2012vol.42No.04

-

Upload

amcham-taipei -

Category

Documents

-

view

226 -

download

7

description

Transcript of 2012vol.42No.04

TH

E A

ME

RIC

AN

CH

AM

BE

R O

F C

OM

ME

RC

E IN

TAIP

EI

TA

IWA

N B

US

INE

SS

TO

PIC

SA

pril 2

01

2 | V

ol. 4

2 | Issu

e 4

中華郵政北台字第5

000

號執照登記為雜誌交寄

April 2012 | Vol. 42 | Issue 4www.amcham.com.tw

NT$150

A Report on

the Telecom

Sector

INDUSTRY FOCUS

Modernizing the Airport桃園機場重新出發

Taiwan Business

Topics

ISSUE SPONSOR

4_2012_Cover.indd 1 2012/4/27 6:50:41 AM

4 taiwan business topics • april 2012

NEWS AND VIEWS

C O N T E N T S

april 2012 vOlumE 42, NumbEr 4一○一年四月號

Publisher 發行人

Andrea Wu 吳王小珍

Editor-in-Chief 總編輯

Don Shapiro 沙蕩

Art Director/ 美術主任/Production Coordinator 後製統籌

Katia Chen 陳國梅

Staff Writer 採訪編輯

Jane Rickards 李可珍

Manager, Publications Sales & Marketing 廣告行銷經理

Irene Tsao 曹玉佳

Translation 翻譯

Zep Hu 胡立宗

OFFICERS:Chairman/ Bill Wiseman Vice Chairmen/ William E. Bryson / David Pacey Treasurer: Carl Wegner Secretary/ William J. Farrell

2011-2012 Governors:William E. Bryson, William Farrell, Christine Jih, Steven Lee, Neal Stovicek, Carl Wegner, Bill Wiseman.

2012-2013 Governors: Richard Chang, Sean Chao, Michael Chu, Varaporn Dhamcharee, Revital Golan, David Pacey, Lee Wood, Ken Wu.

2012 Supervisors: Douglas Klein, Richard Lin, Catherine Teng, Fupei Wang, Jon Wang.

COMMITTEES: Agro-Chemical/ Melody Wang; Asset Management/ Christine Jih, Winnie Yu; Banking/ Victor Kuan; Capital Markets/ Jane Hwang, Jimin Kao, C.P. Liu; Chemical Manufacturers/ David Price; CSR/ Lume Liao, Fupei Wang; Education & Training/ Robert Lin, William Zyzo; Greater China Business/ Helen Chou, Stephen Tan; Human Resources/ Richard Lin, Seraphim Mar; Infrastructure/ L.C. Chen, Paul Lee; Insurance/ Mark O’Dell, Dan Ting, Lee Wood; Intellectual Property & Licensing/ Jason Chen, Peter Dernbach, Jeffrey Harris, Scott Meikle; Manufacturing/ Thomas Fan; Marketing & Distribution/ Christopher Fay, Wei Hsiang, Gordon Stewart; Medical Devices/ Nelson Hsu, Daniel Yu; Pharmaceutical/ David Lin, Edgard Olaizola, Jun Hong Park; Private Equity/ William Bryson, Steve Okun; Real Estate/ Tony Chao; Retail/ Prudence Jang, Douglas Klein; Sustainable Development/ Kenny Jeng, Davis Lin; Tax/ Cheli Liaw, Jenny Lin, Josephine Peng; Technology/ Revital Golan, R.C. Liang, John Ryan, Jeanne Wang; Telecommunications & Media/ Thomas Ee, Joanne Tsai, Ken Wu; Trade/ Stephen Tan; Transportation/ Michael Chu; Travel & Tourism/ Pauline Leung, David Pacey.

American Chamber of Commerce in Taipei

129 MinSheng East Road, Section 3, 7F, Suite 706, Taipei 10596, TaiwanP.O. Box 17-277, Taipei, 10419 TaiwanTel: 2718-8226 Fax: 2718-8182 e-mail: [email protected]: http://www.amcham.com.tw

名稱:台北市美國商會工商雜誌 發行所:台北市美國商會

臺北市10596民生東路三段129號七樓706室 電話:2718-8226 傳真:2718-8182

Taiwan Business TOPICS is a publication of the American Chamber of

Commerce in Taipei, ROC. Contents are independent of and do not

necessarily reflect the views of the Officers, Board of Governors,

Supervisors or members.

© Copyright 2012 by the American Chamber of Commerce in Taipei,

ROC. All rights reserved. Permission to reprint original material must

be requested in writing from AmCham. Production done in-house,

Printing by Farn Mei Printing Co., Ltd.

登記字號:台誌第一零九六九號

印刷所:帆美印刷股份有限公司

經銷商:台灣英文雜誌社 台北市105敦化北路222巷19之1號1樓

發行日期:中華民國一○一年四月

中華郵政北台字第5000號執照登記為雜誌交寄

ISSN 1818-1961

6 Editorial The Need for Urban Renewal 推動都更仍有必要

7 Taiwan Briefs By Jane Rickards

11 IssuesEncouraging Over-the-Counter Drugs; Too Many Product Standards for Tex-tiles and Footwear; USTR’s Latest List of Trade Concerns 鼓勵非處方藥品;紡織品與製鞋標準亟需整合;美國貿易代表署公布年度國家貿易評估

By Don Shapiro

INTERVIEW

25 Ford’s Perspective on the Asian Car MarketDave Schoch, chairman and CEO of Ford Greater China, sat down with TOPICS during a recent visit to Taiwan. By Timothy Ferry

TAIWAN BUSINESS

28 Perspectives on Private EquityThe right investment partner can help open new vistas for a company seek-ing to upgrade. By Don Shapiro

COVER SECTION15 Modernizing the Airport 桃園機場重新出發 By Jane Rickards 撰文/李可珍 After years of decline, the Taiwan Tao-

yaun International Airport is undergo-ing a thorough facelift and expansion at Terminal 1, plus an overhaul of its runways. Bidding will begin soon for construction of a new Terminal 3, and the MRT airport link is due to be opera-tional next year. The government hopes these improvements will enable the facility to become a major regional hub, particularly as a transit and transfer point for traffic between North America and inland cities in China.

經過三十多年的使用,台灣桃園國際機場終於開始翻新第一航廈與重鋪兩條跑道。另外,第三航廈的工程招標即將開始,機場捷運明年也將啟用。政府希望前述工作能讓桃機改頭換面,爭取區域樞紐地位,甚至成為北美與中國內陸間不可或缺的轉機要點。

24 Whatever Happened to the Taoyuan Aerotropolis?

4 Contents.indd 4 2012/5/1 8:57:13 PM

taiwan business topics • april 2012 5

iSSuE SpONSOrapril 2012 • Volume 42 number 4

WHY TAIWAN MATTERS

33 Crucial Role in the Security of AsiaTaiwan’s strategic geographical position gives the island immense importance for maintenance of the U.S. presence in the Asia-Pacific. By June Teufel Dreyer

A Bridge to Nowhere? By Alan Patterson

41 Looking Beyond WiMAX By Timothy Ferry

44 Commentary: the Importance of Spectrum Management

By Jason T. Wang

CHAMBER EVENTS

49 Hsieh Nien Fan 2012

iNDuSTrYF CuS

Finding the right Technology: a report on the Telecom Sector

CORRECTIONIn the article “New Opportunities to Partner with Fulbright” in the Issues column of the March issue, an incor-rect contact email address was given for William Vocke. The correct address is [email protected] .

4 Contents.indd 5 2012/5/1 8:57:18 PM

38

6 taiwan business topics • april 2012

台北市「文林苑都更案」三月強

制拆除王家透天厝,儘管住戶

表明不願參加都市更新計畫,

但仍不敵優勢警力的重重包圍。輿論抨

擊與民意反彈的主因,除了王家歷代世

居北市士林,也包括公權力介入的正當

性。市長郝龍斌稍後雖表示「遺憾」,

亦無助於平息民怨。

文林苑一案中,居民權益顯然未獲

適切保障;然而,如果此一負面案例導

致台灣都市更新計畫停擺,無疑將造成

更大的負面效應。從許多方面來看,國

內大城都亟待更新,特別是台北市。舉

例來說,房價居高不下導致許多人無力

購屋,其中不少人只好越搬越遠,通勤

人潮不僅造成交通壅塞、也形成能源浪

費。鑑於市區空地難求,都更即為增加

房屋供應、降低市區房價的最佳手段。

此外,台北地區1970年代前後趕工興

建大量建築工程品質粗略的住宅,以因

應鄉村湧入的求職人口。多數老舊公寓

靠樓梯上下,不利台北日漸增加的老年

人口,而其建築材料與工法的防火耐震

程度亦低於新式建築。當時的公寓許多

未經專業的建築設計與規劃,如今這些

水泥樓群也造成雜亂無章的都市景觀,

與其後多數新穎建物形成強烈對比。

台灣都市更新腳步遲緩的原因,在

於政府欠缺公平有效機制,以鼓勵都更

並確保計畫執行。此一機制必須能兼顧

三方權益,意即開發商、支持都更計畫

住戶,以及反對都更者的權利與利益。

一旦絕大多數現住戶同意都更,仲裁機

制必須儘速處理反對者的訴求,避免全

案長期拖延。少數反對者的權益必須保

障,但多數同意者(通常必須達到占建

案的80%)也必須確定進度以規劃未來

安排。當然,在所有法律手段已經窮盡

之後,才能動工拆屋。

王家的案例誠然不幸,民意也不樂見

類似案例一再重演,但個案不應該影響

整體都更。因為對台北來說,要想成為

朝氣蓬勃、魅力無窮、全球匯萃的大都

會,同時具備高品質、買得起的住宅,

都市更新確為必要手段。

One of the biggest news items of the past month in Taiwan was the questionable razing of two houses in Taipei’s Shilin District – over the objections of the

owners and with the protection of a phalanx of police officers – as part of an urban renewal project. The incident caused an outpouring of public indignation, as the property had been the home of the Wang family for generations and the demolition was apparently conducted without a proper permit. Mayor Hau Long-bin’s later expression of regret did little to quell the criticism.

Clearly, proper procedures to safeguard the rights of prop-erty-owners were not followed in this case, but it would only compound the misfortune if this experience were allowed to set back the overall progress of urban renewal in Taiwan. The need for redevelopment in the major cities, especially Taipei, is evident from a number of perspectives. One is the high price of real estate, which is putting home ownership beyond the means of many people and causing others to commute from far out in the suburbs, exacerbating transportation and energy prob-lems. Given the unavailability of vacant land in the cities, urban renewal is the best option for increasing the housing supply and lowering the prices in more central locations.

