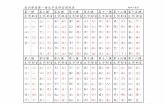

趙綺平製表 第七課 第九課 第十一課 第十三課 第十五課 部首 生字 … · 第五課: 第七課: 第九課: 第十一課: 第十三課: 第十五課: 生字;

1 課程十: Options 選擇權 本講義僅供上課教學之用。. 2 何謂衍生性金融商品...

-

Upload

shannon-wiggins -

Category

Documents

-

view

236 -

download

0

Transcript of 1 課程十: Options 選擇權 本講義僅供上課教學之用。. 2 何謂衍生性金融商品...

1

課程十: Options 選擇權

本講義僅供上課教學之用。

2

何謂衍生性金融商品Derivatives

Contracts that are priced according to underlying variables (prices are derived from underlying).

Options, Futures, Forwards, Swaps, Warrants, etc.

3

買入選擇權 A Call OptionA call option gives its holder the right to

purchase an asset for a specified price, called the exercise price (or strike price) on or before a specified expiration date.

A European option - can be exercised at maturity only.

An American option - can be exercised at any time prior to maturity (or at maturity).

4

A Call Option

A call option gives its holder the right to purchase an asset for a specified price, called the exercise price (or strike price) on or before a specified expiration date.

Example: A July call option on Intel with a strike $85 gives you a right to get this stock for $85.

To get this option one should pay a price (called premium).

If the price grows above $85 will you exercise it?

5

A Call OptionExample: A July call option on Intel with a

strike $85 gives you a right to get this stock for $85.

July arrives.a. The price is $80. What are you going to

do?b. The price is $85. What are you going to

do?c. The price is $87. What are you going to

do?

6

Call Value before Expiration模式價值與履約價值

E. Call

X Underlying

premium

7

賣出選擇權 A Put Option

A put option gives its holder the right to sell an asset for a specified price, called the exercise price (or strike price) on or before a specified expiration date.

8

Put Value before Expiration模式價值與履約價值

E. Put

X Underlying

premium

X

9

An option is in the money when its immediate exercise produces profit.

An option is at the money when its immediate exercise produces 0 profit.

An option is out of the money when its immediate exercise produces loss.

10

Call: Buyer has right to purchase underlying asset. Put: Buyer has right to sell underlying asset. Writer (seller) of call option: Commitment to sell underlying asset. Writer of put option: The commitment to buy underlying asset. Writing a covered call: Own the underlying stock. Writing a naked call: Not owning the underlying. Buyer and seller have opposite price expectations. Premium is the price of the contract. Options may be: exercised, traded in the open market, allowed to expire worthless.

11

Options TradingMajority of standard options have short time to maturity and strike close to the current price.However on OTC market one can find almost any imaginary option. Like: generate an option on weather?What if something happen with the underlying?

split, dividend, trade was stopped.There is a split adjustment (including the strike).There is NO dividend adjustment (for cash dividends). Dividends are usually anticipated.

12

Options Clearing Corporation

Major goal - to reduce the counterparty risk, and to create a standardized tool.

OCC - is jointly owned by the exchanges on which stock options are traded. It plays a role of a credit buffer.

Margin requirements on writers.

13

Other Listed Options

An option can be traded even if the underlying asset is not traded.

Index Options S&P 500 NYSE IndexNikkei 225FT-SE 100Eurotrak 100

14

Other Listed Options

Futures Options - options on futures contracts.

Currency options (Philadelphia Stock Exchange and International Monetary Market)

Interest Rate Options, Options on BondsCommodity Options

15

Protective PutPayoff

X Underlying

X

Put

Protective Put

Stock

交易策略

16

Covered CallPayoff

X

X

Written Call

Covered Call

Stock

17

StraddlePayoff

X

X

Straddle Call

Put

18

The Put-Call Parity

Compare the following two portfolios:A. Has one share of stockB. Has a Call option and a short

position in a put option on the same stock with the same time to maturity, and the same exercise price.

P = C – S + PV(X)

19

Option Valuation

Intrinsic value of an in-the-money call option

max(S – X,0)

For out-of-the-money options it is set at zero.

