Սպայկա ՍՊԸ համախմբված ֆինանսական ......e uanertitty Basis for Qualified...

Transcript of Սպայկա ՍՊԸ համախմբված ֆինանսական ......e uanertitty Basis for Qualified...

-

«Սպայկա» ՍՊԸ համախմբված ֆինանսական հաշվետվություններ

2019թվականի դեկտեմբերի 31-ին ավարտված տարվա համար Անկախ ստւդիտորական եզրակացության հետ միասին

-

SPAYKALIMITED LIABILITY COMPANY

CONSOLIDATED FINANCIAL STATEMENTS

31 I}ECEMBER 2019

YEREYAN 2S2O

-

Content

Audit ReportConsolidated Statement ofpr'ofit or loss and other comprehensive incomeConsolidated statement of financial positionConsolidated statement of changes in equityConsolidated statement of cash flowsNotes to the consolidated financial statements

nJ{U*t

It

s

s

1fi

-

ffi tumkmffiH eeyHBaker Tilty Arrtrenla SJ$*ft* Hanr*petutymn $treetSm{& Yersvam, Repuhtlc sf ArrmenisTel: *sf4it&3 s44-3s*Ys[; *S74{ { fi} S44"-/S#SFax: +$76{1tr} $tr*-4tr4ffi rma * * : i ttfq#Sahsi,4i I lvarmqiliF,s* nftMrvffi&r" ha ks rtl il I y. a nr

Q frrtrr ]f]?{}-.' st L,tJ..l lar'Q i; V

b{ s33*1{}

##fff,sffiffi#f3k

G.HVffiRGVATE{

&$amaging FartmerBmker Ti$$y Armiemia il-H$C

f,r*:en,$'e/nr Awdit seffir##ss ,|f# fiffflP#S4Fr*videsi fut t&r* tr 4 fulireistry *f' ffimrxrl*#& amd ff**xe*wryt

To the Participants afSpayka LLC

Qualified Opinion

We have audited the consolidated financial statements of Spayka Limited Liability Company (the"Company"), *4 its subsidiaries (the "Group"), which comprise the consalidated statement offinancial position as at 31 December 2019, the consolidated statefixents of protit or loss and othercomprehensive incame, the cctnsolidated changes in equity and the consolidated cash.flows for theyear then ended, and notes to the consolidated financial statements, including a summary ofsi gnificant accounting polici es.

In our opinion, except for the possible effects of the rnatter described in the Basis for QuatifiedOpinion section of our report, the accompanying consolidated {inancial statements give a true andfair view of the consolidated financial position of the Group as at 31 December 2019, and of itsconsolidated financial performance and its consolidated cash flows for the year then ended inaccordance with International Financial Reporting Standards (IFRSs).

ADVISORY . ASSURANCE .ACCOUNTING .TAXBaker Tilly Armenia CJSC is a member of the global nef$'-ork of Baker Tilly International Ltd., the members of which areseparate arrd independent legal entities.

3

ffiffitrffiffiIgK*qtffip $,Hffiffi,ffi effi:#JtH

-

e uanertitty

Basis for Qualified OpinionThere is an ongoing tax case against Davit Ghazaryan, the General Director and shareholder ofSpayka LLC, for possible indirect tax avoidance during prior years tlrough anotler legal entity.The State Revenue Commitlee, believes that this entrty has been de facto under the control ofmanagement of Spayka LLC and allegedly acted within the interests of Spayka LLC. The detailsof the tax case are described in Note 25 of the financial statements. As described in Note 25,although the Group has made AMD 1,000,000 thousand deposit to the unified account of StateRevenue Committee for Davit Ghazaryan to be released from custody, in the financial statementsfor the year ended 3l December 2019 the Group did not recognize any provision for potentialliabilities that could possibly arise from this case. We were unable to obtain sfficientappropriate audit evidence ourselves about possible liability, if any, arising from the case as of31 December 2019, because the investigation is still ongoing. Consequently, we were unable todetermine whether any adjustments in respect of provision for liabilities atfibutable to the Grouparising from the tax case were necessary.

We condueted our audit in accordance with International Standards on Auditing (ISAs). Ourresponsibilities under those standards are further described in the Auditors' Responsibilities forthe Audit of the Financial Statements section of our report. We are independent of the Group in&ccordance with the Intemational Ethics Standards Board for Accountants' Code of Ethics forProfessional Accountants (IESBA Code) and rvith the ethical requirements that are relevant toour audit of the frnaneiat statements in Armeria, and we have fulfilled our ethicat responsibilitiesin accordance with these requiremenj$, Ws bslieve that the audit evidence we havp obtained issufficient and appropriate to provide a basis for our qualified opinion.

Material Uncertainty Related to Going ConcernWe drarnr a,ttention ts Note 2.2 tn the financial staternents, which indicates that the Group'srevenues and operating profits have decreased by AMD 24,987,61Q thousand and AMn16,597,454 thousand respectively, as compared to prior year and, as of 31 .December 2019 theGroup had overdue loan liabilities. In addition to this, the Group has noted further uncertaintycreated by the COYID-l9 pandemic. As stated in Note 2.2, these events or conditions, alongwith other r-nattors. as set for.th in Note 2.2, indipate thet a material uneertainty exists.that maycast significant doubt on the Group's ability to continue as a going concern. Our opinion is notmodified in respect of this rnatter.

Responsibilities of Management and Those Charged with Governance for the FinancialStatements

Management is responsible for the preparation and fair presentation of the financial statements inaccordance with IFRS, and for such internal control as management determines is necessary toenable the preparation of financial statemenB that are free from material misstatement, whetherdue to fraud or eror.

In preparing the frnancial statements, mflnagement is responsible for assessing the Group'sability to continue as a going concern, disclosing, as applicable, matters related to going concernand using the going concern basis of accounting unless management either intends to }iquidatethe Group or to cease operations, or has no realistic alternative but to do so.

Those charged with governance axe responsible for overseeing the Group's financial reportingprocess.

ADYISORY . ASSURANCE .ACCOUNTING .TAXBaker Tilly Armenia CJSC is a member of the global network of Balier Tilly Intemational Ltd., the members of whichare separate and independent legal entities.

4

-

(3 uam*ltty

Audilor's Rcsponsibilities for the Audit of the Financial Statemeuts

Our objectives are to obtain reasonable assurance about whether the financial statements as awhole are free from material misstatement, whether due to fraud or elror? and to issue anauditor's report that includes sur opinion. Reasonable assurance is a high level of assurance, butis not a guarantee that an audit conducted in accordance with ISAs will always detect a materialrnisst*tement when it exists. Misstateme*ts oatr arise ftorn frand or ertcr and are csnsideredmaterial if individually or in the aggregatn, they could reasonably be expected to influence theeconomic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with ISAs, we exercise professional judgment and maintainprofessional skepticism throughout the audit. We also:

r Identify and assess the risks of material misstatement of the financial statements, whetherdue to fraud or elror, design and perform audit procedures responsive to those risks, andobtain audit evidence that is sufficient and appropriate to provide a basis for our opinion.The risk of not detecting a material misstatement resulting from fraud is higher than forone resulting from error, as &aud may involve collusion, forgery, intentional omissions,misrepresentations or the override of internal control.

. Obtain an understanding of internal confrol relevant to the audit in order to design audit. procedures that are appropriate in the circumstances, but not for the purpose of

expressing an opinion on the effectiveness of the Group's internal control.

. Evaluate the appropriateness of accounting policies used and the reasonabteness ofacaounting estimates and related disclosures made by management.

r Conclude on the appropriateness of managemenl's use of the going concern basis ofaccounting and, based on the audit evidence obtained, whether a material uncertaintyexists related to events or conditions that may cast significant doubt on the Group'sabiltty to cortifiue as a going coflcern. If we conelude th6t e ffiateriel uncertaifify exists,then we are required to draw attention in our auditor's report to the related disclosures inthe {inancial statements or, if such disclosures are inadequate, to modify our opinion. Ourconclusions are based on the audit evidence obtained up to the date of our auditcr'sreport. However, future events or conditions may cause the Grcup to cease to continue ase goirlg ootrcem.

r Evaluate the overall presentation, structure and content of the financial statetnents,including the disclosures, and whether the financial statements represent the underlyingtransactions and eyents in a manner that achieves fair presentation.

o Obtain sufficient appropriate audit evidence regarding the financial information orbusiness activities of the Group to express an opinion on the financial statements. trMe areresponsible for the direction, supervision and performance of the audit. We remain solelyresponsible for ow audit opinion.

We communicate with those charged with governance regarding, among other matters, theplanned ssope and timing CIf the audit and significant audit findings, including any siguificantdeficiencies in internal control that we identify during our audit.

A rrriitnr.4. 1. t',Prirt-r G.q-r.r.'*tr If, ft ,r trvr. lviKfficft)ien

{}s " s? "2020

ADYISORY . ASSURANCE .ACCOUNTING .TAXBaker Til\, Armenia CJSC is a member of the global network of Baker Tilly lnternational Ltd", the members of rvhichare sep'rrate aod independent legai entities.

5

-

mffiffiftf,mKe

Revenu*

tclst trf salssffiross prmffit

S*l}ing mnd distributimn sxpsn$ss

A dmi ni stretivf, sxps{rss s

#th*r in*omeSther expsnsfis

#p*rmfimg pr*f?*#thm' xl ortr*operating in*orne

Nmt frxanc* eosts

Frmfif h*fmr* faxtrn*ernne t*x

{Lo*s}fPr*ffis for tke }'$frr

#*k*r ssffiIprefixsmsive" tmc*mr*#th*r fi*{$pr*hmn siv* in*offi}*Tofml €$ffirpr*hexlsive {[css]/im* sffi*

CONSOLII}ATEI} STATEh{ENT OF TROFIT OR LO$S,A.ND OTHERCOMPRnIIENSIYE INCOME

S.or f,lre y#er emrted 31 &*csnnber 2SI I

SffiI*a"Cd##o*m&dsr*d"&ffi mef r#f,r*rmmffi

{sr *e y*w *Hd*d.3J .^&mr*mkr ffii P

3(}1S

T'hmssawd AMI)

3STfilt{mfes

*,ryI

s

#

1*

11

12

I3

14

I3-S?S,?S(}(5,S55,8?2)

(2,267,*84)

2{}5,2S3

( [,9ss,94 I]

31,t)3x-1$g

{6,?95,S43}(2,22 I,-143)

53S,7* I

{ 1,$84 ,624}

57,4i9,157{ A* Oa} S 0.T-r\t"tJ?o*)&$ { t }

8?,4fi5,?S?/ tr .t 4 F*Pt rr riq {'}\

f SIrJ /JIOA#)

t Q?r 6&sv ur t r1 ,1J-., a.F?3fi,SS2

t4,957, 1$?)