In addition, Taipei is filled with poorly constructed residential buildings erected hastily about four decades ago to accommodate the influx of migrants from rural areas. These aging structures are mainly walk-ups, unsuitable for this society’s increasingly aged population, and the materials and methods employed in the

construction make them less safe against fire and earthquakes than their newer counterparts. Built mostly without benefit of an architect’s designs, these cement boxes also detract from the city’s attractiveness – and contrast sharply with the visual appeal of most of the more modern structures.

What has held up the pace of urban renewal in Taiwan so far has been the lack of a sufficiently fair and efficient government-monitored system for putting projects together and ensuring that they can be carried out. Such a system needs to simulta-neously look after the rights and interests of the developer, of home-owners in favor of redevelopment, and of home-owners who oppose it. When nearly all of the property-holders on a site have agreed to the terms offered by the developer, an arbi-tration mechanism should be in place to rule judiciously on the claims of the hold-outs without the case dragging on for months or years. The rights of the minority deserve to be protected, but so do those of the large majority (usually 80% agreement is required) who have committed to the project and need to be able to plan their lives with some certainty. Only after all legal procedures have been completed, of course, should any demoli-tion work proceed.

The Wang family incident was a tragedy that should not be allowed to be repeated, but it should not cast a pall over the concept of urban renewal in general. For Taipei to reach its potential as a vibrant, attractive, international metropolis, as well as one with an adequate supply of high-quality, affordable housing, urban redevelopment is a must.

The Need for Urban Renewal

推動都更 仍有必要

E d i t o r i a l

4_Editorial.indd 6 2012/4/28 9:53:09 PM

t a i w a n b r i e f s

taiwan business topics • april 2012 7

— BY don shapiro —

M A C R O E O N O M I C S

eLeCtriCtY, fUeL PriCes tO rise

Amid a slow and fragile global recovery and worries about the Euro-pean sovereign debt crisis, two new factors popped up in Taiwan’s macro-economic soup-mix in the form of hikes to gasoline and electricity prices. In early April, the government allowed gasoline prices to rise by an average of 10.7% by removing previous subsi-dies. Then it was announced that the state-owned Taiwan Power Co. (Tai-power) will hike electricity prices in mid-May to offset the company’s reported US$4.48 billion in losses since 2008 that resulted mainly from increased fuel costs. Electricity prices for industrial use will rise 35%, for commercial operations by 30%, and for households by 16.9%. Although the new policy will raise the cost of doing business and heighten the risk of inflation, it was widely agreed that existing rates were unrealistically low.

Two local economic research insti-tutes subsequent ly s lashed their economic growth forecasts for 2012. The semi-official Chung-hua Institu-tion for Economic Research (CIER) in mid-April put GDP growth for 2012

at 3.55%, down from an earlier fore-cast of 4.07%, mainly due to the fuel and electricity price hikes’ impact in increasing production costs, dampen-ing private consumption, and raising the consumer price index (CPI) for the year to 1.93%, from an earlier fore-cast of 1.48%. CIER President Wu Chung-shu noted, however, that as headline inflation is due to these one-off adjustments, the economy is not currently under significant inflationary pressure. It should also be noted that inflationary increases of under 2% are considered relatively mild. The Taiwan Institute of Economic Research (TIER) also decreased its economic growth forecast for this year to 3.48% from an earlier 3.96%. It also adjusted its inflation forecast to 1.98%, from an earlier 1.46%, citing rising uncer-tainties about consumer prices and weaker-than-expected global economic momentum. Meanwhile, the Inter-national Monetary Fund in its latest World Economic Outlook report fore-casts that Taiwan’s economy will grow by 3.6% this year and strengthen to 4.7% next year. Analysts are divided as to whether the Central Bank will respond by tightening monetary policy when it meets in June.

Exports, at US$26.34 billion in

March, were down by 3.2% over the same month of last year (although they increased compared with February), while the US$23.99 billion in imports represented a 5.8% decline from the year before. The trade surplus came to US$2.63 billion. Exports to Europe, at 11.6%, showed the greatest slump year-on-year, the Ministry of Finance said, reflecting economic uncertainties there and the austerity measures that are sapping demand. Export orders, a sign of things to come in the next several months, at US$38.4 billion were also down 1.58% year on year, the Ministry of Economic Affairs said, as global demand for high-tech elec-tronics recovers slowly.

C R O S S - S T R A I T

seMi-OffiCiaL OffiCes tO be set UP in CHina

Ta i w a n ’s g o v e r n m e n t - s p o n -sored (but nominally private) trade-promotion organization, the Taiwan External Trade Development Coun-ci l (TAITRA), has applied to set up offices in Beijing and Shanghai following adjustments completed in mid-April to relevant Taiwan-ese laws. The offices would be the

March

THE RED LINE SHOWS CHANGES IN TURNOVER AND THE SHADED AREA CHANGES IN THE TAIEX INDEX.

50

65

80

95

110

125

140

155

170

185

6250

6500

6750

7000

7250

7500

7750

8000

8250

8500

Taiwan sTock exchange index & value

unit: ntD billionchart source: twse

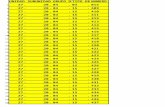

economic indicaTors

Year EarlierCurrent Account Balance (2012 Q4) 12.10 9.44Foreign Trade Balance (Jan.-Mar.) 5.66 4.55New export orders (Mar.) 38.37 38.99Foreign Exchange Reserves (end Mar.) 393.87 392.63 Unemployment (Feb.) 4.25% 4.29%Overnight Interest Rate (Apr. 5) 0.45% 0.29%Economic Growth Rate (2012 Q1) p 1.19% 6.62%Annual Change in Industrial Output (Mar.) -3.42% 14.64%Annual Change in Industrial Output (Jan.-Mar.) 1.31% Annual Change in Consumer Price Index (Feb.) 0.25% 1.33%Annual Change in Consumer Price Index (Jan.-Feb.) 1.31% 1.11%

sources: Moea, DGbas, cbc, boFtnote: p=preliMinary

4_Briefs.indd 7 2012/4/30 8:03:54 PM

t a i w a n b r i e f s

8 taiwan business topics • april 2012

f irst from a Taiwan government-related institution to be located in China. TAITRA said it is likely to apply to set up trade offices in other mainland c i t i es such as Wuhan, Guangzhou, Dalian, Qingdao, and Chengdu, while a Chinese coun-terpart organizat ion is expected to open an off ice in Taiwan this year. The establishment of recipro-cal representative trade offices in the form of non-profit organiza-tions was one of the provisions in the Economic Cooperation Frame-work Agreement (ECFA) signed by Taiwan and China in 2010. Experts said that while the move is signifi-cant, TAITRA has limited scope and this arrangement does not amount to an exchange of representative offices having d ip lomat ic and consular functions. In a separate develop-ment, the Mainland Affairs Council announced that the f i rs t perma-nent official representative offices in Hong Kong and Macau will be formally opened in mid-May.

siX CHinese Cities aDDeD fOr inDiViDUaL tOUrisM

Beijing is broadening the ability of individual Chinese travelers to come to Taiwan, allowing residents of six more Chinese cities to qualify to visit the island without being part of a tour group starting in late April. In addi-tion, Taiwan's ceiling on the daily entry of individual Chinese travel-ers was raised from 500 to 1,000. The cities added were Tianjin, Chongqing, Nanjing, Guangzhou, Hangzhou, and Chengdu, while Jinan, Xian, Fuzhou, and Shenzhen reportedly are likely to be included by the end of the year. Previously the program was open only to residents of Xiamen, Beijing, and Shanghai. Chinese tourism has become an important driver of Taiwan’s econ-omy since tour groups first began arriving in 2008. Chinese tourists brought an estimated US$2 billion into the economy in 2010.

tUrbULenCe in CCP UnLiKeLY tO HaVe CrOss-strait iMPaCt

The political turmoil in the Chinese Communist Party (CCP) surrounding high-level politician Bo Xilai, who was brought down by a scandal involving the mysterious death of a British busi-nessman, may be rocking China and fascinating the world, but it is consid-ered unlikely to have any marked effect on cross-Strait relations. Bo, now under investigation for violating party discipline, has been stripped of his positions as Communist Party chief in Chongqing and member of the elite 25-member Politburo, while his wife is under investigation for the English-man’s murder. Analysts say it is the most serious Chinese political disrup-tion since the 1989 Tiananmen Square massacre, and the timing is especially sensitive as the CCP faces a leader-ship transition this fall. Fan Liqing, a spokesperson for Beijing’s Taiwan Affairs Office, reassured Taiwanese

reporters that the investment envi-ronment in Chongqing will remain unchanged. In recent years, Chongqing has seen a large influx of Taiwan-ese investors, as companies like Acer and Hon Hai locate there in search of cheaper land and labor. Lin Chong-pin, a China expert at Tamkang University, was quoted by the Taipei Times as saying that Bo’s downfall, along with other factors, could cause the Beijing leadership to be more patient with Taiwan. Lin, a former vice minister of the Mainland Affairs Council, said that China’s relatively tough foreign relations stance adopted since 2009 could have been a reaction to internal political instability.

D O M E S T I C

fOrCeD eViCtiOn Of faMiLY sParKs Urban renewaL Debate

The dramatic forced eviction of a

STOP THOSE BULLDOZERS — Demonstrators protest the city government's move to raze two houses in Shilin over the property-owner's objections. .

photo: cna

4_Briefs.indd 8 2012/4/30 8:03:55 PM

t a i w a n b r i e f s

taiwan business topics • april 2012 9

family surnamed Wang from their two ancestral homes in the Shilin district of Taipei in late March has triggered an emotional debate how urban renewal should be carried out. At the heart of the debate is a law stating that if a certain proportion of the property owners on a given site (75% or 80%, depending on the type of project) give their consent to an urban renewal project, a construction firm can ask the government to demolish the build-ings even if a minority of the owners still do not agree. The Wangs refused to leave the two-story houses that they had lived in for several genera-tions to make way for a 15-story high-rise construction, causing the Taipei city government to send bulldoz-ers to raze the structures, with some 1,000 police officers dispatched to keep 300 protesters at bay. Questions were also raised as to whether the city government had followed proper legal procedures in ordering the demoli-

tion. Amid public outrage, the Taipei city government has appointed a panel to review the Urban Renewal Act, with the results to be presented to the Ministry of Interior in May.