The time value of the option is the difference between the price of the option and its intrinsic value.

20

Binomial Option Pricing二項選擇權評價模式

Assume that only two possible states can occur at maturity. The stock price will either increase by a certain amount or decrease.

21

Binomial Option PricingStock

50

200

100 C

Call

0

75

Bond

1+r

1+r

1

22

The three assets are NOT independent

Let’s create a synthetic call option – a portfolio of the stock and the bond which replicates the call option. STATIC

Take stocks and bonds:Portfolio

50 + (1+r)

200 + (1+r)

23

The three assets are NOT independent

Portfolio

50 + (1+r)

200 + (1+r)

100 +

C

Call

0

75

24

200 + (1+r) = 75 50 + (1+r) = 0150 + 0 = 75

= 1/2, = – 25/(1+r)

The three assets are NOT independent

25

The three assets are NOT independent

Portfolio

50 0.5 – 25

200 0.5 – 25

100 0.5 -25/(1+r)

C

Call

0

75

If r = 8%C = 100 0.5 – 25/(1+0.08) = $26.85

26

Hedge Ratio

How many stock options would offset the price movements in one option?

In other words how to form a riskless portfolio of stocks and options?

SS

CCH C

27

Hedge RatioForm a portfolio of 1 option and H stocks SHORT.

SSS

CCC

HSC

SSS

CCC

Why do I think that there is NO uncertainty here?

28

Hedge Ratio

0

SSSS

CCCC

SSS

CCCS

SS

CCC

There is NO uncertainty here!

29

Black-Scholes Model

Assumptions:no transaction fees, no taxesno borrowing constraints, the same rcontinuos tradingefficient market, no arbitrage

30

Black-Scholes Model

Tdd

T

TrXS

d

dNXedSNC rT

12

2

1

21

2ln

31

Black-Scholes ModelC – current call option valueS – current stock priceN(d) – the probability that a normally

distributed random variable is less that dX – exercise pricer – risk free interest rateT – time to maturity – yearly volatility of the stock

32

Example

Use the BS model to price the call option on a stock S0=$70, X=$70, T = 70 days, r = 6%. There are no dividends, = 20% (yearly).

087586.0365/702.0

17517.0365/702.0

36570

22.0

06.07070

ln

12

2

1

dd

d

33

Example

Use the BSM model to price the call option on a stock S0=$70, X=$70, T = 70 days, r = 6%. There are no dividends, = 20% (yearly).

85.2$

)(*70)(*70

534897.0)(

569527.0)(

2365/70*06.0

1

2

1

dNedNC

dN

dN

34

Option Valuation

Stock price Exercise price Stock volatilit Time to expiration Interest rates Dividend payout

35

If this variable increases the call option

Increases

Decreases

Increases

Increases

Increases

Decreases

Stock price Exercise price Stock volatility Time to expiration Interest rates Dividend payout

敏感性分析

36

Restrictions on Option Values

Price of an option is always positive C S – PV(X) – PV(D)

For a non-dividend paying stock, it never pays to exercise early:

C S – PV(X) S – X Non dividend means no dividend durin

g the life of the option only!

37

Early exercise of a putIf you have a put option on a stock of

a company which goes bankrupt.

Then the early exercise is optimal because you prefer to be paid now rather than at maturity.

The American put is more valuable than the European put. (American calls will not be early exercised.)

![[Nelson 2003] dissociable neural mechanisms underlying response based and familiarity-based conflict](https://static.fdocument.pub/doc/165x107/55ca3956bb61ebc7748b472b/nelson-2003-dissociable-neural-mechanisms-underlying-response-based-and-familiarity-based.jpg)

![arXiv:1207.3616v3 [math.DG] 30 Dec 2013 · G2-structure ϕwhose underlying metric g ...](https://static.fdocument.pub/doc/165x107/5ae40ce57f8b9a5d648ec7df/arxiv12073616v3-mathdg-30-dec-2013-whose-underlying-metric-g-.jpg)