

Category

Business

-

view

82 -

download

0

description

Transcript of Business confidence survey 2014 by the European Chamber - European Business in China

© European Union Chamber of Commerce in China All rights reserved www.europeanchamber.com.cn

European Chamber

3

TABLE OF CONTENTS EXECUTIVE SUMMARY…………………….…………………………………………….....…………6

1 FINANCIAL PERFORMANCE CONTINUES TO MARGINALLY DECLINE…………………8 1.1 Slowing revenue growth…………………………………………………………...…………………………..…......8 1.2 Pressure on bottom-line growth………………………………………………………….………………………….10 1.3 Overall performance perception in line with financials, but discrepancies seen

in some industries...........................................................................................................................................11

2 SOBER NEW REALITY: PERSISTENT MARKET CHALLENGES ARE NOT EASING UP AND OPTIMISM IS WANING............................................................................14

2.1 The usual challenges, but more intense…………..…………………………………………………………..........142.2 Future outlooks reflect an entrenchment of the general downward trend………………………………………..202.3 Are the good times really over?.............................................................................................…………….........22

3 MORE MODEST EXPECTATIONS AND REVISED INVESTMENT PLANS………………….243.1 The changing role of China for European companies…………………………………………………………….243.2 Reducing investment ambitions………………………………………………………………………………………263.3 'Looking over the fence'……………………………………………………………………………………………..…33

4 REGULATORY AND MARKET ACCESS ISSUES CONTINUE TO PRESENTCHALLENGES, BUT REFORMS WOULD PRESENT OPPORTUNITIES...........................354.1 Regulatory and market access issues………………………………………………………………………………..364.2 Careful acknowledgement of improvements………………………………………………………………………404.3 Need for real reform and market opening…………………………………………………………………………42

5 CONCLUSION……………………………………………………………………………………..46

6 ABOUT THE SURVEY MOTIVATION AND DESIGN…………………………………….……48

7 PANEL OVERVIEW……………………………………………………………………………….49 7.1 Industry…………………………………………………………………………………………………………..........49

7.2 Revenue, size and time in China……………………………………………………………………………………49

8 ABOUT ROLAND BERGER STRATEGY CONSULTANTS………………….….........………529 ABOUT THE EUROPEAN UNION CHAMBER OF COMMERCE IN CHINA.......................53

European Chamber

4 In partnership with

TABLE OF FIGURES Figure 1: Historic revenue performance, 2008-2014, and performance by time in China, 2014…...…........……..8

Figure 2: Revenue performance by industry, 2014………………………………………………………………........9

Figure 3: EBIT of Mainland China operations……………………………………………………......………………..10

Figure 4: EBIT margin of Mainland China operations…………………………………………………………….......11

Figure 5: Performance perception versus actual performance, 2014…………………………………....………...12

Figure 6: Performance perception versus actual performance by industry, 2014……………………………........12

Figure 7: Judgement about the ease of doing business in China by size of company and time in China...........14

Figure 8: Challenges for future business in Mainland China, 2012-2014……………………………………......…15

Figure 9: Key HR challenges, 2013-2014…………………………………..…………………………………………16

Figure 10: Top challenges in attracting and retaining expat talent in China, 2014…………………………......….17

Figure 11: Competitive pressure business outlook, 2010-2014, and competitor analysis by company, 2013-2014........................................................................................................................18

Figure 12: Competitive advantage by company type, 2013-2014…………………………………………....…….19

Figure 13: Business outlook for growth, 2008-2014, and outlook by time in China, 2014……………....………20

Figure 14: Business outlook for profitability, 2008-2014, and outlook by time in China, 2014………......………21

Figure 15: 'Golden Age' outlook, 2014………………….……………………………………….……………….........22

Figure 16: 'Golden Age' outlook by industry, 2014…………………..……………………..………......…………….22

Figure 17: The role of China for European companies………………………………………......…………..………24

Figure 18: Permanent positions in China, 2010-2014………………………………………………………....…….25

Figure 19: Cost cutting plans, 2013-2014, and reasons, 2014…………………………………………….…....….26

Figure 20: Ranking of China as a new investment destination, 2011-2014……………………………….....……26

Figure 21: Expansion plans of China operations, 2013-2014………………………………………………....……27

Figure 22: Means of expansion, 2013-2014…………………………………………………………….....…………32

Figure 23: Expansion to other PRC provinces………………………………………………………………....…….32

Figure 24: Investment opportunities outside of China, 2014……………………………………………..…....……33

European Chamber

5

Figure 25: Future investment plans, 2013-2014, and investment destinations outside of China, 2013-2014…...........................................................................................................................34

Figure 26: Treatment of foreign-invested companies by the government, 2014………………....……………….36

Figure 27: Regulatory obstacles when doing business in China, 2013-2014………………………………....…..37

Figure 28: The effectiveness and enforcement of written laws and regulations, 2010-2014…………....………38

Figure 29: Analysis of missed business opportunities, 2012-2014……………………………………........………39

Figure 30: Importance of the Third Plenary Reforms, 2014……………………………………………......………..40

Figure 31: Implementation of Third Plenary Reforms, 2014…………………………………………………......…..40

Figure 32: China (Shanghai) Pilot Free Trade Zone, 2014………………………………......………………………41

Figure 33: Replacement of the business tax by a value-added tax, 2014…………………………....…………...42

Figure 34: Requirements for China's economic development, 2012-2014 and for the relationship with the West, 2014...................................................................................................…42

Figure 35: Impact of reforms on investment plans, 2014…………………………………………....………………44

Figure 36: The impact of greater market access, 2014……………………………………………......……..………44

Figure 37: Industry breakdown of respondents, 2014……………………………………………....……………….49

Figure 38: Breakdown of respondents' total revenues in China, 2014……………………………………....…….50

Figure 39: Breakdown of respondents' total employees in China, 2014……………………………....…………..50

Figure 40: Breakdown of respondents' operational presence in China, 2014………………………….....……….51

European Chamber

6 In partnership with

Pressures on both top-line and bottom-line growth have led to a continued decline in the financial performance of European companies in China:

• The proportion of companies reporting year-on-year increased revenues continued to decline from 78% in FY 2010, 75% in FY 2011 and 62% in FY 2012 to just 59% in FY 2013.

• Likewise, there was a continued decline in the proportion of profitable companies, from 74% in FY 2010 to just 63% in FY 2013.

• Some 63% of companies also failed to increase their profit margins in FY 2013.• For the first time in the history of this survey, more companies noted that their Chinese profit margins were lower

than their companies’ global averages than vice versa.

Business is tough and is getting tougher. A number of persistent market challenges are becoming entrenched and show little sign of abating:

• 68% of large companies stated that business in China has become more difficult over the last two years.• A Chinese economic slowdown surpassed rising labour costs as the number one perceived challenge for future

business in China.• Competitive pressure continues to be a steadily growing challenge. SOEs are perceived to have increased their

strengths relative to their competitors over the last year and, as such, the proportion of European companies that view SOEs as their main competitor is increasing.

A new sober reality is developing. An abiding sense of pessimism for future performance is setting in, which is leading many to question whether the good times have ended:

• Growth expectations are at their lowest levels since the peak of the financial crisis, with only 68% of companies optimistic about growth in their sector over the next two years.

• A general gloom about profitability prospects has continued, with only 31% of companies optimistic about profitability in their sector over the next two years.

• Almost half (46%) of European companies believe that the ‘golden age’ for multinational companies in China has already ended.

China will continue to remain a strategic market, but European firms are adapting to the new reality by setting more modest expectations for the Chinese marketplace. This in turn is leading many companies to scale back their investment plans and to ‘look over the fence’ to see what opportunities exist outside of China:

• Only 21% of companies ranked China as their top global destination for new investments, a drop from 33% just two years ago.