.?fE-f;6&"r qsAd arrr.,, c.t-l 9 .it ri.} t

{3,6fiS,z63;

{?46,6S4}12S,9#6

16r$frS,SS?

{ },515,S54}/ 4.4 N r'dt^\

tftr'/,&vil) 15,3SS0ff3S

{6I?o$qffi} 1$,365,8$3

1-30 *otes on pages 1046 are an ur*tegral part of these ccmsolidated financial statements.6

-

--

EpavilEF.

Ass*ts

Nsm-{Hrr*mf *ssefsFrnpcrty, pl.ant nnd equiprnentImtangible a*sets

Seftrred tax assstsTrade and *ther recrivables

Tofal nsm*f;iltrrfinf assefs

Curr*nt mssetrXnventories

Biological assetsCnsh and *sstre *q*ivalentsTrads and *th*r receivabl*sT'r.rtal *Lu.r*mt xgngts

Tot*I *s*sts

Slquif,y alld Lixbitrifies&quity$hars Q*pitmlAdditi*nal Paid in CapitalRml'aluafj gn R.e*erve

Retain*d Harnin&$

Total eqxify

N$n*eurr*mt linbititiesLoa*r and b*nowingsSeferrrd im**ffrsF\..S.**-*'rrrd +^o' X: ^I,.i I; +i o-t-.rtJ-1.\i'I t hi["[ tG,,,h. lt6t/III LIt"S

T*txtr afisrr*curr#mt liahill fies

Currenf lf;ah,iliLoans *nd b*rrTrarje and *thTax linbilityTotal f,ums

CONSOLIDATED STATEFIENT OF FINANCIAL POSITIO}{

As ilt 3I l)*cennher 2SI I

Hctes 2{}1S

.e#ye"f,f,#fr mmJiiefa*edf-u+u,rssf #tef#ffi *rn*s

{*r the pw*r end#d SI fu*amkr 3#!P

Z?rrsttsand AMI)

3{}I I

15

I614

?*

tr?

Iffi

1q

2r}

?i"i)l 1.4* ,A t ixt

? 1"3

?2r4 FiAJ1A-[T

21

Z4

132,5fi5,8S6ss,071

?83,51 I

3S5,S55

4,3#4,7$*t {?a ?qfid,,g€Nile--*

545,85 5

9,433_34*

t'1ft4 Ai-{\6, j.94, iS95,63?,3 55

t"u 1-44,2:qZ

41,14?,57?

62,4*7,1356, 13fi,804

*r2A',l{,A&.r-l'"iit "t

?"6,218,9411,92[},S{iS

- 38,XS?,$fis,.-l SI n$34u$*$

1I4,259,6fi137,559

1S 1,S83

?",\$x..69{}

tr s3,931*SSS .....,. -.Imqq$?5$L

5,20S,402r ??fi t dfi,.*)4* v94 {u1".3?5, 143

8,593,t)33dF m{{.4}if\!rtI /?dI X,}iA:, t { u- ftcFfr r'a&-fIB'JI! lqt"l,w

I51,{}34,6S{} IS3,{}tlS,?S$

6, tr S*t,1Ss

5,63 7 ,3551,,144,?q?

41,765,??fi

54,123,3SS s4-?4l"$ss

63, 167,6trS

6,369.666a,'t 7 2A1L t I,J\l*

681777,r?{}3 69,8[,8 1637

*$

vin 7,0s1,p641,3 I S,33l

5S,?51

s*4s9r546

Totat eqrli

ffiavtt #Genernl llir*

S.fir#$; 2{l2tl

1-30 notes on pages 10-46 are an integral part of these consolidated financial statemeots"7

{*l'\#, ll;"f"{,,h'1,,.'tr*

I rlt*,$ne '/9

133,S{}S,?59

FIak*byan

-

-__-Bp+vF(*

Balmn*e at i Jnnuary ?*1&Cr*rrp r *la e ns iv e i n * * wre

Pr*Jit.fbr rk* j,e*r{}ther { {}rwprsltens it, * i nc *meT*tsl c*wtpreksnsive fn**mef*r the y€er

Smtraxnse mf Sl ffiecermh*r 2SI$

Salan*e at 1 January ?SI q

C*mprehensive in*offieI*ss f*t'{&ts y##r

{}ther c {}ffn{}r#he ns iv e iwcowe

T*ts{ **mpr*h*rl,sive isa**wa*f*r the ystxr

BaI*m** ut'3tr llecermhsr 2SIg

-e#J*#J,f,#fumwlidxr*Cesmm#ffi rffi*ffi r#

for *&epmar ended #J #mrem&en ffiI #

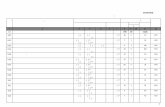

ilffiNSSLmATffin STA?Htr[HIqr #S CHANGE$ rH mQUrTy

frcr tks yenrr end*d 3I ffecsmlber 2{}I S

Shnrc Addfrtflomntr.. , tr*frd ir,tfr & r'&r f,{r I*.ocrr r a{+r

capitatr

H*vntruati*nBes*rve

T\r*us*nd AMfi

Retsimed Total*ernirngs equitg

d {dl.* {ddrtlrl _y*fl'"Lt ), $ns}7r3SS t 4 t* dt{.lt

-S 5 t- 5#'fl AY&

tf ,}fhfi daFry afr aFrtr tpa*q"lrr}:r;fs*t# / ",yrJ l;h.*il}J

/5,365,Ur: 15, "rS5,83J

I 5,365,833 15,365,8336rtp4,L69 51637o3SS tr nI.$4r29I 41176fr,??{} 54,741,$SS

611. 4,X69 s,ss7r3ss I,I44,299 4tr0?65,??{} 54,?41,fi$6

{6t 7,6fi8i {# t 7,#p#i

{61} 6AR\\*,* ')v-.,vj

{6 t ? 6AR1\**tlv'/vrr

611*4rlSS 5n637,35$ ! rtr44oX#2 41,747,572 S4,133r3trS

1-30 notes on pages 10-46 are an integral part of these consolidated financial statefilents.I

-

::hpgrrHrs,

{Lnss}lPr*fit f*r ths yser,,4 ff r*.-rfi*rem fs,frlr..Depreciati*nAmortiza{i*nhnpairun*nt * Inventmri*s{rupnir'ffient and write, off* Trade and *ther rsceivahl*sln*cmle fiar:t fhrryiv*fi l:ftysbtr*sImc*rnc fr*rn Ssverxxnsnt grantsInccme fium sale of Frupsrty plant and oquiprnentUmr*alis*d fmreign exche$ge lossInterest incame

fut*r*$t sxpsrlssIne*rnr tax#sush ft*ws fr*rr#{txu*S irt} *persfiems b*f*r& w*rkimg eepit*l chsngssillmnges in:

{nv*ntod*stsiotrogical assets

TraEl* and mthsr fle*eivabicsTrad* *nd *ther paynhles

Cns*r fImry* frcnn #pereti*msTmx paidN*t eark flows fr*m, *p*ratf;mg mefivities

Cnsh fi[*ws frmm imvesting nefivifiesAcqwi*iti*n of propefly, plant arrd *quipmmntA*rymsififin mf intangiblc assstsPr*c**ds fi"om sale *f propfirty, plant and equiprnnntN*t l*ams pr*vid*eif n f erpt t rpcr*i l rrorli-r-l]LaJ.l qllr|./ r tlCi'rhr.A V V\,&

lYef ens*n flows used im imne*ting acfivitier

Cmsh ftrcws f,r*m finsn*ing *cflvifissNet prfisseds fi"om b*n'owingsInter*st paidHst emmh fr[mws fr*mn finam*ing nefivities

Net decresse in cash amd cash cquivntrentnF'*reign exchang* *ffccts *n cash ared cash *quival**.tsCmsh and cash *quivatrsnts at ths begin*ing of the )rsffrCssh pmd *ssh eqmivnl*rrfs *lt fhe *nd *f fhe y*nr

WalrcfuamMatedfraawielwtsws

fartbeywrMSl kxabsfrl9

CONSOLIUATEI' STATE}IENT OF CASH FLOWS

For the year ended 31 December 2019

?sI$Th*u,s*nd AMf)

?{}1S

{6 t 7,#p8}

4,121,540

?,5781,3 17,991

34S,432{ l: *, t Frr.}\

{r$J11!3}

{?3&,8S2}

34S,e?;

{5#,?$S),{ qq? TRqt )Y' r' 8.) , v."-

*" *{q?$* ff}-e 6qR Y64-/ rlr.rttrr,rt , tsr+/

(413,3 S?)( X ,6tl?,?fi?)

rl{.f, r}r}Fr* I. JIJ-) /

413,*?8srssr,s$s

r{6 ?{t\_ .-__-J.* :,-*J_'./

. $,T*4*s$s

(?3,#64,qS4)

{3S,*S*)

dfi ?qd4s\Jut.r',#

"l3$'Qff$,$3.fiI-

17,S95,068

_" "{qsp?*psra a ,ldrt {r/{,t Jr*Y^4tj?E!;

.

,--- dftd \

( /o.6r-86r.,

t 1s,ss?)*-*ffis4s,ss5

l{ "$65,,S3-$

7. "r2.n d,{QJ Tld*J'tq\r*' {.)

5,43fitr*d$3S,$43

94,ffi?31484 1 lrp*\tzJ t,L3 f ]

215s35,724(3,S61)

?,96t),6341,5 15,#54

?$,I &S,s$fr

{44?,SS5}(ss$_2?3)r''&.^ n- ,{ il { \(J/), /r+ l" J*.Jm"

tr$,x{}9,ss8

*"{1;,tr9$%_*J?#$6*$$$ -

{3S,25 }, } l5}{}s"6fi u

2,488sfi#,3##

? #'6?,t g\jaJ *

_-{fr&qq#-{ffiL

22,31?,445

*J3#A+-?*3)*I8,89i ,*4:t,

nry{lF +c\^}/ssr$u,,

{2 },3$4}5S l_?34

1-30 notes on pages 1A-46 arc an iategral part of these co,nsolidated finaacial statements.9

tr,3?SrI43

-

----BFE-tflT€JE

Spxytuf,fl#

"ff**mr r* *&* c*xwl:i&ted#pssmkI,#rtr*mrsm#f*nr r&e jr#$ *sd*d #J g6rem&er 3#I #

NOTI,S TO THE COI{SOLIDATED FINANCIAL STATEMMNTS

Scr th# y*er *nd*d 3tr" Be**ffiber 2{}1S

1. INCONFONATION AND PRINCIPAL ACTIVITIESThe consolidated financial statements for the year ended 3t December 2019 consist of the financialstatements of the Spayka LLC (the "'Company'') and its subsidiaries: Spayka-OeorgiaLLC, GreenhouseLLC and Caucasfood LLC (which together are referred to as "the Group").