I N T E R N AT I O N A L

Ma COMPLetes His first Visit tO afriCan aLLies

On his f irst visit to Africa – a 12-day high-profile tour that took him to allies Burkina Faso, Gambia and Swaziland – President Ma Ying-jeou found himself engaged in several athletic contests with his hosts among African leaders. Ma visited hospi-tals in Burkina Faso and offered the nation one million Euros (US$1.32 million) – in addition to the 600,000 Euros previously pledged – to help with its refugee crisis caused by a coup d’etat in neighboring Mali. He then went on to Gambia, where he

donated US$3 million to help with a food crisis, and also led a victo-rious team of Taiwan officials in a soccer penalty-kick contest. In Swazi-land, Ma jogged and did push-ups with King Mswati III, after which Ma contributed US$300,000 worth of notebook computers. The lead-ers of the three countries all hosted state banquets for Ma and accorded him the full pomp and pageantry reserved for heads of states. Ma said the African leaders had also prom-ised to help Taiwan in its efforts to gain more international space, espe-cially in its bid to become a long-term member of the World Health Organi-zation. Taiwan has long been sharing its development experience with these countries in the fields of agriculture, medicine, and solar power.

Ma MaKes first-eVer stOPOVer in inDia

On his way to Africa, Ma also

WHAT JET LAG? — President Ma Ying-jeou demonstrates his diplomatic fitness as he joins the king of Swaziland in a bout of push-ups.

photo: courtesy oF presiDential oFFice

4_Briefs.indd 9 2012/4/30 8:03:57 PM

t a i w a n b r i e f s

10 taiwan business topics • april 2012

became the first serving Taiwan-ese president to set foot in India when his aircraft made a refuel-ing stop in Mumbai. The diplomatic breakthrough reflected the increased economic activity between Taiwan and India, and the two governments’ interest in further deepening ties. The two-hour refueling stop in the Indian city formerly known as Bombay was not announced to the media until the plane was already airborne. Despite the secrecy, presumably designed to avoid efforts by China to block the transit stop, Beijing’s response when the news came out was relatively mute, a reflection of warmer cross-Strait ties. At the Mumbai airport, Ma was greeted in the VIP lounge by Taiwan's representative to India Philip Ong as well as Maharashtra state government officials. He did not meet any Indian central government offi-cials. “Transit diplomacy” is often used by Taiwanese leaders to step up ties with countries that do not accord diplomatic recognition to Taiwan. A stopover does not have the status of a formal visit, which China would object to.

B U S I N E S S

KGi seCUrities sOLD in Us$1.85 biLLiOn DeaL

China Development Financial Holdings will acquire KGI Securi-ties in a cash-and-stock deal worth NT$54.6 billion (US$1.85 billion), it was announced in early April. China Development, which has been moving from a background in private equity into a role in investment banking, said the deal involves a share swap scheme, under which each KGI share may be exchanged for 1.2 China Development Financial common shares plus NT$5.5 in cash. The Financial Supervisory Commission in late April gave the green light to

the deal, while Fitch Ratings said the move may spur more consolidation in Taiwan’s brokerage industry. The transaction is expected to give the two firms a combined market share in the securities business of 9.5%, second only to Yuanta Polaris Securi-ties, which has around 15%.

HtC PrOfits anD MarKet sHare taKe a tUMbLe

Taiwan’s HTC, which rose from relative obscurity to become Asia’s second-largest smartphone maker wi th in a decade , in ea r ly Apr i l reported a 70% drop in first-quar-ter profits to US$152 million, coming after a 26% decline in the final quar-ter of last year, amid stiff competition from global giants Apple and Samsung Electronics. The company, which came to prominence after its handsets adopted Google’s Android operating system much earlier than other play-ers, also saw its revenues last quarter drop 35% from a year earlier. In April, HTC launched a new series of hand-set models called the “HTC One,” which the company will help boost its market standing. The new models allow the user to snap four pictures in one second, while simultaneously making videos. But industry observ-ers say HTC does not have much time to regain its market share, as

Samsung and other rivals are soon to unroll their new models. HTC’s CEO Peter Chou forecast a rebound for the company, but noted that starting this year the United States would no longer be HTC’s largest market.

CaPitaL Gains taX PrOPOseD, eXeMPtinG fOreiGn inVestOrs

The Executive Yuan in late April accepted a proposal from the Minis-try of Finance to impose a capital-gains tax on securities transactions starting next year, but in order not to drive away foreign investors, over-seas investors without offices and direct business operations in Taiwan will be exempt. The plan, which still needs legislative approval and is likely to be challenged by some lawmakers, would levy a 15-20% tax on indi-vidual investors who earn more than NT$4 million annually from stock trades, the Executive Yuan said in a statement, but individuals would not be taxed on gains made from trad-ing in futures. In addition, investors holding stocks for three years or more would be taxed based on only 50% of their gains. Local institutional inves-tors earning in excess of NT$500,000 would face a 12-15% tax, while the existing securities transaction tax of 0.3% would remain unchanged.

20122011

20122011

20122011 20122011

2012201120122011

U.S.

HK/China Japan TOTALASEAN

Europe

Imports Exports Unit: US$BN Source: BOFT

69.2

4.1

11.4

4.4

13.6

10.7

30.2

10.1

27.3

6.8 8.1

5.6 7.

5

7.6 12

.1

7.7 13

7.3

7.9

6.6 7.

3

73.8

65.2 70

.8

Taiwan's JanuarY-march Trade Figures (Year on Year comParison)

4_Briefs.indd 10 2012/4/30 8:03:57 PM

taiwan business topics • april 2012 11

Issues

低風險藥物如果能以非處方藥(OTC)的

形式在藥局供應,不必非得到醫院拿處

方簽,應會讓消費者方便許多,因為既

省時、又免負擔掛號費。此一作法同時有助全民

健保財務狀況,降低醫療院所的給付負擔。台灣

雖然沒有相關研究,但美國近期一項調查發現,

「消費者每購買一美元的OTC藥品,平均能替醫

療體系省下六至七美元」。因此,美國食品藥物

管理局(FDA)正研究是否能夠擴大OTC涵蓋範

圍。而英國也已允許特定種類的降膽固醇藥「斯

達汀(statin)」為非處方藥。

台灣社會持續高齡化,加上健保財務緊繃,製

藥產業代表發出呼籲,期待政府跟上國際潮流,

放寬自我照護藥品的管制。目前而言,非處方藥

的主要類別包括:頭痛等的止痛藥、咳嗽與感冒

藥、維他命與膳食補充劑,以及腸胃藥與暈車

藥。業界代表認為,應該納入的其他產品包括:

過敏用的無鎮靜作用之抗組織胺藥劑,以及400毫

克的止痛藥「普羅芬(ibuprofen)」。目前藥房

只能出售200毫克的普羅芬,但就算是中度疼痛,

藥師往往也建議使用400毫克劑量。

此外,一些常用的指示藥品應考量轉類為乙

類成藥 (GSL) ,除了藥房,也能在超商、便利商

店,以及量販店等大型連鎖通路銷售。如果常用

的止痛藥能夠納入乙類成藥,將是消費者的一大

福音,因為半夜藥局關門時牙痛或頭痛的人將不

必花更多錢去醫院看急診或辛苦等到隔天早上。

當處方藥轉類為指示藥品時,衛生署中央健康

保險局仍可將這些藥品納入健保給付。健保每年

給付OTC藥物費用約為新台幣22億元。但健保局

未來很可能迫於財務壓力而不再給付感冒藥等指

For relatively risk-free drugs to be available in pharmacies on an over-the-counter (OTC) basis rather than by prescription is a great convenience for consumers, saving them the time

and cost of visits to the doctor. It is also helpful for the national healthcare system in relieving some of the burden on the resources of hospitals and clinics. Although no such research has been done in Taiwan, a recent study in the United States found that “on average every dollar spent by consumers on OTC medicines saves $6-7 for the U.S. healthcare system as a whole.” As a result, the U.S. Food and Drug Administration (USFDA) is looking at the feasibility of expanding the number of drugs available as non-prescription prod-ucts, and in the United Kingdom even certain statins for cholesterol control have been classified as OTC.

Considering the aging nature of the population and the financial strain on Taiwan’s National Health Insurance program, members of the pharmaceutical industry have been urging Taiwan to follow the international trend of increased reliance on OTC products for ailments suitable for patient self-care. Currently, the major catego-ries of OTC drugs are analgesics (for relieving headaches and other pain), cough and cold remedies, vitamins and other supplements, and products for gastro-intestinal discomfort and motion sickness. Industry representatives suggest that such other products be added to the list as non-sedating antihistamines for allergic conditions and the 400-mg dosage of the painkiller ibuprofen (at present only the 200-mg version is available OTC, but pharmacists tend to recom-mend 400-mg for even moderate pain).

In addition, some current OTC products could be considered for reclassification to the General Sales List (GSL), enabling them to be sold not only at drugstores but also in supermarkets, convenience stores, and mass-merchandise outlets like hypermarts. If this change were to include mild painkillers, it would be a boon to consumers – for example, to those experiencing a severe toothache or headache in the middle of the night when drugstores are closed and the only current option is going to a hospital and paying the high cost of emergency-room treatment.

Once prescription drugs are reclassified as OTC, the Bureau of National Health Insurance (BNHI) would still have the option of maintaining their coverage for reimbursement under the national healthcare program. It currently reimburses health-providers for the use of an estimated NT$2.2 billion worth of OTC items a year. But BNHI is likely to face pressure in future to reduce costs by delisting OTC products such as cold remedies. The move would undoubt-edly bring complaints from some patients, but in fact the cost to the consumer of buying the product in a drugstore would not be much different from obtaining it from a hospital after savings of time and transportation are factored in.

Promoting more self-care would relieve the national

health program of some of its burden.