• Only 57% plan to expand their current China operations in the short-term, down from 86% just one year ago.• Likewise, the proportion of companies intending to engage in M&A in China in the short term plummeted from

41% last year to just 17%.• The number of companies considering expanding operations to other provinces dropped to 45% from 69% in

2012.• Almost half of the European companies surveyed (48%) regularly review investment opportunities outside of

China but still within the Asia region.

European companies still perceive themselves to be discriminated against in the Chinese marketplace. It is estimated that European companies that are members of the European Chamber missed out on EUR 21.3 billion in revenues in FY 2013 due to market access and regulatory barriers. Although there is careful acknowledgement of some positive policy developments, European firms remain sceptical and are yet to be convinced that real change is afoot:

• Over half of European companies (55%) perceive foreign-invested enterprises to receive unfavourable treatment compared to domestic enterprises, whereas only 11% perceive the opposite to be true.

• An unpredictable legislative environment is regarded as the most significant regulatory obstacle to doing

EXECUTIVE SUMMARY

European Chamber

7

business in China.• Increased rule of law and transparent policy-making continues to be ranked first as the driver deemed most

significant for China’s future economic performance, a position it has maintained ever since it was introduced as an option in this survey.

• Just over half of European companies (53%) are confident that China’s leaders will start meaningful implementation of the reforms outlined in the Decision of the Third Plenum of the 18th Central Committee (Third Plenum Decision) in the coming one to two years.

Were the authorities to ‘practice what they preach’ and implement meaningful reforms, especially administrative and market-access related ones, European companies are prepared to re-intensify their investment. However, despite the importance of, and exuberance surrounding, the Third Plenum―with only 26% of European companies more likely to increase investment due to the reform agenda as iterated in the Third Plenum Decision―it still fails to garner the confidence and commitment of European companies to the same extent that actual market access opening would bring. More than half (55%) of European companies would be more likely to increase investment if greater market access were afforded to foreign companies. In this regard, the European Chamber’s annual Position Paper remains the best source for understanding the reforms that would increase the confidence of European business in China.

European Chamber

8 In partnership with

1 FINANCIAL PERFORMANCE CONTINUES TO MARGINALLY DECLINE

The Chinese economy continued to slow over the past year and this is reflected in the financial performance of European companies. Pressure on both bottom-line and top-line growth continues and the financial results of European companies in China have declined following the markedly poorer performance witnessed last year:

• Fewer companies reported increased revenue.• Fewer companies reported profits, with less than half the companies reporting EBIT growth.• For most companies EBIT margins did not grow and are now lower in China than global averages.

The perception that companies hold of their performance is generally in line with their actual financial performance. Yet there are some discrepancies in specific industries; a few industries are more pessimistic than one would expect from their financial results and vice-versa.

The financial performance of European companies suggests that achieving financial targets in China has become more challenging, particularly for those companies that have been doing business in China for several years and have more substantial revenue bases and expectations about their performance.

1.1 Slowing revenue growth

Decreasing revenue growth

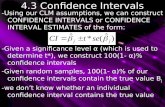

Continuing a downward trend that started in FY 2010―after a recovery from the poor financial results of FY 2009―there were again fewer companies that reported an increase in revenue this year. In particular, China ‘veterans’, i.e. companies that have been doing business in China for over five years, are driving this downward trend:

16%12% 9%

20%22%

27%

16% 18%

23% 29%

31%32%

30%

37% 39%

40% 36%

45%35%

20%41% 36%

22% 23%

7%9%

2014

3%

2013

4% 1% 5%

2009

2%3%

2010 201220112008

2%1% 3%11% 8%

28%30% 28%

22%

36% 39%

42%

19% 20%

7%

6-10 years

4%4%

> 10 years<5 years

0%

Figure 1: Historic revenue performance, 2008-2014 and performance by time in China, 2014 Question: How did the total Mainland China revenues of your company evolve year-on-year?

Increased substantially (> 20%) Decreased substantially (> 20%) Remained the same (+/- 5%) Increased (5-20%) Decreased (5-20%)

N=376 N=262 N=224 N=452 N=453 N=67 N=140

by time in China, 2014:

N=246 N=233N=207

European Chamber

9

Revenue performance for the past year was comparatively similar across the main sectors:• 61% of companies in the consumer goods & services industries reported an increase or significant increase in

revenue, which was slightly better than the 58% of companies in the professional services and industrial goods & services sectors.

Stronger differences in revenue performance can be found when looking at specific industry sub-sectors:• Automotive and auto component companies achieved the highest revenue growth over the past year, with 79% of

companies reporting increased or substantially increased revenue.• The medical devices & other healthcare sector, which comprises a mix of manufacturing and service companies,

saw 76% of companies reporting an increase or substantial increase in revenue.• The machinery sector reported the third-highest revenue growth, with 64% of companies reporting increased

revenues.• The two main service industries in our survey—financial services and (non-legal) professional services companies—

ranked only number five and six respectively in the breakdown into nine sectors with regard to revenue growth performance, with only 60% and 57% of companies reporting an increase of revenue in FY 2013.

• The revenue performance of companies in some highly-regulated sectors, often characterised by manufacturing overcapacity, such as the utilities & energy, petrochemicals & chemicals and transportation sectors, was expectedly disappointing.

• The number of companies that reported an increase in revenues has continued to decline year-on-year, from 78% in FY 2010; 75% in FY 2011; 62% in FY 2012; and finally to just 59% in FY 2013.

• Almost one third (29%) of companies reported stable revenues; one of a number of indications that the blockbuster years of Chinese growth are behind us.

• 42% of companies that have been in China for less than five years reported that their revenue has increased substantially, while only 20% of veteran companies that have been in China for over ten years were able to substantially increase their revenues. However, this can be partly explained by the fact that these younger companies are growing from a lower base than the veterans.

Revenue performance fairly stable across main sectors, but varies considerably by industry

Figure 2: Revenue performance by industry, 2014

10% 15% 13% 14%16% 20%24% 32% 25% 26% 40% 36% 44%

42% 40%32% 25% 29% 32%

33% 32%44%37% 36% 32% 36% 31% 25%

13% 14%

9% 6%4%3%

3%

Chemicals & petroleum

6%

Transportation, logistics & distribution

5%

Utilities, primary energy & other commodities

Financial services (incl. insurance)

4%

Agriculture, food & beverage

4%

Machinery Medical devices & other healthcare

4%

Automotive & auto- components

3%

(Non-legal) professional services

1%

decreased substantially (>20%) decreased (5-20%) remained the same (+/-5%) increased (5-20%) increased substantially (>20%)

N=38 N=25 N=34 N=28 N=48 N=68 N=15 N=22 N=18

9% 11% 8%

28% 30% 28% 35%

32% 33% 39%48%

29% 25% 19%

0%6%1% 10%Others Industrial

goods & services

2%

Professional services

Consumer goods & services

6%

N=151 N=105 N=166 N=31

by industry, 2014: by sector, 2014:

Question: How did the total Mainland China revenues of your company evolve year-on-year?

Note: For the industry analysis, only industries with N>14 are shown

European Chamber

10 In partnership with

From these results, we see a mixed picture of the dominance of manufacturing versus services in the economy. Some manufacturing industries are performing well while others are not. Services companies are in the middle of the performance curve. This suggests that China's efforts to create the environment and incentives to shift away from a manufacturing-based economy towards a more service-oriented one have yet to be fully realised.

1.2 Pressure on bottom-line growth

Fewer profitable companies and sluggish EBIT growth

The bottom lines of companies are also deteriorating:• The percentage of profitable companies has decreased year-on-year from 74% in FY 2010 to 63% in FY 2013. This

figure tallies with the proportion of companies reporting profitability at the start of the global economic crisis in FY 2008.

• Likewise, the number of companies reporting breakeven EBIT has increased from 16% in FY 2010 to 21% in FY 2013 and those with negative EBITs has increased from 11% in FY 2010 to 16% in FY 2013.