Spayka LLC was incorporatod iir 2001 under the laws of Re,public of Amrenia by Davit Ghazaryan. Itsregistered Office is at 007 Arshakunyats Avenue Zll,Ywevan Republic of Armenia. Main activities ofthe Company are:

; Sale/exFort ofagricultural productsr Produetiom of agricultural p,roducer Production ofblue cheesr Internationalkansportation,o Maintenance services for trucksr Processingofagriculturalproduce

Spayka-Georgiiti;C was incorporated in 2010 under the laws of Republic of Georgia, Its rogisteredOffice is at village Digomi, Saburtalini region, Tibilisi, Georgia, The Spayka-Georgia LLC acts as avehicle for organising the acquisition of *uits in the territory of Georgia and their export to Russia.

Gree,nhouse LLC was acquired by Spayka LLC during ZA1,J. lt was incorporated in 2011 under the lawsof Republic of Armenia. Its registered otfice is at 54 Dsereteli Street, 0043 Yerevan, Armenia.Greenhouse LLC mainly owns greenhouses used for producing fresh vegetables.

Caucasfood LLC was acquired by Spayka LLC during 2At1. k was incorporated in 2013 under the lawsof Republic of Armenia. Its registered office is at 5612 Garegin Nzhdeh Street, 0006 Yerevan, Armuria.Caucasfood LLC mainly orruns orchards used for producing and harvesting Aesh fruis.

The total number of Group employees amounted to 2,054 as of 31 December 2019 (as of 31 December20 I B: 1, 599 ernployeos).

2. BASIS OF PREPARA?ION

2*1 Statement of compli*nceThe consolidated financial statements have been prepared in accordance with Intemational FinanciaJReporting Standalds $FRSs) as issued by the Intarnational Accounting Standards Board (*IASB').

1S

-

.- :Er-avLE^e

eryFtuflf;#rlfu*m r* x&e retrffi&d#r#d #mamm# ffi f#trffif, ffi #

for x&e Jffinr emded -$J -ffiemmfurtrf#

2.2 Going concern ba$s of accountingThe consolidated financial statements have been prepared on a going concern basis and the Group willcontinue its operations for the foreseeable futne.

During the year ended 31 December 2019 the Group recorded an accounting net loss of AMD 617,698thousand, and the Glroup's revenues and operating profrts havs decreased liy AMD 74,981,63A thousand(around 30.3Yo) and,AMD 16,5W,454 (around 809/o) respectively, as cornpared to prior year. As of 31Decfinber 2019 the Group's current loan liabilities amounted to AIvID 26,2L8,941. The Managenrent ofthe Group believes that this is a reflection ofnegative impact ofthe tax case/dispute (as described in NotE25) on Group's financial performance, u,hich forcod the 6roup to downshift its profitable high marginkading operations siguificantly, caused serious delays in Crroup's planned capital investment projects andfinancing projects and made reputable world class credit rating agoncy to recall its credit ratingassignment.

As mentioned in Note 21, as of 31 December 2Al9 *re Croup had overdue loan payments in the totalamount of AMD 1,691,679 thousand" To date the overdue loan balanoes of the Group had amounted toUSD 7.3 million and ELIRO 4,8 miilioo. In addition, the Group had bank loans with earrying amounts ofAMD 16,153,894 thousand, AMD 10.737,271 thousand and AMD 4J2A,27A at 3l December 2019, theloan agreements of which provided for ce*ain financial cov$nants, and as of 3l December 2019 some ofthese financial covenants were not rnet by the Crroup. Although the aforementioned cases may constitutean event of default in respect of socured bank loans, in which case the loans may become re,payable ondernan{ however, up to date none of the lenders had called on default. Accordingly, the respective loanswere ricit classified As priydbte dri dfiiidnd as cif 31 Deceriiber 2019.

In appreciation ofthe Group's strategic importance for the agriculhral sector of Armenia and economy ingeneral, the Group's role in refining competitive advantage of the counffy's agriproduct export" during2020 leaders have concluded to form a Lenders Club to nnonitor the Crroup's financial performance on aweekly basis, assist the Group to pursue its further development plans, ensure s5mchronized lenders'process and &cilitate repErmsnt of loans. The Management of the Ckoup has started negotiations with alllenders to achieve relised repayment terrns based on the agreed businese plan and financial forecasts.

Additionally, as described in Note 30 a trade receivable from a single coufierparty has increased toaround RIIR 360 million as of to-date. However, the management considers that the arnounts arerecoverable and will be repaid in near future.

As described in Note 25, there is an ongoing Tax oase against the General Direotor of Spayka LLC for analleged tax avoidance, which as pel Croup's Management will have no going concolx impact on theGroup.

The financial perforrnance of the Group for the year ended 3l December 2019 and thereafter, has beenlargely alfected by the Tax case (as described in Note 25) and further uncertainty created by the COVID-19. The Management expocts the financial performance of the 6roup to continue recovering andstabilizing once the Tax case is resolved and post COYID-l9 paradigrn flattens as a nsw nolm.

The Management anticipates renegotiating the terns of existing loans and possibie obligations and thatany addrtioaal repaymsets required will be mst or* of, operating. eash flows, repaynoer,rt of outstandiagtrade receivables or from altemative forms of capital raising such as new or revised loans/credit lines,issue of bonds, private placeme,nts or asset sales. Manhgement has access to underwriters and a plan forissuing bonds or equrry raising, ifrequired.

Management acknowledges that certain uncertainty remains over the Group's ability to refinance or repayits loan facilities as they {atrl due. Horrever, as described ahl'e, mafiegemefit hm a reasonable expeetatiorthat the Group has adequate resources to continue in operational existence for the foreseeable future. Iffor any reason the Group is unable to coutinue as a going concern, then this could have an impact on theCroup's ability to realise assets at their recognised values and to extinguish liabilities in tho normalcourse of business at the amounts stated in the consolidated financial statements.

11

-

---*-

fu-r*:rr{JE

2.3 Basis of measurementThe consolidated financial statements have been prepared under the historical cost convention, except inthe case of land and buildings, bearer plants and under construction bemer plants which are stated at theirrevelued efiowlts.

2.4 Functional and presentation currencyThe national curreilcy of the Republic of Armenia is the Armenian Dram (*AMD"), which is the Group'sfinctional curre$cy and the currency in which these consolidated financial state,ments me presented. A1lamounts have been rounded to the nearest thousand.

Z.S Use of estimates and judgmentsThe preparatiou of consolidated financial statement$ in accordance with IFRS requires from Managementthe exercise ofjudgruent, to make estfunates rud asswrptions that influence the application of accountingprinciples and the related amounts of assets and liabilities, income and expenses. The estimates andunderlying assumptions are based on historical experience and various other factors that are deemed to bereasonable based on knowledge available at that time. Actual results may deviate &om such estimates.

The estimates and underlying assumptions are revised on a continuous basis. Revisions in accouutingestimates me recogrriscd in the period dming which the estirmte is revised, if the estimate dects onlythat pegod, or in the period of the revision and future periods, if the revision affects the present as well asfuture periods.

ln pmticular, information about sigrrificant areas of estimation, uncertainty and critical judgments inapplying accounting policies that have the rnost significant effect on the amount recognised in theconsolidated financiai statsments are described befow:

Usefal lives o{property and equipment

Management has estimated usefirl lives of the prqperl.y, plant and equipment. Managernent believesthat estimated useful lives of the property, plant and equipment me not materially different fromeconomical lives of those assets. If actual usefirl tives of properly, plant and equipment are differentfrom estimations, financial statements may be materially different.

M easurement al fair valuesA numbsr of Company's accounting policies and disclosures requiro the measurement of fair valuesfor finaneial assets and liabilities.

When measuring the fair value of an asset or a liability, the Company uses market observable data asfm as possible. Fair yalues are categorised into different ievels in a fair value hierarchy based on theinputs usod in the valuation techniques as follows:

a Level /: quoted prices (rmadjusted) in active markets for identical assets or liabilities.e Level 2: inputs other than quoted prices included in L-e:rel I that are observable for the asset

or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices).e Level 3: inputs for the asset or liability that are not based on observable market data

(rxrobservable inputs).

If the inputs used to moasure the fair value of an asset or a liabilrty might be categorised io differentlevels of the fair value hiermchy, then the fair value msasurem€nt is categorised in its entirety in thesame level of the fair vaiue hierarchy as the lowest level input that is significant to the entiremeasurement.

S#qptufrfl#fi&r*r ** *ke ffigw,ildet*:djtr#e#nfuf #afe{rrffi*r

&r th* y#trffidsd-3J "&*em*er ##tg

12

-

Sp#f*H.tf,ffi fofn# r* *e mxs*f*?darsd #nfie#*f ffi f*ffi#m#

fw xh*Jffier ssded-.?J -kmmfur ffi # #

Measuremenl Pravlsionfor bad and doubtful debtsThe Company reviews its trsd€ and other receivables for evidenee of their recoverabiliry. Suchevidence includes the customer's payrnent record and the customer's overall financial position. Ifindications of irrecoverability exist, the recovErable amount is estirnated and a respective provisionfor bad and doubtful det*s is made. The amount of the provision is charged through the profit or loss.The review of credit risk is continuous and the methodology and assumptions used for estimating theprovision are reviewed regularly and adjusted accordingly.

Provisian for obsolete and slow-moving inventary

The Group reviews its inventory reoords for evidence regalding the saleability of inventory and itsnet realizable value on disposal. The provision for obsolete and slow-moving inventory is based onmanagement's past exporience, taking into consideration the value of inventory as well as themovsmefit md the level of stock of each category ofinventory.

The ,rdldtisr 6f prdvlsiofl is recogcired ia thd profir ot' loss. The refidir of tlis rier realisabl€ tatri€ ofthe inventory is continupus and the methodology and assurnptious used for estimatiog the provisimlfor obsotretE and slow-moving inventory are reviewed regularly and adjusted accordingly.