Encouraging Over-the-Counter Drugs

推廣自我照護幫助減少健保負擔

鼓勵非處方藥品

4_Issues.indd 11 2012/4/29 3:57:05 PM

12 taiwan business topics • april 2012

Issues

全球紡織品與製鞋產業的尺寸規格太過龐

雜,已使生產廠、零售商與經銷商越來

越頭大。台灣紡織業拓展會稍早在台北

舉辦的會議中,香港「全球成衣鞋類及紡織品提

案」(GAFTI)的董事Andre Leroy在簡報時指出,

GAFTI計畫逐步推動產業標準的整合工作。Leroy

除了負責現代技術有限公司的市場行銷業務,亦

兼任香港美國商會服裝與鞋類委員會主席。

GAFTI現有三個委員會,負責領域分別為產品

安全、社會責任、環境永續。Leroy以產品安全為

例指出,鎳、偶氮染料、甲醛、鉛、鄰苯二甲酸

等化學物品,世界各地共有14種相互衝突的管理

規範。狀況未來還可能更為複雜,因為美國有28

個州正計畫立法規範紡織品的有毒物質。

鑑於難以獲得各國與非政府組織同意整合現有

標準,GAFTI現階段的目標包括:一,為尚未建立

產業標準的商品品項創造新的標準與檢測方法;

Self-care through OTC products is seen as increasingly suit-able for Taiwan consumers, given the higher level of education and sophistication in the society. A generation ago, patients relied almost entirely on physicians’ advice regarding healthcare, but many people now actively inform themselves by reading health-related articles, both online and off.

In the past, manufacturers considering applying for reclassi-fication of a product from prescription drug to OTC found that the procedure and conditions governing such a shift were not well defined. The Taiwan FDA could encourage more such applications by clearly laying out the requirements.

—– By Don Shapiro

The proliferation of different standards in the global textile and footwear industries has placed an increasingly heavy compliance burden on manufacturers, retailers, and distrib-

utors. A recent presentation in Taipei sponsored by the Taiwan Textile Federation introduced the efforts of the Hong Kong-based Global Apparel, Footwear and Textile Initiative (GAFTI) to grad-ually bring more order to the marketplace. The briefing was given by GAFTI board member Andre Leroy, who is also chairman of AmCham Hong Kong’s Apparel & Footwear Committee and marketing director of Modern Testing Services.

GAFTI operates three subcommittees, devoted to product safety, social compliance, and environmental sustainability respectively. Regarding product safety issues, Leroy said that there are currently 14 conflicting standards in the world covering such chemicals as nickel, azo dyes, formaldehyde, lead, and phthalates. The situa-tion may soon grow even more complicated, as 28 states in the United States are currently considering legislation governing toxic substances in textiles.

Recognizing the difficulty of getting different government and non-government organizations to agree to harmonize existing conflicting standards, GAFTI at this stage is focusing 1) on creating new standards and testing methodology for items currently without standards, and 2) improving the consistency of testing of existing standards. Its working group on lead, for example, found a 33% variation in test results among different labs. By refining and unifying calibration methods, it has been able to reduce the discrep-ancy to 22% and is working to lower the gap still further so as to lessen the need for costly retesting. A similar process is underway for cadmium, and it will later be extended to other chemicals.

示藥品;一旦如此,必然引發部分病患的不滿。

但事實上,消費者到藥房購買類似藥品的開銷並

不會高過自醫院取藥,因為省下了時間與交通費

用。

台灣消費者已經越來越適合以OTC藥品進行自

我照護,因為教育水準夠高,社會也越趨成熟。

上一代的台灣人多半依賴醫生使用藥品,但現在

的民眾多數都會透過網路或書籍吸收醫療保健資

訊。

以過去經驗,製藥商申請處方藥轉類為非處方

藥,常會面臨規定及程序不清的問題。衛生署食

品藥物管理局如能更加清楚地列出要求事項,可

鼓勵更多藥品申請轉類為非處方藥。

—撰文/沙蕩

紡織品與製鞋標準

亟需整合

香港GAFTI組織企盼逐步統合產業標準

Too Many Product Standards for Textiles and Footwear

A Hong Kong-based organization hopes to gradually

bring more order to the industry.

4_Issues.indd 12 2012/4/29 3:57:05 PM

taiwan business topics • april 2012 13

Issues

美國貿易代表署最近公布關於外國貿易障礙

的國家貿易評估,其中關於台灣的章節足

以反映美國關切的雙邊議題。而許多議題

對台北市美國商會會員與TOPICS雜誌的讀者應不

陌生:

• 智慧財產權保障:評估報告指出,雖然台灣

整體而言已有有效智財權保障與執法,但部

分問題仍然存在,包括網路著作權侵權行

為,大學與附近商家的教科書翻印,產品包

裝配置外觀的保護不足,軟體最終使用者的

侵權作法,有線電視私接現象,營業秘密竊

盜與佔用,仿冒藥品持續存在,以及來自中

國的仿冒品。

• 銀行服務:報告引述業界對行政院金融監督

管理委員會兩項作法的擔憂,即外國銀行分

行必須繳回分行營業執照,以及消費金融服

務必須於國內設立資料處理中心。報告指

出,「外銀抱怨金管會在此事的決策不夠透

明,也不符國際慣例」。

• 證券服務:報告指出,金管會採取多項行政

措施,限制資產管理公司所設境外基金。

The Taiwan section of the 2012 National Trade Estimates Report on Foreign Trade Barriers recently released by the Office of the U.S. Trade Representative (USTR) is instruc-

tive as a compendium of the current issues in the bilateral economic relationship as seen from Washington. Many of the items cited are familiar to AmCham members and other readers of this publication, including:

• Intellectualpropertyprotection.WhilenotingthatTaiwangenerally provides effective IPR protection and enforce-ment, the report mentions such continuing problem areas as “infringement of copyrighted material on the Internet; illegal textbook copying on university campuses and by nearby busi-nesses; inadequate protection for the packaging, configuration, and outward appearance of products (trade dress); end-user piracy of software; signal theft of cable TV; trade secret theft and misappropriation; continued availability of counterfeit pharmaceuticals in Taiwan,” and the importation of counter-feit products from China.

• Bankingservices.USTRreferstoindustryconcernsaboutFinancial Supervisory Commission (FSC) plans to require foreign subsidiary banks to surrender their branch licenses

In terms of social compliance, such as requirements for factories to maintain safe and healthful working conditions, limit excessive overtime, and avoid the hiring of under-age labor, Leroy said the global industry is currently spending US$2 billion on enforcement, because each brand is setting its own standards and conducting its own auditing. Some staff members at textile mills spend nearly half their time each year making arrangements for and accompanying visiting auditing teams.

GAFTI hopes to bring about a more centralized auditing process with uniform standards and documentation requirements. It views the development of a training and accreditation system for audi-tors and factory personnel as a vital part of that effort. Currently the qualifications of some of the auditors are doubtful, said Leroy, and there needs to be a way of disqualifying and blacklisting corrupt auditors who take bribes in exchange for ignoring abuses.

The Taipei presentation was designed to spur greater interest in participating in GAFTI’s activities among both multinational and domestic companies. Bringing order out of the current chaos will be a long process, said Leroy, but it’s one that the industry has no choice but to undertake.

—– By Don Shapiro

美國貿易代表署公布年

度國家貿易評估

內容指出與台灣等主要貿易伙伴的

貿易障礙

USTR’s Latest List of Trade Concerns

The agency annually reports on the status of issues with

its major trading partners, including Taiwan.

二,增進現有標準之檢測的一致性。舉例來說,

GAFTI的鉛化物工作小組發現,不同實驗室的檢測

結果差距可達33%。藉由改進與整合校準方式,小

組已經使差距縮小至22%,未來也將繼續努力,以

避免重複檢測所形成的浪費。GAFTI也已對鎘化物

進行類似工作,未來也將擴展至其他化學物質。

社會責任方面推動的計畫則包括:廠方必須維

持安全健康的工作環境、限制過度加班,以及避

免雇用未成年勞工。Leroy表示,全球紡織成衣業

者落實上述規範所需經費總額約為20億美元,因

為每家廠商自有一套管理標準與監督機制。部分

紡織廠員工每年有近半的時間在為督察小組安排

行程與陪同參觀。

GAFTI希望建立更為一致的監督機制,採行相同

標準與文書格式,而發展督察與工廠人員的訓練

及認證制度將是關鍵的一步。Leroy說,目前一部

分督察員的資格可能有問題,而未來也必須建立

退場機制,淘汰收受賄賂、包庇過失的人員。

GAFTI代表特別來台簡報,主要在鼓勵跨國與台

灣廠商加入。Leroy強調,從目前的一團混亂中建

立新的遊戲規則必然需要很長時間,但這卻是業

界發展不得不然的必經之路。

—撰文/沙蕩

4_Issues.indd 13 2012/4/29 3:57:05 PM

14 taiwan business topics • april 2012

Issues

and to establish stand-alone onshore data centers for their consumer banking units. “Foreign banks have complained about the nontransparent nature of the FSC decision-making on this issue and such new requirements’ variance with interna-tional practice,” the report says.

• Securitiesservices.ThereportnotesthattheFSChasadoptedseveral administrative measures to restrict offshore funds estab-lished by asset management firms.

• Paytelevision.Aftercitingrestrictionsholdingforeigninvest-ment in pay-television services to a 20% equity share for direct investment and 60% for combined direct plus indirect invest-ment, the report notes that proposed amendments to the Cable, Radio and Television Law are expected to ease those restrictions.

• Telecommunications.USTRmentionstheproblemsTaiwanhas faced (reported on in the Industry Focus in this issue) in promoting Wi-MAX services, and says that the National Communications Commission “has been ineffective in inte-grating telecommunications and broadcasting regulations, causing Taiwan’s telecommunications industry to fall behind in an era of digital convergence.”

• Pharmaceuticals.Thereportcites industryrecommenda-tions for reforming the National Health Insurance system, including implementing a Drug Expenditure Target program to improve the stability and predictability of reimbursement rates, improving the reimbursement pricing for innovative drugs, and maintaining a reasonable differential in the pricing of original and generic drugs.

• MedicalDevices.Likethepharmaceuticalmanufacturers,the medical device industry has proposed suspending the Price Volume Survey mechanism and its subsequent price cuts, arguing that it “lacks transparency and does not reduce budgetary waste as intended.”

• BeefandPork.USTRsaid the“UnitedStates isdeeplyconcerned about Taiwan’s trade practices affecting U.S. meat exports, including beef.” Those issues are discussed in more detail in another recently released USTR report focused specifi-cally on agricultural matters.

The document also goes into some issues that are less familiar to most AmCham members, including:

• Rice.TheUnitedStates“continuestoengageTaiwan”aboutfilling past shortfalls of about 70,000 metric tons in the agreed-upon volume of imports of U.S. rice and about the impact of its ceiling price mechanism on the tendering process.

• DistilledSpirits.TheUnitedStatesandothertradingpartnershave expressed concern about the 2010 lowering of tax rates on “cooking rice wine,” and have asked for measures to ensure that domestic mijiu does not compete with, or substitute for, imported alcoholic beverages.