EBIT growth is continuing to slow, with more companies reporting stable EBIT performance and the number of companies recording substantial increases remaining low:• Less than half the companies (48%) were able to increase their EBIT in FY 2013, which does not show much uptick

from FY 2012 when just 43% of companies were able to increase their profits. The indication is that most companies are struggling to increase margins and that the average EBIT reported has only grown marginally since FY 2011 and has even declined for a not-insignificant number of companies.

• At the same time, an increasing number of companies are reporting stable EBIT performance: 36% reported a stable EBIT performance compared with only 22% in 2011, further indicating a growing entrenchment.

----------------------------------------------------------------------------------------------------------------------------------------------------------------Compared to the overall FY 2013 average, manufacturing industries had better EBIT performance than the consumer goods and services industries: for example, 74% of automotive & auto components companies reported a positive EBIT compared with 68% of (non-legal) professional services companies and 50% of companies in the agriculture, food & beverage segment.----------------------------------------------------------------------------------------------------------------------------------------------------------------

4 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY

DRAF

T

16% 21% 18% 13% 15% 16%

14%16% 23%

16% 14%20% 21%

70% 63% 58%74% 73%

64% 63%

11%

2014 2013 2012 2011 2010 2009 2008

Question: Please characterise the EBIT of your company in Mainland China last year. (2008-2014)

Source: Business Confidence Survey 2014, Roland Berger analysis

Question: How did your company's EBIT in China for last year compare to previous year's results? (2010-2014)

N=390 N=262 N=224 N=452 N=453

Negative Break-even Positive

N=210 N=230

13%10%

16% 11%

37%

22%23%

35%36%

29%

39%37%

29% 34%

14%32% 27%

14% 14%

7% 3%

2010

4%

2012 2011

3%

2013

5% 4%

2014

N=452 N=453 N=390 N=262 N=224

Remained the same (+/- 5%)

Decreased (5-20%) Decreased substantially (> 20%) Increased (5-20%)

Increased substantially (> 20%)

Figure 3: EBIT of Mainland China operations

updated

European Chamber

11

Margins are tighter than worldwide averages

The same trend towards less growth intensity is seen in reported EBIT margins:• The EBIT margins of nearly half (45%) the companies remained unchanged compared to last year, while just 37% of

companies stated that their margins have increased.

EBIT margins in China are now slightly lower than global averages:• 38% of companies stated that Mainland China EBIT margins are the same as their company's worldwide average,

up from 29% in 2011.• Only 30% of companies stated that their Mainland China EBIT margins are better than their company’s global

average, compared to 42% in 2012. A higher figure (33%) noted that their Chinese margins are lower than their global average.

This is the first time in the history of this survey that more companies noted that their EBIT margins in China are lower than their global average than vice versa, after having reached parity in FY 2012. This shows that the Chinese marketplace is becoming much tighter, with fewer opportunities for easy profits and supersized growth. Despite this, almost half the companies (47%) noted that their market share had increased over the past couple of years, compared to just 14% that stated that they lost market share in this time. This likely shows that companies are strategically aiming to grow market share at the expense of their EBIT margins to edge out weaker competitors.

1.3 Overall performance perception in line with financials but discrepancies seen in some industries

Perception is in line with financials:

Figure 4: EBIT margin of Mainland China operations Question: How did your company's EBIT margin in China for FY 2013 compare to FY 2012 results?

Question: How did the EBIT margins of your Mainland China operations compare to your company's worldwide margins in the past year? (2010-2014)

4%

2014

45%

26%

11%

14%

Increased (5-20%)

Decreased (5-20%)Remained the same (+/- 5%)

Decreased substantially (> 20%)

Increased substantially (> 20%)

N=451

34% 30% 29% 34% 33%

29% 37%29%

34% 38%

37% 33%42%

33% 30%

2013201220112010 2014

Same as company average worldwide Better than company average worldwide Lower than company average worldwide

N=389 N=262 N=224 N=450 N=453

European Chamber

12 In partnership with

6 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY

DRAF

T

Figure 5: Performance perception versus actual performance, 2014 Question: How does your company view its performance in the China market?

N=552 N=453 N=453

PERFORMANCE PERCEPTION EBIT REVENUE

content and very content

positive 63% increased substantially and increased

59% 60%

average break-even 21% unchanged 29% 26%

discontent and very discontent

negative 16% decreased and decreased substantially

12% 14%

Source: Business Confidence Survey 2014, Roland Berger analysis

✓

✓

✓

good/very good medium bad/very bad

~

~

~

✓ Performance matches perception

7 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY D

RAFT

Figure 6: Performance perception versus actual performance by industry, 2014 Question: How does your company view its performance in the China market?

AUTOMOTIVE MEDICAL DEVICES & OTHER HEALTHCARE AGRICULTURE, FOOD & BEVERAGE

(NON-LEGAL) PROFESSIONAL SERVICES MACHINERY

TRANSPORTATION, LOGISTICS & DISTRIBUTION

CHEMICALS & PETROLEUM FINANCIAL SERVICES (INCL. INSURANCE)

UTILITIES, PRIMARY ENERGY & OTHER COMMODITIES

good/very good medium bad/very bad

Note: Answer options were adjusted in order to make the results of the three questions comparable

Source: Business Confidence Survey 2014, Roland Berger analysis

Perception Revenue EBIT 79% 74% 83%

16% 11% 8%

6% 16% 10%

> < ~

Perception Revenue EBIT

Perception Revenue EBIT

57% 68% 64%

26% 21% 27%

16% 12% 8%

~ > <

44% 61% 54%

44% 28% 29%

12% 11% 17%

~ ~ >

Perception Revenue EBIT 76% 64% 69%

20% 24% 23%

4% 12% 8%

~ ~ ~

Perception Revenue EBIT

Perception Revenue EBIT

64% 74% 63%

24% 9% 21%

12% 18% 16%

< ~ ~

60% 65% 48%

25% 23% 37%

14% 13% 15%

< > >

Perception Revenue EBIT 61% 50% 67%

32% 32% 23%

8% 18% 10%

> < ~

Perception Revenue EBIT

Perception Revenue EBIT

46% 59% 61%

36% 27% 21%

19% 14% 18%

> < ~

46% 67% 46%

40% 20% 27%

13% 13% 27%

~ ~ >

✗ ✗

✗ ✗

✗

✗

✗ ✗ ✗

✗

✗ ✗

✗ ✗

✓

✓

✓ ✓

✓ ✓

✓ ✓

✓

✓

✓

✓ ✓

✓ Performance matches perception ✗ Performance is better or worse than perception

Note: Answer options were adjusted in order to make the results of the three questions comparable

When looking at cross-industry data, the performance perception of companies is in line with the reported financial performances: for example, 60% of companies were content or very content with their performance, which roughly matches the 59% of companies that reported that their revenue increased or increased substantially and the 63% of companies that reported positive EBIT.

Performance misperceptions seen for some industries

On the other hand, when comparing the actual performance and performance perception for individual industries, several discrepancies can be seen:

European Chamber

13

• The most extreme example of an industry that has a more negative perception than would be expected by looking at financial performance data alone is the financial services sector: only 48% of financial services companies perceived performance to be good or very good, while 60% reported an increase or substantial increase in revenue and 65% reported a positive EBIT. This is likely because European banks are building from a low base. Foreign banks, due to market access constraints, only account for approximately 2% of the entire marketplace in which Chinese banks continue to post massive profits.

• Automotive companies, in contrast, have a positive perception compared to actual financial results: 83% perceived performance as good or very good, while only 79% reported an increase or substantial increase in revenue and only 74% reported positive EBIT. This is likely a reflection of the relative performance of European manufacturers compared with their domestic peers. Automobile manufacturers, although restricted to operating in non-majority shareholding joint ventures with Chinese firms, continue to perform better on average than their wholly Chinese-owned competitors. European companies attribute their performance in China to their better use of technology over local brands as well as brand advantages, particularly given European brand histories and cachet among Chinese consumers.