Ineome'taxes

Significant judgment is required in determining the provision for income taxes. There aretransactions and calculations frr which the ultirnatc tax determhation is uncertain during theordinary course ofbusiness. The Group recognises liabilities for anticipated tax audit issues based onestimates of whether additional taxes will be due. Whsre the final tax outcome of these matters isdiffsrefi from the amounts that were initially recorded, such differencos will impact tho income ta>rand de&ned tax provisions in the period in which such determination is made.

3. SIGMFICANT ACCOUNTING POLICIES

The following accounting policies have been applied consistently for all the years presented in theseconsolidated financial statemsnts and in stating the financial position of &e Group. The accountingpolicies have been consistently applied by all companios of the Group.

3.1 Basis of consolidationSubsidiaries me entities controlled by the Group. Control exists where the Group has the power to governthe financial and operating policies of an entity so as to obtain benefits from its activities.

The financial statemeats of subsldiaries acquired or disposed of during &e year are included in theconsolidated statemert of comprehensive income from the date that control cofiilnences until the datecoufrol ceasss. Intra-group balances, and any unrealised income and expenses arising from inta-grouptransactions are eliminated in preparing consolidated financial stet€ments.

Where necessary, a{iustments are made to &e financial statements of subsidiaries to bring theiraccounting policies into line with those used by other membsrs of the Group.

3-2 RevenuerecognitionRevenue is measured at the fair value of the consideration received or receivable and represents arnountsrecEivabte goods and services p,rovided in the normal conrse of business, net of discounts and salesrelated taxes. Revetrues earned by the Group me recognised on the following basEs:

13

-

--

Beerr#Eg.eqptus6#

ffsff,tr t* *h* *onmlidated#tranmkJ #feffisffi*rfw*&*;'mar mde6 3I fr**empg#g*

Sale af goods

Sales of goods ae recoguised whffi significant risks and rewards of ownership of fhe goods havebeen transferred tq the customer, which is usually when the Group has sold or delivered goods to theoustomer, the sustomer has aecepted the goods and eolleetabili6r of the celated rooeivable is.reasonably assured

Rendering of services

Sales of serviees are recognised in the accounting period in which the seruices are rendered byreference to completion of the specific transaction assessed on the basis of the actual serviceprovided as a proportion ofthe total services to be provided.

3.3 Finane+ income and expenseThe Company's finatree income and finance costs include:

r Intefest income;r Interest expeilse;r Net foreign crrrrency gain or loss on financial assets and financial liabilities.

Interest income or expense is recognised using the effective interest method. Borrowing eosts t}tat aredirectly attributable to the acquisition, conshrction or production of a qualifying asset ae capitalised onthe respective qualifring asset.

3.{ Payments fo employe€sSalaries aud other employee henefits are measured on an undiscounted basis and are expensed in theperiod during which the related service is provided.

35 Foreign curency transactionsTransactions in foreign currencies are translated to the AMD at exchanse rates at the dates of thetransactions, as issued by Central Bank of Armenia.

Monetary assets and liabilities denominated in foreigrr currencies at the reporting date are translated to thefirnctional curr€noy at the exchange rate at that date, as issued by Central Bank of Armenia. The foreigncurrency gain or loss on monetary items is the difference between amortised cost in the functionalcrurercy at the beginning of the pmiod adjusted for effective intsrest 3nd payments during the periodand the amortised cost in foreign crurency translated at the exchange rate at the end of the reportingperiod.

Non-monetary items in a foreign currency that are measured based on historical cost are hanslated usingthe exchange rate at the date ofthe ffansaction.

Foreign currency differences mising in trauslation are recognised in profit or loss.

3.6 Income taxlncome tax expense comprises current and deferred tax. It is recognised iu profit or loss except to theextont that it relates to items recognised directly in equity or in other comprehensive incomo.

14

-

----EP*=!EHEAeqr&"[S#

ifclfstrfcfx**rsrf; ffi#fd#rdr$tr*##*J#rremem#

"&r r&e ymar *md*d"?f .&ramm&mr ffii #

Carrent tax

Currefit tax conryrises the expected tax payable or receivable on the tarable income or loss for the year,using ta:r rates enacted or substantivety enacted at the reporting date, and any adjustment to tax payable inreryeet of previexr* ]effrs.: Inco*re or tross rclated to eertafui aetivities- of the Cornpany, sueh asinternational transportation is subject to presumptivo tax and is excluded from the calculation of thecurrelil tax. Presumptive tax is based on fixed pammsters of the Company, such as nurnber of trucksrather than on actual income or loss from such activities. Presumptive tax \ilas recognised in otheroperating expenses.

Deferredtux

Deferred tax is recognised in respect of tempr ronsequerces that would follow the manner in which theCompany expects, at the end of the reporting period, to recover or settle the carrying amount of its assetsand liabilities. Deferred tax assets and liabilities are offset if there is a legally enforceable right to offsetcurrent tan assets and liabilities, ard they relate to income taxes lwied by the sarne tax authority on thesarne taxable urtrity, or orr differe,nt tax entities, but they ifltend to settle current tax liabilities ard assetson a net basis or their ta>c asssts ad liabilities willSe realized simultaneously.

tn determining the amount of current and deferred tax the Company takes into account the impact ofuncertain tax positions and whether additional taxes, penalties and late-payment interest may be due. TheCompany believes that its accruals for tax liabilities are adequate for all opetr tax years based on itsassessmsnt ofrnany factors, including interpretations oftax law and prior experience.

This assessment relies on estimates and assumptions and may iavolve a series ofjudgments about futureevents. New information may become available that causes the Company to charge its judgrnentregadirg the adequacy of existing tax tiabilities; such changes to tsx liabilities will irrrpmt the taxexp€nse in the periodthat such a determination is made.

37 Property, plant and eqnipmentProperty, plant and equipment are measured at cost less accumulated depreciation and impairment losses.Except for Land and buildings, which are stated in the statement of financial position at their revaliredarnounts.

Cost includes expenditure that is directly attributable to the acquisition of the asset. The cost of selfconstructed assets includes the cost of materials and direct labour, any other costs directly attrjbutable tobringrng the asset to a working condition for their intended use, the costs of disnantling and removing theitems and restoring &e site on which they aro located and capitalised borrowing costs. Purchasedsoftware that is integral to the functionality of the reiated equipment is capitalised as part of thatequipment.

15

-

:-B+"grrT€J*,

Tpresf,#A&e'er r* t&s cwxwffdat*;d.#:ramsfuf #*seffife#

fwde Wilx wded-ff .&nrcx fux .Wi P

Revaluations of Land and buildings are performed with sufficient regularity such that the carrying arnountdoes not differ materially from that which would be determined using fair values at the reporting date.Revaluations are performed on the entire category ofthe fixed assets.

Any revaluation increase arising on the revaluation of such land and buildings is recognised in othercomprehensivo income and then credited to the properties revaluation res@rye, exoept to tho e>d6nt ttrat itreverses a revaluation decrease for the sarne assot previously recoguised in profit or loss, in which casethe increase is credited to profit or loss to the extent ofthe decrease previously charged. A decrease incarrying amount arisins on the revaluation of such land mrd buildings is chmged to profit or loss to theextent that it exceeds the balance, if aa1r, held in &e properties revaluation reserve relating to a previousrevaluation of that asset.

When m iteur of property, plant and equipnent cmrprises major components having different usefiillives, they are accounted for as sepmate items of,property, plant and equiprnent.

Atty g*in or loss on disposal of an item- of poperty aud equipnrcnt is determined by eo*rparing theproceeds from disposat with the carrying amount of property and equipment, and is recognised net withinother iucome/other expenses in profit or loss.

The cost of replacing e cCImpCInCInt of an ite,m of propaty and equipment is recognised in the carryingamount of the item if it is probable that the future economic benefits ernbodied within the component willflow to the Corrpany, and its cost can be measued reliably. The carrying amount of ttre re,placedcsmponent is derecoguised- The costs of the day-to-day servicing of property and equipmeat arerecognised in profit or loss as incurred.

Depreciatian

Items of property afid equiprlleftt are depreei*ted from the date that they are instdlod and are ready foruse, or in respect of internally constructed assets, from the date that the asset is completed and ready foruse. Depreciation is based on the cost ofbn asset less its estimated residual value.

De,preciation is reoognised in profit or loss on a sfraight-line basis over the estimated usefrl lives of eachpart of an item of property and equipment, since this most closely reflects the expected pattern ofconsumption of the fufure economic benefits enrbodied in the asset, except for vehicles used inIntemational transporlation, which are dryreciated based on unit of production; each kilometer ofexploitation. Land is not depreciated.

The estimated useflrl lives of,significant items of properfy and equipment for the current and comparativeperiods me as follows:

V^^*.,I {$flt s

BuildingsPlant afid sqldpsmsntffther vehiclesFurniture, fitting$ end other

5S

)*/u1S

5

Depreciation methods, usefirl lives and residual values are reasse$sed at each reporting date and adjusteCifappropriate.

3.8 Intangible assets

Intangible assets that are acquired by the Company, which have finite usefu1 lives, are measured at costless accumulated amortisation and accurnulated impainnent losses.

r6

-

spqptur"s#"&f,**m *$ g*e rsmm&idef#d#uam#sf ffitr#x#*##

.fer *&s y#wemded #J &remfue' A#fi #

Subsequent expenditsre is capitalised only when it increases the future economic benefits embodied inthe specific assstto, which it relates. A1l other eryenditure is rocognised in the profit or loss as incurred.

Amortisation is recognised in profit or loss on a straight-line basis over the estimated usefirl lives ofintangible assets, from the date that they are available for use since this most closely reflects the expectedpattcrn of consumption of ftture economic bencfits embodiod in the asset. The estirnated useful livos forintangible as$$ts are 10 years for the cuneff and comparative periods.

Amortisation methods, usefirl lives and residual values are reviewed at each finmcial year end andadjusted if appropriate.

3.9 Biological assets

Except for agricultural produce at the stage of growth/biological transformation prior to harvest,biological asset$ me nneasured at fatr value less oosts to sell with any changes there in recognized in prefitand loss.

Agricultural produee at the stage ofgrowtl/transforrtration and prior to harvest, are recog[ized at cost.Which are subsequently measrned at fair value less costs to sell upon harvest with any changes there inrecognized in profit and loss.

3.10 Inventories

Inve,ntories me stated at the lower of cost and net realisable value. The cost is detemined using theweighted average method, which includes purchase cost, production or replacement costs and costsassociated with bringing the inventory to cu$ent place and condition. ln the case of manufacturedinventories or work in prrogross, cost includes an appropriats share of production overhoads based onnormal opfllilting capacity.

Net realisable value is the estimateA seUing price in the ordinary course of business, less the costs tocompletion and selling expensos.