• Tariffs.“U.S.industrycontinuestorequestthatTaiwanlowertariffs on many goods, including large motorcycles,” the report states.

Assuming resolution of the ongoing beef-import controversy and the resumption of trade talks under the bilateral Trade and Investment Framework Agreement (TIFA), it is likely that many of the issues raised in the report would be on the U.S. side’s agenda requests.

—– By Don Shapiro

• 付費電視:報告表示,台灣限制外資直接持

股不得超過20%,直、間接總持股不得超過

60%,不過有線廣播電視法修正案可望取消

相關限制。

• 電信產業:報告提及台灣在推廣WiMAX服務

上遭遇的問題(本期雜誌有專文報導),以

及國家通訊傳播委員會未能有效整合電信廣

播法規,導致台灣電信業在數位匯流發展中

屈於弱勢。

• 製藥:報告引述,相關業者建議重整全民健

保體質,包括落實藥品支出目標制度以提昇

給付價格的穩定度與可預測性,修改新藥的

給付制度,以及維持原廠藥與學名藥之間的

合理價差。

• 醫療器材:如同製藥產業,醫材業者也希望

暫停藥價調查與其後的給付刪減,因為此一

作法欠缺透明度,也無法達成撙節開支的原

意。

• 牛肉與豬肉:報告表示,美國高度關切台灣

對美國牛肉等肉品進口的貿易措施,而相關

議題在另一份農業專案報告中深入探討。

商會會員較不熟悉的議題包括:

• 稻米:美國持續對台溝通,以補足實際進口

與配額數量間的7萬公噸差距,並化解稻米

標購進口的價格上限機制所產生的影響。

• 蒸餾酒:美國與其他貿易伙伴關切台灣2010

年調降料理米酒稅率的作法,並要求台灣採

取措施確保國內米酒不至影響進口酒類。

• 關稅:報告指出,美國廠商持續要求台灣降

低多項產品的關稅,包括重型機車。

美國牛肉進口台灣的問題若能解決,美台貿易

暨投資架構協定下的談判或將恢復,該評估報告

所提到的許多問題應會成為美方爭取的重點。

—撰文/沙蕩

4_Issues.indd 14 2012/4/29 3:57:06 PM

taiwan business topics • april 2012 15

A I R P O R T

15 taiwan business topics • april 2012

撰文/李可珍BY JANE RICKARDS

桃園機場重新出發

Modernizing the Airport

Cover story

photo: courtesy of norihiko Dan anD associates

4_12_CoverStory.indd 15 2012/4/28 11:20:00 PM

16 taiwan business topics • april 2012

Cover story

When it first opened in 1979, the Taiwan Taoyuan Interna-tional Airport (then known

as the Chiang Kai-shek International Airport) was considered one of the most advanced and fashionable in Asia. One of the “Ten Big Construction Projects” initi-ated by President Chiang Ching-kuo to modernize Taiwan’s infrastructure, the facility took over the role of main entry point into Taiwan from the outmoded and cramped Songshan Airport that now serves domestic and cross-Strait flights.

Over the past decades, however, the Taoyuan Airport failed to keep pace with the dynamic pace of development in the Asian region, which now boasts many of the world’s top airports. Although Taiwan is a global star in the world’s information and communications tech-nology (ICT) industry, critics have argued that the airport’s frumpy appearance and antiquated facilities do nothing to reflect this achievement to business trav-elers. “At this stage, it is probably one of the most rundown airports in Asia,” says Vivian Lo, general manager for Taiwan and Korea at Cathay Pacific Airways, summing up the feelings of many of those interviewed from the airline and tour-ism sectors. “This really does not match Taiwan’s image.”

As tourism, driven by the influx of

1979年啟用時,中正國際機場(現

改為台灣桃園國際機場)曾是

亞洲最先進與新穎的機場之一。身為蔣經國

總統任內的「十大建設」之一,桃園機場取

代松山機場成為台灣對外重要門戶。

然而,其後數十年間,桃園機場跟不上

亞洲民航的發展腳步,落後於許多城市的頂

尖機場。批評者認為,台灣身為資通訊產業

(ICT)重鎮,桃機陳舊的外觀與硬體實在無

法反映產業活力。國泰航空台灣暨韓國區總

經理羅穎怡說,「目前而言,桃機大概是亞

洲最落後的機場之一」,「跟台灣的形象落

差太大」。羅穎怡的看法也是許多航空與旅

遊業受訪者的心聲。

每年百萬中國觀光客帶動下,觀光旅遊占

台灣經濟的比例越來越高,機場升級的必要

性也越來越迫切。因此,為將桃園機場打造

成中國與東亞的交通樞紐,政府推動多項硬

After years of decline, the Taiwan Taoyaun International Airport is undergoing a thorough facelift and expansion at Terminal 1, plus an overhaul of its runways. Bidding will begin soon for construction of a new Terminal 3, and the MRT airport link is due to be operational next year. The government hopes these improvements will enable the facility to become a major regional hub, particularly as a transit and transfer point for traffic between North Ameri-ca and inland cities in China.

經過三十多年的使用,台灣桃園國際機場終於開始翻新第

一航廈與重鋪兩條跑道。另外,第三航廈的工程招標即將開

始,機場捷運明年也將啟用。政府希望前述工作能讓桃機改

頭換面,爭取區域樞紐地位,甚至成為北美與中國內陸間不

可或缺的轉機要點。

photo: courtesy of norihiko Dan anD associates

photo: courtesy of norihiko Dan anD associates

4_12_CoverStory.indd 16 2012/4/28 11:20:02 PM

taiwan business topics • april 2012 17

A I R P O R T

millions of Chinese visitors per year, becomes a more significant driver of the island’s economic growth, the need for a top-notch airport has recently taken on added importance. In response, the government has come up with an ambi-tious vision for the airport to become a new gateway to China and an East Asian hub. Several projects have been launched to improve the airport’s physical plant in stages, with the aim of gradually bring-ing it up to the highest international infrastructure standards. These projects

include renovation of the 33-year-old Terminal 1, scheduled to be completed by the end of this year; an overhaul of the existing runways and construction of a Mass Rapid Transit link to Taipei’s outer suburbs, both to be completed sometime in 2013; and the building of a new Termi-nal 3, to be operational by 2018.

“We are in a position to make the Taoyuan Airport a gateway to mainland China from around the world – not only for long-haul flights across the Pacific, but also from East Asia,” says Samuel

Lin, president and CEO of the Taoyuan International Airport Corp. Ltd. (TIAC), the state-run company established in November 2010 to take over the opera-tion of the airport.

One of the airport’s chief advantages, explains Yeh Kuang-shih, Deputy Minis-ter of Transportation and Communica-tions, is its central geographical loca-tion. The average flying time to the other main airports in Asia, for example, is 2.55 hours, the shortest for any airport in the region. Raymond Chang, general

體環境改善計畫,以使桃機逐步趕上國際頂級水平。

其中包括使用33年的第一航廈訂於年底完成翻新,現

有跑道重鋪及機場捷運將於2013年達成,而旅客量

更大的第三航廈則可望2018年啟用。

桃園國際機場公司總經理林鵬良表示,「我們希望

桃機成為全球進出中國的門戶,不只是橫跨太平洋的

航班,還有東亞各國的客源」。

交通部政務次長葉匡時表示,桃園機場的主要優點

之一便是地理位置。桃機至其他亞洲主要機場的平均

飛行時間為2.55小時,低於區域內所有機場。達美航

空台灣區總經理張建仁則認為,桃機整建完成後,可

成為東南亞與北美航班的最佳燃油補充航點。葉匡時

證實東南亞國家的航空公司確實曾經表達,希望將桃

機當成加油機場。

一項外界忽略但其實深具意義的發展是,由於兩岸

直航快速發展,台灣的航班已經可以通達43個中國

城市,超過香港的40個航點。上海與北京的機場未

來可能更加擁塞,中國西北與西部的居民經由台灣前

往美國與加拿大可能還更加便利。此外,交通部次長

葉匡時認為,東南亞或北美前往重慶、成都或武漢等

內陸城市的旅客,「將會發現台灣是個不錯的轉機地

點」。直飛中國內陸都市的國際航班相對稀少,形成

台灣發展的市場利基。

葉匡時表示,台灣要完全發揮航運潛力,「我們仍

須增加兩岸連結」,以及擴大全球宣傳,因為國際旅

客與旅行社現在都將香港當成往來中國的轉運點。為

了積極搶佔中國快速成長的海外旅遊市場,台灣必須

說服中國放寬居民赴台旅行證件的限制,特別是對僅

僅在台轉機的旅客。

當被問到,南韓仁川國際機場與新加坡樟宜機場

已經躋身國際一流,台灣如何才能抗衡強勢對手時,

交通部的葉匡時承認競爭確實激烈,但亞洲航空市場

成長快速,一定會有足夠空間供台灣發展。交通部曾

經引述波音公司2010年的數據指出,亞太地區的航

空運輸年增6.9%,高於全球平均的4.9%。葉匡時也認

為,桃機必須與其他航站發展伙伴關係,特別是中國

When the first terminal opened in 1979, it was one of the most modern in Asia, but it has since been eclipsed by many new airports around the region.

photo: taoyuan international airport corp.

4_12_CoverStory.indd 17 2012/4/28 11:20:04 PM

18 taiwan business topics • april 2012

Cover story

manager for Taiwan at Delta Airlines, adds that it is potentially the best refuel-ing stop for planes flying between South-east Asia and North America, once the airport’s infrastructure is modernized. Yeh confirms that some airlines from Southeast Asian nations have expressed interest in using the airport as a refueling point.

What is less well known but even more significant is that cross-Strait direct aviation links have developed to the point where more Chinese cities (43) can be reached by air from Taiwan than from Hong Kong (around 40, according to the Hong Kong airport website). With the increasing congestion at the Shanghai and Beijing airports, Chinese travelers from northwestern and western mainland cities might find it much more convenient to transit through Taiwan on their way to the United States and Canada. In addi-tion, says Yeh, travelers from Southeast Asia or North America heading for inland Chinese destinations such as Chong-qing, Chengdu, or Wuhan will find that “Taiwan offers a good place to trans-fer flights.” Direct international flights to those interior cities tend to be rather infrequent, providing Taiwan with a market niche.

Yeh notes that for Taiwan to take full advantage of this potential, “we need to further increase connections between

Taiwan and China,” and to engage in more promotion, since international trav-elers and travel agents now tend to think of Hong Kong as the gateway to China. To be able to fully tap into the rapidly growing outbound travel market in China, Taiwan would also need to obtain Beijing’s agreement to liberalize its policy on issuing travel documents to its citizens for travel to Taiwan, particularly when the purpose is merely to transit or trans-fer en route to another destination.