European Chamber

14 In partnership with

9 BCS_Figures for report_FV_updated2.pptx

PREL

IMINA

RY DR

AFT

Figure 7: Judgement about the ease of doing business in China by size of company and time in China, 2014 Question: How has doing business in China for your company developed over the last couple of years?

Source: Business Confidence Survey 2014, Roland Berger analysis

by number of employees:

2014

9%

39%

51%

N=552

Business has become easier About the same Business has become more difficult

45%34%

28%

43%60% 68%

12%

>1,000

3%

251-1,000

6%

<250

N=338 N=94 N=120

20%

52%44%

28%45%

61%

11%

33%

>10 years

5%

6-10 years < 5 years

N=83 N=170 N=299

by time in China:

mistake not from RB ppt

2 SOBER NEW REALITY: PERSISTENT MARKET CHALLENGES ARE NOT EASING UP AND OPTIMISM IS WANING

Business in China is already tough, and it is getting tougher. European companies face a sober new reality from several persistent and deepening market challenges, including:

• A Chinese economic slowdown;• Rising labour costs;• Difficulties in attracting and retaining talent; and• Fierce competition from both privately-owned enterprises (POEs) and state-owned enterprises (SOEs).

These challenges present no surprises. They are the same operational challenges that European companies identified in last year’s survey as most impacting business. The business outlook for growth and profitability suggests that these challenges are becoming entrenched and are here to stay. Confidence about growth and profitability continues to decline, and an abiding sense of pessimism about future financial performance is increasingly taking hold among EU companies.

European companies are left wondering if the good times in China have already ended.

2.1 The usual challenges, but more intense

Business is more difficult

European Chamber

15

Note: For each challenge, participants were able to select between 4 answer options. Shown percentages representparticipants that selected the 'significant' answer option.

10 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY D

RAFT

Figure 8: Challenges for future business in Mainland China, 2012-2014 Question: Please indicate how significant you perceive the following challenges to be to your future business in Mainland China?

Source: Business Confidence Survey 2012-2014, Roland Berger analysis

N=552

Note: For each challenge, participants were able to select between 4 answer options. Shown percentages represent participants that selected the "significant" answer option

ANSWER 2012 2013 2014 Trend (2012-2014)

Chinese economic slowdown 65% 62% 61% Rising labour costs 63% 63% 56% Attracting & retaining talent n/a n/a 55% Market access barriers n/a 54% 52% Ambiguous rules & regulations n/a n/a 52% Discretionary enforcement of regulations 44% 47% 50% Global economic slowdown 62% 58% 50% Competition from domestic POEs 48% 51% 48% Lack of sufficient and qualified talent n/a 48% 46% Competing against non-compliant competitors n/a n/a 39%

N=586 N=557

Companies believe that business has become more difficult:• Over half the companies (51%) stated that business has become more difficult over the last couple of years and

only 9% stated that business has become easier.

Large companies in particular find business more difficult these days:• 68% of companies with more than 1,000 employees in China stated that business has become more difficult.• In contrast, only 43% of companies with fewer than 250 employees perceived business as having become

harder.

On average, veterans also find business tougher than newcomers:• 61% of companies that have been in China for more than ten years stated that business has become more

difficult, while only 5% stated that it has become easier for them.• In contrast, only 28% of companies that have been in China for less than five years stated that business has

become more difficult and 20% stated it has become easier.

These findings are in line with the revenue results from Chapter 1: as presented in Figure 1, the percentage of newcomers able to increase revenues substantially was double that of veterans. However, the fact that veterans with over ten years of experience in China markedly perceive the business environment to have become tougher is particularly telling because of the longer memory time span that these companies possess. It means that these results likely reflect a more general observational trend over a number of years that business is increasingly becoming tougher.

----------------------------------------------------------------------------------------------------------------------------------------------------------------Legal companies, in particular, mentioned that business has become more difficult, with 62% of companies making that claim. In contrast, machinery, transportation and automotive companies had easier times with merely 42%, 43% and 45% of companies stating that business has become more difficult.----------------------------------------------------------------------------------------------------------------------------------------------------------------

The Chinese economic slowdown is the top future business challenge

European Chamber

16 In partnership with

11 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY

DRAF

T

Source: Business Confidence Survey 2013-2014, Roland Berger analysis

Figure 9: Key HR challenges, 2013-2014 Question: What is the top HR challenge you face?

N=551

10% 10%

8% 12%

14% 12%

33% 28%

24% 31%

6%8% 2%

2014 2013

1%

Rising labour costs

High staff turnover

Other

Talent shortage

None

Long training period needed to be fully efficient Difficulty in convincing good canditates to join

N=552

mistake not from RB ppt

The Chinese economic slowdown was ranked as the number one challenge for future business in China, surpassing last year's top identified challenge, which was rising labour costs:

• 61% of companies indicated that they perceived a Chinese economic slowdown as a significant challenge going forward.

• While rising labour costs is still considered a key challenge, only 56% considered this a significant challenge going forward. This is lower than last year, when 63% stated that rising labour costs were a significant challenge for future business.

Another key challenge going forward is the attraction and retention of talent, which was ranked number three and regarded as significant by 55% of companies. Notably, the global economic slowdown has become less of a concern. It has dropped over the past three consecutive years and is now regarded as just the seventh most significant challenge for future business. China's economic health seems to be a more important driver for most European companies' success than the global economy, supporting another data point that an increasing number and vast majority (76%, up from 56% in 2011) of European companies are 'in China for China'.

Top HR challenges continue to be rising labour costs and a talent shortage

The two main HR challenges identified by EU companies for two years in a row have been rising labour costs and talent shortage, but the order reversed this year. The reversed order suggests that companies are fairing better at finding talent but have had to pay more for it:

• 31% stated that their top HR challenge was rising labour costs in FY 2013, compared to 24% in FY 2012.• A talent shortage was ranked as the second most significant HR challenge, identified as the top challenge by

28% of companies this year compared to 33% last year.

European Chamber

17

12 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY

DRAF

T

Question: What are the biggest challenges you face in ATTRACTING the right expat talent in China?

Figure 10: Top challenges in attracting and retaining expat talent in China, 2014 Question: What are the biggest challenges you face in RETAINING the right expat talent in China?

Source: Business Confidence Survey 2014, Roland Berger analysis

Note: For this question, participants had to select their top three challenges; Percentages represented are the sum of percentages from top 1- top 3 challenges

68% Air quality issues

62% Lack of willingness to be assigned to China

56% Too high expectations on salary / package

25% Schools for children

27% Career opportunities not seen as promising

2014

N=310

64% Air quality issues

59% High expectations for expat packages

35% High expectations in pay / benefits

25% Schools for children

29% Employees not seeing promising career prospects

2014

N=232

mistake not from RB ppt

Air pollution surfaced as the key challenge for attracting and retaining expat talent in China this year:• 68% of companies stated that air quality issues are one of the top three challenges for them to attract expat

talent in China.• Likewise, 64% reported that air quality issues are one of the top three challenges for them to retain the right

expat talent in China.

In addition to the impact of air pollution on recruitment, almost one third (27%) of companies believe that air pollution is also contributing to higher HR costs, as companies need to compensate employees to move to polluted cities and need to take other steps to respond to employee concerns.