3.11 Government grants

Government graflts are recognised where there is reasonable asswance thaf the grant will be received andall attached conditions will be complied with. Whffi the grant relates to an expense itenr, it is recognisedas income over the period nscessary to match the grant on a systematic basis to the eosts that it isinteuded to compensate. Where the grant relates to an asset, il is recognised as defsred income ardreleased to income in equal amounts over the expected usefirl lifb of the related asset.

3.12 Financialinstruments

Recogniti.on and initial tmeasurement

Trade receivables and debt securities issued me idtially recognised when they are originated. All otherfinancial assets and financial liabilities are initially recognised when the Group becomes a party to thecontactual provisions of the instniment.

A firarcial assef (ufile$s it is a fade receivatle wifiiout a sigrti{lcartt finatrcirg coriryorien$ or fifiafisiatliability is in"itially msa$*red at fair yalus p!.u$, for m item not at FVTPL, tran$a{tian assts that fredirectly atributable to its acquisition or issue. A trade receivable without a signifcant financingcomponent is initially measured at the transaction price.

Lf

-

BFAITIf.&,Sffifltufrf,#

-&focies m #s cafrwli&t*d#fi6rffi&f ffiafsmxrm#{wrif,* yw snd*d-3J &remfurkffIP

CI a S s ifr e {i{tri n dti tt i ul lis e qu e nt riie dS ti i e ni e& tFinanclal assets

On initial recognition, a financial asset is classified as meastred at amortised cost; FVOfi * debtinvestment; FVOfi * equrty investrnent; or F\[IPL.

Financial assets are not reciassified subsequent to their initial recognifion unless the Group changes itsbusinsss model for managiilg financial assets, in which case all affected finansial assets are reclassifiedon the first day of the first repofiing period following the change in the business model.

A financial asset is measured at amortised cost if it meets both of the following conditions and is notdesignated as at FVTPL:

r it is held within a business model whose objective is to hold assets to collect contractual cashflows; and

r its contractual terms give rise on specified dates to cash flows that ale sotrely payrnents ofprincipal and interest on the principal amount outstanding.

A debt investmsnt is measurEd d FVOCI if it meets both of the following conditiorm and is notdesignated as at FVTPL:

. it is held within a business model whose objective is achieved by both collecting contractual cash{lows and selling financial assets; and

r its contractual terms give rise on specified dates to cash flows that are solely payments ofprincipal mdinterest on the pnncipal afflount outstandirg.

All financial assets not classified as measured at amortised cost or FVOCI as described above aremeasured at FVTFL. This includes atl derivativo financial asssts. On initial recognitioa the Group nrayirrevocably designate a finaacial asset that otherwise meets the requiremonts to be rneasured at amortisedcost or at FVOCI es at FVTPL if doing so eliminates or significantly reduces an accounting mismatch thatwouldothqwise arise.

Financial assets at FVIPL: These assefs are subsequently measured at fair value. Net gains and losses,including any inte(est or dividend inoome, are reoognised in profit or loss.

Finansial assef$. at amortis.ed cost: These assets are subsequently measured at amortised cost using theeffectivs interest method. The amortised cost is reduced by impairrnont losses. InterEst income, foreigrexchange gains and losses aud impainnent are recognised in profit or los*. Any gain or loss onderecognition is recognised in profit or loss.

Debt investrqeuts at FYOCI: These assets me subsequently measured at fair value. Interest incomecalculated using the effective interest method foreign exchange gains and losses and impairment arerecognised in proftt ot loss. Otherilet gains and'tosses aro rocognised in OCI. On derecogrrition, gains andlosses accurnulated in OCI are reclassified to profit or loss.

Equitv invpstrnents at FVOCI These asssts are subsequently measured at fair value" Dividends arerecognised as income in profit or loss urless the dividend clemly represents a recovery of part of ttre costof the investment. Other net gains and losses are recognised in OCI and are never reclassified to profit orIoss.

Financial liabilities

Financial liabilities are classifisd as msasred at arnortised cost or FWPL. A financial liability isclassified as at FVTFL if it is classified as held-fortrading, it is a derivativo or it is designated as such oninitid recognitisn Firmsiat liabilities at FVTPL ffie measured at fair value and net gains alld losses,including any interest expenss, are recognised in profit or loss. Other financial liabilities are subsequentlymeasured at amortised cost using the effective interest method. Interest expense and foreign exchangegains and losses are recognised in profit or loss. Any gain or loss on derecognition is also recognised inprofit or loss.

18

-

,ey*sJd#;Yslrtr rs r*e ffi #ssm*r*f ####fitr#ffi #

far xhe jww euded #J ..ksxmr&ff trJS

Daecognitittn

Flnancial as.cer.r

The Group derecognises a financial asset when the contractual rights to the cash flows &om the financialasset orpire, m it transfers the rights to receive the contractual cash flows in a transaction in whichsubstantially all of the risks and rewards of ownership ofthe financial asset are transferred or in which theGroup neither transfers nor retains substantially all of the risks and rewmds of ownership and it does notretain coutrol oftho finanoial asset.

The Croup enters into transastions whereby it transfers assots recognised in its statement of financialposilion, but retains either all or substantially all of the risks and rewards of the transferred assets. In thesecases, the transforred assets are not derecognised.

Financial liabititiesThe Group derecoguises a financial liability when its coutractual obligations are discharged or cancelled,or expire. The Group also derecognises a financial liability when its terms are modified and the cashflows o.f the modified liability are substantially different, in which case a new financial liability based onthe modified terms is recogrised at fair value.

On derecognition of a financial liability, the difference between the carrying amount extinguished and theconsideration paid (including auy non-cash assets fransferred or liabilities assumed) is recognised in profitor loss.

SfsettingFinancial assets and fiuancial liabilities are otTset and the net amount presented in the statement offinancial position whsn, and only when, the Group currently has a legally enforceable right to set offtheaxnounts and it intends either to settle them on a nst basis or to realise the asset and settle the liabititysimultaneously.

3.13 ImpairmentImpairment of property *nd equipment afid intangible o.ssers

Assets that have an indefinite usefirl life are not subject to amortization and are tested annually forimpairment. Assets that are subject to amortization are reviewed for impairment wheuever events orchanges in circrmrstances indicate that the carrying amount may not be recoverable. An iurpairment lossis recognized for the amowt by which &e asset's carrying amount exceeds its recoverable amount,

Recoverable amouIrt is the higher of net selling price and value in use. If the recoverable arnount of anasset or cash-generating unit is estimatsd to be less than its carrying amount, the carrying arnount of theassst or cash-gererating unit is rsduced to its reoovetabls amormt. Impairrnent losses are recognized irthe statement of comprehensive income as an expense imrnediatelp unless the relevant asset is carried ata revalued amount, in which case the impairment loss is fteated as arevaluation decrease.

Where an impairment loss subsequently revorses, the carrying amount of the as$st or cash-generating unitis increased to the revised estimate of its recoverable amorurt, o-ut so that the increased carryiag amountdoes not exceed the carrying amount that would have besn determined had no impairment loss recognizsdfor the asset or s&sh-generating unit in prior years. A reversal of an irnpairment loss is recognizod asincome immediately, ualess the relevant asset is carried at a revalued amount, in which case any reversalofimpairment loss is treatod as a rsvaiuation incraase.

Impair me nt of fi n an cial ilsf etsFinancial assets. other thau those at fair value through profit or los$, are assessed for indicators ofimpaitnent at each reporting date" Financial assets are impaired where &ere is objective evidence that, asa result of onE or mo(e events that occurred after the initial recognition of the financial asset, theestimated ftture cash flows ofthe inveshnent have been impacted.

19

-

------BE_EVI€Jn'

Sqpewfl{#f&r*r r* #* *amwlidar*d#ffiarlrg#J.#rrmn*r

fwr&e W&r emdad#J "fi*mm#mn #ff{#

For financial assets canied at amortized cost, the amount of the impairment is the difference between theasiet's carrying amourrt and the pressnt value of sstimated futuro cash flows, discouuted at the originaletTective interest rate. The carrying amount of the financial asset is reduced by the impairment lossdirectly for all financial assets with the exception of tade receivables where the carrying amount isreduced through the use of an allowance accsutrt.

With the exception of available-for-sale equity instruments, i{ in a subsequent period" &e amount of theimpairment loss decreases end the decrease can be related objectively to an eveut occuring after theimpairment was reooguized the previously recognized impairment loss is reversed through profit or lossto the CIdent that the carrying amount of the investment at the date the impairment is reversed does notexceed what the amortized cost would have been had the impairment not been recognized.

3.14 Leases

Where substantially all of the risks and rewards incidental to ownership of a leased asset have beentransferred to ths Couryany (a "finance lease'), the ass6t is treatsd.as if it hd-beefi purehased ousiglrt.The amount initially recognised as an asset is the lower of the fair value of the leased property and thepresent value of the minimum lease payments payable over the term of the lease. The corresponding leasecommitment is shown as a liability. Lease payments are analysed between eapital and interest. Theinterest element is charged to the consolidated staternent of comprehensive income over the period of thelease and is calculated so that it represents a constant proportion of the lease liability. The capital elementreduces the balance owed to the lesurr.

Where substantially all of the risks and rewards incidental to ownership are not tran$ferred to theCompany (an "operating lease'n), at inception of a contract, the Group assesses whethsr a contract is, orcontaing a lease. A conkact is, or contains, a lease ifthe confiact conveys the right to confrol the use ofan identified asset for a period of time in exchange for consideratiou. To assess whether a contractconveys the right to conftol the use of an identified *sse( the Croup uses the definition of a lease in IFRS16. This policy is applied to contracts entered into, on or after 1 January 2019.

As a lessee

The Group applies a single recognition and measuremert approach for all leases, excepf for shorl-termleases and leases of low-value assets. The Group recognises lease liabilities to make lease payments andright-of-use assets representing the right to use the underlying assets.

Right-rsf-use dsssls

The Croup recognises right-of-use assets at the commeflcefirent date of the lease (i.e., the date theunderlying asset is available for use). Right-of-use assets are measured at cost, less any accumulateddeprecimion and impaimlent losses, and adjusted for any remeasurefilent of lease liabilities. The cost ofright-of-use assets includes the amount of lease liabilities recognised initial direct costs incurred, andlease payments made at or before the commencement date less any lease incentives received. Unless theGroup is reasonably csrtain to obtain ownership of the leased assst at the end of the lease terrq therecognised right-of-use assets are depreciated on a straight-line basis over the shorter of its estimatedusefiil life and the lease tenn. Right-of-use assets are subject to impairment.

