ASSET ALLOCATION MUST BE ACTIVELY MANAGED Richard Temperley Head of Investment Development –...

-

Upload

moris-james -

Category

Documents

-

view

216 -

download

0

Transcript of ASSET ALLOCATION MUST BE ACTIVELY MANAGED Richard Temperley Head of Investment Development –...

ASSET ALLOCATION MUST BE ACTIVELY MANAGED

Richard Temperley

Head of Investment Development – Zurich

Source: Zurich Life, September 2014

Active Management adds value

Source: Zurich Life, September 2014

25 years – Good Active Management Expertise

Source: Zurich Life, September 2014

25 years – Good Active Management Expertise

Source: Zurich Life, September 2014

25 years – Good Active Management Expertise

“Valuations and unprecedented policy response make strong equity gains possible”

Zurich Investment Outlook - 2009

Making the Right Calls

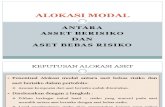

Active Fund ManagementActive Management of Asset Classes

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

% A

lloca

tio

n

Cash

Alternatives

Property

Bonds

Equities

Source: Zurich Life, September 2014

Active Management of Asset Classes

ProcessAn Active Management Process

THE OUTLOOK FOR ASSET CLASSES

Equity Bull Market - a record breaking run…

Source: Zurich Life, September 2014

4thLongest bull market on

record!

Bull Market’s End – the warning signs…

Very tight monetary policy

Sustained acceleration in inflation

A big rise in short-term interest rates

An overheating economy

Severe overvaluation of equities compared with interest rates

Source: BlackRock, September 2014

Long-term Rates – Government 10-year Bond Yields

Short-term Rates – ECB

Source: European Central Bank, September 2014

House Prices – Global Developed Markets

Source: BIG, 24.06.14

Asset Class Performance

Source: J.P. Morgan, Guide to Markets, Q3 2014.

A Multi-asset solution is the answer

Warning: Past performance is not a reliable guide to future performanceWarning: The value of your investment may go down as well as upWarning: Benefits may be affected by changes in currency exchange rates.Warning: If you invest in this product you may lose some or all of the money you invest.