----------------------------------------------------------------------------------------------------------------------------------------------------------------Beijing- and Nanjing-based companies, in particular, regard air quality as one of the top three challenges for attracting the right expat talent to China: 68% of companies in Beijing and 71% of companies in Nanjing stated this. In contrast, only 39% of companies in the Pearl River Delta and 58% of companies in Southwest China mentioned air quality as a key recruitment problem. Shanghai was slightly below the overall average, with 61% of companies regarding it as a top challenge.----------------------------------------------------------------------------------------------------------------------------------------------------------------Nearly two thirds of companies have taken steps to address employee concerns about air pollution, including 27% of companies that have installed air purifiers at the office, 21% that have provided employees with masks, 5% that have implemented a work-from-home policy and 6% of companies that have even increased the pay of employees. ----------------------------------------------------------------------------------------------------------------------------------------------------------------

Note: For this question, participants had to select their top three challenges. Percentages represented are the sum ofpercentages from top 1 to top 3 challenges.

Air pollution is further aggravating HR difficulties

European Chamber

18 In partnership with

Competitive pressure has been a continuously growing challenge for European companies in China for several years and it shows no sign of abating:

• 38% of companies are pessimistic about the effect of competitive pressure on the business outlook in their sector. This number is in line with last year's results and up from 33% in FY 2011.

• A stable and low 14% of companies are optimistic with regard to easing competitive pressure in the future, which is the same as it was in FY 2010 but down from 16% in FY 2011.

Private companies are the main competitors, but the threat from SOEs is re-emerging

Chinese privately-owned enterprises (POEs) continue to be the number one competitor in China, but the challenge from state-owned enterprises (SOEs) is increasing:

• Some 49% of companies reported that POEs were their most significant competitor in FY 2013, a similar figure to FY 2012.

• The relative percentage of companies viewing SOEs as their most significant competitor has increased from 30% in FY 2012 to 36% in FY 2013. This perceived strengthening of SOEs may be an effect of consolidation in many industrial sectors in China, in which SOEs have absorbed many weaker companies.

----------------------------------------------------------------------------------------------------------------------------------------------------------------Industries have different takes when asked about their most formidable competitor: while the utilities, financial services and transportation industries clearly state that SOEs are their most significant competitors, professional services, medical devices and legal industries reported that POEs pose the greatest competitive challenge. Other industries, including the chemicals, automotive, machinery and agriculture, food & beverage sectors are somewhat in the middle, but slightly more fretful about POE competition.----------------------------------------------------------------------------------------------------------------------------------------------------------------

13 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY

DRAF

T

Question: How would you describe the business outlook for your sector in China in terms of competitive pressure within the next two years?

Figure 11: Competitive pressure business outlook, 2010-2014, and competitor analysis by company, 2013-2014

Question: Which type of company do you see as your most significant competitor in China?

Source: Business Confidence Survey 2010-2014, Roland Berger analysis

43% 40% 33% 38% 38%

43% 44% 46% 44% 47%

14% 15% 16% 16% 14%

2014

1%

2013

2%

2012

5%

2011

2%

2010

0%

N/APessimisticNeutralOptimistic

N=450 N=596 N=557 N=598 N=552

19%

51% 49%

30% 36%

15%

20142013

N/APOESOE

N=604 N=552

Competitive pressure continues to intensify

European Chamber

19

Clearly, POEs and SOEs have different areas of competitive advantage, but SOEs are believed to have mostly increased their strengths relative to their competitors over the past year:

• POEs are stronger in marketing & sales and pricing.• SOEs have a competitive advantage in governmental relations, access to subsidies/tax incentives, access to

financing and economies of scale. They are also perceived to have increased their strengths in all of these areas relative to their competitors over the last year.

It could be regarded as surprising that SOEs increased their strengths in many areas in which they are already perceived to have an unfair advantage, for example, in terms of governmental relations and access to subsidies, tax incentives and financing, in a year in which the government noted that the market should take a more decisive role in allocating resources. However, this tallies with the concerns that many European companies hold that the hand of SOEs has been strengthened. They see that already powerful SOEs are gaining in strength as their sectors consolidate. This development is supported by the Chinese Government, which often aims to build strong local companies for each industry instead of supporting smaller ones.

----------------------------------------------------------------------------------------------------------------------------------------------------------------To counter growing competition and reinforce their strengths, the number one investment priority for European companies is marketing & sales, followed by management efficiency and brand recognition. ----------------------------------------------------------------------------------------------------------------------------------------------------------------

14 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY

DRAF

T

Source: Business Confidence Survey 2014, Roland Berger analysis

Figure 12: Competitive advantage by company type, 2013-2014 Question: In each of the following areas, which type of company do you perceive holds the greatest competitive advantage?

European Company N/A Privately-owned enterprise

State-owned enterprise

5% 2% 6% Governmental relations 3% 5% 91% 87% 1%

6% 68% 12% Brand recognition 5% 10% 16% 14% 69%

11% 3% 17% Access to subsidies / tax incentives 10% 16% 70% 68% 5%

8% 6% 16% Access to financing 9% 11% 77% 71% 3%

8% 36% 39% Marketing and sales 8% 38% 19% 17% 35%

8% 8% 56% Pricing 6% 57% 32% 28% 5%

5% 83% 8% Product quality, variety and innovation 6% 9% 3% 4% 81%

13% 20% 21% Economies of scale 11% 20% 50% 46% 19%

9% 62% 14% HR management and ability to attract top talent

9%

16%

18%

16%

56%

2013 2014 Trend

N=552

2013 2014 Trend 2013 2014 Trend 2013 2014

updated "privately-owned enteriprise"; "Pricing" misalignment not from RB ppt

Each has its own distinct competitive advantage

European Chamber

20 In partnership with

Most companies see growth ahead, but a lower percentage than in the past:• The number of companies optimistic about future, short-term growth in their sector now stands at just 68%. Although

this number is still substantial when viewed in isolation, it represents a steady decline from 79% in FY 2010. • The number of companies that have a neutral view about growth has increased from 17% in FY 2010 to 27% in FY

2013, meaning that more than one third (27% + 5%) of companies believe that growth in their sectors will remain stagnant or decline over the next two years.

The necessary reforms that China has identified to rebalance its economy are growth detracting in the short term. As such a projected decline in growth should not necessarily be regarded as negative if this sentiment is based upon expectations for reform. However, as will be seen in the fourth section of this report, European companies show mixed expectations and a general scepticism about whether the necessary reforms will be meaningfully implemented in a timely fashion.

Newcomers are more optimistic than veterans:• 84% of companies that have been in China for less than five years are optimistic about growth, while only 60%

and 67% respectively of companies that have been in China for five to ten years and over ten years are optimistic, showing that veteran companies are generally much more pessimistic about growth outlooks.

----------------------------------------------------------------------------------------------------------------------------------------------------------------Industries have different levels of optimism with regard to growth: the most optimistic are medical device & other healthcare companies (88% are optimistic), followed by automotive & auto components companies (78%) and (non-legal) professional services (78%). Financial services firms are least hopeful with only 49% being optimistic about growth.----------------------------------------------------------------------------------------------------------------------------------------------------------------

15 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY

DRAF

T

by time in China, 2014:

12%27%

20% 17% 18% 22% 27%

83%65%

78% 79% 76% 71% 68%

6%3%3%8%

2012

3%

2011

1%

20092008

5%

2013 2014

1% 5% 2%

2010

N/APessimisticNeutralOptimistic

N=450 N=596 N=557 N=607 N=552N=207 N=233

34% 26%

84%60% 67%

6%

> 10 years

1%

6-10 years

6%

<5 years

1% 14%

N=83 N=170 N=299

Figure 13: Business outlook for growth, 2008-2014, and outlook by time in China, 2014 Question: How would you describe the business outlook for your sector in China within the next two years in terms of growth?

Source: Business Confidence Survey 2010-2014, Roland Berger analysis

2.2 Future outlooks reflect an entrenchment of the general downward trend

Growth expectations are at the lowest levels since the peak of the global economic crisis five years ago

European Chamber

21

Pessimism about profitability prospects has continued this year:• Less than one third of companies (31%) have an optimistic view about profitability, similar to the figure from FY

2012―the lowest level of optimism for profitability in this survey’s ten-year history―and down from nearly half (47%) in FY 2007.