Lease liabilities

At the commencement date of the leasq the Croup recognises lease liabilities measured at the presentvalue of lease paynrents to be rnade over the lease teffi. The lease payments include fixed payrnents(including in-zubstance fixed payments) less any lease incentives receivable, variable lease payments thatdepen:d on an index or a rfrte; and amounts expected to be paid under residnal value gu:arantws. Ths lease"payments also include the exercise price ofa purchase option reasonably certain to be exercised by theGroup and payments of penalties for terminating a lease, if the lease tenn reflects the Gloup exercisingthe option to terminafe. Tlhe variable lease payments that do not depetrd on an index sr a rate arerecognised as expense in the period on r{rich the event or condition that triggers fhe payment occurs.

20

-

-tu---

BTS*YffiASryFtu"rd#

ffsres *sp #e rmmmfiida# #xtffi ffi m#f ,ffi f*rxeu#"ffir*&s yffir *xd*d#J.&mmrfur P#ff#

In calculating the present value of lease payments, the Group uses the incremental borrowing rate at thelease commencement date if tre interest rate implicit in the lease is not readily detenninable. After thecommencerrent date, the amount of lease liabilities is increased to reflect fhe accretion of interest andreduced for the lease payments made. In addition, the carrying arnount of lease liabilities is remeasured ifthere is a modification, a change in the lease terrr, a change in the in-substance fixed lease payments or achange in the assessment to purchase the underlying asset.

Shart-term leases and leases of low-value ossets

The Group has electEd not to recognise right-of-use assets and lease liabilities for leases oflow-valueassets and short-term leases, including IT equipment. The Group recognises the lease pa5rmurts associatedwith theso leases as an exptrlss otr a straight-line basis ovsr the lease term.

3.15 Provisions

A provision is recognised if, as'a result of a past evsnt, the Company has a present legal or constructiveobligation that cau be estimated reliably, and it is probable that an outflow of economic benefits will berequired to settle the obligation. Provisions are determined fu discounting the expeoted firture cash flowsat a pre-tax rate that reflects surrent rnarket assessrnents of the time value of money and the risks speciflctc the liability. The unwinding of the discount is recognised as finance cost.

3.16 Share Capital

Ordinary shares issued by the Company, recogaised based on their nominal values.

3.17 Dividends

Dividends me recognised as liability in the period i:r which they are declared.

3.18 Segment reporting

An operating segmffit is a component of the Group that engages in business activities *om which it mayearn revenues and incur expsrises (including reveflues and expensos related to transactions with othercomponerts of the Group; whose operating results are regularly reviewed by the managemsnt to makedecisions about resources to be allocated to the segment and assess its performance.

3.19 Comparativefigures

Where neeessary, comparativo figures haye bpen adjusted to conform to chaages io presentatiou in thecurrent year.

4. ADOPTION OT NDW AND REVISND STANDARDS

In the eurtn* year the Company has adopted all of the new and revised Standatds and Interpretationsissued lry the lnternational Accountiug Standards Board (the "IASB") and International FinancialReporting lntorpretations Committee (the "IFRIC") of the IASB that ue relevant to its operatinns andeffective for annual reporling periods beginning on 1 January 2019. Although these new standmds andamendments are applied for the first time in 2019, they did not have a maferial impact on the annualconsolidated financiel statements of the Group.

21

-

-Ee*rrr€i*'Sffipk fAC

fihrms w *** mendfifsrdtree&tr#f #f#Hf#a{pf*r*A* y*ar emdatd #J -krmmmfur Xffi P

Standards ond interpretations th# have ftotyd been $fec.tive

The nsw and amended standards and interpretations that are issued, but not yet effective, up to the date ofissuancE of the Croup's consolid*ted financial statcmeftts are disclosed belo'rv. The Group intends toadopt these new and amended standards and interpretations, if applicable, when they become effective.

Amendments tro 145 I and IAS I : Defr ni t i an af Adate ri alIn October 2018, the IASB issued amendments to IAS 1 Presentation of Financial SAtements and lAS 8Accounting Pbtricies, Changes in Accounting Estimates and Errors fo align the definition of ''material'across the standards a$d to clarify certain e$peots of the definition. The new definition states that,'Information is matErial if omitting misstating or obsouring it could reasonably be expected to influencedecisions that the primary users of general plrpose financial statsments nrake on the basis of thosefinancial statements, which provide financial information about a specific reporting entity.'

The amendments to the definition of mxerial is not expected to have a significant irnpact on the Group'sconsolidated financial statements.

5. OPERATING SEGMENTS

The main activities of tlre Group ccmprise of 6 main operation* which are its reportable segments. Thesummtry description ofthe reportable segments is presentedbelow:

1) Saldexport of ugriculwral productsThe Group implernents seasonal collection of different fresh fruits and vegetables in Arme,ni.a andGeorgia, as well as produces agricultural produce sush as fruits and vegetables. These fruits andvegetables are stored in the re*igerated warehouses ofthe Group and are mainly exported.

The Group also purchases and exports to Russia dairy products. The Group has sup,ply contractswith rnajor retail chains in R+ssia.

The agricultural products are mainly exported under the ffademarks "Ararat Fruit" and "AraratFood".

This is the largest segmsnt ofthe Group in terms of revenues and gross profits.

2) Intemation*ltransytrtatianThe Group provides third party International transpor|atio'n services mainly to importers toArmenia. The Group provides international ffansportation service mainly using its own trucks;however, in case of necessity it also sngages rented trucks. The Group owns more than 300Volvo and Krone/Schmitz trucks.

The Internati.onal transportation segment largely serves as a support to the main segment ofSale/export of agricultural products. In addition, it provides economies of scale by generatingadditional external revenues.

??

-

&rre=r#E.e.ffiqr*ffi {e#

Jfsr## r* #e c*mwtidar*#ftfi#frf#f ffisena€ffi#fCIr x&E Jffi#r emded.Sf ffismmfurffiJ#

3) Production of agricakural praduceDuring the recent years the Group has been increasingly devetroping the segment of ownproduction of agncultural produce (fresh ftuits and vegetables), which mainly comprise ofoperation of greenhouse areas, open field cultivation of vegetables and fiuits and cultivation offruit orchmds. The &uits and vegetablos producod me oxported by the Croup as part of its mainsegorept of Sale,lexport of agricultural products"

During 2019, the Group has completed the construction and subsequently *tarted the operation clfaround 50 hectares ofgreenhouse area, thus increasing the total greenhouse area operated by theGroup to over 105 hectares.

During 2018 and 2019 the Group has completed the construction and plauting of around 50hectares of fruit orchards, thus increasing total cultivation of fruit orphards to more than 125hectares (mainly apricot, cherry, ap'ple, plum and pear). In addition, as of 31 Decembsr of 2019the Group has started the consfuction of around 300 hectares of iatensive orchards. 425 hectmesare expected to urahre for &uit harvesting W 2021-2A22.

During 2018 the Croup has completed the constnrction of mound 80 hoctares of open fieldcultivation, thus increasing the open field cultivation area to around 1?7 hectares (radish, melonand garlic).

4) ServicingtruchsThe Company has constructed a mainterance service cetrter for trucks, which is the of{icialrepresentatiye of Volvo Tnrcks in Armenia. The Service center has been put into operation duringthe year ended 31 Decernber 2016. It provides servicss to the Company's own trucks as well as tothird parties.

5) Froductian of blue cheeseDuring 2017 the Group has started construction of a blue cheese factory. For this purpose, it hasreceived a plot of lard under Government grant and has signed a loan agreemsnt wift a creditinstitution to finance the purchase of the equipment - production line for blue cheese.

During 2019 the Blue Cheese faotory has been put it into operation and the Group stafied toproduce and sell blue cheese, mainly for expotl, uader the trademmk "Sambiel".

Other segments ma;inly cornprise of production of caaary, production of plastic boxes and cornrnissionservices.

lnformation relating to each reportable segrnent is set out below. The management monitors the reports ofthe operating segment$ and makes strategic decisions based ou the operational results. Operating profit ofeach segment is used to measure results bec*use the management believes that this information is themost relevant in evaluating the results.

?3

-

ryft

!tr ni t{^t(*'l S f*rq$" f*" f*t\J\fi

/q. & -ft\\J \f LI1v) *fi rfiLll f*l l.H{J'd*df,"i {\.I f*-

iltii

f'"- ['*-. r*r,i'*4

r$ ,*iFei qf f-r$ *d' u{'(t r-tr $iFH4 tS" FEt

f\}

r.*{ ffi f""f\mfi*tr'1 n\ l.lFv 'v' {

a\5r\

ffi[:**{g) wa ffi1.q{' \a^, #

J\f\,1wi f- 0Or\1 rq r"'"Fr.{

fr* .c# fi\o**(}0L #" fq\* S .tf* t* f.'I

, fir.?*i fft Pi

lcF&NVI

AA{e } q$;l

f'X #\6\ g\,

"Er "$l*q \f}Io.} t*(V

l\ a\

'fiIr'1

r'f"} tt f"oow :v .p,.q|, fft, [f1\* {} r.d1

lr! *\ l\Srs v^l *#\ ce ftl{q ={ ft!*4 l,6{ (q

r*{

\s r,l '\sf{ tr*{ O#!*( \S f*

f\tnfi,&' rA ,fr.\-, '-4 I L.' 1ii"d C) '{}\S f;r., (;}a\ {ri f,\tw{ qc*.{ t*4

0o {fa

f*. ?r4 "Hi\F*(q?mi rf ff)rri' tr'{' i.# \* r.ll*,!i {-"t fq

f\ sn fl0###r-.'i {{X fq

\&Ji,f lsfSI\c)

f\

f*h

"xB-{q.I p\i Ld$riS* F-. 'iY\

a$* S ffi$ t) #, .;.. ' FtrHitrErra'H- yir {J i: 'ipi r*i

;;.-FrHm!dr'tr. '*t ''r{ ft, ile fitHHtr 5 tr ffi'lrqir bfl tL-. *sn +,J ,{..}

h* r,- ,""4 Fi F.4 ,-4\-) +J Sai fn{ Fca {diH.*$d")$$t- { fl F1' f,'l {cfr.tFfit,r Fqft *4 &*J tr.i h.,E*tr tr # #

f.*.r-"t()"$rp"d

\nf't#dfi

f'*fi\

sfflrd!"]

rf\

{\I.rfi

*

[]*

\$l*.+

t\13.d

$&f\

r}fi14.lqt'

tr1

ral"-4

A

$fiqr

'\s(q

t\rT\

l\frOCfrr.- rci^* l^^'+l qi

Q 1r5l\F CIC}r.f, -,"1s$ fr'""{

t"t'\ {fr\h.n;fi,

in &\tJ \."'