Asked how Taiwan will be able to

compete against such other Asian hubs as Korea’s Incheon International Airport and Singapore’s Changi Airport that are considered to be among the world’s best, Yeh concedes that the competition is tough, but sees Asian air transporta-tion as growing so rapidly that there will be sufficient demand for Taiwan to claim part of the pie. The Ministry of Trans-portation and Communications (MOTC) cites 2010 data from Boeing showing annual growth in aviation traffic of 6.9% in the Asia-Pacific, compared with the

西北地區。

交通部的葉匡時表示,除了開發轉機客源,拓展貨

運同樣重要。轉運中心的另外一個要件是桃機週邊的

商旅設施,例如桃園航空城,也必須提供多元的轉機

度假方案,吸引商務旅客在台灣多玩幾天。

拓展兩岸旅遊

台灣2008年開放中國觀光客後,至去年11月已有

292萬人次訪台,大幅提振觀光產業。民航技術供應

商台灣亞瑪迪斯的總經理劉家輝說,中國海外觀光的

快速成長已使台灣的全球能見度更高,特別是經常出

國的旅客,這些經濟條件較佳的族群,可能已去過泰

國普吉島五次,想換換口味。台灣近來常被列為國際

觀光忽略的潛力地點,例如澳洲人報2010年的評比,

以及美國新聞網站msnbc.com在2012年的調查。

另一個可喜的現象是,部分航空公司首度將桃園機

場納入定期航點。香港航空三月開始降落桃機,荷蘭

皇家航空在取消台北直飛阿姆斯特丹的直飛班機之後

決定恢復,印尼航空也計畫五月重新降落桃機。

桃園機場公司另一項工作是提升旅客滿意度。具體

目標是在三年內躋身「機場服務品質評比」(ASQ)

的前十名。評比是由國際機場協會(ACI)每年編

纂,被視為業界重要指標之一。評比主要指標包括報

到與海關等候時間、行李推車可用數量、與市區間的

交通服務等等。交通部的葉匡時表示,桃機目前的排

名多半在20至30名。而仁川機場2011年已是第七度

拿下榜首,其後為樟宜與北京首都國際機場。

桃園機場改善計畫的第一步是耗資新台幣30億元

整建第一航廈。一航廈過於老舊的問題,反映在近年

層出不窮的管線與屋頂漏水現象。預定年底前完成的

改建工程是由日本建築師團紀彥設計,以類似翅膀的

斜頂象徵中國傳統屋頂。新的航廈除了提高屋頂以增

加空間感,並將保險與其他營業櫃台由地面層移往三

樓,增加可用空間。從大面積窗戶往外看,可一覽週

邊景致。改建後的一航廈可增加13,000平方公尺的樓

photo: courtesy of norihiko Dan anD associates

4_12_CoverStory.indd 18 2012/4/28 11:20:05 PM

taiwan business topics • april 2012 19

A I R P O R T

world average of 4.9%. Yeh also stresses the importance of developing coopera-tive alliances with other airports, espe-cially those in some cities in northwestern China.

Besides increasing transfer and tran-sit traffic, the vice minister says the hub vision will also be achieved by expand-ing the number of cargo flights and devel-oping business attractions around the airport (see the following story on the Taoyuan Aerotropolis), as well as by offering holiday stopover packages to

try to attract business travelers to extend their trip to take a bit of vacation in Taiwan.

Booming cross-Strait tourism

Since Taiwan opened up to Chinese tourists in 2008 through last Novem-ber, 2.92 million Chinese visitors had visited the island, boosting the tourism industry enormously. Daver Lau, general manager of Amadeus, an airport technol-ogy company, says the boom in Chinese

tourism has helped to raise Taiwan’s profile around the world as a tourist destination, particularly with “discretion-ary travelers” – well-heeled types who, for example, may have been to Phuket five times and are looking for something new. Recently Taiwan has been frequently featured high up on lists of underrated international tourist destinations, such as those compiled in 2010 by The Austra-lian newspaper and in 2012 by the news website msnbc.com in the United States.

Another encouraging sign is that some additional airlines have recently put Taoyuan Airport on their route schedules. Hong Kong Airlines started service to the airport in March, KLM has resumed direct flights to Amsterdam after a break of many years, and the Indonesian airline Garuda is also scheduled to resume flying to Taoyuan in May after a long period of interruption.

Raising the quality of the passen-ger experience at the airport is another of TIAC’s goals. Specifically, Taiwan Taoyuan International Airport has set the objective of being ranked within the next three years among the top 10 in the Airline Service Quality (ASQ) report, an industry benchmark produced annually by the Airports Council International. Key performance indicators include the check-in and immigration waiting times, baggage cart availability, transport service

地板面積,使總面積達200,000平方公尺,年度旅客

量可由現在的1200萬人次增加至1500萬人次,與二

航廈合計可達3200萬人次。

不過,第一航廈改建卻造成許多困擾。國泰航空的

羅穎怡說,出入口一改再改,常讓旅客搞不清楚。不

過,施工黑暗期即將過去,北側入境大廳與報到櫃台

預定六月初步完成,南面與其餘櫃台則訂於十一月底

完成。

國泰的羅穎怡說,改建工程早就該做了,以國泰航

空的櫃台來說,在完成改建後,「看起來好多了,富

有現代感」。達美的張建仁則持保留態度,認為建築

本身還是太老舊,最好還是拆掉重蓋。

桃機公司的林鵬良表示,雖然負責遠程航線的第

二航廈相對較新,2000年部份開放、2005年全部開

放,但相關的改善工作還是持續在做,例如兩個航廈

都將換成新的標示系統。林鵬良說,「我們是以香港

國際機場為指標」。

翻新機場跑道

桃園機場另一項重大計畫是新台幣百億的跑道重

鋪工程,工程顧問包括荷蘭空港顧問公司與亞新工程

顧問公司。北側跑道工程已經啟動,南側跑道招標作

業會從八月開始,整個計畫預計2014年完工。除了

重鋪工程,南側跑道也規畫由寬60公尺加寬至75公

尺,長3,350公尺延長至3,800公尺,降落導引與其他

設備也將更新。整修完畢後,桃機將可首度提供雙

層、四引擎的廣體客機空中巴士A380起降。

國泰航空的羅穎怡預估,延宕已久的南側跑道翻修

工程大概得花上一年,「之前狀況很糟,只是尚未真

正影響飛航安全」。她說,「在任何國家,關閉跑道

超過一個月都很罕見」,而長時間只有單一跑道勢必

影響機場運作。羅穎怡的另一個擔憂則是,飛機拖行

的距離增加可能增加輪胎磨耗或破損。

關於上述問題,桃機公司的林鵬良回應,跑道翻修

將會分段進行,因此單一跑道起降運作的時間將不超

photo: ? ?

4_12_CoverStory.indd 19 2012/4/28 11:20:06 PM

20 taiwan business topics • april 2012

Cover story

into the city, and so on. Currently, the airport is usually ranked between 20 and 30, says Yeh, while by comparison the ASQ report in 2011 rated Incheon Inter-national Airport as the best in the world for the seventh year running, with Changi Airport coming in second, and Beijing Capital International Airport third.

The first step the airport has taken toward reaching this goal is the NT$3 billion (US$100 million) renovation proj-ect at Terminal 1, where the roof was sometimes known to spring leaks on rainy days. Remodeling of the interior is due to be finished by the end of this year. The design is by Japanese archi-tect Norihiko Dan, who also designed the beautiful Sun Moon Lake Adminis-tration Office for the Tourism Bureau, and features graceful sloping roofs remi-niscent of a traditional Chinese cottage. The design elevates the interior ceil-ings to create a sense of greater spacious-ness, and that feeling is enhanced by moving the travel insurance and other business kiosks from the ground floor entrance area to the third floor. Look-ing out through the terminal’s large windows, passengers will enjoy impres-sive views of the building’s surroundings. In all, 13,000 square meters of additional space will be added to Terminal 1, bring-ing the total floor area to 200,000 square meters. The annual passenger capacity

will be increased to 15 million, up from the current 12 million, bringing the entire airport’s passenger capacity to 32 million a year.

While the renovations have been taking place, however, significant disrup-t ions have occurred at Terminal 1. Cathay Pacific’s Lo notes the confu-sion caused for travelers by the frequent changes in the layout for entry and exit. But the work should be finished soon. The north expansion of the arrival hall and new check-on counters are expected to be partially completed by June, while the south expansion and the remain-ing counters are to be done by the end of November.

The changes are “much welcome and much overdue,” Lo says. Refer-ring to Cathay Pacific’s counters, which are already completely renovated, she says: “It does look much better – more contemporary and modern.” Delta’s Chang is more skeptical, saying that because the building is still far too old, he would have preferred to see an entirely new terminal constructed.

TIAC’s Lin says that although Termi-nal 2, which mainly handles long-haul flights, is newer – it did not begin partial operations until 2000 and went into full operation in 2005 – it will also undergo improvements, such as a new signage system that will be introduced in both

existing terminals. “We’ve been using the Hong Kong airport as a benchmark for this,” says Lin.

Overhauling the runways

Another major project is the planned overhaul to the airport's two runways at a budgeted cost of around NT$ 10 billion. The general consultant is a consortium consisting of Nether-lands Airport Consultants (NACO) and Taiwan’s Moh &Associates. Work on the north runway has started, and the tendering process for the south runway is expected to begin around August, with the entire project to be completed in 2014. Besides repaving, the overhaul of the south runway involves increas-ing the width from 60 to 75 meters and the length from 3,350 to 3,800 meters. Landing instruments and other equip-ment will also be updated, enabling both of the airport’s runways to accommodate the double-decker, wide-body, four-engine Airbus A380 for the first time.