• At the same time, the number of companies with a neutral perspective has increased from 35% in 2008 to 51% this year.

This seems to indicate an expectation that the business environment will continue to remain very tight and that companies are adjusting their expectations to this sober new reality.

In line with Figure 13, veterans are less optimistic than newcomers:• 39% of newcomers stated that they are optimistic about profitability compared to 29% and 30% of companies that

have been in China for more than five years and ten years respectively.• A mere 11% of veterans have a pessimistic view on profitability versus 22% and 15% of veterans.

----------------------------------------------------------------------------------------------------------------------------------------------------------------Optimism varies strongly among industries: agriculture, food & beverage companies are the most optimistic (42% of companies are optimistic), followed by automotive & auto-components companies (40%) and legal companies (33%). Transportation, logistics & distribution companies are the least optimistic (14%).----------------------------------------------------------------------------------------------------------------------------------------------------------------Optimism is overall quite low no matter which business area: a year-on-year unchanged 7% of companies are optimistic about labour costs and an unchanged 37% of companies are optimistic with regard to the productivity outlook.----------------------------------------------------------------------------------------------------------------------------------------------------------------

Profitability expectations remain in line with last year's pessimism

European Chamber

22 In partnership with

Companies are divided overall when asked if the 'golden age' for MNCs is over, but veterans are more inclined to believe so:• 54% of companies—regardless of size—believe that the 'golden age' for MNCs in China is not yet over. Of course

this also means that nearly half (46%) of companies believe that the 'golden age' has already come to a close.• Only 37% of companies that have been in China for less than five years think that the good times are over, while

48% of veterans that have been in China for more than ten years think the best times have ended.

A broad consensus across industries

Note: Only industries with N>20 are shown

2.3 Are the good times really over?

The 'golden age' for multinational companies (MNCs) in China might already be ending

European Chamber

23

The industry breakdown reveals broad consensus, although companies in the legal industry are conspicuously pessimistic:• 62% of companies in the legal industry believe that the 'golden age' is over. The most optimistic are machinery

companies with 58% of companies believing that the 'golden age' is not yet over, potentially reflecting the opportunities that still continue to exist in technological upgrading in China.

• The figures in all other industries closely resemble the industry average of 54%, believing that the 'golden age' is not yet over. This likely shows that we are currently in the midst of a highly uncertain period in China’s economic development and that opportunities are likely differentiated even across different product segments within the same industry sectors.

----------------------------------------------------------------------------------------------------------------------------------------------------------------More intense competition from local companies was cited as the key reason for why the 'golden age' is over:

• "Chinese multinational companies are rising and improving. They have caught up with foreign players in terms of brands, quality and know-how."

• "Competition from local companies is growing ever more intense in a lopsided playing field. China's cost advantage is eroding. [There is] No definite sign that 'domestic consumption' will become the next big growth engine for EU companies in China."

• "Rising costs and [the] maturity of domestic companies are the main reasons for why the 'golden age' is over."• "China doesn't need FDI as it did a few years ago."

----------------------------------------------------------------------------------------------------------------------------------------------------------------

Note: Quotations provided are from member companies in response to the question, "Why do you believe that the 'golden age' for multinational companies in China is over?"

European Chamber

24 In partnership with

3 MORE MODEST EXPECTATIONS AND REVISED INVESTMENT PLANS

The importance and role of China for European companies is changing: China is still critical for global revenue generation and continues to be strategically important, but plans and actions suggest that European companies in China are developing more modest expectations:• An increasingly lower percentage of companies over the past four years deem China to be growing in strategic

importance.• The expansion of the number of permanent positions at companies is slowing.• Cost-cutting plans continue.

China no longer seems to be seen as the saviour and companies have further reduced their investment ambitions:• Fewer companies consider China as a top priority for investment.• Fewer businesses are considering expanding current operations.• Fewer firms are interested in M&A opportunities.• Fewer companies are looking to expand to other provinces.

Companies are wary of placing all their bets on China and are 'looking over the fence' to see what neighbouring countries have to offer, either to complement what they are doing in China or to replace it. 3.1 The changing role of China for European companies

China is still a key market for Europeans, although the proportion of companies that regard China as an increasingly important market continues to slide

20 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY

DRAF

T

Question: What proportion of your global revenues was generated in Mainland China in the last year? (2010-2014)

Figure 17: The role of China for European companies Question: How would you currently characterise the importance of China in your company's overall global strategy compared to last year? (2011-2014)

19% 26% 26% 26% 29%

10% 11% 12% 10%23%17% 21% 23% 20%

45% 40% 35% 32% 31%

9%8%

2014

7%

2013 2012 2011

7%

2010

6% 7%

N=342 N=246 N=224 N=545 N=453

11-15% 16-25% < 5% 5-10% > 25%

18% 23%30% 36%

79% 74% 64% 59%

2014 2013

3%

2012

6% 5%

2011

3%

N=443 N=557 N=600 N=552

Same level of importance Increasingly important Declining in importance

Source: Business Confidence Survey 2014, Roland Berger analysis

updated

European Chamber

25

Companies are still investing in people, but are also increasingly keeping the same amount of permanent positions, too:• In 2014, 48% of companies stated that they increased the number of permanent positions while 61% did so in 2012.• 31% stated that they are expecting the number of permanent positions to stay the same over the next two years,

while only 20% said so two years ago.

----------------------------------------------------------------------------------------------------------------------------------------------------------------A key driver for why headcount has remained relatively stable is the recent revenue slowdown: while 36% of companies stated that they significantly increased their revenue in 2012, only 22% and 23% did so in 2013 and 2014. As a result, companies significantly increased their headcount in 2012 but comparatively less so in 2013 and 2014.----------------------------------------------------------------------------------------------------------------------------------------------------------------

Mainland China continues to be critical for global revenue generation:• The number of companies that generated 10% or more of their global revenue in China has increased over the

past five consecutive years and is up to 48% in FY 2013 from 32% in FY 2009.• Likewise, fewer companies generated less than 5% of their global revenues in China; down from 45% in FY

2009 to 31% in FY 2013.

As the world’s second-largest economy with a fast-expanding consumer market, China will almost certainly remain very important for European companies. Many of these companies are already highly reliant upon the Chinese marketplace for significant portions of their global revenues and will therefore continue to invest to try to maintain their positions and grow.

Despite this, there is a notable downward trend relating to the growing strategic importance of China in the overall global strategies of companies:

• Only 59% of companies ranked China as increasingly important in FY 2013. This represents a drop of 20% compared to 79% in FY 2010.

Companies continue to invest in people but a downward trend continues

European Chamber

26 In partnership with

More companies plan to cut costs

22 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY

DRAF

T

Question: Do you plan on making cost cuts in China this year?

Figure 19: Cost cutting plans, 2013-2014, and reasons, 2014

Question: If yes, why?

Source: Business Confidence Survey 2013-2014, Roland Berger analysis

N=114 N=572

78% 76%

22% 24%

2013 2014

Yes No

N=552

45791114

172020

3140

4453

61

Other (please specify)

Reduce procurement cost

Reduce rental expenses

Subcontracting / outsourcing

Headcount reduction

Sell existing assets Reduce / cut further benefits for employees

Cancel planned assets investments

Relocate to a less-developed area of China

Localisation of staff

Reduce total compensation to employees

None of the above

Relocate to a country with lower cost profile Suspend plant activity

updated

23 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY

DRAF

T

Source: Business Confidence Survey 2014, Roland Berger analysis

8%9% 9% 13%

17%15% 19% 16%

34% 38%41% 43%

30% 24% 21%

7%9%8%

33%

2014 2013 2012

6%

2011

Not top 10 destination Top 10 destination Top 5 destination Top 3 destination Top destination

Figure 20: Ranking of China as a new investment destination, 2011-2014 Question: On a global basis, where does China rank as a destination for new investments for your company?