\h*\**,S vl** t.r"!*a*r'{ ,*;a0

(\g \*'\*\rf\ cr.1rri oa\t" srsr&

f\.1 \f1r-i 'Brn*\* *i\s \F\$" \c,\' t*;

r*OfrB\#*a(;\

\srtry\hr\i\(}

NN

rn=f,f-.*I.f') [** \S Sc)^q.rysf-! $1 '"-i ** s\OClf*S{ste&\CSH-risiidH$

sffitr-l R

E,:{",dlil$frF.a5E

beq)(rfri*d),a{

rtr.r{Etft\tr/'

{} qf '\#cf f..I \#\sf,icfi \s \d)r'I rfi oorq ft.I

rr)

CLie&W{a 'lclE d

ffil{.lrrqE ..3 4-).ar* t dia ilt hitJ A ti

["4 X hfiL lrd* dL*\ ia,

i5 qnhry

Irc

{*} V}.#id$L,cl ss

aqd||1iJ 'df,BPF\

il q'F{

ffi

e#!.-r{

\'"cf,'qf{\s[}*

.rf,s\

f.tHi

"*rn

o0\rf{"1

f-'l{}.ah.

r"i"f*"

os'cf

I

rya*0

f'* fl\It n $r'I\*nA \A\r1,J a....\r\\t- (}t"''l n'itt '*",

,*^_{ |\i"fr

h

\{"rr1

\g: t\'g,^"g nf-}{*rr C}!{ '*;\i \ol'- nrl*CIffidr';tr1 F{

\t.\"sc \0*C\c\ lfiq) ['-ft r \, raraY \,i

t\

-,.}rr1fr

\() r4c0 lr,\**s*iq)\on\r \t"

r trler*-(!r-)

r'qr.f

trX I

\t-"";Y"*,{rry

q*E

tar (Js{ CAX(,}t J d,,)irt+r c;"1t, ddU g")ta.# s)f!d, !r'{

l*l r{de d.d

A,d.{

axF.{{ H*s c3$l dtiPd '&ls6

.UIila bi

lE /ftiid3{ wr!t&, *{-} hr"{I.i !u

FqH p?

EdCd! r.{

sI.$fi#{J"i3#gHf;S*iai+ r Fq Ld

F htr-t'{d

l&

hrtm,.'. Yt EdD

i E .-'i*Er;WSrtEJ,; lr flALJ, 6d r.,,,

' IH ll,!f14 pt td{,} fJ tsLa*iduxr.:3 E& h"r.#qs

{frf'"mr--'?|d{EfirhUL-'lffi

ftd

Ht;Irt

F-iH,FqAh#d(iill

ktffi

fq {} t*-{F*r tl,^l #5f, r'Hi falo.idwfra \f,) ooCrt td^i fe

frfif\va qn \s'+ffi*n{

r{ rq r"lescs(}fq fq [:*"#'i i' r-:\# tft if,

q l.s1

"el

(}1 FF{ t4r*i* e=i (:}$\ n} f".l

f\ #\ I'\{fi v1 f,\{lA Et- rf..

s#sf\ l\

tJ^, "H1i

rA t\" i.ft(ryu') cs #\oh r- \*,\F$\

y*"{ liiil4 XFtq. rd-) (}frl qr n

6\ '1th Fhr

\d\ LC \

?*{

o& c) sofil 600\S 0\ []*',\6^

f- "qi" f-l1'--t {:- [-*{ri,4 ,llti tr\

frfir\

f\t \P C)o0 \*

fi\ o\ c)*S(}FdL/-I flh ACI*i[t, f"'. f*

-

krr*v#(&Spqle"f,,f;#

ffsrss *m s&e *mmmJikfured#*mmcsaJsmrem#ffi#r&r t&e ywar*mded,3J "keum futr #ffXP

RepgngiHatio" n qf informafion o"n r-eportalrls $egmsnts tq IF'RS measur*$

The infsrmation on reportable segmefits rsconciles with the amour$s in IFRS finmcial statements on thefollowing basis;

?{}$9

lf'h*ns*n{f AMil

2SrS

"ffigyem$de

Repcnrrnbls $egln*ffit$f,}+h **r (,rtrr trr rstrf c:\"-, rli.trr L",'rjtlearl}/.r.s&L,

Hlimmatierm *f intsr*s#ffimffiIt r#vsnriftCsms*ili,r*at*d reveffirufi S?r'4I Srtr57 sk,4fi5!?s7

s!1 f\A"-t f.L, f,I Jzy\jAr"art0

541 q4tr4 t.I-z-i

( [ 7,(}26,fi32]

trT'? F?4I? / (}r\Ylri,*llatb\.i

qtd x Q?JJ ;rr.L.t t

{ I 5,S55,SS#}

f{perrlti,ng prur$$Rcportable S*6pn*mts

ffther SmgrnesltxLJ rral l*#ffitsd &ffilsrxrt$

Cmnsotfd*t*d op*rnfimg prcffit

,4,gggf.g

ft"eprrtmbls Segm*nts

fithmr Segmemts

Linail **mt*c[ erm*unts

Csns*flidsferl *ota[ s*s*ts

f,{tt*{{itt*sKeportahte $*gments*ther S*gmemtsUn al I ocateel &ffi:tor[txts

Corrs{}trf; dat*d t*tal [f; ahltritis.q

R*vemrrs nm&lysis hn**rf; om gsffgrnphicnl lrlcafitlms

Reffisim

Arunenia

T]AH

Hti and f,mstorn Hur*pr

5,33S,413

?2,61*( 1,39s,357)

? 1,4 1S,3S?

L3?.,11-l

(qs 1,2?4)

3,9?1f696 utl.s{isri s{!,

145,56S, I5*3.236,324A .AA]\ 4 A fl,lly,l'Lfa

1?S"S5{i,345

?,638,44?

3,Y3,3,46?

151,S34,S## 133,fi{}ffi0?S9

9S,3S5,2* I?ft6 ft66& uv|l v V'v

239.945

7S,fi*4,*S4I qq ? I 1,\rvJrx.L

I??,3$8

9$,9tr I,XI2 ?s*3sT,I ?3

3{}I9Tkrsuscnt{ A&$*

2#1S

5 1 ,?51,s.Sg5,?q?,oo:

tldfi ,n(}a#\j7,441-!

7 4,337,1 75

s,s83,33;2,777 ,15S

tf\f) 1 /1#ct s? r&)

?5

fiFf .,{{Q TE'T*r I g\ -il.(I1lr,l I *.n lrtrEfi "YQTtl&9'llu+lX I W I

-

-

8iltr&V#E..a

s. ffi.ffivHNfliH

Sales af agrtclllrurml pr*ducts

I*t*r:nati mnal tra*rsp*rfiation smrvi *es

Truck ssrvicing

Ot}ler

Sale *f ag"ricultural pr*du*ts[*r f lorsr q f i n*t *tr fr qrn anrrr-f af i ntr c {*r't,'i fl srflIalGt/r ttii,t.r.1*t.Lr-1"&.r. Lt r,&rLx)f-r!r-A [rL,l.{*I.a,.rIL tt}t/I 's -t.\/t/sl

Tru*k semi$ing

ffth*r

{.lc}str r$s'cdes conrprdses *,l/ #i e $tltrs*wffg ffip#rt$o$';

Agricultural prmdu*ts

tjtitrities and Ssrvi**s

tust*rns clutissStaff costsFrrel nsrc*qa t,#*/I q/\-/Lr*,\,

D*prrciatiom

#ther

,&6yfufrf,#ff*r** xp r*s *mmm*dst&d trfr,fifr*u*fmr*m*m*r

&r *&e y'mr esd#d "3f -kans&er ##JS

2{}r$

I'h*ws*rcd Ae,{il

?(}r s

5?*3b#_446

4,3*fi,SSS

?ffis,*84

541,$41

?7,**2,45S

4,466"3 7?

34?,?S?

534, tg?

s7r41SrX$7 s2,4SSu?&7

$ales of agricultural products comprise sxport of &esh fruits and vegetables and dairy ploducts mainly toRussian market.

ffithrr rsv#.nrle nrainly e*rmp*ises *f other s&,Ims and c*tr:fi,tissicrns"

7. Cff$'r $S'' SAtffi$

?sls

? ;h eru,sscpr r"f ,4 ildJj

2{}T fi

4S,SS4,S44') &,1 A d.61",4d)I(},.L-?J 1\.' r

I (}$,8{}2

424,7*7

4&,2? 1,35 X

'] fi?ft dq?.ldr\J.*t-t,j I Qld

1S?,6?S

311,tr4?

-t3#ss,s7? sIos?31628

tsl$l{kou.s*t*dJ,,td#

2fi1S

?5,sx 1,t)*$

7 ,g$1,1 14/n &.1.^r .a Je'na racJ .,rs*s I"

2,5?5" 1S?1 ?t{} ??L}.L )*t*t \n a I *t

J

3,012,7S9

tr274,543

3S,{} I5,?49

5,36S,002Fr rt * ^{ ,{^,t4,410-1t[J l

2"?$S"3221 qf,!6 {td.-r.. )

J \,, \-/ ) e/ J. a

}, n 1?,495I _356,S55

2&

43,SSS,ff7? 5I,373,62S

-

ffirt&;til'il{-A

S- SMLT"TN# ANM EISTKIBT}?I{}H HXPHNSHS

Trmnspo*ation costs

$alariss

Cornrnissions

tr)*pr*ciati*nF ixed ass*ts maintenftnce

kf*rketir* g *nd *dv*rti sernent

#ther

$" AtrII,{I1{TSTHA,TTYS ffiXPMNSffiS

Salaries

tr)eprocintion

Fr*fsxsi*nal and fsmsultimg fmesh fi .l** J o*nrt r far*

-

--

*p-atrr{Jtrr

T[. ffiTHMREXPENSH,S

Impainn*nt *f invemtori*sImpairmemt ar:d wrjte *ff*- Trads end other re*eivablesD*pr**iatiqxl

#ther *xpfinsss

} , ffTX{H,ffi. NffiN-*PMffi-ATTNffi TNCffiMM

Incume f,.rm S*rrermnemt grants (l{*te 23}

I"nc*Enc frorn fimvernrnent grmnts r$prss*mtsincnnrn (rofer t* J'{clte ?3}

IS. FXNANflE nHil$e{rffi/{C*ST}

Ffmsmce f,xx*&Egrs

Irrt*e"est incowl*

Rcaliscd f,*reign excha:rg$ Saiil, n$t

S"immr** *wsf

Realised for*ign exchamg* tr*s$, nstLJmre*.lis$d fbr*iglr *xshilftge l**s, n$tInfereqt exnf;'rl*sr+4+*+.4.e&+ *+

N** #lnamee cmst

-,*# E&ffJlb*s *r *&e sffi#meu#*f#r#cerxeffi#

{*y r&e jwar *r,dnd"fJ fuemfor##J$

t&{ $&r\"? E^ -,,

?'la w s,s tg,yt d, A!,vff}

?fl{ *,*r\r-l t.p

I,3 X ?.99I34&,432

ls3,sfi8a^ -tu^a[, t "iti

tr,43&,943g4,s?3

I6S,535

29i,t73

1,ffiffi$u$4l I "8S.#-S24*7* - -?"'.-'-

?sr$

{'hmts*rurt,LMf}

r{}1s

,) * a a4')l, J {}) {.f1.J1"

23S,&62

am*rtixation cf the #ovsrnntemt gramt re*ognlaed ffis deferr*d

zrll9

T'hrnrswrd Af$13

3{}1S

5*,,?ES 3,#{i }

I #4_434

5{t,vg# J#S,flss

{65,299)rtAq *?ft\\v

!/-\ItvJ

{4,592,78$}

rat { T?,t'\\t)J -r 1 , "e'r J

f7 q6# 6?4\\'F}..