Cathay's Lo estimates the “long over-due” overhaul of the south runway will take a year to complete, as “the condition was pretty bad, but it hadn't compro-mised safety – yet.” She adds that “it is very rare for any country to close down a runway for more than a month,” and that availability of only one runway for

過六個月。他也指出,成田國際機場等地也曾經經

歷過單一跑道的時期,而拖行距離應不至影響飛機

輪胎壽命。

至於航空旅遊業者都認為極為重要的機場捷運,

交通部的葉匡時表示工程進度順利,2013年將通車

至三重,2015年則到台北車站。機場捷運在第一、

二航廈與高速鐵路桃園站都會設站。

國泰航空的羅穎怡分析,雖然第一航廈與機場

捷運都很必要,但更為關鍵的是第三航廈的設計與

管理。三航廈初估約需新台幣600億元,但不包括

224,000平方公尺的入出境大廳。另外,桃機公司曾

表示將會引進國際頂尖設計團隊。三航廈位於二航

廈停車場以西,主體建物的樓地板面積達421,000平

方公尺;獨立的65,000平方公尺將供辦公、會議、

商店、餐飲、休閒、展覽使用。三航廈每年客運量

可達4300萬人次,使桃園機場的總量達7500萬人

次。

交通部的葉匡時表示,總體顧問契約的招標資訊

預定上半年公告,其後三個月內可望簽約。設計的

國際競圖與建築施工招標將在2013年進行,預計

2014年動工後可在四年內完工。雖然投標廠商的

名稱必須保密,但葉匡時證實,在去年的意見徵詢

(RFI)後,至少有十家美國、歐洲、亞洲企業表達

意願。與台北市美國商會保持聯絡以瞭解第三航廈

招標進度的美國業者透露,此一建案是目前全球市

場最具吸引力的機場建築案之一。

桃機公司的林鵬良特別強調第三航廈的國際性

質,例如招標文件將同時公布中英文版。他說,國

內法雖然沒有要求各語言版本同步公告,但此一作

法符合台灣加入世界貿易組織政府採購協定時的承

諾。此外,桃機公司也不希望語言形成障礙,或被

批評為變相保護國內廠商。他說,「我們一定會提

供公平競爭的環境」。

華眾營造工程公司董事長兼執行長 、美國商會基

礎建設委員會共同主席李雨朴表示,他對第三航廈

的國際參與程度非常樂觀。亞瑪迪斯的劉家輝同樣

4_12_CoverStory.indd 20 2012/4/28 11:20:06 PM

A I R P O R T

such a long period is likely to cause a lot of operational constraints for the airport. Another of Lo’s concerns is that the increased towing of aircraft may cause additional wear and tear on the tires.

Asked about these points, TIAC’s Lin responds that the runway overhaul will be carried out in stages, so that single-runway operations will not last longer than six months. He also notes that other airports such as Japan’s Narita Interna-tional Airport have gone through peri-ods of single-runway operations, and that damage to airplane tires from towing was not a problem.

With regard to the MRT link to the airport – a project that those in the avia-tion and tourism industries consider absolutely vital – construction has been proceeding smoothly and the system is due to open as far as Sanchong in 2013 and to reach Taipei Main Station by 2015, Yeh says. There will be stops in each airport terminal and at the Taoyuan High Speed Rail station.

While improvements to Terminal 1 and an airport MRT are needed urgently, Cathay’s Lo says, the real key to the Taoyuan airport’s future is the proposed third terminal – including how well it is designed and managed. The project budget is NT$60 billion (US$2 billion), not including the cost of a 224,000 square-meter satellite concourse, and the

airport authorities say that top interna-tional talent will be engaged to design the structure. Located to the west of the Terminal 2 car park, the Terminal 3 complex will also include a 65,000 square-meter office building housing some corporate headquarters, meeting rooms, shops, restaurants, recreational facilities, and exhibition space. The termi-nal itself will have floor space of 421,000 square meters, and its capacity of 43 million passengers a year will eventually raise the airport’s total annual capacity to 75 million passengers.

Tender information for a general consultancy contract is scheduled to be released this spring, and the airport hopes to sign a contract within three months, Yeh says. Then an international design competition and tender for the architec-tural contract will take place in 2013, with construction set to begin in 2014 and take four years to complete. Although the names of potential bidders for the general consultancy contract is confi-dential, Yeh confirms that following a Request for Information seminar last year, at least 10 American, European, and Asian companies have expressed interest in the project. U.S. companies who have been in touch with AmCham Taipei about the prospective Terminal 3 tender say it is currently one of the most attractive new airport projects in the global market.

CEO Lin of TIAC stresses the inter-national character of the tender. All bid documents will be prepared in both Chinese and English, with both versions released simultaneously, for exam-ple. Although this step is not manda-tory under domestic law, Lin says, it is required under Taiwan’s commitment to the World Trade Organization’s Agree-ment on Government Procurement. In addition, TIAC does not want a lack of Chinese-language skills to be a barrier to participation or to give unfair advan-tage to local companies whose person-nel read Chinese fluently. “We’re commit-ted to providing an environment of equal competition,” says Lin.

Paul Lee, pres ident and CEO of Global Construction International and co-chair of AmCham’s Infrastructure Committee, says he is very optimistic about the prospect of attracting global talent to take part in the Terminal 3 proj-ect. Equally enthusiastic, Lau of Amadeus says the Terminal 3 project provides a rare “chance to start from scratch” in envisioning how a major facility should be designed and built.

Airline executives Chang and Lo note that the congestion at the existing two terminals makes it difficult for carri-ers to expand there. While a third termi-nal is needed, they say, so far the industry stakeholders have not been given enough

樂觀認為,三航廈是難得的機會,可以從零開始設

計與興建大型建築。

達美航空的張建仁與國泰航空的羅穎怡認為,現

有兩個航廈已經飽和,民航業者很難再擴大營運。

但他們說,雖然第三航廈勢在必行,但航空業者目

前仍未獲得營運決策所需的必要資訊。針對三航廈

的空間利用,張建仁說他認為一切都還只是紙上談

兵,「到底是只給國籍航空使用,或是外國業者也

可利用,我們到現在都還不確定」。

重整桃機軟實力

關於機場的整體發展,交通部的葉匡時說他希望

第三條跑道能在十年內啟用,以確保桃園機場的亞

洲樞紐地位。他並強調,除了改善硬體,桃園更需

要加緊強化軟體面,以使營運更有效率、旅客更為

舒適便利。改善管理效能的計畫之一是引進全新的

營運管理中心,比照香港機場與達拉斯-沃斯堡國

際機場,整合五個獨立的管理中心。

旅客滿意度較低的項目之一是,行李提領等候

時間比先進國家的機場要長。桃機公司的林鵬良表

示,平均等候時間還算符合國際標準的14至35分

鐘,但位於地下室的行李處理設施的確運作較慢。

合理的推測是,第三航廈的設計應會考量此一問

題。

雖然桃園機場已經設有自助報到裝置,供僅有隨

身行李的旅客快速報到,但部分人士認為,桃機公

司的腳步還可以再快一點,引進更多自助服務,例

如自助式行李標籤系統,或是部分澳洲機場已經採

用的近距無線通訊(NFC),方便旅客以手機自助報

到。亞瑪迪斯的劉家輝認為,「桃機要成為全球前

十的機場,整體基礎設施,特別是資訊科技面,是

必須特別留心的地方」。

其他人則建議桃園機場增加軟實力,或者說是

如何讓旅客在機場留下愉快回憶。國泰航空的羅穎

怡認為,改善免稅商店區也許可以使桃機更具吸引

4_12_CoverStory.indd 21 2012/4/28 11:20:06 PM

22 taiwan business topics • april 2012

Cover story

力。她說,「許多成功的國際機場都有良好的免稅購

物服務」,「例如仁川機場有全球最大的LV免稅店,

可以讓商務旅客充分利用等候時間」。另一個軟實力

的例子是,桃機已經採用新的宣傳主題,強調中華文

化之旅、台灣特色之門。管制區內的客家藝品店與霹

靂布袋戲展據說非常受旅客歡迎。

交通部的葉匡時說,桃機公司的另一項任務是吸

引更多航空公司設點。但他也坦承,民航業者增加航

線的意願,往往取決總體經濟,而非單一機場能夠左

右。不過,目前的有利趨勢是亞洲低價航空正快速發

展,例如南韓的真航空(Jin Air)與德威航空(T'way

Airlines)。亞瑪迪斯的劉家輝認為,雖然現在只有

馬來西亞的亞洲航空(AirAsia)與新加坡的老虎航

空(Tiger Airways)等少數廉價航空經營台灣航線,

但產業專家認為台灣很有潛力,而且廉價航班的增加

可忘大幅提升旅客量。如果票價跌至特定水準之下,

原本根本不想出國的人很可能突然改變心意。劉家輝

說,「這就是低價航空的魅力」,「而第三航廈或許

能夠趕上熱潮」。桃機公司的林鵬良表示,為鼓勵廉

價航空進駐台灣,桃機計畫在跑道翻修完成後,區分

尖峰與離峰時段的落地費。

受訪的民航業主管雖然普遍肯定政府重振桃園機場

的企圖心,但仍擔憂執行步調太過緩慢。交通部的葉

匡時承認進度比預期要慢。但他說,「對於如此大型

information for them to start to make business decisions about the future. “I think the plan is still up in the air,” says Chang about the use of space at Termi-nal 3. “Is it limited to national carriers or open to all international carriers? We still don’t know.”

Looking at the “software”

As for the airport’s overall future, Yeh says he hopes a third runway can be completed in 10 years’ time to help Taiwan Taoyuan secure its position as an Asian hub. And besides all the hardware improvements, he emphasizes the need for the airport to work on “software” elements to make its operations more effi-cient and more comfortable and conve-nient for passengers. One of the plans to improve management efficiency involves setting up a new operational control center, modeled on systems in use at the Hong Kong and Dallas/Fort Worth inter-national airports, integrating five existing separate centers for different functions.

Among the shortcomings that passen-gers perceive regarding the current airport operation is the relatively long wait at the luggage carousels compared with other airports in advanced countries. Lin notes that the current average waiting time is within the international industry standard of 14-35 minutes, but concedes that the underground location of the baggage-handling facilities at the existing terminals is responsible for adding a few minutes to the process. Presumably, this problem will be considered in devising the layout for Terminal 3.

Although the airport already has auto-

mated check-in facilities to enable passen-gers with only carry-on baggage to avoid long waits at the counter, some observ-ers stress that TIAC needs to move faster to incorporate more self-service tech-nology, including self-tagging luggage systems at electronic kiosks. It might also consider the Near Field Communi-cation technology that some Australian airports are experimenting with to allow passengers to check in simply by swiping their mobile phones against an electronic reader. “For Taiwan to be among the top 10 airports in the world, the overall infrastructure, especially on the IT side, is something they have to look at,” says Lau of Amadeus.