Tomorrow: Today:

N=595 N=556 N=554 N=552

11%17% 12%

19% 16%

44%46%

44% 48%

25% 30% 23% 20%

7%9%7%

2014

5%

2013

5%

2012

5%

2011

7%

N=595 N=496 N=464 N=552

A slightly higher percentage of companies plan on cutting costs in China this year:• In 2014, approximately one quarter (24%) of companies reported that they are planning to cut costs. This is a

slight increase compared to 2013 when 22% of companies stated an intention to cut costs, but still likely reflects the increased pressures on companies’ bottom lines.

• Cost cuts are planned mostly to reduce procurement costs, headcount and rental expenses.

3.2 Reducing investment ambitions

Fewer companies consider China as a top investment destination

European Chamber

27

24 BCS_Figures for report_FV_updated2.pptx

Figure 21: Expansion plans of China operations, 2013-2014 Question: Are you considering expanding your current China operations in the next year?

Source: Business Confidence Survey 2014, Roland Berger analysis

N=484

7%

2013

6%

86%

2014

18%

25%

57%

No Yes Not sure

16% 19% 20% 27% 25% 29%8% 13%19% 15% 27%

25%23% 29%

45%

48%79% 78%

65% 65% 63% 55% 50% 46% 45%24%

11%10%10%13%

Legal Machinery Transportation, logistics & distribution

Utilities, primary energy & other commodities

Financial services (incl. insurance)

(Non-legal) professional services

Medical devices & other healthcare

Agriculture, food & beverage

Automotive & auto-components

Chemicals & petroleum

N=24 N=40 N=31 N=26 N=73 N=71 N=22 N=28 N=38 N=21

Note: Only industries with N>20 are shown

N=552

by industry, 2014:

updated

Fewer companies consider China as a top destination for investment:• Only one fifth of companies (21%) stated that China was their top investment destination in FY 2013 compared

with one third (33%) two years ago.• Likewise, only 20% of companies ranked China as the top destination for future investments, a drop from 30%

just two years ago.

Substantially fewer companies are planning to expand current China operations

A significantly smaller percentage of companies are considering expanding their current China operations. However, strong differences exist between industry sectors:

• While over half (57%) stated that they plan to expand their current China operations, this is down considerably from the 86% who said the same just one year ago.

• Chemicals and automotive companies are driving expansion plans with 79% and 78% of companies planning to expand, while only 24% of companies in the legal industry plan to expand.

Note: Only industries with N>20 are shown

European Chamber

28 In partnership with

38%

FINANCIAL PERFORMANCE CONTINUES TO STEADILY DECLINE…> REVENUE & PROFITABILITY: > EBIT MARGINS:

of companies failed to increase profit margins

Chinese economic slowdown

> EASE OF BUSINESS:

51%

49%

2012

2013

…AND PERSISTENT MARKET CHALLENGES ARE NOT ABATING> TOP BUSINESS CHALLENGES:

> OUTLOOK ON COMPETITION: > MAJOR COMPETITORS:

COMPANIES IN CHINA ARE FACING A NEW SOBER REALITY…

…AND THIS IS GIVING THEM PAUSEOPTIMISM IS WANING….> POTENTIAL OF CHINA: > SHORT-TERM BUSINESS OUTLOOK:

…AND COMPANIES HAVE REVISED DOWN THEIR EXPECTATIONS AND INVESTMENT PLANS> TOP

INVESTMENT DESTINATION:

> EXPANSION OF OPERATIONS:

> M&A: > EXPANSION TO OTHER PROVINCES:

> INVESTMENT OPPORTUNITIES OUTSIDE CHINA:

READY WHEN YOU AREREFORMS PRESENT AN OPPORTUNITY> INCREASED

RULE OF LAW:> IMPLEMENTATION

OF REFORMS:> GREATER MARKET

ACCESS:

of companies reported increased revenues

of companies are profitable

2013

Rising labour costs

Attracting & retaining talent

of MNCs reported that business has become more difficult

of companies stated that POEs are their most significant competitor

30%

36%

2012

2013

of companies stated that SOEs are their most significant competitor

33%

2012

2013

38% of companies are pessimistic about competitive pressure

REGULATORY AND MARKET ACCESS ISSUES EXACERBATE CHALLENGES> TREATMENT OF COMPANIES: > REGULATORY OBSTACLES: > LOST REVENUE:

54%of companies regard the unpredictable legislative environment as one of the top 3 most significant obstacles

EUR

21.3bnin revenues are estimated to have been lost due to market access and regulatory barriers

76%

68%

2011

2013

of companies are optimistic about growth in their sector

34%

31%

2011

2013

of companies are optimistic about profitability

46%of companies believe that the 'golden age' for MNCs in China has ended

33%

21%

2011

2013

of companies ranked China their top destination for new investment

86%

57%

2011

2013

of companies plan to expand their current China operations

41%

17%

2011

2013

of companies are considering M&A

69%

45%

2011

2013

of companies are considering expanding operations to other provinces

48%

of companies are regularly reviewing investment opportunities outside of China but within Asia

71%of companies ranked 'rule of law & transparent policy-making' the #1 driver for future economic performance

47%of companies are unsure or not confident that China's leaders will start meaningful implementation of the 3rd Plenum reforms in the next one or two years, though 45% believe implementation would be good for them

of companies would be more likely to increase investment were more market access afforded to foreign companies

55%

For the first time in the history of the survey, more companies noted that their profit margins in China were lower than their company's global average.74% 64%73% 63%

2011

2012

2010

2013

55%of companies believe foreign-invested enterprises receive unfavourable treatment

78%75%

62% 59%

Note: All years shown in this centrefold are financial years

Business Confidence Survey 2014 Findings

European Chamber

29

38%

FINANCIAL PERFORMANCE CONTINUES TO STEADILY DECLINE…> REVENUE & PROFITABILITY: > EBIT MARGINS:

of companies failed to increase profit margins

Chinese economic slowdown

> EASE OF BUSINESS:

51%

49%

2012

2013

…AND PERSISTENT MARKET CHALLENGES ARE NOT ABATING> TOP BUSINESS CHALLENGES:

> OUTLOOK ON COMPETITION: > MAJOR COMPETITORS:

COMPANIES IN CHINA ARE FACING A NEW SOBER REALITY…

…AND THIS IS GIVING THEM PAUSEOPTIMISM IS WANING….> POTENTIAL OF CHINA: > SHORT-TERM BUSINESS OUTLOOK:

…AND COMPANIES HAVE REVISED DOWN THEIR EXPECTATIONS AND INVESTMENT PLANS> TOP

INVESTMENT DESTINATION:

> EXPANSION OF OPERATIONS:

> M&A: > EXPANSION TO OTHER PROVINCES:

> INVESTMENT OPPORTUNITIES OUTSIDE CHINA:

READY WHEN YOU AREREFORMS PRESENT AN OPPORTUNITY> INCREASED

RULE OF LAW:> IMPLEMENTATION

OF REFORMS:> GREATER MARKET

ACCESS:

of companies reported increased revenues

of companies are profitable

2013

Rising labour costs

Attracting & retaining talent

of MNCs reported that business has become more difficult

of companies stated that POEs are their most significant competitor

30%

36%

2012

2013

of companies stated that SOEs are their most significant competitor

33%

2012

2013

38% of companies are pessimistic about competitive pressure

REGULATORY AND MARKET ACCESS ISSUES EXACERBATE CHALLENGES> TREATMENT OF COMPANIES: > REGULATORY OBSTACLES: > LOST REVENUE:

54%of companies regard the unpredictable legislative environment as one of the top 3 most significant obstacles

EUR

21.3bnin revenues are estimated to have been lost due to market access and regulatory barriers