- )

{5,##7,$5#} {3,7p&,3,$-$}

28

{4,957,X6}} t3,6SS,3S3)

-

I4. flN'fls&tm TAX

ffi.*cCIgmflsed im Profft mr trmss

{wrvgwt ts-YCurrent year-

Chamgns im sstimrates rclatsd t* prior ysar$

I)*ferr*d trrx*ri gination an ct rfi vsr sal *fl t*inpilrary di ffer*n*es

T*tnl fnx sxpsm$e

frfrvement im def*rred tltx assets amd triabitiff;es

##qf*#f-f,#-&fures *r #* ffi sm#e#eJffifffierrffs

fsY X&e ;'eer **dgdr "Sf fuem&er J'#JS

?t)1s

T'htsu.s*nd Afid#

2(}18

{ 1,22?,592}

{27fi,4 }4}

i(,d*7,9#6)

l no {\fi{l"4(}? Y\lw { 1-t frfio\\.t /,t *jrlf

, ?.* sdld,C. *|2g,t\.d\-t {l 'F f,}{^-gI1t tlw-rwf

I?*,S{}{; {I,S15,#54}

2*I9

#ef'*rrs{# tffx trsss#s

Frmperty, planf and equiprn*nt'I'*^ -I ^ ^.* J ^*L ^- ^:* -^1^t ^*t Iit{J{i etlrtr utfi$r. r.$urif;"vaut$s'T-'rnrle *rrr:l n't'trrer n*trqhlr*c[ "L!L.r\+aJ i&r.aLr_ \Jf,,It.hr.r .tr*J t,&q.lrvd

Tax loss*s *axr{ed f*r:ryard

Tlo**t d*f*rred tax *sssf$

13 *f*rred {*x tio, bititi*sFroperty, p}*nt mnd eq*ipmemt

TtltmE deferyed tax }inbitifi*s

Net deferred tax *ss*fs

2S[8

ffL,,{n*u n.l l n n, rt,.c, rt,,rtr.rql *f t El,* ttd-t f,tililtlarl

Pr*p*rg, pluxrt ffird *quiprxentT"radc mr,td *ther r$ff$ivahtres

l['rade asld *th*r payah]csYtpfal d*ferred tmx n$$ef$

#ef*rr *d tax {i*bititiesPr*prrff, plant and *ryxiprnentT'ct*l deferr*d t*x }iabil*ties

ll{ef dsfemed fnx *$$sfs

A* ^e-afas H& r.Jmnttary

ru^^^**r^^J -*ftruuH,rrr$st-l rIrProflt or loss

Th:riusawd,4Mf3

Reeognised im As at 31#flI llm*nnfoer

37,1(}31 rlt frl l.tl. &{rv+v?? Ed.{'}t, tu) */ I 1J'

(3,S57)dc n{\o"f t33Jt-to

rl R 1?ri\\r*)_rrr"ly'

s7,34?

33,4461 E$ t.d $.t. tlolJ"f s

I d- ?"{^r-[ [1*J t t.e

s7,34?

ffiI,6S3 gtr,g2g 2S3,SI I

n\ry 1 +/tn\\.e I LzJ*tdI

a ry n1fr,J/rU/0 dnry,4 ndfi\\,ti?"tld\Jry ]

(27tr,34?) 3?,{}?S {?s4,264}

{79,S59} 12fi,SffS 4$r34?

According to the 2019 amendments to the Armenian Tax codq effective as of I January 2420, tha profit ta:<rate ha$ been reduced from ZAVa b t8%. This had a corresponding e{bct on deferred tax asset$ and liabilitiesarisrng from temporary differences.

'I'h*asafid A$,{l}

Recagmiscd im As at SI"Str.fi Beesmheu"

As *t I H.ecogn[sed inJnnmary PrcfIt or loss

37 ,t fi3

1*5,593

62,383

1S,447

{29,S43}

3?,1*3

122,{}40

3?,54fi

2fi5,S?S {13-39S} Igt,sss

{267,680} {3,S62} #71,34?)(267,6S{}) {3,6S?} {?TI,3 4X}

{s2,6S1} (17,{}58} & {?$}SSS}

29

-

LJra

\*\$fts

Aa

rf?A\tdlrn

*t

$TtftFrl

w/4\wF*i

{}a

{,m\&tr*

fttl*{F4

f"H\rr/

4..

r&r dr.\fi/F.**

.r-hrwsF,d

f\ts\larhwa

ffir{tI|r*&4

t\f*\s?*{

*-\

m!ilt

\sffi&

fi

ffi\A\Nd/

?r(a\

u?\#

rlt{mfr#

l|i.!frvst\

r'a.

f,fiff$

tllrq.qrd\ffi

{\.s\hn{\Ixs!k4tm|{

ffhV1f*\tq

lr\ffitElf*

*lr,Irfif*)

aerq\H}

fi

!fauet

f\t,h,rd\q{+tIq{tr

f*

t\Tfi0iFF4

gli.!s!&vra

s^.

FrI,ilt{

#\frlffi

IF\

r-*,&\d

s\{\t*tf)

lrn{ofif*

riiL&w

\&f**\f*{\I

rf)rfif#?

ari

FTr&ryfflrd(

\sf*w

c\l{?qf".l!{

r#?,n{tcdt*ra&d

"*r.wv{fi

m!f,'{rm{

6\.r. ,i"\*.,#F\s

g1

XT

J*r\"dFf\

f*fr

ff}F{f\I

{lq

[q-

is&!{#lch.U\f#t

t\LArt*rCffifl)

f'.

ld4

. ,&Xlr\

oo y}n\ '{J'* i' f\'lt** '"../lx{

ffir*

t*CI

$\i{,^}

L.{,' :..J.'tl- '{(}', xlPra.\

fri \"."/"r*.n{",1

f"-.i\ (]q,rt' l*t\-, ')

A "V

01

TAi( v^)v \'/

4\

f*r*.ry"rq

f** *trHLJ\ .A

"n \t#

r*fftr

#\ffi!-+w

c\qffq!H{

e\rh,u'!

xfrf*eEm0&

ffi,{sffif-+lff!

fq\(,IEF4

!t\\#(41s

fift?

€\A

fr?t\s

f4rfrrw1

t*\

ft!

f{*;*qr{h

s*ing\

H \r)\Ea ,\,e.l \J"L S0ffi e.iil{ \d/rr^)

ryi\sffi

Ga

f{f-rf)

f,rnn

lrrd t

\sli

re.if]

qrf*fl{

aI/h,*rrf\l

sfi-bI rtl.

a^ !rc'

#\

f"\-:-., \d)Xffi\,.) ,'"4f\ \Jil r*.

f"!\w

n\i+..' IJaU'Ar.^ LJ',\ i \.,//

st()r#i

a\

r"I

f-"* f

#\6,

irs4V')rr"!

\sfl.s{\\#*\UJ

\#

ffis\sffiF{wr{

t\ts,TAqfi,,

f.\#fiSB

.l\

f{

TfirrilbE*sCJ*lta#

Arf

g

.Eo\'HkeoH$,

E* H H F * s* R EFFiB S * EEE Te * TTEEg$sBr$eeri a$geiEei $i f,

#{\*t\x

C\

0srr)'Er

*1w"$!rE{

ql-rr\rdF{

{}.rflrlrtlyf\*\!n4p.,i

(qr'fl\rrytW

s\h{r/?nriL"Lcr l

qd?!#r*(${m-rf

#\st{

\#frfr!WAr.\j1

t\td?\#0&+{h{*q

TAYlrqf*

lf,\r}fr&fa

lt\f\If**

f"*wf"{

i\

r|}-\Up(

rl\f-?4

q!.i. I

CIb Er8\ LJ*',A

a\ \-",=S:\# :-",e' v

rd.rq

ffi'fiii: af,

i'\I \'rr..\A

Jr q. IJ

f** ;h\&HH*=.t f**ffi fl.ifl^i'\w/

\.c {}sHfifir{ t .d frtrF- \",,r'' qf,

f". ffitrxi c{

aftli*: cNidt* L \"r"/

rqfr)f-

Ot

f*"

,.h l*\ ,Pl\.t r L.,,,Fdr{ F-l f\fnilq(} \,,/ frlV{(}m

a\ at,rr) qafi{

F@ ,ri.rl\ S'.ft#surq I'i, F-

^\#ft\$ ?*Edf*i {,f1rq{}

fi'"\

l*i f*

r-tUqrf\I

6\rsfq

61

fqrtr+q

&f*llq

dF'1f-

fim#1

f{t,4.\8r,(ffr

{h\wlrdn\

til(sffi*.\r/h.#rt#

tr\rd

r*s-At,",

sAlrd'ff)Iffi4{\tfirr{

00i#vn(

*\ffif{r}6&.\F{s

ws{f\I

{a

trf*f"{[*

it\f,orI

afi'I;d r:*Y, t{^l!*n

A td^r\E//\ \#s

\s'rr)

tfi | /^\B

F".{ \

.{-t In*^ f"-(}\iff\, \J\ { *r.f L-J\rAf"{" u*ffinl

Fri{\-/