Others recommend that the airport increase what they call its “soft power,” or how the time spent in the airport can be made into a pleasurable experience. Lo of Cathay Pacific suggests that improv-ing the duty-free facilities could help put Taiwan on the tourism map. “A lot of successful international airports have good duty-free shopping experiences,” she notes. “For example, Incheon has the biggest LV (Louis Vuitton) duty-free shop in the world. It gives business travelers a way to make good use of their time.” As another example of “soft power,” the airport has already adopted a new theme – “the start of a journey to Chinese culture and a gate to Taiwan’s special features”– to guide its branding activities. A Hakka culture shop and Pili Puppets exhibition in the controlled area report-edly have proved popular with travelers.

Another aim of TIAC is to increase the numbers of new airlines serving the airport, Yeh says. He notes that

an airline’s willingness to add a new route is often based on macroeconomic factors that are beyond the airport’s direct control. One current significant trend that could influence this develop-ment is the growing market in Asia for low-cost carriers such as Korea’s Jin Air and T’way Airlines. Lau of Amadeus notes that despite the limited numbers of bargain airlines now flying to Taiwan (they include Malaysia’s AirAsia and Singapore’s Tiger Airways) , indus-try watchers consider that Taiwan has great potential for development in this sector, and that an increase in such low-cost flights could dramatically boost the passenger volume. Once air tick-ets drop to a certain price level, people who never previously considered trav-eling abroad would suddenly want to. “That’s the promise of the low-cost carri-ers,” Lau says. “The third terminal hope-fully will be ready in time to take these increased travelers.” TIAC’s Lin says that to encourage more budget airlines to fly to Taiwan, the airport plans to offer different landing fees for peak and off-peak hours after the runway overhaul is completed in another two years.

Industry executives interviewed for this report generally praised the govern-ment’s vision for revitalizing the airport, but expressed concern that the implemen-tation process has been too slow. Vice Minister Yeh admits that the progress has been slower than expected. For a project of this size, “you need a lot of coordina-tion among different (central government) agencies and also with the local govern-ment,” he explains. “You need to reach a consensus and that can be a bit tough.”

4_12_CoverStory.indd 22 2012/4/28 11:20:07 PM

taiwan business topics • april 2012 23

A I R P O R T

的計畫,不只中央部會間必須整合,中央與地方也需

要協調」,「規劃要取得共識,得花點時間」。

華眾的李雨朴等部分人士認為,問題一部分來自桃

機公司很多成員還是改不了官僚心態。桃機2010年

11月公司化至今不過一年半時間,多數員工來自交

通部民用航空局。仍是國營體質的桃機公司,接手機

場與自由貿易區的計畫、興建與運作,可能還需要一

段時間才能達成當初公司化時的目標,即提高經營效

率、快速回應市場。

華眾的李雨朴雖然肯定政策目標,但認為「現在還

看不到太顯著的成果」,因為「改善的都是局部,而

非整體」。而他認為,因為桃機公司還是國營,因此

就算引進心態開放的林鵬良等人,大概也很難在短期

內改變內部文化。李雨朴認為,真正的解決之道是,

比照越來越多國家的作法,讓桃機公司民營化。作法

包括股權全部釋出,或是引進民間資本部分持股,甚

至是在證交所掛牌上市。他認為,不管是哪一種作

法,應該都能改善企業治理、強化桃機的國際競爭

力。

華眾的李雨朴表示,北京首都機場公司雖是國營企

業,但仍在香港掛牌,「如果北京的共產黨都可以,

為什麼台灣不行?」目前的障礙之一是法令要求機場

必須百分之百公有。但也許未來立法院會考慮修法,

為桃園機場注入更多活力與專業作風。

Some, including Global Construc-tion’s Lee, consider that part of the problem is the bureaucratic mental-ity of many of the personnel working for TIAC. The state-owned company, which has been given responsibility for the planning, construction and operation of the entire Airport Park area (includ-ing the airport and a free trade zone), has been in existence for only a year and a half. Most of its employees were formerly civil servants on the staff of the Civil Aeronautics Administration, which previously ran the airport. The motiva-tion for “corporatizing” the administra-tive agency was to enable it to become more efficient and respond more quickly to market changes.

Lee applauds that objective, but says that so far “the results are not that obvi-ous,” since “you see pockets of improve-ment, but not overall.” Because the corporation is sti l l state-owned, he surmises, it could be difficult even for an open-minded CEO such as Lin to change its culture very rapidly. Lee suggests that the best solution would be privatize the corporation, in line with what has been a growing global trend in airport manage-ment. The model could involve either total private ownership or a hybrid that combines government shareholding with investment from private equity firms or even a listing on the Taiwan Stock Exchange. In either case, he suggests, privatization would improve corporate

governance and enhance the airport’s competitiveness vis-à-vis its counterparts around the world.

The Beijing Capital International Airport Co., which is majority-owned by a Chinese state-run company, is listed on Hong Kong’s stock market, he notes. “If Communists in Beijing can do this, then why can’t we do it in Taiwan?” Lee asks. At present, the answer is that Taiwan law requires the entity operating the airport to be 100% owned by the Taiwan government. But at some point in the future, the Legis-lative Yuan may decide to revisit that requirement in the interest of injecting greater energy and professionalism into the airport business.

The new look for Terminal 1 was designed by Japanese architect Nirohiko Dan, whose work on the Tourism Bureau's Sun Moon Lake Administration Office has been widely praised.

photo: taoyuan international airport corp.

4_12_CoverStory.indd 23 2012/4/28 11:20:08 PM

24 taiwan business topics • april 2012

Cover story

A few years ago, government officials spoke frequently and enthusiasti-cally about the Taoyuan Aerotropolis

project, a vision of an airport city extending over some 6,150-hectares (nearly 24 square miles). Depicted as featuring thriving logis-tics and aviation-technology businesses sur-rounding and supporting the Taiwan Taoyuan International Airport, the concept was touted during the global financial crisis as an ideal infrastructure project to stimulate the then-ailing economy. After all, the airport – with its throughput of 1.76-million metric tons of cargo per year, is the fourteenth busiest air-freight hub in the world (a few notches ahead of Beijing, but still well behind Hong Kong at number one), as shown in a 2010 survey con-ducted by the Airports Council International.

In addition, fast-growing Taoyuan County is home to two million people and one-third of Taiwan’s leading manufacturers, including some of its global ICT stars and 70% of the island’s logistics companies, according to the Taoyuan Aerotropolis Corp. established by the Taoyuan County government. And at just under three hours, the Taiwan Taoyuan Inter-national Airport has the shortest average flying time to other international airports in Asia, and the airport is located close to the Port of Taipei the and High Speed Rail line, making the surrounding area a good base for connec-tions to China and other Asian markets.

But after several years of discussion, the Aerotropolis plan is still waiting for take-off. Implementing the plan has become bogged down in thorny land-acquisition and zoning issues, say officials involved. Yeh Kuang-shih, deputy minister of the Ministry of Transporta-tion and Communications (MOTC), notes that the overall concept has been approved by the Executive Yuan but that the land-acquisition process has been slow. “We’re still planning for how much land we need,” Yeh adds. “Then this needs go through the admin-istrative process and further approval by the Executive Yuan. We’re still in the planning stages as to how to implement this project.”

Some private-sector observers say that as the airport will be the main driver of eco-nomic activity in the Aerotropolis, the gov-ernment is correct in putting the Aerotropolis plan on the backburner for the time being

so as to give priority to improvements in air-port facilities, particularly the renovations to Terminal 1 and the runways. “Until they sort out these most important steps, they’re con-strained in what they can do,” says Vivian Lo, Cathay Pacific’s general manager for Taiwan and Korea.

Officials liken the Aerotropolis to an egg. The “yolk,” an Airport Park managed by the MOTC and the Taoyuan International Airport Corp. (TIAC), will include the airport itself plus the surrounding land at around 1,770 hectares and a free trade zone of around 330 hectares. “The egg yolk is smaller, but it brings all the nutrition and the dynamics,” says Samuel Lin, TIAC’s president and CEO.

Current planning calls for the “yolk” to include air cargo and warehousing facilities, as well as shops, restaurants, meeting rooms, and office space inside the passenger-terminal complexes. The free trade zone would con-tain additional warehousing, a logistics center, and other businesses related to air cargo. A portion of the zone would be allocated to a Flower Exhibition Center and an international trading platform for flower growers. The government is looking for investors for all the projects, Yeh says, and wants to attract the most innovative industries.

Jimmy Liu, general manager of the Tao-yuan Aerotropolis Corp., which is taking charge of the “egg white” section of the plan, says that his part of the project must wait for land acquisition for the “yolk” to be com-pleted, a process that is estimated to require another three to five years. “The real issue for us is that the central government and the MOTC need to take care of their portion before the county government can jump in,” he says. “We’re looking at 10 years from now for future development.”

Eventually the “egg white” portion is expected to take up more than 4,000 hect-ares (15.5 square miles), Liu says, probably to include a 750-hectare aviation industry zone, 490-hectare trade exhibition hall, 1,385-hectare area for aviation-related indus-tries, 360-hectare coastal recreational area, 525-hectare area for high-quality agriculture, and a 685-hectare quality residential district. Activities in the aviation industrial zone could include precision machinery, international

aviation research and development, educa-tion and training, with some of these activities possibly also overlapping into the Airport Park or “yolk.” TIAC’s Lin says the airport’s growing demand for aircraft maintenance facilities could also provide opportunities for industrial operations making spare parts and aviation equipment.

The coastal recreational zone might include tourist villas, shopping malls, and an eco-water park, and the agricultural area might specialize in organic farming. Liu also envisions the “egg white” as containing a 4-5 hectare medical tourism park and a 300-400 hectare cultural village that he describes as a “Little Tokyo,” a holiday place for Japanese looking to get away from the earthquake and tsunami devastation in Japan’s north. In addi-tion, Liu says he welcomes logistics and cul-tural innovation industries, including movies and digital content. An artists’ village is also being considered.

But acquiring land has been a headache. Existing government-owned land in the “egg white,” Liu says, includes 22 hectares around the Taoyuan High Speed Rail Station that belong to the MOTC and are earmarked for commercial development of such projects as hotels, shopping centers, and international exhibition facilities. The government also owns other pockets of land in this area, such as a site of more than 200 hectares belonging to the Civil Aeronautics Administration that is currently sitting idle. The Taoyuan Aerotropo-lis Corp. would like to have the title to that plot transferred to its ownership, but that has not yet occurred. The most difficult challenge, however, is negotiating to take over land now in the hands of private owners. Besides going through a long legal process, Liu says, the corporation must provide them with land of equivalent value in another location.