76%

68%

2011

2013

of companies are optimistic about growth in their sector

34%

31%

2011

2013

of companies are optimistic about profitability

46%of companies believe that the 'golden age' for MNCs in China has ended

33%

21%

2011

2013

of companies ranked China their top destination for new investment

86%

57%

2011

2013

of companies plan to expand their current China operations

41%

17%20

11

2013

of companies are considering M&A

69%

45%

2011

2013

of companies are considering expanding operations to other provinces

48%

of companies are regularly reviewing investment opportunities outside of China but within Asia

71%of companies ranked 'rule of law & transparent policy-making' the #1 driver for future economic performance

47%of companies are unsure or not confident that China's leaders will start meaningful implementation of the 3rd Plenum reforms in the next one or two years, though 45% believe implementation would be good for them

of companies would be more likely to increase investment were more market access afforded to foreign companies

55%

For the first time in the history of the survey, more companies noted that their profit margins in China were lower than their company's global average.74% 64%73% 63%

2011

2012

2010

2013

55%of companies believe foreign-invested enterprises receive unfavourable treatment

78%75%

62% 59%

Note: All years shown in this centrefold are financial years

Business Confidence Survey 2014 Findings

European Chamber

30 In partnership with

A Decade of the Business Confidence SurveyCOMMITMENT TO THE CHINESE MARKETIN CHINA FOR CHINA, GROWING WITH CHINA

THE RISE AND FALL OF PERFORMANCE AND OPTIMISMFINANCIAL PERFORMANCE

> REVENUE:

> PROFITABILITY:

KEY OBSTACLES

MEMBERSHIP AND PARTICIPATION GROWTHTHE BCS HAS GROWN WITH THE CHAMBER

# of European Chamber member companies

# of European Chamber member companies that participated in the BCS

OPTIMISM> BUSINESS

OUTLOOK

A DECADE OF REGULATORY CHALLENGES

IPR PROTECTION

China GDPRMB

18.5 tn

RMB26.6 tn

RMB34.1 tn

RMB47.3 tn

RMB56.9 tn

1) Percentage was adjusted to be comparable to the new question design

GDP Source: National Bureau of Statistics of China

1)

80%76%

50% 62% 59%75%increased revenues

77%70% 58% 64% 63%73%

profitable companies

2005

2005

2005

2007

2007

2007

2009

2009

2009

2011

2011

2011

2012

2012

2012

2013

2013

2013

95%

65%79%

71% 68%

#1

#2

#3

2005 2007 2009 2011 2013

Government regulation / transparency

Discretionary law

enforcement

Discretionary law

enforcement

Discretionary law

enforcement

Unpredictable legislative

environment

IPRprotection

Registration Processes

Registration Processes

Lack of coordination

among regulators

Discretionary law

enforcement

Licenses / Quotas

Local implementation

of national standards

IPRprotection

Local implementation

of national standards

Administrative issues

2005 2007 2009 2011 2013

15% 16%14%18%

23%

22%

34%29%38%

48%

31%29%36%35%

62%

2008

2008

2008

2010

2010

2010

2006 2008 2010 2012 201320112007 20092004 2005

considering expanding their current China operations

registered as a Wholly Foreign-Owned Enterprise

'in China for China'

reported that China isincreasingly importantin their firm's overallglobal strategy

rank China the top destination for new investment

optimistic about growth

optimistic about competitive pressure

optimistic about profitability

consider IPR protection a top three business challenge

consider the enforcement of China's IPR laws and regulations as adequate

2006

2006

2006

15% 16% 14%16%

29%

Pre-Crisis

Pre-Crisis

Pre-Crisis

Global Crisis

Global Crisis

New Sober Reality

New Sober Reality

New Sober Reality

Global Crisis

Note: All years shown in this centrefold are financial years

European Chamber

31

A Decade of the Business Confidence SurveyCOMMITMENT TO THE CHINESE MARKETIN CHINA FOR CHINA, GROWING WITH CHINA

THE RISE AND FALL OF PERFORMANCE AND OPTIMISMFINANCIAL PERFORMANCE

> REVENUE:

> PROFITABILITY:

KEY OBSTACLES

MEMBERSHIP AND PARTICIPATION GROWTHTHE BCS HAS GROWN WITH THE CHAMBER

# of European Chamber member companies

# of European Chamber member companies that participated in the BCS

OPTIMISM> BUSINESS

OUTLOOK

A DECADE OF REGULATORY CHALLENGES

IPR PROTECTION

China GDPRMB

18.5 tn

RMB26.6 tn

RMB34.1 tn

RMB47.3 tn

RMB56.9 tn

1) Percentage was adjusted to be comparable to the new question design

GDP Source: National Bureau of Statistics of China

1)

80%76%

50% 62% 59%75%increased revenues

77%70% 58% 64% 63%73%

profitable companies

2005

2005

2005

2007

2007

2007

2009

2009

2009

2011

2011

2011

2012

2012

2012

2013

2013

2013

95%

65%79%

71% 68%

#1

#2

#3

2005 2007 2009 2011 2013

Government regulation / transparency

Discretionary law

enforcement

Discretionary law

enforcement

Discretionary law

enforcement

Unpredictable legislative

environment

IPRprotection

Registration Processes

Registration Processes

Lack of coordination

among regulators

Discretionary law

enforcement

Licenses / Quotas

Local implementation

of national standards

IPRprotection

Local implementation

of national standards

Administrative issues

2005 2007 2009 2011 2013

15% 16%14%18%

23%

22%

34%29%38%

48%

31%29%36%35%

62%

2008

2008

2008

2010

2010

2010

2006 2008 2010 2012 201320112007 20092004 2005

considering expanding their current China operations

registered as a Wholly Foreign-Owned Enterprise

'in China for China'

reported that China isincreasingly importantin their firm's overallglobal strategy

rank China the top destination for new investment

optimistic about growth

optimistic about competitive pressure

optimistic about profitability

consider IPR protection a top three business challenge

consider the enforcement of China's IPR laws and regulations as adequate

2006

2006

2006

15% 16% 14%16%

29%

Pre-Crisis

Pre-Crisis

Pre-Crisis

Global Crisis

Global Crisis

New Sober Reality

New Sober Reality

New Sober Reality

Global Crisis

Note: All years shown in this centrefold are financial years

European Chamber

32 In partnership with

Organic growth is the most popular means of expansion, while M&A ambitions have declined:• 47% of companies reported an aim to expand through organic growth next year.• M&As were mentioned by just 15% of companies—a conspicuously low percentage compared to last year when

41% stated that they were considering investing in M&A. Most companies already have a sizeable presence in China and appear to be more interested in growing organically in the next year as they take a 'wait and see' approach to China's economic growth and opportunities in China. With the economy slowing over the past year and an expectation that this will continue, companies have become more tentative about doing deals in China.

25 BCS_Figures for report_FV_updated2.pptx

PREL

IMIN

ARY

DRAF

T

Source: Business Confidence Survey 2014, Roland Berger analysis

2013

N=399

Figure 22: Means of expansion, 2013-2014 Question: Via what means are you considering expanding in the next year?

Note: Percentages represent the companies that stated 'yes' for each answer option. Alternative answer options were 'no' and 'n/a'.

n.a. Organic growth on own

n.a. Partnership with Chinese companies

41% Mergers & Acquisitions

n.a. Partnership with MNCs

47%

19%

15%

5%

2014

N=317

Note: Percentages represent the companies that stated 'yes' for each answer option. Alternative answer options were 'no' and 'n/a'.

M&A intentions are also substantially decreasing

European Chamber

33

A shrinking percentage of companies are considering expanding to other provinces.• 45% of companies reported that they are considering expanding to other PRC provinces compared with 69% of

companies just two years ago in FY 2011.• By far the main reason for expansion continues to be the desire to be closer to customers.• Many provinces are considered for expansion, but companies continue to favour the eastern coastal regions